The 2021 State of Annuities

The pandemic brought a double-barrel shot of pain to the annuity industry in 2020. In addition to the sudden economic wreckage, face-to-face sales were virtually eliminated overnight. As 2021 reaches the midpoint, insurers and producers have recovered lost ground and added gains.

1. Let’s Make A Deal!

Private equity firms are eagerly snapping up insurers in deals that have some concerned. Others say the capital infusion means more power to push out products.

Private equity firms are feverishly buying up insurers and their books of business — with both good and bad implications.

The good news first. Annuity innovation and product availability are strengthened by the financial heft a private equity backer brings.

Athene was able to ride out 2020 and even boost some sales figures because it has the financial muscles to do so, said Mike Downing, executive vice president and chief actuary for the retirement services company.

Once the pandemic hit in March 2020, face-to-face selling halted abruptly. By May, many insurers were pulling products, or curtailing sales to specific age ranges. Not Athene.

“Because we have such strong capital and a lot of excess capital, we took a perspective of: We’re going to power through this because we have a huge cushion,” Downing explained. “And we’re going to take advantage of that capital cushion we have in that surplus and really continue to deliver products that customers need.”

In 2020, there were 191 private-equity-backed insurance deals in the U.S., Refinitiv reported, beating the prior record of 154 set in 2019. The dealmaking has continued strong in 2021.

In a February deal, KKR bought 60% of insurer Global Atlantic for more than $4 billion. Blackstone had agreed to buy Allstate Life for $2.8 billion one month earlier.

Athene made its own deal in a March merger with Apollo Global Management, which held a 35% stake in Athene. The $11 billion all-stock deal folds Athene’s hefty annuity business into Apollo’s investment umbrella.

It also adds more financial capital to the annuity business, Downing said. Founded in 2009, Athene is a unique company, he explained, in that it focuses solely on spread-type opportunities in the retirement space, as opposed to traditional life insurance.

“The biggest risk that insurance companies face when offering that kind of product is really on the asset side,” Downing added, “being able to effectively underwrite assets, manage the inherent credit risk that exists, what to get incremental alpha on those assets without taking excessive risk. And that’s where a company like Apollo really excels.”

In other words, the financial might Apollo brings means Athene will continue to be aggressive in the annuity space.

The Bad News

Some critics are concerned about all the attention from private equity. Those concerns relate to the various fees associated with life insurance and annuity contracts. Fees can be raised to a certain capped limit, and some are worried that private equity backers will raid contracts to collect as much fee revenue as they can.

Jacked-up fees could erode the investment earnings of a variable annuity, for example. Consumers and longtime clients would wind up the losers.

So far, the private equity deals appear to be only good news for the business of selling annuities. KKR reportedly has not raised any fees on the enormous book of business Global Atlantic holds, a spokesperson told CNBC.

It is the persistently low interest rates that are motivating insurers to sell off their insurance businesses. The extended low-rate period is making it hard for insurers to get a decent return from the bonds that underpin their portfolios, which in turn squeezes the cash on hand needed to pay benefits on insurance contracts.

“Life insurers are continuing to pivot toward simpler, more fee-based, capital-

light insurance products; and private equity sees investment and asset management opportunities, as well as expense takeouts, as a lure,” said Moody’s Vice President Laura Bazer in a recent report.

Despite this bottom-line financial reality, insurers continue to tweak and create new annuity products. Sales dipped as the COVID-19 pandemic raged, but rebounded strongly in the fourth quarter 2020. That growth continued into the first half of 2021 as the industry adapted to new sales environments and digital delivery systems.

