The Future of Underwriting in the Palm of Your Hand

With UnderRight Life, Global Atlantic is helping you do away with cumbersome underwriting tables by moving underwriting tools into the palm of your hand and making the underwriting process a more customer-friendly experience.

Since the dawn of the life insurance industry, underwriting has weighed on the sales cycle. Its cumbersome and invasive nature, as well as its unpredictable results, slow the overall application process and may even deter some people from seeking the protection they need.

Especially today in the digital age, where people are conditioned to expect immediate gratification, purchasing life insurance is inconvenient and time-consuming. People want instant feedback and results.

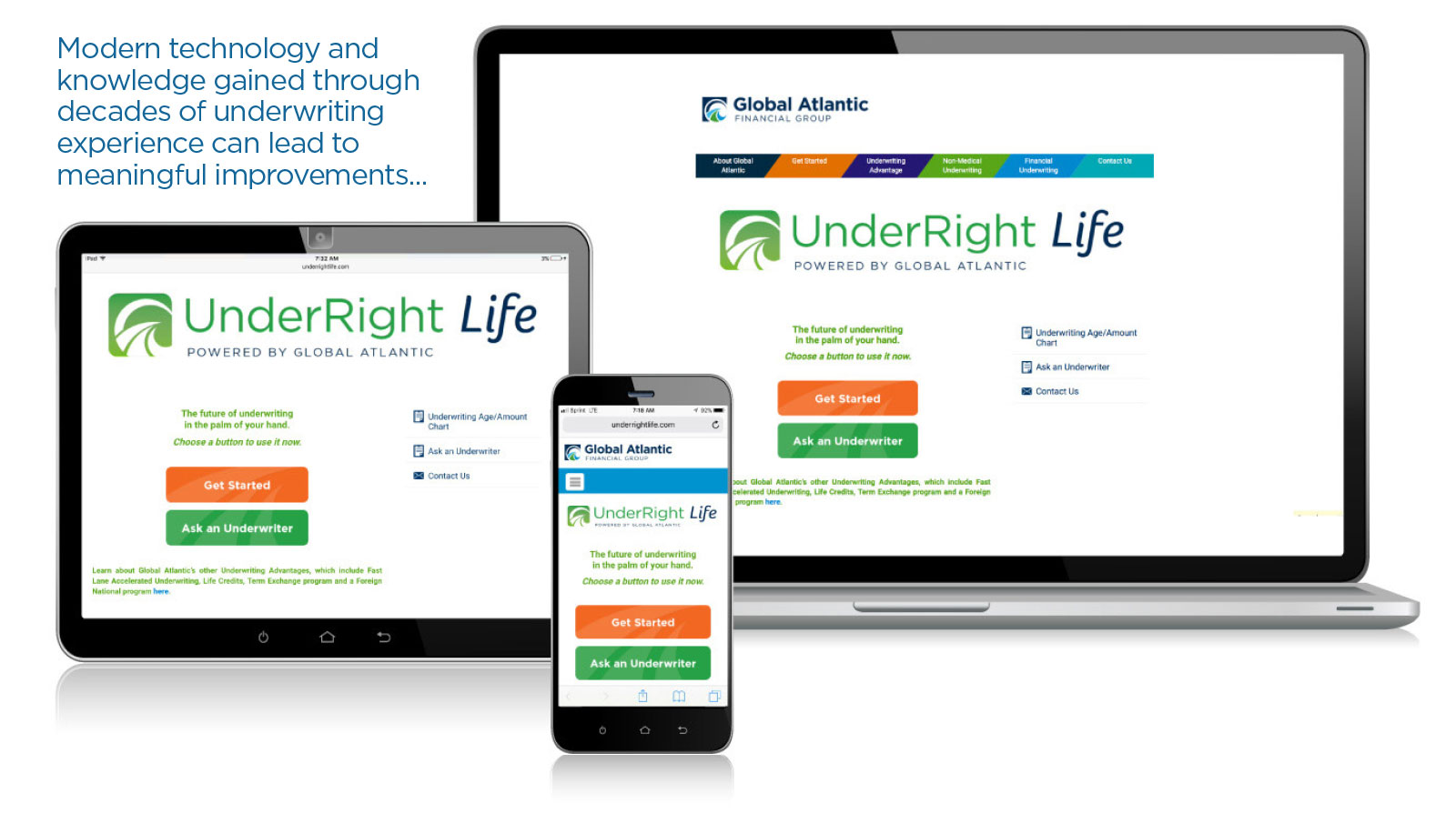

Global Atlantic understands these challenges and is investing in underwriting initiatives that pave the way to a smoother and quicker experience. While underwriting is an essential part of the life insurance process and isn’t going away, modern technology and knowledge gained through decades of underwriting experience can lead to meaningful improvements — such as Global Atlantic’s UnderRight Life.

