Training consumers to make confident financial decisions

Annuities, guarantees, term life, surrender charges, health supplemental plans, voluntary benefits, critical illness, Roth 401(k), target date funds, living benefits, riders — and the list goes on. The financial services lexicon is complex and continues to grow. Things get further complicated when you bring up major financial themes such as savings, budgets, insurance coverage needs, debt, taxes and personal longevity. It’s hard for anyone to have the skills to make confident financial decisions.

Although the COVID-19 pandemic has increased awareness of life insurance and health, knowledge on financial topics is still abysmal. According to the TIAA Institute-GFLEC Personal Finance Index survey, U.S. adults could correctly answer only about half of the financial literacy questions. Eighteen percent correctly answered more than 75% of the index questions, while 23% correctly answered 25% or fewer of the questions. As bad as these results were, the grades were even worse for Generation X and millennial respondents.

In fact, data from the FINRA Investor Education Foundation’s National Financial Capability Study shows a strong correlation between respondents with higher financial literacy (scoring above the median on a seven-question financial literacy quiz) and those who feel financially secure. That finding is exacerbated when, according to LIMRA’s 2022 Insurance Barometer Study, 2 in 5 parents say they are barely or not at all financially secure.

The strength coach analogy

As a 46-year-old coming out of the pandemic, I made my physical fitness a priority. Although I can’t control every aspect of my health, I do want to increase my odds of having a long and active retirement. If I weren’t staying active, it would become harder and harder to exercise and more likely that I would have health issues later in life. I stay active by running every other day, and I use fitness apps that provide on-demand coaching, gamification and ways to track my performance. While I’m using technology to support my fitness, many of my friends use personal trainers and strength coaches. Improving your physical fitness doesn’t have to be a one-size-fits-all approach.

The same logic can apply to finances. By investing time and effort in reading books, listening to podcasts, or using budget tools and programs, some might be able to build financial literacy on their own. Others will need a financial professional, friend, coach, trainer or advisor to increase their financial knowledge, ultimately leading to financial success.

From inertia to action

Why don’t more individuals invest time and effort in improving their financial acumen? Research shows that time, topic discomfort and being overwhelmed are three of the key areas of inertia. So what can you do? Here are three things to consider.

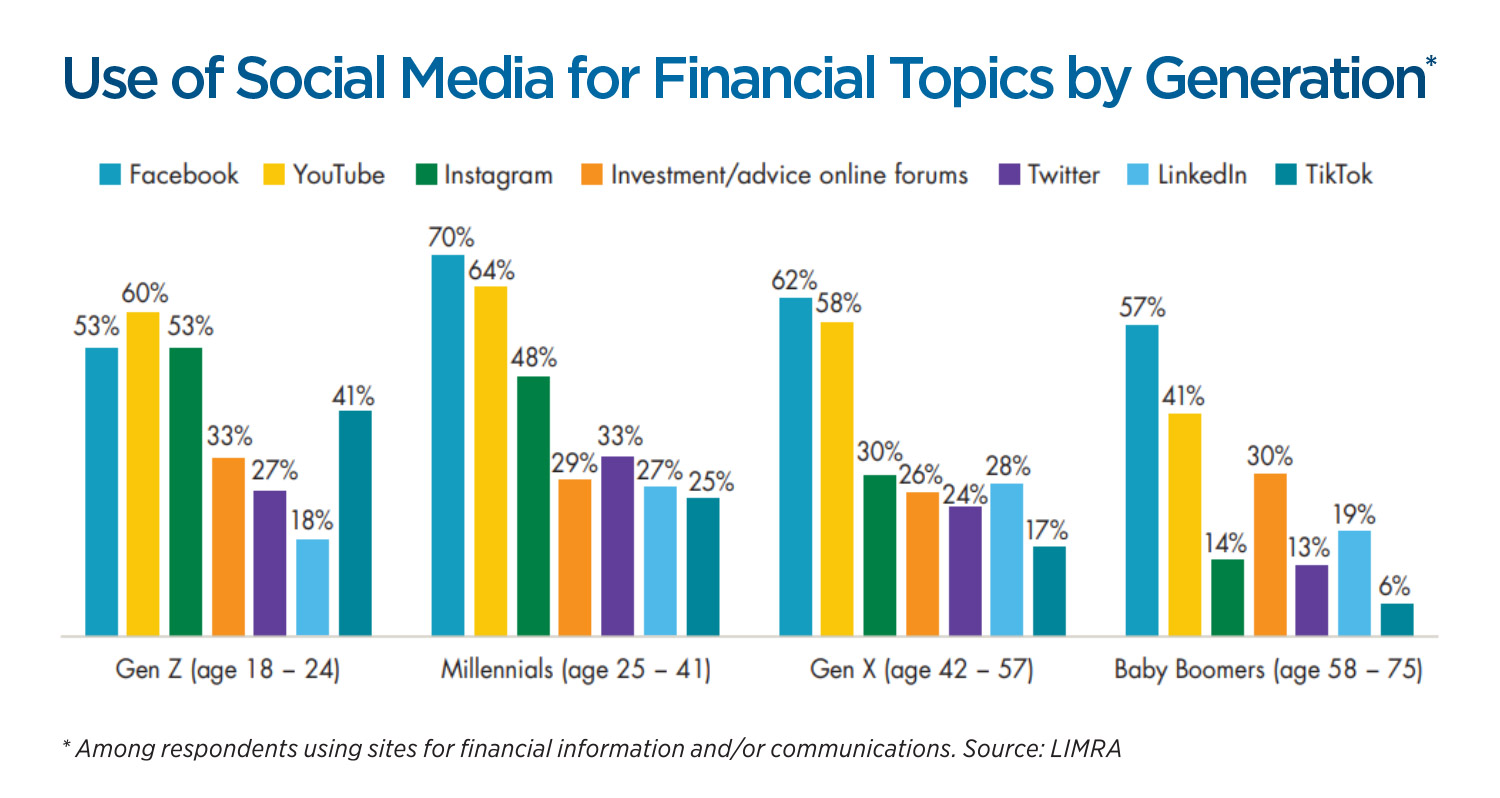

1. Have a social media presence. In LIMRA’s 2022 Insurance Barometer Study, the respondents indicating the use of social media sites for financial purposes more than doubled in the past three years, to 53%. Your online presence should not be about pushing product. Connect the dots for your clients.

2. Be human. Bring expertise and empathy to topics like end-of-life, adult care and holistic advice. According to LIMRA’s 2022 Insurance Barometer Study, 40% of respondents felt discomfort during end-of-life discussions. Advisors and agents can build trust with clients by starting with basic topics like emergency savings, budgeting and longevity.

3. Connect at a deeper level. People love stories. They want to feel emotions. Storytelling is powerful because it can create an emotional connection between you, your personal brand and the client. You can share 1,000 facts with a client with little success, but a powerful story will have a greater chance of moving a client closer to action.

Keith Golembiewski is senior director of LIMRA’s strategic research program. He may be contacted at [email protected].

Annuities: Gaps can lead to opportunities

Leaning into technology and change

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- PROMOTING INNOVATION WHILE GUARDING AGAINST FINANCIAL STABILITY RISKS SPEECH BY RANDY KROSZNER

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Reliance Standard Life Insurance Company Trademark Application for “RELIANCEMATRIX” Filed: Reliance Standard Life Insurance Company

- Jackson Awards $730,000 in Grants to Nonprofits Across Lansing, Nashville and Chicago

- AM Best Affirms Credit Ratings of Lonpac Insurance Bhd

More Life Insurance News