The Allianz Playbook for a Diversified FIUL Allocation Option Lineup

Allianz Life Insurance Company of North America (Allianz) offers innovative fixed index universal life (FIUL) insurance products that provide clients death benefit protection, flexibility and tax advantages.

With FIUL, clients have the opportunity to earn cash value based on indexed interest utilizing a variety of crediting methods and allocation options. So Allianz is simplifying its playbook to educate clients about the benefits and choices that come with FIUL and about how diversifying among a variety of index allocation options may help smooth out market volatility.

The latest Allianz client materials use a baseball analogy to highlight these ideas. The theme conveys that while it would be great if there were one option to always count on for “home runs,” no single index or crediting method produces the best results in all market conditions. A diversified lineup of allocation options can help clients achieve the results they need — like baseball players with different skills and attributes who work together to achieve their goal.

Swing for the Fences, or Aim for Consistency?

To accommodate the challenges of a dynamic economic environment, it’s important to consider balancing growth with stability. That means a client’s FIUL lineup should consider the external index and the crediting method that determines how much interest could potentially be received in a given year—both pieces of the allocation option.

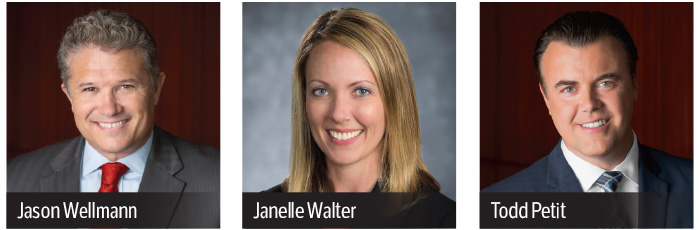

“No one crediting method is right for everyone, and no one method is likely to be the best choice for all years. Each crediting method reacts differently to different economic environments,” says Todd Petit, assistant vice president, Actuarial Product Development, Allianz. “Most important, some methods have higher accumulation potential, with more risk of getting a zero percent interest credit. Understanding your client’s goals and risk tolerance is important in determining which crediting method may work the best for them.”

Petit notes that while the monthly sum with a cap may have the potential to capture high index returns up to a cap, it is also the crediting method that has historically credited the most zeroes. Contrast that with a trigger method, he suggests, which is an annual point-to-point crediting method that will credit the trigger interest rate in any year that the index is flat or positive. This type of crediting method may not credit a zero as often; however, it also may not be able to capture as high of an index return if the market is significantly positive.

“There are crediting methods that fall in between these as well,” says Petit. “The annual sum and the monthly average are good examples of middle-of-the-road crediting methods.”

The Power of Diversification

When the financial crisis was just beginning in the third quarter of 2008, well-known equity benchmarks were 25 percent down from their all-time highs. Equities tumbled, as did interest rates. What index would have been the home-run hitter? Looking back, annual point-to-point with an index that moved away from volatile equities toward bonds would have been the best allocation option.

“It is far easier for one index to have a poor year than it is for several uncorrelated indexes to all have a bad year together. Consistent, steady index returns can be an important part of the long-term success of a fixed index universal life policy,” says Jason Wellmann, SVP, Life Distribution, Allianz. “Unlike other financial vehicles that may have minimal or no charges being deducted regularly, a life insurance policy has monthly charges to cover the costs of the valuable life insurance protection. Because charges are being taken out each month, the need for consistent interest credits becomes even greater.”

Even the most seasoned market analysts don’t know the economic outlook of a year from now or which allocation option will be most effective. Clients can hope for homers from a single source, or they can create a team that can work together and may achieve a more consistent return.

“Diversification among allocation options helps smooth out the highs and lows. So instead of chasing each year’s highest-earning index allocation, it may be more effective to have consistent performers with the potential for stable, steady index credits,” says Wellmann.

Consider that just three years after the start of the financial crisis, amid the fears of global recession in early 2011, a well-known equity benchmark was up again, but increases were minimal. Interest rates fell sharply, helping bond returns. In that case, an allocation option with annual sum crediting and smaller equity returns combined with bond returns would have offered the best option.

“A financial professional also needs to consider the index used with an allocation option,” says Petit. “For fixed index universal life insurance policies today, there are large cap, small cap, international, bond, and a blend of index options available. Just as the crediting method itself can vary in different economic environments, so can the underlying index. As an alternative to indexed interest, your client also has the option of allocating all or part of their cash value to a fixed interest account.”

“Remember, diversification does not ensure that your clients will earn an interest credit every year, but it may help provide more consistent returns by spreading out the interest potential and volatility of the policy over different economic cycles,” adds Wellmann.

Innovative Index Allocation Allows for Stronger Teams

“Allianz is a leader in the indexed annuity and life insurance marketplace. We’re known for our ability to innovate in our index allocation designs. But the innovations must help solve the concerns our clients are facing, and not just be innovation for innovation’s sake. Allianz has had a rich history of pioneering new allocation options,” says Wellmann.

