Annuity leader Athene’s sales drive 75% net income boost for Apollo in Q2

Apollo Global Management leveraged strong annuity sales from its Athene business to drive a 75% increase in year-over-year adjusted net income.

"These are truly exceptionally good times," said Marc Rowan, co-founder, CEO and director of Apollo, during a call with analysts today.

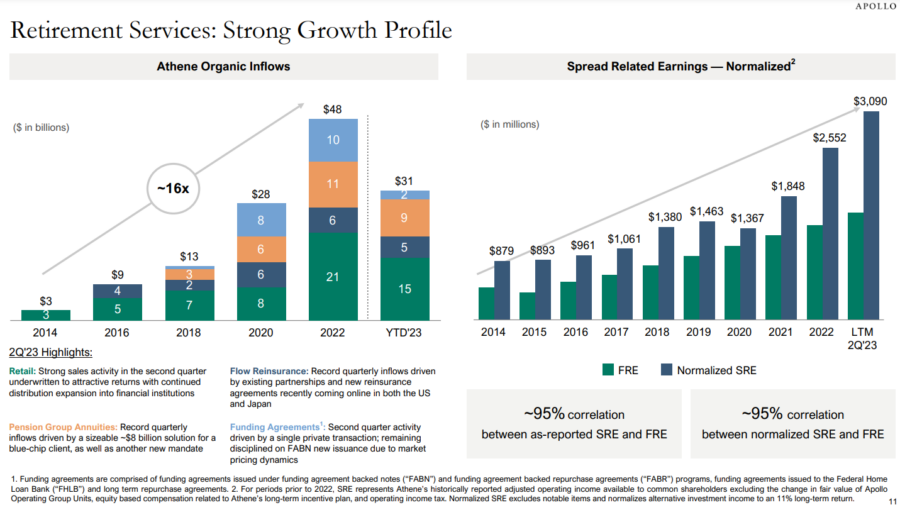

Apollo found a successful formula investing the capital brought in by annuities provider Athene Annuity & Life in mostly investment-grade debt products. The resulting spread-related earnings surged 76% to nearly $800 million.

Despite the good news, Rowan said Athene underperformed its potential in Q2.

"We thought we would do substantially more business this year than last year," he said. "Recall that last year was some $48 billion of organic inflows and we're now confirming and provided guidance that we will be north of $60 billion. I believe that we are leaving between $10 and $20 billion on the table."

First-quarter sales of $8.6 billion put Athene far and away in the No. 1 spot on LIMRA's total annuity sales rankings.

Athene has "the luxury of choosing the highest-quality business, the right business mix, the right profile of liabilities and the right net spreads," Rowan said. Multi-year guaranteed annuities is a business Athene shied away from, he added.

"Most of the business that was left on the table is what I call transactional," Rowan explained. "Transactional does not mean bad. It just means we elected to do other business versus transactional business and MYGAs are primarily transactional business. Anytime we want to add MYGAs, we can add MYGAs. We chose not to for the quarter, given that we were already doing $19 billion of organic inflows."

New relationships

Athene is still growing, Rowan reminded analysts. The insurer struck important deals with big banking distributors in recent years and has more coming, he said.

"We will add the largest or second-largest provider of annuities in this country at some point, I think this quarter, and that will not mature until a year from now," Rowan said. "And then we have two or three other very large providers coming on."

In the company's first-quarter call, Rowan spoke of a desire to draw high-net-worth investors into its alternative investment platforms.

Rowan also addressed the potential for interest rates to decline. Currently, the Fed interest rate is 5.25% to 5.5%. After sitting at 0% for more than a year during the COVID-19 pandemic, the Fed has steadily raised rates since March 2022, except for a brief pause in June of this year.

"I do think the overall market share for retail will be impacted by rates if in fact rates go down," Rowan said. "That doesn't mean negative or substantially negative, but it will on the margin be a negative force. Having said that our distribution is still building so quickly, that I doubt we will see any real decline in retail."

On the investment side, fee-related earnings climbed nearly 30% to a quarterly record of $442 million, Apollo reported. Executives cited a growth in management fees as the company acquired more assets, Reuters reported.

Income from asset sales came in at just $20 million as Apollo avoided cashing out its private equity investments amid the continued slump in deal-making activity.

Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Lincoln Financial execs reassure analysts on delayed Fortitude Re deal

A mixed bag for Equitable’s Q2 earnings

Advisor News

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

- Market reports turn economic trends into a strategic edge for advisors

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

More Advisor NewsAnnuity News

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

More Annuity NewsHealth/Employee Benefits News

- Inmates exiting Green Hill, Echo Glen now eligible for expanded health care coverage

- AM Best to Host Briefing on Negative Pressures on U.S Health Insurance Segment and Whether an Inflection Point has Arrived

- Long-Term Care Insurance: A lifeline or a financial nightmare for seniors?

- New CEO at major health insurer with 3K CT employees. ‘Excited to build on our strong foundation’

- What Florida Blue members in Broward should know about billing, ER and other care

More Health/Employee Benefits NewsLife Insurance News

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

- NAIFA and Brokers Ireland launch global partnership

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- Reimagining life insurance to close the coverage gap

- Busch, Pacific Life settle dispute over $8.5M investmentFormer NASCAR champion Kyle Busch settles $8.5M lawsuit against life insurance companyTwo-time NASCAR champion Kyle Busch and a life insurance company have settled an $8.5 million lawsuit in which the driver said he was misled into purchasing policies marketed as safe retirement plans

More Life Insurance News