Whole life insurance: Is simple really better?

Simplicity is the buzzword of the moment, but when it comes to life insurance, the pursuit of simplicity might be stripping away options that could provide important value to the client.

OneAmerica® believes the insurance carrier’s role is to educate clients by clearly communicating the value of the product and its associated options. We should be removing complicated messages and misconceptions about the product for clients, not eliminating intricacies that make the product valuable. By building relationships and having trusted conversations about whole life insurance with your clients, you can tailor coverage to their unique goals and needs.

Decoding complexity

Adapting coverage to specific needs is effectively done via optional riders. These riders add versatility to whole life insurance. But they can sometimes make the products seem more complicated. However, instead of removing these options, we just need to explain them better. This is one of the ways financial professionals bring value to their clients.

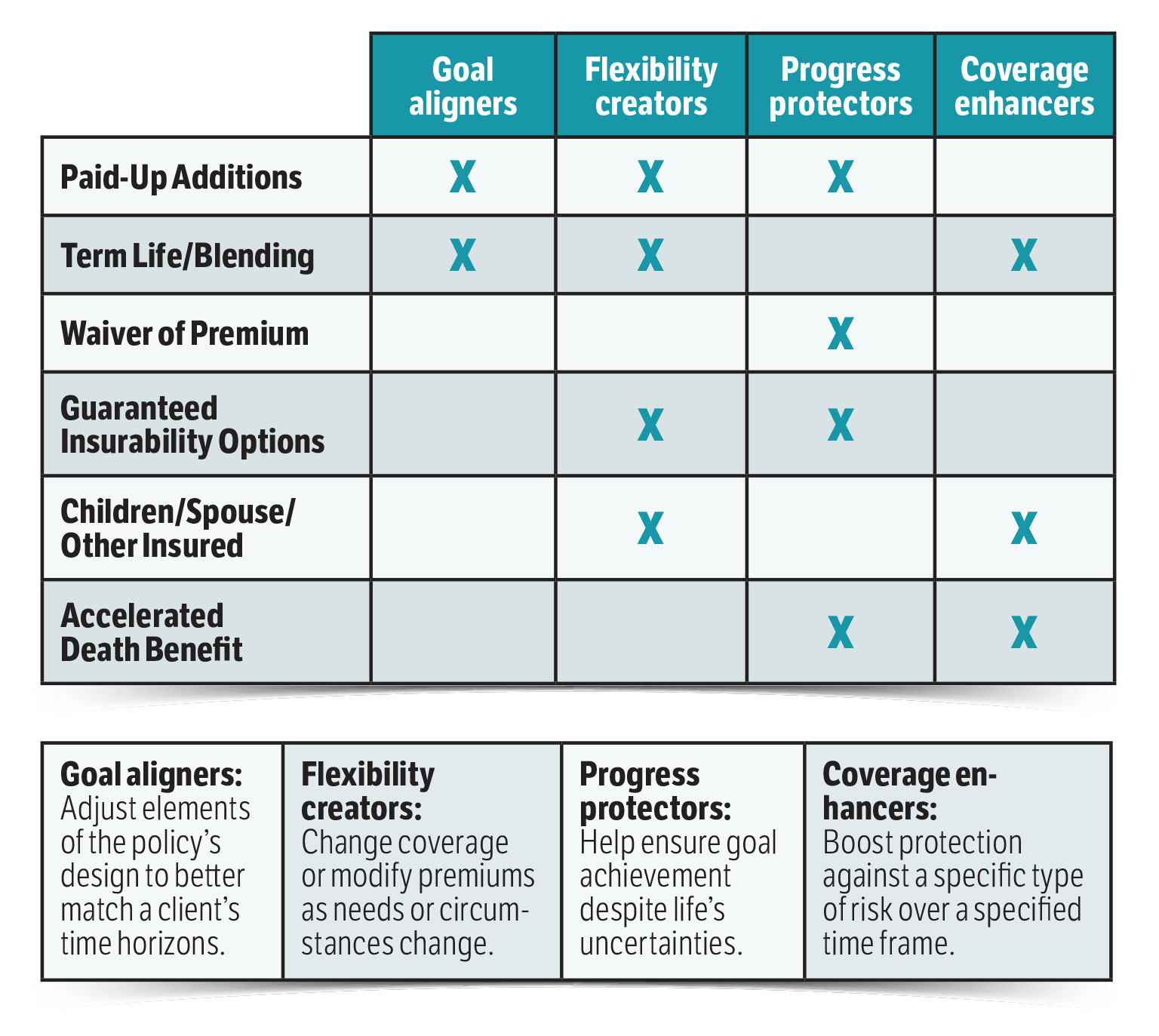

The goal should be to maintain whole life’s valuable complexities while making our communication about them more accessible. One approach is to categorize the goals that riders help achieve.

