Annuity sellers jockey for position in a record-breaking 1Q, LIMRA reports

Several insurers, led by Athene Annuity Life, recorded big sales in a first quarter that saw total fixed annuity sales increase 101% to $70.9 billion compared with prior-year results, LIMRA reported.

Every major fixed annuity product line experienced at least double-digit growth, according to LIMRA’s First Quarter 2023 Individual Annuity Sales Survey.

“There are several factors driving the record-level growth in the fixed annuity market,” said Todd Giesing, assistant vice president, LIMRA Annuity Research. “Continued equity market volatility and favorable interest rates coupled with investor concerns about the banking sector and a potential recession have made fixed annuities an attractive choice to shield assets, generate protected growth and establish guaranteed income for retirement.”

Overall annuity sales totaled $94.1 billion, a 49% increase over prior year results.

Notable highlights from the first quarter include:

Athene Annuity & Life flexed its considerable muscle in rocketing to the top of the sales list. Apollo Global Management fully acquired Athene in 2021 and since then Athene annuities have sold extremely well. Athene sold nearly three times as many annuities on a quarter-over-quarter basis.

Apollo executives recently spoke with analysts about its plans to push further into serving the high-net-worth retirement services market with its alternative investment platforms, which include Athene annuities.

Although AIG is going through a transition, with its life and retirement division splitting off as Corebridge Financial, annuities sales continued to grow. AIG led the way with $5 billion in sales in the first quarter 2022, and Corebridge recorded $6.2 billion in the recent quarter.

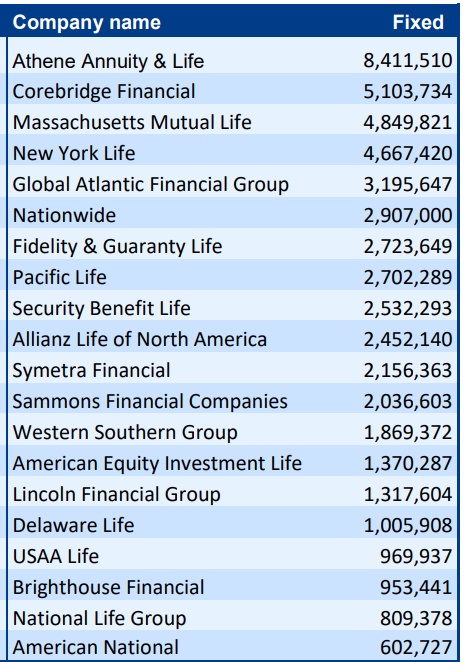

Fixed annuities

Accounting for 44% of all annuity sales, fixed-rate deferred annuity sales jumped 161% to $41.5 billion in the first quarter, LIMRA reported. It is the fourth consecutive quarter of record-breaking sales.

“While bank FRD sales more than tripled, representing 42% of all FRD sales, FRD sales in almost all distribution channels jumped significantly year over year. Independent broker-dealers and independent agents increased their FRD sales more than six-fold (647%) and seven-fold (715%) respectively,” Giesing said. “Under current economic conditions, there are limited options for safe, short-term investments that can compete with FRD products’ returns. As a result, demand for these products remains high.”

In the first quarter 2023, fixed-indexed annuity sales jumped 42% to $23.1 billion, setting a record for the third consecutive quarter. LIMRA expects FIA sales to grow as much as 10% in 2023, as investors seek out solutions with a balance of protection and growth. A majority of the growth projected in the FIA market will be in products without a guaranteed living benefit.

Notable highlights from the first quarter include:

USAA Life saw a surprising decline in the first quarter, surprising because nearly every company sold more fixed annuities. USAA fell from seventh in the year-ago quarter with nearly $1.6 billion in sales to 17th in the recent quarter.

USAA was formed in 1922 by Army officers, and remains a privately owned, member organization.

Income annuities

The income annuity market saw its highest quarterly sales ever, topping $4.2 billion in the first quarter 2023. Single-premium immediate annuity sales more than doubled (127%) in the first quarter to $3.3 billion. The majority of the SPIA sales growth came from independent and full-service broker-dealers, whose sales increased 352% and 209%, respectively. Deferred-income annuity sales surged 127% to $830 million in the first quarter.

“Our research shows 44% of pre-retirees do not feel their forecasted guaranteed retirement income streams (Social Security, pension income/guaranteed annuity income) will cover their basic living expenses in retirement,” Giesing said. “After a decade of ultra-low interest rates that dampened demand for these products, rising payout rates have prompted investors to buy income annuities and lock in the guaranteed income stream for retirement. LIMRA is forecasting income annuity sales to grow at least 15% in 2023.”

Variable annuities

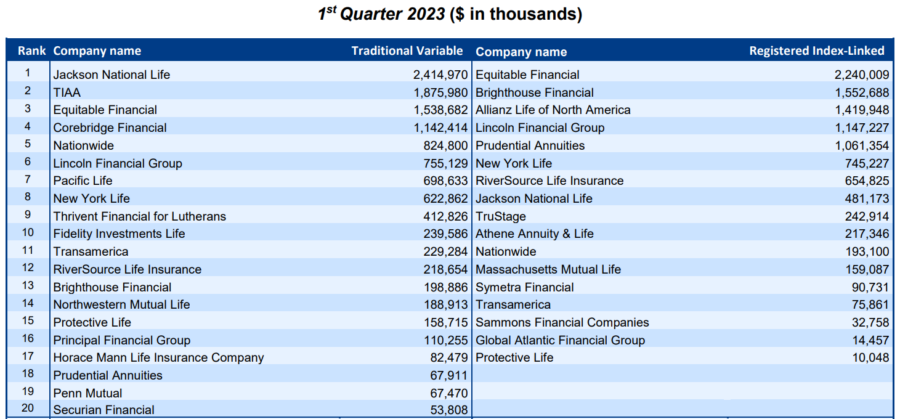

For the fifth consecutive quarter, traditional variable annuity (VA) sales fell year-over-year. Traditional VA sales were $12.8 billion in the first quarter, down 31% from first quarter 2022 results. With market volatility expected to remain high, LIMRA is forecasting sales in this category to be flat in 2023.

In addition to the favorable market conditions, the number of carriers offering registered index-linked annuities has grown nearly 60% over the past four years, expanding access and driving sales growth. In the first quarter, RILA sales totaled $10.4 billion, up 8% from the prior year. LIMRA projects RILA sales will grow more than 15% in 2023.

Notable highlights from the first quarter include:

Traditional variable annuity sales plunged from $18.5 billion to $12.8 billion. The sharp decline of VAs especially hurt Jackson National, which saw a sales decline of nearly 40% from the year-ago quarter. Jackson reported a difficult quarter financially.

A year ago, eight companies recorded at least $1 billion in first-quarter VA sales. This year, just four hit that magic number. Only TIAA emerged unscathed, recording essentially flat sales of $1.88 billion for the quarter to maintain second place in VA sales.

Among the growing number of registered indexed-linked annuity sellers, New York Life made a big move. In the first-quarter 2022, NYL sold 219,000 worth of RILAs for 10th place. In the most-recent quarter, NYL ranked sixth with 745,000 in sales.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Distracted driving continues to spiral, with estimated costs in billions

Overcoming common misconceptions about group DI

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News