What would proposed Social Security changes mean for clients?

The future of Social Security solvency has been a topic of debate, especially during this election year. But what financial impact would each of the scenarios under discussion have on real Americans? And would those scenarios have any effect on the Social Security program over the long term?

HealthView Services published a white paper describing the significant financial impact of a one-year delay in full retirement age, reducing cost of living adjustments, and reducing spousal benefits for mass affluent and average income couples 25 and 10 years from retirement. It also shows the cost of increasing the number of years to calculate Social Security benefits, higher FICA contributions, and taxing employee and health care premiums. The authors of the paper conclude that eliminating the cap on contributions for the affluent would go a long way to addressing the solvency shortfall.

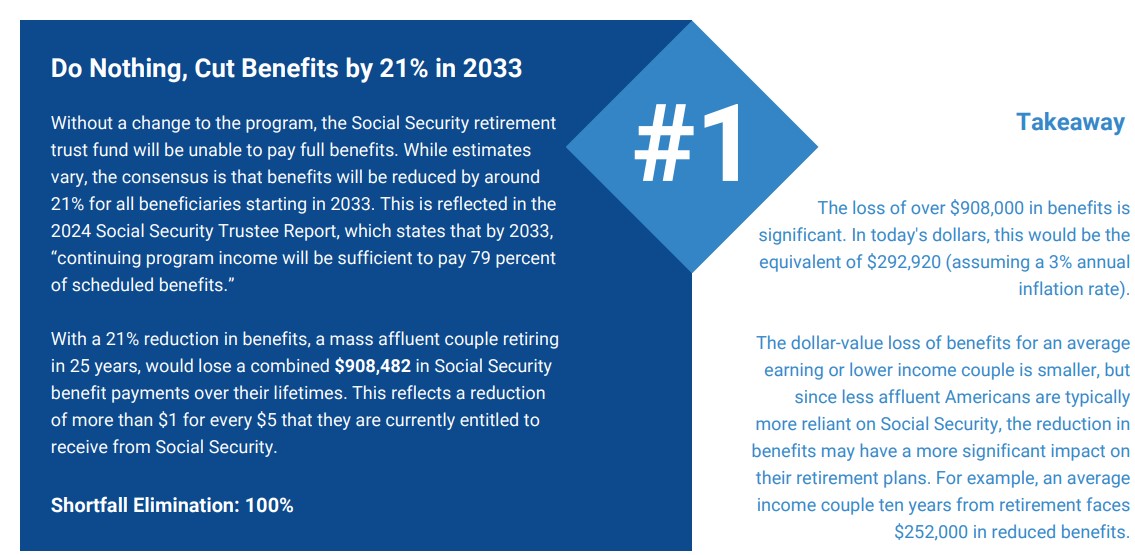

The greatest impact on retirees will be if future administrations do nothing and cut benefits. The report shows if benefits are reduced by 21%, consistent with current Social Security funding expectations, a mass affluent couple 25 years from retirement risks losing $908,000 in future Social Security benefits. An average income couple only ten years from retirement would face a cut in lifetime benefits of $252,000.