These categories allow you to clarify the unique benefits of each type of rider, which may enable clients to better understand their options. In some cases, a single rider may span multiple categories. An additional term life insurance rider, for example, is designed as a coverage enhancer, offering a boosted coverage amount for a designated period. Simultaneously, it can add flexibility to the policy, enabling policyholders to adjust their coverage to align with their changing needs and goals. This includes creating capacity to add more permanent whole life coverage beyond what was initially purchased.

By using this framework, you can collaborate with clients to make decisions that go beyond the core benefits of whole life insurance. This approach opens a conversation about the various customization options that whole life insurance can offer to align the policy with the individual client’s needs and financial goals. As a result, what might seem like a complex decision becomes a clear, guided process.

Leveraging the power of customization

Whole life insurance, known for its guaranteed death benefits, cash value growth and fixed premiums, provides a sturdy foundation. Yet the true potential is in the customization options available through optional riders. The key is to build a client’s financial future on the guarantees and leverage the flexibility of the non-guaranteed elements to tailor coverage to specific needs and circumstances.

Consider a client scenario in the context of “goal aligners.” Suppose a client has embarked on a high-intensity career path — perhaps in sales. They plan to go full throttle for the next 10 to 15 years, fully aware that sustaining this pace for 30 years could lead to burnout. Their strategy includes a peak earnings period, during which they intend to overfund their insurance. However, they also foresee a career transition, during which they will shift gears rather than maintain that breakneck speed for the next two to three decades.

In such cases, the goal isn’t always to align the coverage with a retirement date. Instead, it’s about understanding your clients’ premium goals and time horizons and aligning the policy design as closely as possible with those horizons. This could mean, for instance, explaining a policy this way: “By using riders, I’ve customized your policy design to plan for intentionally higher premiums during your peak earning years, with a target of reduced premium requirements as you get closer to retirement and no planned premiums after retirement.”

Clarifying complexity to deliver value

As our world accelerates, automates and streamlines, it’s tempting to simplify products to keep pace. Yet the value of an insurance company and the financial professionals it partners with lies in the ability to clarify complexities, not eliminate them.

Clearly communicating concepts to the client shouldn’t come at the expense of flexibility and potential for personalization. It’s essential not to lose sight of the true objective: to offer nuanced, adaptable solutions that cater to the diverse needs of clients.

To learn more about the power and adaptability of OneAmerica’s whole life products, go here.

OneAmerica® is the marketing name for the companies of OneAmerica. Riders may be optional and carry an additional cost. The long-term advantage of a rider will vary with the terms of the benefit and the length of time the product is owned. As a result, in some circumstances, the cost of a rider may exceed the actual benefit paid under that rider. Guarantees are subject to the claims paying ability of the issuing insurance company.

Medication Therapy Management: A Part D Plan Program to Benefit Your Clients

Pioneering a tech-driven future for life insurance

Advisor News

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Higher premiums, Medicare updates: Healthcare changes to expect in 2026

- Wellmark still worries over lowered projections of Iowa tax hike

- Trump’s Medicaid work mandate could kick thousands of homeless Californians off coverage

- CONSUMER ALERT: TDCI, AG'S OFFICE WARN CONSUMERS ABOUT PURCHASING INSURANCE POLICIES FROM LIFEX RESEARCH CORPORATION

- REP. LAUREN BOEBERT INTRODUCES THE NO FEDERAL TAXPAYER DOLLARS FOR ILLEGAL ALIENS HEALTH INSURANCE ACT

More Health/Employee Benefits NewsLife Insurance News

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

- NAIFA and Brokers Ireland launch global partnership

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- Reimagining life insurance to close the coverage gap

More Life Insurance News