Real time, real value

UnderRight Life is a new, mobile-friendly, web-based underwriting tool that saves time by allowing agents to provide a deeper level of underwriting insight in real time during client meetings, facilitating more accurate quoting and more informed decision-making.

By accessing the UnderRight Life tool at UnderRightLife.com from any device with an internet connection, agents can enter some basic case information to receive tailored underwriting guidance. In addition to age and desired face amount, the tool asks six yes/no questions based on the client’s history. No personally identifiable information is required.

Topics include driving history, bankruptcies, foreign residency and travel, criminal history, prior life insurance offers and major medical conditions. Depending on the responses, agents may be asked the policy type — term or permanent — and the client’s height, weight and gender.

UnderRight Life will either indicate the likely underwriting class the client will be offered, to help you quote with greater confidence, or it will prequalify the client for Global Atlantic’s Fast Lane Accelerated Underwriting program.

Get your clients in the Fast Lane

Fast Lane Accelerated Underwriting is a dynamic approach to underwriting life insurance cases. Rather than completing a full traditional medical exam with labs, Fast Lane streamlines the process, using:

- Fewer sections of the application.

- Authorization for our underwriting team to use a variety of personal consumer information sources to complete the underwriting process.

- Tele-med medical interview by phone.

According to LIMRA’s 2017 “Barometer Study,” consumers are looking for a more transparent, simple experience — especially in the area of underwriting. The study found that 70% of respondents would be more likely to buy if there were no need for a medical exam.

Fast Lane Accelerated Underwriting makes this a reality. It can be a faster, simpler way for clients to receive a life insurance offer without the hassle of a medical exam. Although Fast Lane underwriting and traditional underwriting produce consistent results, they get there in different ways. Fast Lane uses information clients provide and information from consumer-reporting agencies.

All information gathered is used only to evaluate and underwrite a life insurance application. The questionnaire completed during a tele-med interview becomes part of the policy and will be included in the policy documents when they are delivered to the policy owner. The UnderRight Life tool makes it easy for you to see on the spot whether a client qualifies.

Not sure? Just ask.

Finally, UnderRight Life features a prominent Ask an Underwriter link that provides quick access to an online form where agents can reach out directly to the Global Atlantic underwriting team with questions. On normal business days, inquiries received by 2 p.m. Central Time will receive a same-day response. Those received after 2 p.m. will receive a response on the next business day.

The goal of Global Atlantic’s Underwriting department is to complement and enhance the relationships you have with your clients and prospects. The team, having an average of 19.7 years of experience, promises to provide you with the services and value you deserve. We do this through competitive and prudent underwriting decisions that ensure the needed protection will be there for you and your clients. We call this approach the Global Atlantic Underwriting Advantage.

About Global Atlantic

Global Atlantic Financial Group, through its subsidiaries, offers a broad range of retirement, life and reinsurance products designed to help our customers address financial challenges with confidence. A variety of options helps Americans customize a strategy to fulfill their protection, accumulation, income, wealth transfer and end-of-life needs.

Adam Lucas, a marketing manager at Global Atlantic Financial Group, has over 15 years of experience in the financial services industry with a focus on life insurance.

The Allianz Playbook for a Diversified FIUL Allocation Option Lineup

A More Balanced Approach to Comparing Policy Illustrations

Advisor News

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

- Making the most of Financial Literacy Month

- Tariffs alter Q2 economic outlook downward, Morningstar says

- Women need an advisor who’s also a coach

More Advisor NewsAnnuity News

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

More Annuity NewsHealth/Employee Benefits News

- Friday roundtable in Rochester to focus on possible Medicaid cuts

- Studies from University of Southern California (USC) Yield New Information about Military Medicine (Health Insurance Coverage and Hearing Aid Utilization In Us Older Adults: National Health Interview Survey): Military Medicine

- Pritzker's Proposed Budget Will Take Away Health Coverage From Immigrants Without Legal Status

- A fifth of Americans are on Medicaid. Some of them have no idea.

- Proposed ban on drug middlemen owning retail pharmacies passes

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- Symetra Partners with Nayya to Introduce Digital Leaving Planning Solution

- Krispy Kreme's owner is seeking approval to buy Shenandoah Life

- Krispy Kreme owner to acquire Roanoke-based Shenandoah Life

- Directors' Report and Financial Statements 31 December 2024

More Life Insurance News