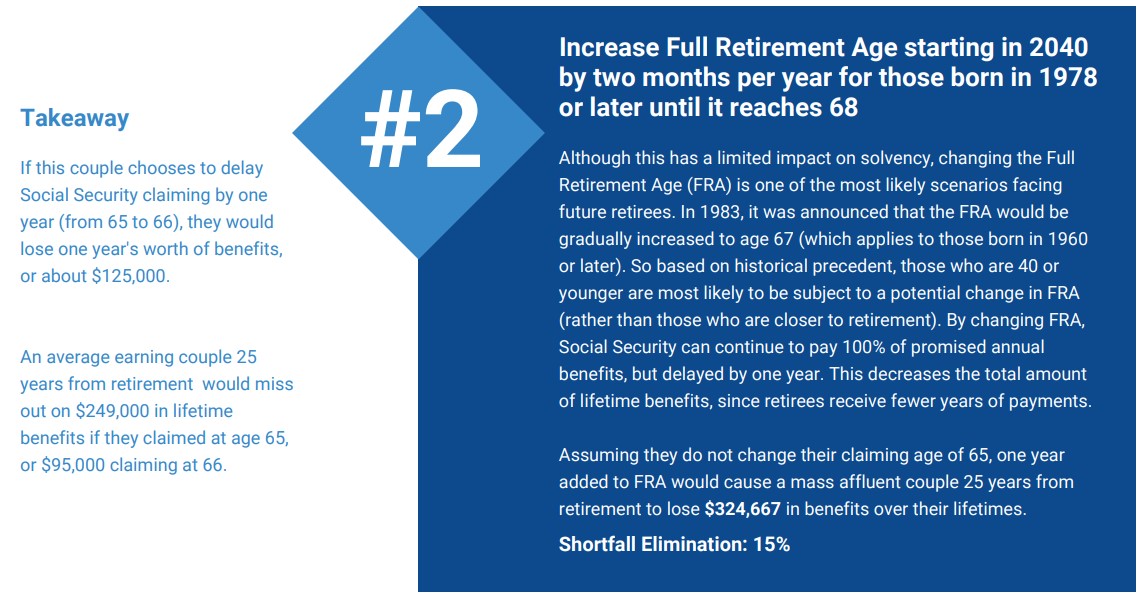

The paper shows the next most significant proposal in terms of dollar impact for retirees will be the most likely – changing the full retirement age. Delaying the FRA for future retirees by one year, from 67 to 68, would cost a mass affluent couple retiring in 25 years, claiming Social Security at 65 years old, $325,000 in lost lifetime benefits. Under the same conditions, an average income couple will see benefits reduced by $249,000. If the couples delay claiming for one year, they will see lifetime Social Security benefits reduced by $125,000 or $95,000.

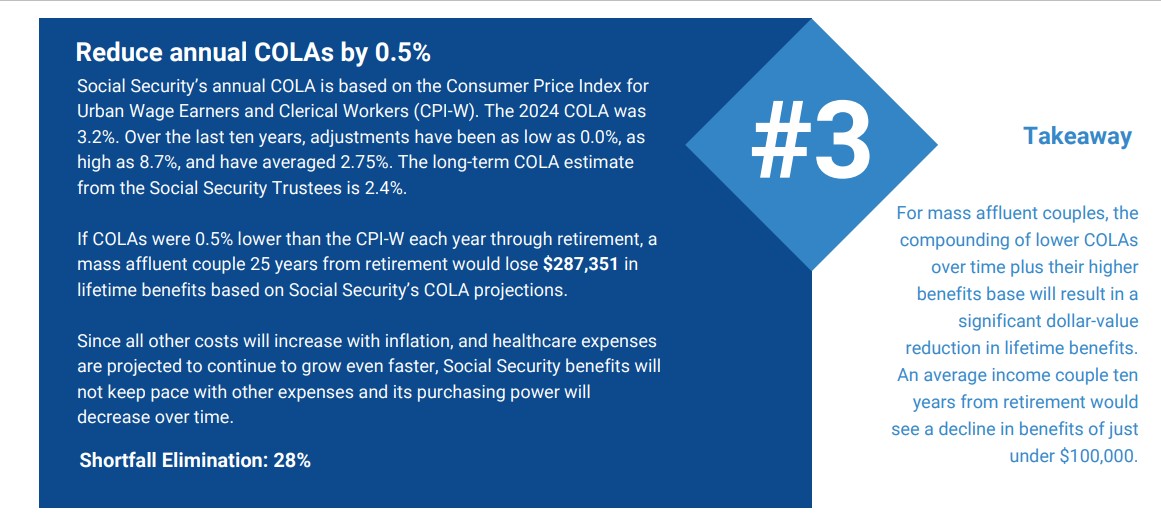

Another scenario described in the paper is lowering the annual COLA based on the Consumer Price Index for Urban Wage Earners and Clerical Workers by 0.5% each year through retirement. For a mass affluent couple retiring in 25 years, this would mean a reduction of almost $287,000 in lifetime benefits. An average income couple 10 years from retirement would lose slightly less than $100,000 in Social Security payments.

Reducing spousal benefits from 50% to 33% will have minimal effect on Social Security funding, but significantly reduce the benefits of the lower-earning spouse of a mass affluent couple 25 years from retirement by close to $250,000.

The paper also shows the cost to individuals of proposals to raise taxes on employees and employers to fund Social Security. Raising employees and employers’ FICA tax from 6.2% to 8% would address the Social Security funding shortfall at a stroke. The cost to working Americans would range from $133,000 in lower net income for a mass affluent couple over the next 25 years to $22,000 for an average income couple retiring in 10 years.

