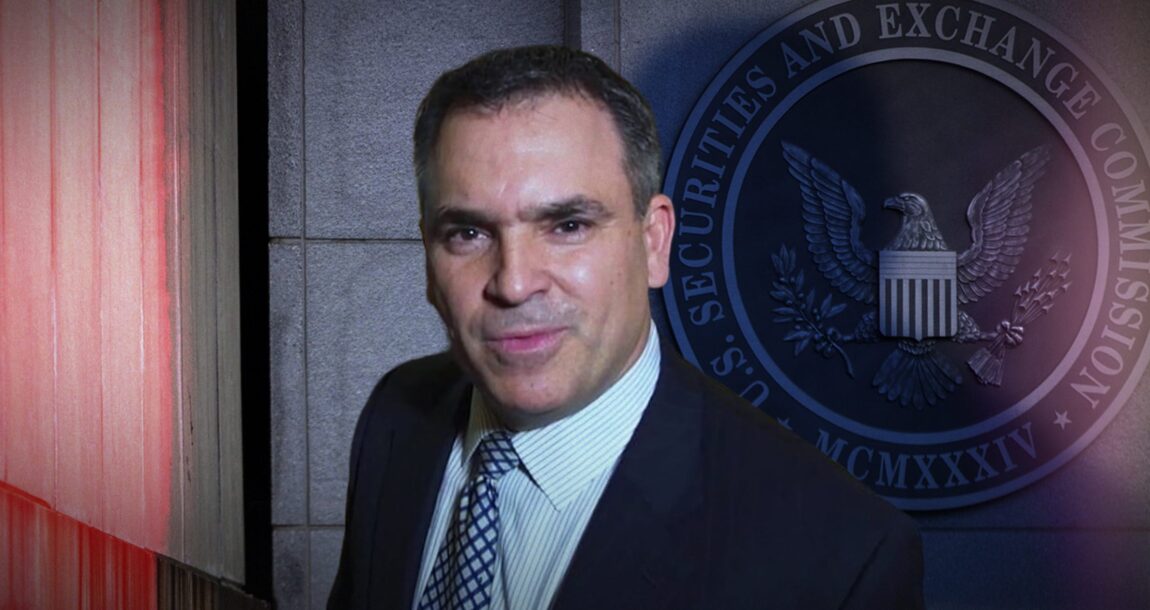

‘My life has been destroyed’: Dean Vagnozzi plots life insurance comeback

Dean Vagnozzi waited a long time for the opportunity to restore his reputation and get back into the life insurance business.

Once a multimillion-dollar life insurance producer and local Philadelphia celebrity of sorts who tooled around the city in a lime green Porsche and lived in a large, Main Line home, Vagnozzi became entangled in a sweeping Securities and Exchange Commission fraud investigation of the Par Funding business.

Vagnozzi faced multiple penalties for securities violations. In May 2019, Vagnozzi agreed to a state-record settlement for selling securities without a license, a $490,000 fine for violations related to the sale of Par Funding promissory notes. In 2022, Vagnozzi settled with the SEC over the Par Funding matter and agreed to pay $5 million, including $4.5 million in disgorgement, $161,000 in interest and a $400,000 civil penalty.

After years of lawsuits, fines and frozen bank accounts, only the large home remains, and Vagnozzi is determined to keep it. He traded in his sharp businessman suits for a FedEx uniform and did DoorDash deliveries to earn income and keep the household afloat.

All the while, Vagnozzi plotted his comeback.

“My life has been destroyed, and for five years I had to be quiet,” he said.

Going to court

Vagnozzi’s campaign to clear his name has several steps. First, he went after his attorney of nearly two decades, John Pauciulo, and his law firm, Eckert Seamans Cherin & Mellott. Vagnozzi stated that he paid substantial sums of money to Pauciulo and the law firm to conduct due diligence on Par Funding and ensure that his sales were properly registered.

“I paid a law firm over a million dollars over a 10-year period to make sure all of my investment funds were properly registered, and that they included all of the disclosures needed,” Vagnozzi said. “When the SEC sued me, they alleged that all of my funds should have been registered. Well, I paid my law firm to do that.”

Pauciulo lost his partnership with Eckert Seamans and, in 2022, settled with the SEC for $125,000 and was barred from appearing before the agency for five years.

On Feb. 28, 2025, Eckert Seamans settled for $38 million for its alleged role in the Par Funding Ponzi scheme. Vagnozzi received an undisclosed amount from the law firm to settle his claims.

Eckert Seamans and Pauciulo have denied any wrongdoing.

Meanwhile, Vagnozzi is next going after the SEC and Amie Riggle Berlin, senior trial counsel at the agency. A Dec. 8 lawsuit filed in the Eastern District for the District of Pennsylvania asks the court to compensate Vagnozzi for alleged constitutional violations and abuse of power.

Vagnozzi’s damages “are in the tens of millions of dollars,” the lawsuit states. The SEC rushed to judgment and fingered Vagnozzi as a fraudster before considering the evidence, his attorney writes.

