Accelerated Underwriting Could Close The Life Insurance Gap

Accelerated underwriting holds the promise of being able to cut the agent's time spent selling a $500,000 policy from 20 hours to roughly five, a Deloitte analyst said.

The associated benefits from that are numerous. In particular, it could lead to more life insurance sold to Americans who need smaller amounts for basic protection.

Chris Stehno, managing director, human capital practice, at Deloitte, shared data and analysis Thursday on new underwriting technology for the National Association of Insurance Commissioners; Accelerated Underwriting Working Group. The benefits offered by accelerated underwriting have the potential to revolutionize the life insurance industry.

"Right now, agents aren't selling below a million dollars," Stehno said. "It's not they don't want to, but for the most part, they're not too interested in it. What accelerated underwriting does is say, 'Hey, for a portion of those people, the young and healthy, I'm interested in selling to them again.'"

Annual Milliman surveys show a steadily increasing shift to accelerated underwriting. For example, Milliman found that 24.6% of indexed universal life sales were made with accelerated underwriting for the fiscal year ending Sept. 30, 2018. That figure is up from 16.8% during the fiscal year 2017.

The Accelerated Underwriting Working Group was formed during the NAIC's summer meeting in August. The group will "consider the use of external data and data analytics in accelerated life underwriting, including consideration of the ongoing work of the Life Actuarial (A) Task Force on the issue and, if appropriate, drafting guidance for the states."

Life Insurance Buying Gap

Life insurance sales have been stagnant for many years, but Stehno said it's actually much worse than the numbers show. Policy counts are declining, but face value is going up because life insurance has become a tool for the wealthy, he said.

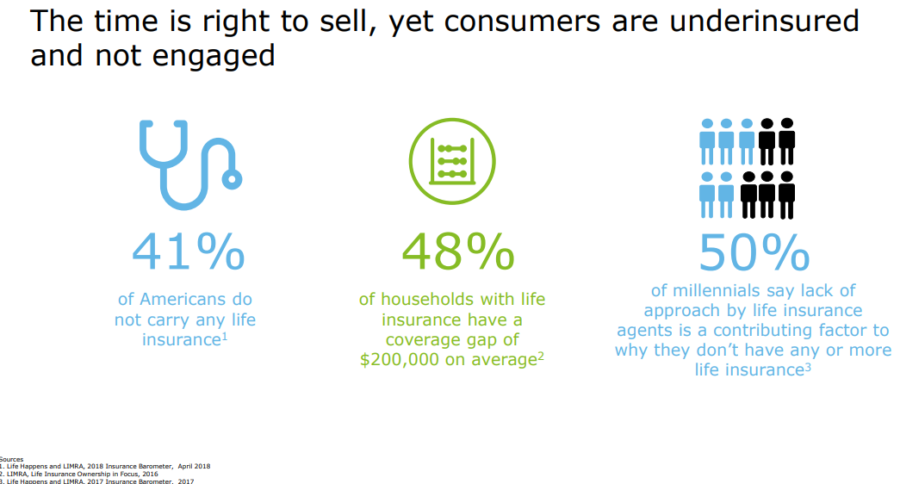

"You talk to consumers and you'll find out that about 41% of Americans don't carry any type of life insurance," he said. "Of those that do, almost half of them have a coverage gap of at least 200,000.

"If you really talk to people like the millennials or other groups, you know, the people that should be buying it now that they're about 25 to 40 years old, they say they haven't even been approached."