Sales Trends

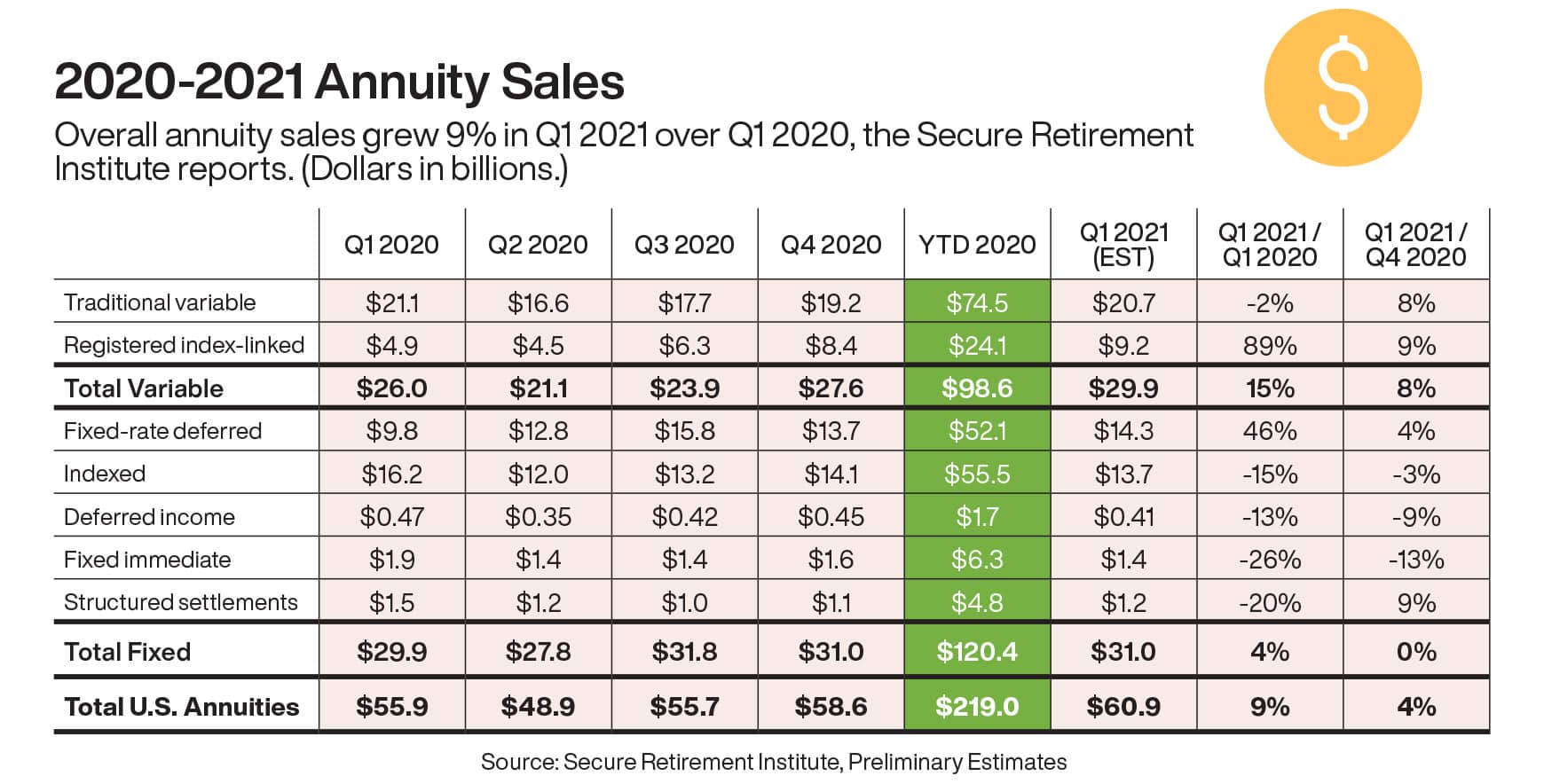

Total annuity sales of $219 billion represented a 9% decline in 2020, according to the Secure Retirement Institute’s U.S. Individual Annuity Sales Survey. The rebound began in the fourth quarter, with a 2% year-over-year increase, SRI said.

As this issue went to press, preliminary first-quarter SRI sales data showed a continued strong bounce back in most product areas, said Todd Giesing, senior annuity research director, SRI.