“He was an innocent victim of government overreach, good faith reliance on counsel, and a victim of Par Funding’s fraud and deceit,” the lawsuit claims.

A spokesman for the SEC declined to comment on the lawsuit.

Massive fraud alleged

Par Funding and founder Joseph LaForte were the primary targets of the years-long SEC investigation. Authorities say LaForte hid past felony convictions [for a prior Ponzi scheme and illegal gambling operation] and his true role in the company from investors.

Founded in 2012, Par Funding portrayed itself as a legitimate alternative lender that provided high-interest, short-term working capital to small and mid-size businesses that couldn't qualify for traditional bank loans.

The company raised over $500 million from more than 1,600 investors by selling unregistered securities and promising annual returns of 10% or more.

Meanwhile, Vagnozzi was busy cultivating a Philadelphia-area profile via heavy radio advertising and free steak dinners, doing business from his King of Prussia business named A Better Financial Plan, or ABFP. He touted and sold alternative investments to Wall Street for many years, one of which was Par Funding.

Vagnozzi claims he was unaware of LaForte’s criminal past. He would raise more than $100 million for Par Funding, Philadelphia Magazine reported last year.

As the years went by, Par Funding attracted the attention of regulators, who say they discovered wide-ranging illegal activities. LaForte and his wife, Lisa McElhone, allegedly diverted more than $200 million of investor money for personal use, including luxury properties and a private jet.

The couple bought a $5.8 million home in Jupiter, Fla., in 2019, in addition to a $2.4 million home they already owned in Lower Merion and a $2.6 million lodge in the Poconos.

LaForte and associates allegedly engaged in significant tax evasion, hiding millions in income from the IRS. Authorities say Par Funding evolved into a Ponzi scheme.

In July 2020, the SEC filed a sweeping fraud lawsuit, and a federal court appointed a receiver to seize Par Funding's operations and assets. LaForte was sentenced to 15.5 years in federal prison.

The SEC did not even speak to him before obtaining a temporary restraining order on July 27, 2020, Vagnozzi said, which froze his assets and installed a receiver over his business.

“Had the SEC Miami office given me 30 minutes, I could have buried them in proof that I wasn't an insider,” Vagnozzi said. “Because I have the emails. I’ve got videos. I’ve got testimonials, I’ve got declarations. I’ve got so much proof that the SEC jumped the gun.”

Choosing to settle

Vagnozzi said he was unable to fight the SEC because they froze all of his assets, and he had just $80 in his pocket at one point. So, he settled.

In July 2020, he agreed to a $95,000 penalty for selling $32 million in unregistered "Pillar" life settlement funds to 339 investors, many of whom did not meet required wealth thresholds.

Vagnozzi also paid approximately $600,000 in disgorgement and penalties for selling unregistered securities for Fallcatcher Inc., a biometric software startup.

Since then, Vagnozzi has been clawing his way back. In 2022, the Pennsylvania Department of Insurance issued an order affirming Vagnozzi’s license suspension for “providing incorrect, misleading, incomplete or false information to the Department in a license application.”

The department warned that any future licenses could be immediately suspended if terms weren't met or if new complaints arose, with potential license suspension for up to 20 years.

Vagnozzi applied to get his license back last year and was denied on Aug. 22. An investigator for the department admitted under oath to doing little actual investigating, Vagnozzi claimed. The department ignored the “catastrophic life circumstances” Vagnozzi endured during the period in question, he added.

Vagnozzi appealed the license denial decision. The Department of Insurance provided a copy of Insurance Commissioner Michael Humphreys's order denying Vagnozzi's license application, but declined further comment.

"[T]he applicant engaged in activities that led to substantial penalties from both state and federal agencies, resulting in the revocation of his insurance license," the order reads. "The Department contends that the applicant’s blame shifting and failure to accept responsibility for his actions demonstrates a lack of self-awareness and respect for the Department’s responsibility to regulate producers to protect the public and maintain the appearance of worthiness among insurance producers."

Vagnozzi appealed on Sept. 8.

“I am extremely confident I will get my license back,” he said.

It’s the final piece of Vagnozzi’s strategy to return to his former lucrative days selling life insurance.

“I am the most honest, ethical, hard-working, best damn insurance agent in the country. And my life was turned upside down,” Vagnozzi said.

© Entire contents copyright 2026 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Many auto insurers slashing rates as claims drop

FSI announces 2026 board of directors and executive committee members

Advisor News

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

More Advisor NewsAnnuity News

- Court fines Cutter Financial $100,000, requires client notice of guilty verdict

- KBRA Releases Research – Private Credit: From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

More Annuity NewsHealth/Employee Benefits News

- CVS Pharmacy, Inc. Trademark Application for “CVS FLEX BENEFITS” Filed: CVS Pharmacy Inc.

- Medicaid in Mississippi

- Policy Expert Offers Suggestions for Curbing US Health Care Costs

- Donahue & Horrow LLP Prevails in Federal ERISA Disability Case Published by the Court, Strengthening Protections for Long-Haul COVID Claimants

- Only 1/3 of US workers feel resilient

More Health/Employee Benefits NewsLife Insurance News