Pioneering a tech-driven future for life insurance

While life insurance is a crucial component of any financial plan, selling life insurance is complex and challenging. From tricky underwriting requirements to long health questionnaires, many obstacles can make the process frustrating and time-consuming.

What if there were a better way?

Michael Konialian, co-founder and CEO of Modern Life, was inspired to start the tech-enabled life insurance brokerage when confronted with the complexities of the application process himself. It propelled him to channel the expertise he’d honed to build and scale several insurtech businesses into transforming the life insurance industry.

Michael Konialian, co-founder and CEO of Modern Life, was inspired to start the tech-enabled life insurance brokerage when confronted with the complexities of the application process himself. It propelled him to channel the expertise he’d honed to build and scale several insurtech businesses into transforming the life insurance industry.

Tech savvy meets industry wisdom

Konialian understood that serving insurance advisors effectively demanded more than technical proficiency. The advantage was in marrying easy-to-use technology, advanced data analytics and industry knowledge.

“My co-founder, Jack Arenas, and I bring a wealth of experience from successful tech startups. Our distribution leaders have an understanding of the market derived from 50 years collectively at the helm of prominent brokerages and carriers. With this fusion of skills, we can advocate for our advisors, ensuring our platform delivers unparalleled value and impact.”

The power of advanced technology

Modern Life’s technology empowers advisors to increase conversion and place policies faster, while elevating their client service.

“Tech has been considered a four-letter word in the life insurance industry, largely due to outdated, error-prone, difficult-to-use legacy systems,” says Konialian. “However, when technology is built with the advisor in mind, it augments what the user can do and is enjoyable to use.”

Seamless technology improves the client experience, according to Jared Levy, CFP®, co-founder at Brix Partners: “Embracing technology allows advisors to streamline the buying process, leveling up life insurance capabilities and client satisfaction. Modern Life does it best.”

Modern Life analyzes clients’ health data and other key factors to help find an optimal match, which advisors can use to personalize client offerings, boosting the chances of successful sales.

First-of-its-kind digital life insurance journey

An integrated and intuitive agency management system is at the core of the Modern Life platform. It provides advisors with a consolidated view of their cases — from case details and quotes to applications and policy statuses. The advice experience is also integrated; advisors can compare quotes and complete an electronic application using the technology.

The platform’s flexibility allows advisors to engage the client as it fits their workflow and client needs. For instance, advisors can share life quotes directly with clients in a responsive, custom-branded experience.

