Annuities: Gaps can lead to opportunities

The year 2024 is expected to be the year of Peak 65, when more people in the U.S. turn age 65 than ever before, unleashing the greatest surge of new retirees in history.

“The baby boomers are redefining everything, and they are redefining retirement,” said Jon Rosborough, vice president of Statler Nagle, at a recent webinar presented by the National Association for Fixed Annuities and the Alliance for Lifetime Income.

With disappearing pensions, the traditional three-legged stool of retirement security has collapsed, Rosborough said. This makes annuities a key part of the new retirement security framework needed to support baby boomers through a potentially long retirement.

The alliance and CANNEX recently released the findings of the Protected Retirement Income and Planning Study of investors and financial professionals. Those findings found gaps in how investors perceive annuities and in their understanding of them.

“In our analysis, we found there are 4.3 million households in America that are approaching or are in retirement who need that annuity discussion but are not getting it. They want you to reach out,” Rosborough said.

The research showed that protected income and the benefits of annuities are of great interest to investors, but many investors don’t connect the benefits of annuities to the name “annuities.”

What financial professionals must do for annuity prospects, said Mike Harris, education advisor with the alliance, “is link those things up — show them this is what an annuity does.”

Harris said research found investors are interested in annuities.

» Nearly two-thirds of investors expressed an interest in buying an annuity as part of their retirement plan. That interest was even greater among younger investors.

» Nearly half of investors believe financial professionals have a responsibility to present guaranteed lifetime income products to their clients.

» Seven in 10 investors who have a 401(k) plan are interested in investing in annuities through their plan.

Harris said he believed a significant finding is that 66% of investors are considering an annuity and that half of investors believe financial professionals have a responsibility to discuss annuities and how they fit into a portfolio if they meet the client’s needs.

All these findings align with previous research done by the alliance. Less than 15% of consumers who are familiar with annuities have a negative impression of them. But 55% who are very familiar with annuities have a very favorable impression.

One key gap that the research uncovered is that investors who work with a financial professional tend to worry about their finances, but few financial professionals believe their clients worry that much. Nearly half (48%) of investors said they worry about their finances several times a month or more often. Only 8% of financial professionals said they believe their clients worry about finances that often.

“There’s a gap between what clients are feeling and what their financial professionals believe they are feeling,” Harris said. The implications of the research, he added, are that financial professionals must focus on reassuring clients and identifying risk-mitigation strategies.

It’s one thing to plan for retirement, but an unforeseen retirement is another matter, Harris said. The research showed that nearly all financial professionals (92%) said they discussed the possibility of an unforeseen retirement with their clients, yet 37% of clients said their advisors never discussed that possibility with them.

The opportunity here, Harris said, is for financial professionals to discuss the possibility of an unforeseen retirement with clients and use that discussion to initiate a conversation about retirement income.

