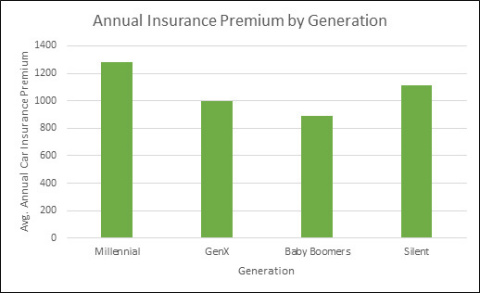

Compare.com Data Reveals Millennials Disproportionately Burdened by Car Insurance Premiums

Millennials pay up to 44% more on car insurance premiums than other age groups

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181115005073/en/

Figure A

On average, Millennials pay

Those who live with their parents pay most of all. On average, people who live with parents spend

Impact of Claims and Accidents

Millennials are also burdened by high costs when it comes to claims and accidents. After their first claim, this age group pays 21 percent more than GenX (as illustrated in Figure B). Millennials with two or more claims pay 7 percent more than their peers with no claims (

After their first accidents. Compare.com analysis reveals that Millennials and Silent Generation drivers get penalized the most, with high premiums at

“It isn’t fair that Millennials are disproportionately burdened by car insurance premiums, considering this group also faces record levels of debt as a result of student loans and high living expenses,” said Compare.com CEO

Drivers can use Compare.com to compare car insurance rates from over 50 top auto insurance companies in seconds. For additional information about the research, visit https://www.compare.com/auto-insurance-report.

About Compare.com

Compare.com is a limited liability corporation headquartered in

View source version on businesswire.com: https://www.businesswire.com/news/home/20181115005073/en/

ICR

[email protected]

(646) 677-1802

Source: Compare.com

CIRMA Selects Guidewire InsurancePlatform for Claims Management, Data and Analytics, and Digital Engagement

Camp Fire: They survived, their homes burned, where will Paradise residents go?

Advisor News

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

- How 831(b) plans can protect your practice from unexpected, uninsured costs

- Does a $1M make you rich? Many millionaires today don’t think so

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- To attract Gen Z, insurance must rewrite its story

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

More Life Insurance News