5 Myths Keeping Black Americans From Buying Life Insurance

Some recent studies show that Black households are more receptive than other races are to purchasing life insurance — the key is reaching that market.

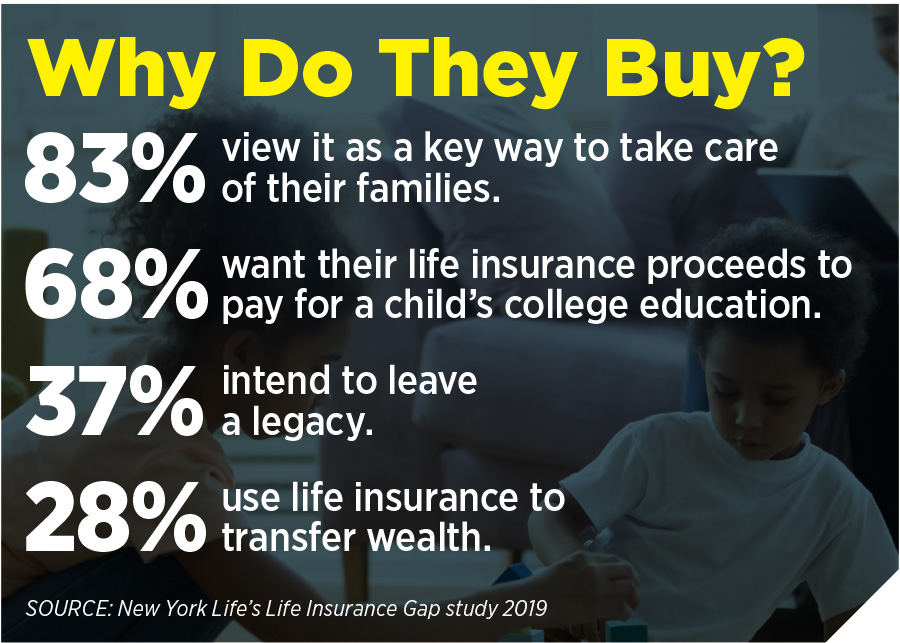

Nearly 80% of Black Americans said having life insurance is a goal for them, a 2019 New York Life study found, versus 63% of all adults. More than 90% of Black Americans said they believe life insurance helps future generations succeed.

Many of the barriers to life insurance ownership in Black communities can be traced to several myths about the process. Five myths, in particular, keep Black Americans from buying life insurance, said Delvin Joyce, a financial planner with Prudential.

“Not only is there a racial wealth gap, there's also a knowledge gap in certain areas and where we see that knowledge gap is in life insurance,” said Joyce during a recent webinar sponsored by Life Happens, a nonprofit group supporting the life insurance industry.

Myth #1: Final Expenses Only

Many Black Americans come from communities that have come to view life insurance as a way to cover final expenses. That narrow view grew out of a proud desire to cover all debts, Joyce said, even in death.

It is common in Black communities for church members to “pass the hat” to help families cover final expenses, Joyce noted. A stigma developed around that well-meaning tradition.

“I think what happened is this culture developed where people did not want to be that member,” Joyce said.

Along the way, the life insurance industry missed an opportunity to educate and inform.

“We didn't as an industry talk to people about the miracle that life insurance truly is and all the other uses of life insurance,” Joyce said. “When you go out there talking to the general public about life insurance, don't be an order taker. I'm saying to them, ‘You know, we only have enough to bury you, and your family will be buried after you're gone.’”

Myth #2: No Handouts

Kristen Hall Eskew grew up hearing about her father's struggles for success. Growing up in rural Kentucky, he went to a segregated high school, was part of the first Black class in college, and then went into the military. Today, her father is 72 and a private practice dentist, said Hall Eskew, director of talent acquisition at Consolidated Planning in Charlotte, N.C.

“Using life insurance as a way of wealth building, that meant nothing to him,” she said. “Legacy for him meant making sure he could provide me and my sisters with the same grit, perseverance and education that he has to build our own."

That type of attitude can be hard to change. It is important not to even try, Joyce said.

“What I would say is, empathize; but then show them ways that you can utilize life insurance and put some guardrails around that life insurance to make sure that your kids are still growing up with that same hard work, determination and grit,” he said.

Myth #3: I Have Life Insurance

This myth extends beyond the Black community: I have life insurance through my job. But it can be very prevalent in the Black community, where gains have trailed and having lifelong job success leads to a personal attachment to the benefits that came with it.

“The mentality is ‘I've worked. I've done everything right. I'm going to utilize these benefits. That's enough for me,’” Joyce said.

The conversation should start with, “How do we supplement what you already have to make sure that your family is completely covered?” Joyce added. “The second thing that I would say is, have a conversation and appeal to reason about what that life insurance coverage at work truly means.”

Often it is some multiple of a person's salary, and that might not be enough to provide for surviving family members in an emergency situation.

Myth #4: It's Only For My Beneficiary

As with many clients, it can be difficult to get Black Americans to personalize the benefits of life insurance.

“There's only a benefit if I die, and I'm dead. So why do I care?” said Joyce, recounting a typical conversation. “I have, unfortunately, heard that many, many times."

Education is key to countering this myth as well. Hall Eskew conceded that she did not know much about life insurance prior to joining the industry. Now she has a term life insurance policy with a benefit rider.

“If you have someone who has the mindset of, ‘Life insurance is just for the people that I leave behind. Who cares? I’m dead,’ talk to them about some of the benefits to them while they’re alive,” Joyce said. “And I think that would help to really shift the tone of the conversation.”

Myth #5: $5 Million Is Too Much

Many Black Americans watch television shows like “Unsolved Mysteries” and “Dateline,” Joyce said, which highlight stories of murders being committed for the life insurance proceeds.

It creates a lot of reluctance and inaccurate perceptions around buying life insurance.

People think a million-dollar policy must cost a thousand dollars a month, Joyce added.

“When I tell them it’s $65 a month, they let their guard down,” he said. “The first thing that I try to accomplish when working with a couple, especially from a life insurance needs standpoint, is we’re going to figure out what the need is. Before we talk about term, before we talk about whole life and all these things.”

The Smoke In Our Eyes

Survival Comes With A Massive Price Tag

Advisor News

- Beyond Finance: How an inclusive approach builds client trust

- Study asks if annuities help financial advisors build client relationships

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

More Advisor NewsAnnuity News

- Michal Wilson "Mike" Perrine

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

More Annuity NewsHealth/Employee Benefits News

- The lighter side of The News: Political theater; A bone to pick with a Yankee; Health insurers have mascots?

- CommunityCare names Josiah Sutton new president and CEO

- Strengthening Roots, Shaping the Future: Josiah Sutton Appointed CEO of CommunityCare

- Artificial intelligence was hot topic at Kentucky Chamber’s inaugural Healthcare Innovation Summit

- Cancer coverage for firefighters clears Senate

More Health/Employee Benefits NewsLife Insurance News

- Best's Market Segment Report: AM Best Maintains Stable Outlook on U.K. Non-Life Insurance Segment

- Michal Wilson "Mike" Perrine

- Proxy Statement (Form DEF 14A)

- AM Best Affirms Credit Ratings of Subsidiaries of Old Republic International Corporation; Upgrades Credit Ratings of Old Republic Life Insurance Company

- Proxy Statement (Form DEF 14A)

More Life Insurance News