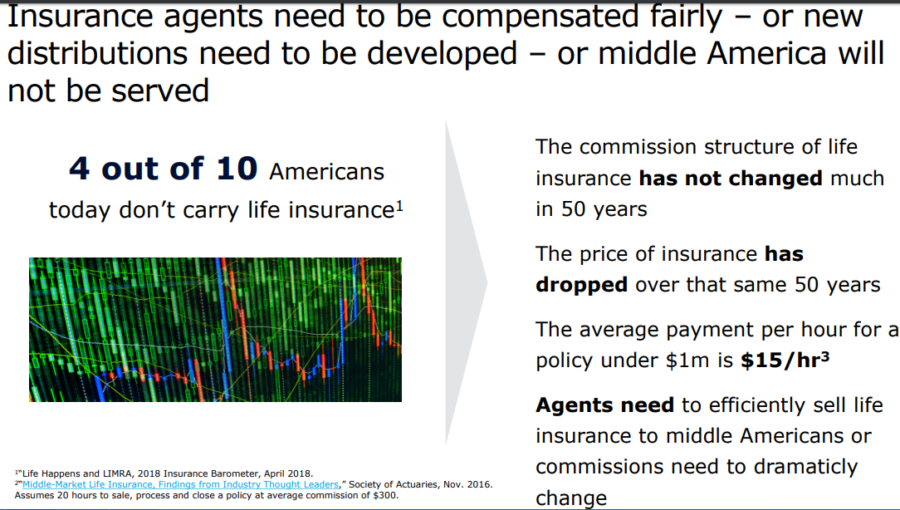

A big part of the problem is the lack of incentive for agents to sell small policies, Stehno said. In this slide, he explained the implications of a commission structure that has barely changed in 50 years:

"If you ask an agent how much time does it take them to show half-million-dollar policy under traditional underwriting, let's say they spend about 20 hours on it," Stehno said. "They'll get about a $300 check in the end. So they're getting about 15 bucks an hour. So agents really aren't even that interested in selling that half-million policy anymore."

Strong Results

Underwriters are utilizing predictive analytics to triage applications, identifying certain healthy applications for whom selected medical underwriting requirements can be waived, Stehno explained.

The algorithm kicks a certain percentage of applicants out at the beginning, sending them to traditional underwriting, but actuaries are constantly tinkering with the testing methods, Stehno said. Results have been surprisingly accurate, he said.

"There are some companies that have gotten up to maybe 40% of the applicants that they can take through the accelerated timeline or not ordering certain requirements," he said. "But about 60% probably still go to traditional and that's probably companies that are being pretty aggressive at it."

Big Benefits

Accelerated underwriting means savings in two ways, Stehno said. The first comes from the 20% to 25% of people who drop out of the life insurance buying process during the laborious 30- to 40-day traditional underwriting process.

"They were probably sold insurance in the first place," Stehno said, indicating a successful sales pitch. "This is dragging on, they're having to do more things and they just kind of eventually, you know, the process is too cumbersome and they give up."

A 75% placement rate jumps to the 95% neighborhood when the underwriting time is cut dramatically, Stehno said.

The second savings comes from the underwriters themselves.

"It frees up underwriters so they can actually spend more time on the tougher cases and do a better job with those," Stehno said. "We've seen enhancement on getting rid of some of the underwriting errors that we saw in the past just because they had too much on their plate."

Agents are happier because they're spending five hours instead of 20 hours, Stehno noted. And that means the middle market should get more attention, and more of those half-million policies get sold.

"When we put these in place, we're seeing a lot more sales in this million dollar and less (market)," he said. "A lot more people interested in sort of reaching out to middle America again, and pushing to sell them a policy."

The working group will hold monthly conference calls and identify issues and a "potential work product" throughout 2020. Tentative plans call for that work product to be delivered to the NAIC's Life Insurance and Annuities Committee "at or before the 2020 fall national meeting," the work plan stated.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

AHIP Wants ACA Court Case To Move Quickly

Trump, On Twitter, Pledges To ‘Save’ Social Security

Advisor News

- OBBBA and New Year’s resolutions

- Do strong financial habits lead to better health?

- Winona County approves 11% tax levy increase

- Top firms’ 2026 market forecasts every financial advisor should know

- Retirement optimism climbs, but emotion-driven investing threatens growth

More Advisor NewsAnnuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

- U.S. Federal Minimum Wage Remains Flat for 16th Straight Year as Billionaires’ Wealth Skyrockets

- Reports from Case Western Reserve University Add New Data to Findings in Managed Care (Improving Medication Adherence and Medication Optimization With a Medicaid-Funded Statewide Diabetes Quality Improvement Project): Managed Care

- Data on COVID-19 Published by Researchers at Peking University (Socioeconomic Disparities in Childhood Vaccination Coverage in the United States: Evidence from a Post-COVID-19 Birth Cohort): Coronavirus – COVID-19

- 2025 Top 5 Health Stories: From UnitedHealth tragedy to ‘excess mortality’

- AMO CALLS OUT REPUBLICANS' HEALTH CARE COST CRISIS

More Health/Employee Benefits NewsLife Insurance News