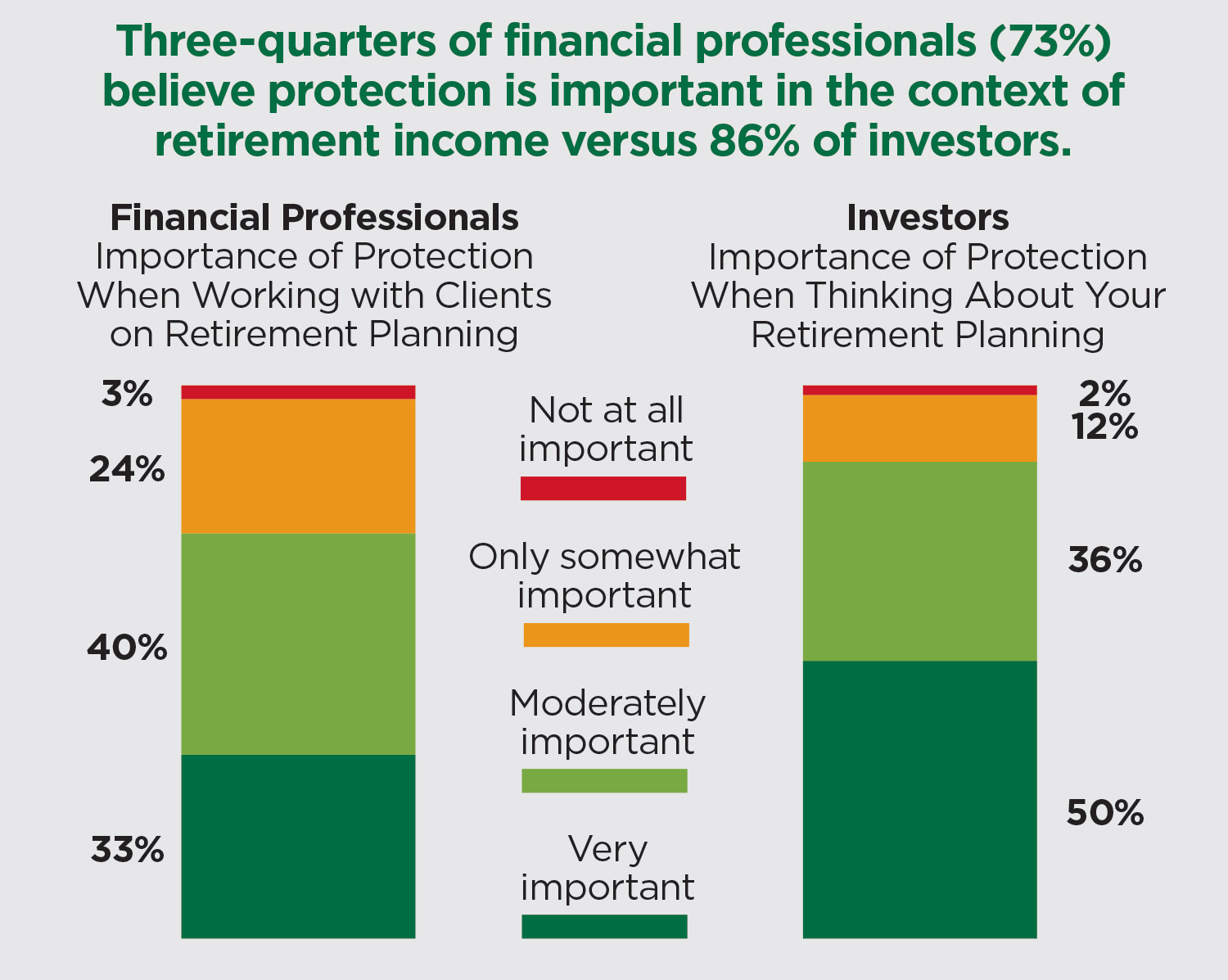

The research found that although 86% of investors believe protection is important when planning for retirement income, only 73% of financial professionals found the same to be true, Harris said.

“Investors have only one shot at retirement planning,” he said. “If you don’t do it right, you can’t go back and start it over.”

“You might be confident in doing a plan, but clients are more concerned about making sure their basic expenses in retirement are covered by protected, guaranteed income.”

What clients value and the role their emotions play in decision-making are powerful, Harris said. Market volatility and high inflation rates are driving anxiety, and that anxiety “can be a prison for some clients,” he said.

“Make sure those emotions, worries and uncertainties in terms of funding their future goals are key ingredients to successful income planning conversations with clients,” he added.

The study found that one-third of financial professionals are more likely to recommend an annuity due to rising interest rates, inflation and growing anxiety.

Another gap found in the research is that almost all financial professionals said they have had a good conversation about the changing economic environment with their clients, yet one-quarter of investors disagreed.

“There is a communication disconnect between what you’re saying and what clients are hearing and feeling,” Harris said. “This is not matching up with their feelings and emotions — and emotions motivate them to take action.”

Harris advised financial professionals to try to find the disconnect around the client’s desire for protection. “That’s where you want to embed their emotions so they can feel there is safety and security for them,” he said.

Consumers and financial professionals alike are concerned about inflation reducing retirees’ spending power, the research found, with more than 80% of consumers and more than 90% of financial professionals worried about it.

This concern, Harris said, provides an opportunity for financial professionals to reach out to clients and have a conversation about the changing economic environment and how to increase protection of their retirement income.

“You must address these emotions head-on,” Harris said. “You have to meet your clients’ financial needs, but you also must meet their emotional needs.

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Why the 4% rule may no longer be the retirement golden rule

Training consumers to make confident financial decisions

Advisor News

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Wellmark still worries over lowered projections of Iowa tax hike

- Families defend disability services amid health cuts

- RANDALL LEADS 43 DEMOCRATS IN DEMANDING ANSWERS FROM OPM OVER DECISION TO ELIMINATE COVERAGE FOR MEDICALLY NECESSARY TRANS HEALTH CARE

- Trump's Medicaid work mandate could kick thousands of homeless Californians off coverageTrump's Medicaid work mandate could kick thousands of homeless Californians off coverage

- Senator Alvord pushes back on constant cost increases of health insurance with full bipartisan support

More Health/Employee Benefits NewsLife Insurance News

- Gulf Guaranty Life Insurance Company Trademark Application for “OPTIBEN” Filed: Gulf Guaranty Life Insurance Company

- Marv Feldman, life insurance icon and 2011 JNR Award winner, passes away at 80

- Continental General Partners with Reframe Financial to Bring the Next Evolution of Reframe LifeStage to Market

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

More Life Insurance News