Harnessing artificial intelligence (AI) for life insurance

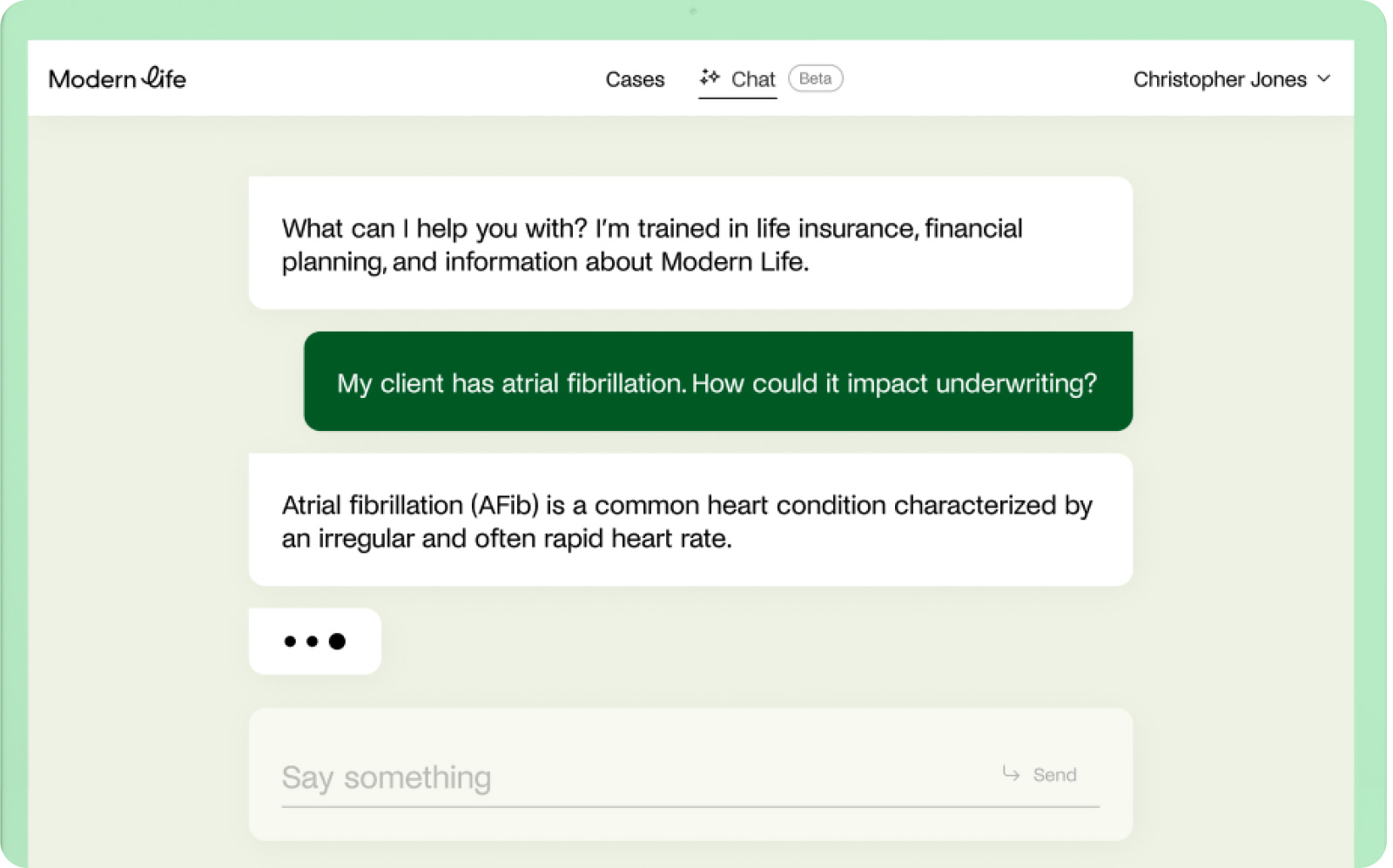

Among Modern Life’s standout features is its proprietary generative AI for life insurance, a powerful tool that helps advisors delve into underwriting issues, strategize advanced sales and better advise on client needs.

The system, built on GPT-4, has been trained using a large set of proprietary life insurance content and data. It outperforms stand-alone AI models on financial protection topics.

Seizing the moment

Konialian notes that the most successful advisors within Modern Life leverage technology to streamline and scale their financial practice and grow their book of business, placing large and complex cases.

According to Scott DeSantis, CEO at Civic Financial, “Modern Life’s offering has been exceedingly helpful in streamlining the underwriting process and securing policies quickly.”

Reflecting on the company’s inception, Konialian says, “We launched Modern Life during the pandemic, when the life insurance industry was undergoing some of the most rapid changes in its 150-year history. This period of flux provided an opportunity to introduce modern solutions for today’s top-tier advisors, setting the stage for the industry’s digital evolution.”

Added DeSantis, “Modern Life is a tremendous value-add to our firm on both the front and back end.”

Whole life insurance: Is simple really better?

Inclusion Through Underwriting Innovation

Advisor News

- FSI announces 2026 board of directors and executive committee members

- Tax implications under the One Big Beautiful Bill Act

- FPA launches FPAi Authority to support members with AI education and tools

- How financial planners can use modeling scenarios to boost client confidence

- Affordability on Florida lawmakers’ minds as they return to the state Capitol

More Advisor NewsAnnuity News

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

More Annuity NewsHealth/Employee Benefits News

- Deerhold and Windsor Strategy Partners Launch Solution that Enhances Network Analysis for Stop-Loss Carriers and MGUs

- Alameda County hospital system lays off hundreds of employees to counter federal cuts

- Detailing Medicare prescription drug coverage

- NFIB TESTIFIES FOR LOWERING HEALTH INSURANCE COSTS

- VITALE BILL TO STRENGTHEN NEW JERSEY IMMUNIZATION POLICY AND COVERAGE HEADS TO GOVERNOR'S DESK

More Health/Employee Benefits NewsLife Insurance News