4 Reasons To Sell Ancillary Health Products This Open Enrollment Period

By Mike Zundel

It happens every fall. The leaves change colors, we set our clocks back, and millions of Americans begin the arduous task of understanding their health care options for the upcoming year. Confusion abounds and frustration ensues among rising premiums, deductibles and maximum out-of-pocket costs.

While the future of the Affordable Care Act has never been murkier, we are in the midst of 2017 open enrollment. If you plan on helping any of the 11.4 million estimated 2017 ACA plan enrollees in the coming months, here are four reasons you should consider adding ancillary health products to your portfolio.

- Consumer cost exposure has never been higher.

It’s no secret that deductibles, copays and out-of-pocket maximums have seen sharp, steady increases in recent years. Although these features help drive down plan premiums, they also create significant gaps in consumers’ health coverage.

A recent Kaiser Family Foundation/New York Times survey found that one in five working-age Americans with health insurance had difficulty paying medical bills in the past year. Three-quarters of those individuals reported that their copays, deductibles or coinsurance were more than they could afford. ACA out-of-pocket maximums for 2017 are set at $7,150 per individual and $14,300 per family. Ancillary health insurance products (critical illness, hospital indemnity, accident, etc.) present a cost-effective means to reduce this exposure as well as provide cash benefits in consumers’ hands to pay these and other costs.

- Trusted advisor vs. order taker.

Upon the ACA’s launch four years ago, some gloomy prognosticators warned of “the death of the health insurance agent.” With fewer carrier choices, more standardization in plan design options, and the ability for clients to self-enroll online, the agent’s role has changed dramatically.

The past few years have shown that now, more than ever, consumers are overwhelmed with the health insurance landscape and most would prefer to trust the advice of an industry expert. This year 38 percent of ACA enrollees may have only two insurers to choose from, and 19 percent may have only one. By designing a comprehensive health package with the right ancillary products to complement the health plan chosen, agents can move out of the realm of “order taker” and into the much more desirable world of trusted advisor.

- Better use of premium dollars.

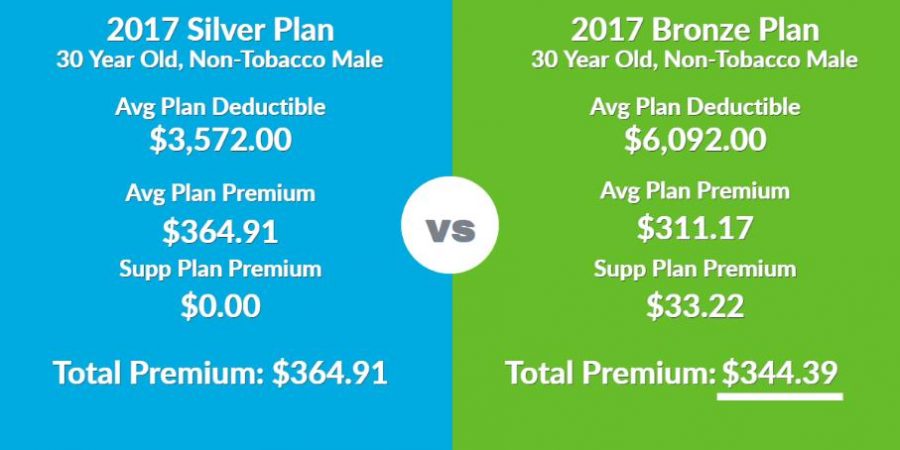

To see the power of adding ancillary health products to a consumer’s portfolio, let’s look at a hypothetical non-tobacco-using 30-year-old male. The national average premium for a 30-year-old on a 2017 silver plan is $364 with an average deductible of $3,572, according to HealthPocket. For that same individual, the national average premium on a 2017 bronze plan is $311 with a $6,092 deductible.

By moving the client from a silver plan to a bronze plan, we save them $53 per month on premium, but we increase their deductible by $2,520. This is where ancillary products come in. In this case, the client could purchase a combination of critical illness, hospital indemnity and accident insurance to help cover the additional deductible exposure and still save money over the silver plan. Here’s how it works:

-The critical illness plan will pay a lump sum of $10,000 upon the diagnosis of cancer, heart attack, stroke or a number of other critical conditions.

-The hospital confinement plan will pay a daily benefit of $1,000 for every day the client is confined to a hospital room.

-The accident plan will pay (in the event of an accident) a lump sum hospital confinement benefit of $2,500, $250 per accident for emergency room or urgent care treatment, $250 for a major diagnostic exam, $50 per follow-up treatment (maximum of five per year) and $50 per follow-up physical therapy treatment (maximum of five per year).

Together, the premiums on these three products total $33, so we can couple these with the bronze plan and still save $20 compared to the silver plan alone. With this approach, we’ve managed to save the client money while offering a solution that will help them pay their deductible in the event of a critical illness, accidental injury or hospital stay. Furthermore, these benefits often are more than enough to offset the difference in deductibles, meaning the client has more cash in hand when they need it most.

4. Your income stream will (and should) grow significantly.

If you were in the industry before the ACA was implemented, you may remember a time when you could survive on selling health insurance alone. Today that is all but impossible due to the vast reductions in commissions that medical loss ratios have necessitated. This year, many companies have stopped paying broker commissions entirely on their ACA plans. Even if you are one of the lucky few who actually earn some sort of compensation on these plans, selling ancillary products could increase your revenue potential drastically. With first-year commissions in excess of 40 percent, offering ancillary products isn’t only right for your clients, it’s right for your business.

This year make the most out of open enrollment by offering ancillary health products. Your clients (and your practice) have never needed them more!

Mike Zundel MBA, LUTCF, is sales director for Surebridge Insurance. Mike may be contacted at [email protected].

© Entire contents copyright 2016 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Bottom Falls Out of Fixed Annuity Market in 3Q

Trump Ready to Name Pro-Business DOL Head, Reports Say

Advisor News

- Todd Buchanan named president of AmeriLife Wealth

- CFP Board reports record growth in professionals and exam candidates

- GRASSLEY: WORKING FAMILIES TAX CUTS LAW SUPPORTS IOWA'S FAMILIES, FARMERS AND MORE

- Retirement Reimagined: This generation says it’s no time to slow down

- The Conversation Gap: Clients tuning out on advisor health care discussions

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

More Annuity NewsHealth/Employee Benefits News

- Harshbarger hopes bill will reduce red tape for those with a terminal illness

- Uninterrupted coverage for thousands as Graves Gilbert, Humana announce new contract

- Unholy alliance of Democrats, insurers has ruined the system

- Trump releases health plan, but it’s short on specifics

- New Findings from University of Colorado in Managed Care and Specialty Pharmacy Provides New Insights (Primary Care Physicians Prescribe Fewer Expensive Combination Medications Than Dermatologists for Acne: a Retrospective Review): Drugs and Therapies – Managed Care and Specialty Pharmacy

More Health/Employee Benefits NewsLife Insurance News