And Petit noted some recent index allocation designs that “were born from true consumer need, helping our customers achieve their financial goals in changing economic conditions”:

- 2005 – The monthly sum crediting method was built to work well in a steady-growth, low-volatility market and in response to demand for access to higher accumulation potential than an annual point-to-point can provide.

- 2008 – Allianz was the first to develop an index allocation that automatically allocated to various sectors such as different U.S. equity sectors, international growth, and stabilizing bond performance in response to the increasing need for diversification.

- 2013 – Allianz created the first volatility-controlled index to help protect against volatile markets, providing consistent accumulation potential and a new way to dynamically diversify an allocation in response to the extremely low interest-rate environment that year.

Ensuring a Smooth Pitch

According to Janelle Walter, senior director, Life Insurance Distribution Marketing at Allianz Life. “It is important for us to make materials and sales concepts available for the field that can help make their conversations with their clients easier. We have always believed that education and transparency are key to building the trust of our clients and financial professionals. That is why we make so much of our content available for client use. We want them to have as much education at their fingertips as possible before purchasing a product.”

Going to the Ballgame to Simplify the Message

“Our new piece, Score the Benefits of a Diversified Lineup, helps the client make an educated decision on which allocation options may be appropriate for their particular situation. We integrate analogies and stories that resonate with clients into our materials. In this particular piece, we use the baseball analogy to describe the importance of diversification in a way that can be easier for the client to understand,” says Walter.

A diversification calculator is also part of the offering, to assist financial professionals with helping clients determine which index allocation(s) may be appropriate. The calculator shows the hypothetical performance of Allianz FIUL allocation options and market indexes.

“It takes into account both the current and the minimum guaranteed caps and rates, and shows what the 10-year annualized return would have been for each allocation option and each raw index,” says Walter. “This is another tool to help the financial professional explain the importance of allocation diversification in an FIUL policy. With the calculator, they will easily be able to see that there is no clear pattern, and that no index allocation option performs the best in all market environments.”

Another component of the Allianz education package to use with clients is a three-minute video to convey the importance of diversification within an FIA or FIUL policy. Walter notes it is easily viewed on a mobile device or shared on the business website of a financial professional, and is a great conversation starter.

“We make it easy for the financial professional to share our content with their clients. For example, with our diversification video, all they need to do is click “share” and a pre-populated email will pop up where they can send a link to the video to their clients,” says Walter.

In addition to video, Allianz creates campaigns that deliver content in many different formats such as printed materials, social media messaging, and other digital tools. According to Walter, varied delivery helps accommodate differences in learning styles and allows consumers to review content when it’s convenient for them in the format they most prefer.

Hitting Fundamentals for Better Understanding and Engagement

The Score the Benefits of a Diversified Lineup education series from Allianz uses analogies and simplified terminology to resonate with clients.

“FIUL products can be complex for the average consumer when trying to understand the allocation options available and what may be suitable for their financial objectives,” says Walter. “I take the approach of making it simple enough for someone not familiar with FIUL to understand.”

Walter adds, “These are long-term financial products, and we want our clients to have a sound understanding of how the products work so they believe in the FIUL product they purchased and are satisfied with the protection and accumulation potential they may achieve.”

To find out more about Allianz and its strategy to support your clients in understanding the benefits of a diversified allocation option lineup, visit www.FIULplaybook.com.

Product and feature availability may vary by state and broker/dealer.

Guarantees are backed solely by the financial strength and claims-paying ability of Allianz Life Insurance Company of North America. www.allianzlife.com

Products are issued by Allianz Life Insurance Company of North America, 5701 Golden Hills Drive, Minneapolis

John Hancock Vitality Expands the Reach of Life Insurance with Apple Watch®

The Future of Underwriting in the Palm of Your Hand

Advisor News

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

- Market reports turn economic trends into a strategic edge for advisors

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

More Advisor NewsAnnuity News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

More Annuity NewsHealth/Employee Benefits News

- PID finds violations by Aetna Insurance

- Iowa insurance firms warn bill would make health costs rise

- ELLMAN BILL PROTECTS ACCESS TO HEALTH COVERAGE, PREVENTS DENIALS OVER PAST-DUE PREMIUMS

- Blue Cross Blue Shield of Wyoming CEO Gore announces retirement; Urbanek to take lead

- Wellpoint taps Rachel Chinetti as president

More Health/Employee Benefits NewsLife Insurance News

- Jackson Earns Award for Highest Customer Service in Financial Industry for 14th Consecutive Year

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- LIMRA: Individual life insurance new premium sets 2025 sales record

- How AI can drive and bridge the insurance skills gap

- Symetra Partners With Empathy to Offer Bereavement Support to Group Life Insurance Beneficiaries

More Life Insurance News