Advisors play critical role in retirement planning

LIMRA’s 2023 Retirement Investors Survey shows that ongoing guidance from financial advisors remains essential as Americans approach and enter retirement. Changes in the way retirees generate income suggest an even more important role for financial advisors in the years to come.

Although most current retirees rely primarily on guaranteed sources like Social Security and pensions for income, the survey highlights room for improvements that advisors are uniquely positioned to address. Around a quarter of retirees surveyed this year do not receive sufficient guaranteed lifetime income to cover basic living costs without tapping into their savings. Although this proportion has remained similar for more than a decade, the long-term trend away from traditional defined benefit pensions suggests that future retirees will have greater challenges in generating guaranteed income. Current pre-retirees agree, as less than half believe they will have sufficient guaranteed income sources in retirement.

For the sizable minority of retirees who report shortfalls between guaranteed income and basic costs, withdrawals from savings are a common approach. However, this approach risks depleting assets before death, due to unknown life spans. Advisors can demonstrate more sustainable drawdown techniques or guaranteed income substitutes to preserve peace of mind in retirement.

Although annuities present an appealing strategy for addressing income gaps, fewer than 1 in 5 retirees receive annuity income. Among those receiving distributions from qualified accounts, only a small minority do so through guaranteed lifetime payments. Advisors are well positioned to expand appropriate annuity use by explaining how different annuity options can enhance financial resilience in retirement, especially as an increasing number of defined contribution plans begin to offer them.

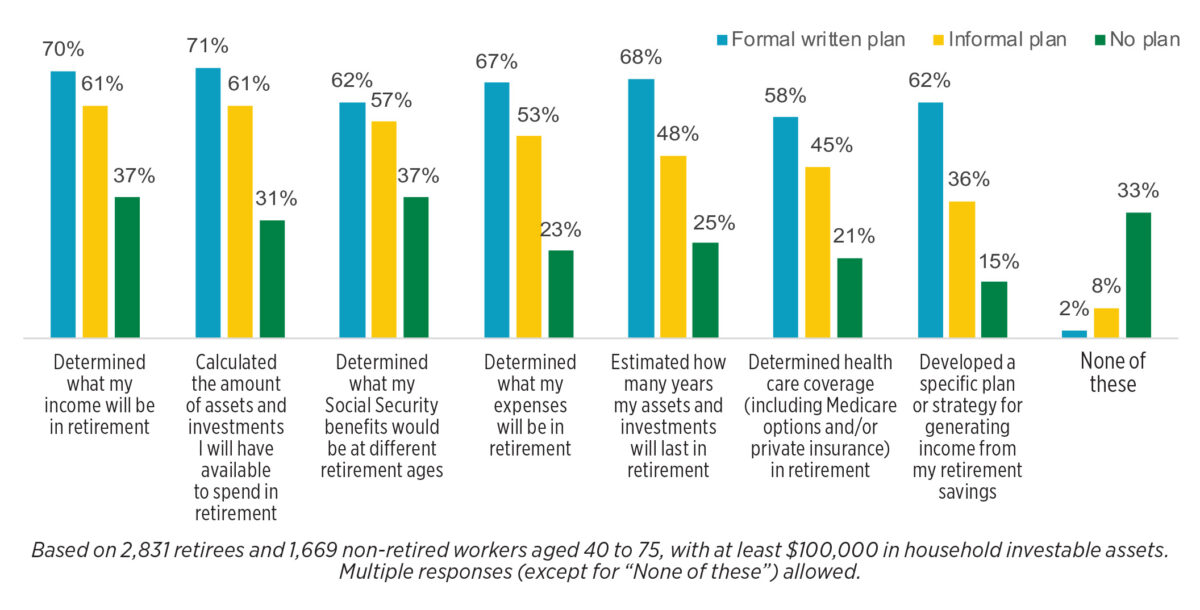

The research also indicates that working with a financial advisor correlates with more positive retirement experiences. About 60% of investors report they typically consult with an advisor on financial decisions, with higher percentages reported among investors who have more wealth. Advisors play a key role in creating a comprehensive, formal written plan for managing income, assets and expenses throughout retirement. Among investors who have these plans and are working with advisors, 94% of plans were created with an advisor’s help, suggesting that most investors are not willing or able to develop a truly comprehensive plan on their own.

Having a formal written plan is associated with completing key retirement planning activities, as opposed to having informal plans or no plan for retirement. When advisors develop formal written retirement plans for clients, retirees tend to rely on more varied, balanced sources of income as well as strategies such as annuitization that provide reassurance and stability in retirement. The ongoing value of advice is clear as personal responsibility for finances grows.

Planning for retirement timing is another crucial step that advisors can assist with. On average, current retirees report retiring around age 62, with the most common ages being 65 and 62. Younger retirements are aligned with benefit eligibility, while others retire as soon as they feel financially secure. Pre-retiree workers also signal an ongoing need for advice. Although most plan to retire by age 65, more than one-quarter envision working part time after age 65, which could be an unrealistic assumption given that few current retirees report earnings. Advisors can help clients determine whether projected resources truly support their desired retirement timelines based on individual circumstances.

As guaranteed income sources evolve and both retirees and workers transition to self-directed retirement models, advisor guidance on optimizing Social Security, annuitizing balances, managing nonqualified and qualified savings, and developing individualized income strategies becomes more imperative. Ongoing retirement education and support will remain important for clients of all stages, given the changing needs highlighted in LIMRA research.

Jonah Morales is a research analyst with Secure Retirement Institute. He may be contacted at [email protected].

Investors bullish on AI as a financial advisor tool

Catching up with the consumer in 2024

Advisor News

- Affordability on Florida lawmakers’ minds as they return to the state Capitol

- Gen X confident in investment decisions, despite having no plan

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

More Advisor NewsAnnuity News

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

More Annuity NewsHealth/Employee Benefits News

- TRUMP ADMINISTRATION DROPS MEDICAID VACCINE REPORTING REQUIREMENTS

- SLOTKIN, WHITEHOUSE, AND SCHAKOWSKY INTRODUCE PUBLIC HEALTH INSURANCE OPTION LEGISLATION

- Wittman, Kiggans split on subsidies

Wittman, Kiggans split on subsidies

- Wittman, Kiggans split on subsidies

Va. Republicans split over extending health care subsidies

- Report: Connecticut can offset nearly $1B in federal cuts

More Health/Employee Benefits NewsLife Insurance News