Jackson National posts $1.4B net income loss, steep annuity sales dip in Q1

Jackson National is continuing to develop its product mix beyond variable annuities – a poorly performing product in the current economy – amid bottom-line financial struggles.

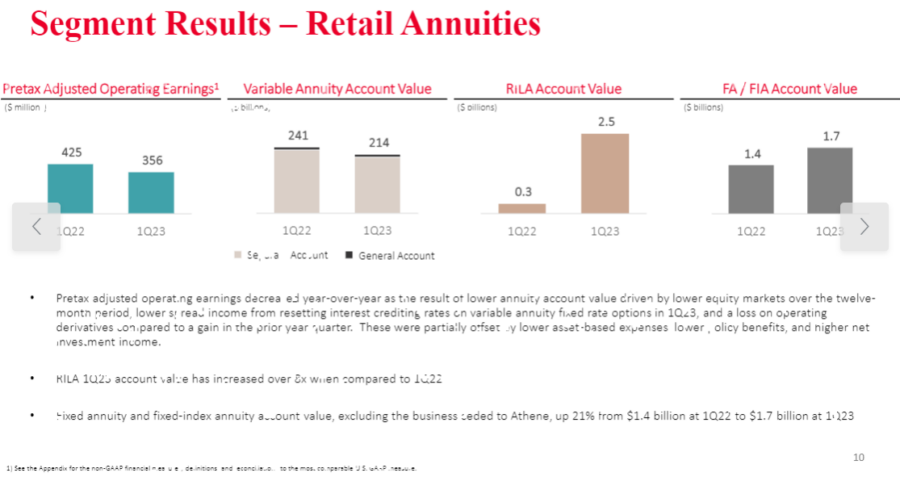

Jackson reported a net income loss of $1.5 billion in the first quarter. Adjusted operating earnings of $271 million were down 28% from the first quarter of 2022, "reflecting the decline in annuity account values and higher interest crediting rates on variable annuity fixed rate options," the insurer said in a news release.

Total annuity sales of $3.1 billion in the first quarter were down 35% from the year-ago quarter. Variable annuity sales were down 46% compared to the first quarter of 2022, "primarily due to the decline and volatility in equity markets and shifting consumer preferences in a higher interest rate environment," Jackson said.

Executives stressed the positive as the Lansing, Mich.-based insurer seeks to retrench amid market volatility and rising interest rates. Jackson has long been a market leader in the sales of variable annuities, a product line that recorded its lowest annual sales since 1995.

"We continue to maintain a strong financial position with substantial liquidity and are on track to reach our 2023 key financial targets," said Laura Prieskorn, president and CEO. "We had a strong start for capital return in the quarter and remain confident in our long-term prospects for continued success."

Jackson shares down

Investors do not share the enthusiasm for Jackson's long-term future. Company shares dived 20% at market opening Wednesday. Analysts on a morning conference call were also skeptical. Alex Scott, equity research analyst, insurance for Goldman Sachs, noted the "pretty optimistic commentary" while adding that "the flows overall, including variable annuities, are still negative this quarter."

Scott pressed executives on why Jackson will be able to take advantage of opportunities in the large and growing retirement planning market.

Scott Romine, president of Jackson National Life Distributors, talked about the diversified product mix Jackson offers, as well as its strong distribution network.

"The hallmark of our success has been the depth and breadth of support we offer our distribution partners," he said. "It's meaningful advisor engagement. It's not just a transactional relationship, but rather we focus on building that mutually beneficial long-term relationship."

Positive sales news

Sales of Jackson's registered indexed-linked annuities totaled $533 million, up from $199 million in the first quarter of 2022.

Jackson came late to the RILA market in the fall 2021 with the launch of Jackson Market Link Pro and Jackson Market Link Pro Advisory. RILAs caught on with investors over the past decade due to the balance between growth and limited downside the products offer.

As of the end of the first quarter, Jackson had $2.5 billion of account value in RILAs, and added more than 2,500 relationships with new or re-engaged advisors since introducing Jackson Market Link Pro 15 months ago, the company said, including nearly 500 added in the first quarter.

Fixed and fixed-indexed annuity sales in the first quarter totaled $133 million, up from $23 million in the first quarter 2022. In total, annuity sales without lifetime benefit guarantees represented 43% of total annuity sales, up from 33% in the first quarter of 2022, Jackson said.

"We expect this percentage to vary somewhat over time, based on market conditions and consumer demand," said Marcia Wadsten, chief financial officer at Jackson National Life Insurance Company.

According to Cogent Syndicated’s 2022 Annuity Brandscape Report, Jackson "holds its lead as the firm with the broadest reach and strongest perception among annuity users for offering the best retirement income products according to financial professionals and investors," Jackson noted.

The report also found Jackson ranks highest by a notable margin for best-in-class service and acting in policyholders’ best interest.

Correction: A previous version of this article incorrectly stated where Jackson National is based. The insurer is headquartered in Lansing, Mich.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Streamline the claims process to tackle supply chain issues

Meet ChatGPT: Your personal marketing assistant

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News