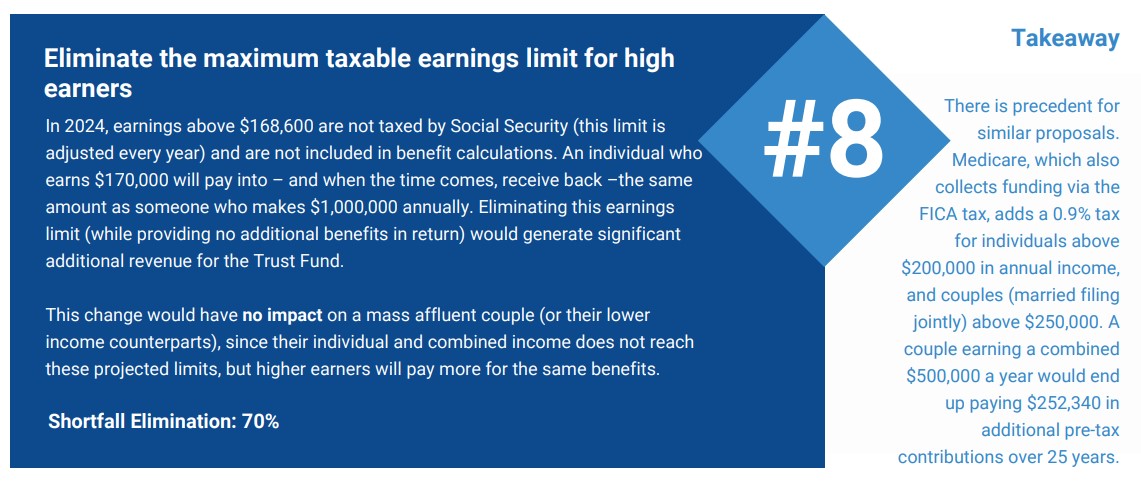

A change that will have no impact on mass affluent and average income couples would be to eliminate the maximum earnings limit on Social Security contributions for high-income Americans. A couple earning $500,000 a year, 25 years from retirement and receiving no additional benefits, would pay an additional $252,000 into the system. According to Society of Actuaries modeling cited in the report, this would address 70% of Social Security’s shortfall.

Ron Mastrogiovanni, HealthView Services CEO, told InsuranceNewsNet the paper was prompted by the need for advisors to help clients understand how they should include Social Security in their retirement planning amid all the reports of the program’s potential insolvency.

“It’s important for advisors to be aware of all the different options the federal government has, and then determine how they should plan with their clients most effectively,” he said.

Mastrogiovanni said he believes the scenarios most likely to become reality, should Congress decide to act, are raising the FRA by one year and raising the maximum taxable earnings limit.

The main takeaway for advisors, he said, is to include Social Security planning when reviewing annual plans for clients who are about to retire.

“Then when working with the client, they can decide whether they want to take a more conservative approach. If they believe they will need the same or a certain number of dollars more a month, they can plan around that. We have to look at Social Security and whether a client needs to delay retirement or save more money, that has to be taken into account.”

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Skyrocketing home insurance rates deter homebuyers

Tailoring workplace benefits for a multigenerational workforce

Annuity News

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

More Annuity NewsHealth/Employee Benefits News

- Best’s Market Segment Report: US Health Insurers Seek to Improve Underwriting Performance in 2026 Amid More-Pronounced Pressures

- Americans give employer-provided health coverage high marks

- Iowa insurance firms warn bill would make health costs rise

- Senate OKs ambulance service reimbursement bill

- UK HealthCare launches Food as Health initiative across state

More Health/Employee Benefits NewsLife Insurance News

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- Reimagining life insurance to close the coverage gap

- Busch, Pacific Life settle dispute over $8.5M investmentFormer NASCAR champion Kyle Busch settles $8.5M lawsuit against life insurance companyTwo-time NASCAR champion Kyle Busch and a life insurance company have settled an $8.5 million lawsuit in which the driver said he was misled into purchasing policies marketed as safe retirement plans

- AM Best Affirms Credit Ratings of The Cigna Group and Its Subsidiaries

- U-Haul Holding Company Announces Quarterly Cash Dividend

More Life Insurance NewsProperty and Casualty News

- Morningstar: US oil tanker insurance plan won’t lower gas prices

- Reports Summarize Insurance Findings from Zhongnan University of Economics & Law (Does Directors’ and Officers’ Liability Insurance Enhance Corporate Tax Compliance? Evidence From Chinese A-share Listed Companies): Insurance

- Parrett Insurance Agency earns ‘Presidential Agency Partner’ distinction

- 3 things to know about blockbuster New Orleans staged wreck trial as opening arguments begin

- Florida Reforms Stabilizing Insurance Markets

More Property and Casualty News