A concerning and extended trend is the decline in guaranteed income product sales. At a time when more and more baby boomers are retiring in need of guaranteed income they won’t outlive, the sales of such products nose-dived, Giesing said.

Over a five-year period ending in 2020, sales of these income-focused products declined from $116 billion to about $60 billion in 2020.

“We don’t think this is a lack of demand or need for guaranteed income,” Giesing said, “because all the demographics point to a demand that needs to be increasing, as fewer people have the backstop of a corporate pension.”

Instead, Giesing pointed to two reasons why consumers are avoiding guaranteed income annuities. For starters, low interest rates are limiting the guarantees offered by income annuities. Second, the pandemic forced many Americans to hunker down and focus on “short-term needs,” Giesing noted.

“We’re hoping that as the pandemic subsides and vaccines roll out here in the U.S., people will get focused back on longer-term planning,” he said. “People may have a different view on mortality, too. Once they get out of this thing, it’s going to be an interesting dynamic. We do expect income-focused sales to grow, but they will still be growing slow and steady.”

‘Kind Of Unique’

The sales star continues to be structured, or registered indexed-linked, annuities. The unique combination of low interest rates, a roller-coaster 21st-century economy and an advancing baby boomer generation is making the upside-downside package offered by structured annuities very popular.

“At the start of the pandemic, the 10-year Treasury plummeted to 56 basis points, and the equities market contracted 32%,” Giesing said. “Worried investors turned to registered index-linked annuities and fixed-rate deferred annuities for the balance of downside protection and investment growth.”

According to sales data collected by Wink, Inc., fourth quarter 2020 structured annuity sales were up 71% over the prior year quarter.

“I project that structured annuity sales will soon gain enough momentum to surpass where their indexed brethren were just over a decade after development,” said Sheryl J. Moore, CEO of both Moore Market Intelligence and Wink. “The consistent double-digit gains in structured annuity sales over the previous quarter, year, and year-to-date support this.”

Clients considering an annuity today have likely lived through deep financial anxiety, said Scott Stolz, head of insurance solutions for Simon Markets, during a recent webinar. First came the tech stock crash of 2000-02, followed up by the great recession of 2008-09.

Those memories are surely driving people to the structured annuities, which offer the potential for market returns, but limit any losses.

“Structured annuities are kind of unique in that they give you the ability to balance the risk versus reward and individualize it for each specific client based on what their needs are,” said Stolz, who headed up the Raymond James Insurance Group for many years.

Structured annuities are no shooting star. Most insurers either have introduced, or are planning to introduce, new products with new features in the structured annuity space. Most product executives see great potential for these products to dominate the market for years to come.

“Probably our single biggest area of product innovation and development going forward is in that [structured annuity] space,” Downing said. “We recognize that that’s a really big growth area. Over the next three years, I would expect in terms of product innovation for Athene to be developing new products in that space to really continue to stay on top of that market.”

2. A Policy Change

Regulators and legislators are fascinated with annuities. The former seems to finally agree on proper sales oversight, while lawmakers are discovering annuities might be able to solve a crisis.

For a good long time, it seemed as though regulators and legislators hated annuities as much as Ken Fisher does.

Things got so bad that the Obama administration went out of its way to talk up annuities on occasion. Even former President Barack Obama himself endorsed the products. Of course, his Department of Labor was also attempting to adopt tough annuity sales rules at the same time.

Things have changed. Annuities and those who sell them are riding a wave of positive public policy that extends from regulators’ offices to the halls of Congress.

Two positive trends are well on their way to established policy:

→ Congress is committed to SECURE Act legislation. The SECURE Act was signed by former President Donald Trump in late 2019. Industry lobbyists are hopeful that SECURE 2.0 will be introduced this summer.

→ Best-interest annuity sales regulations. The Biden DOL joined a growing list of states in endorsing best-interest regulations on annuity sales.

The SECURE Act legislation removes barriers to selling annuities — in particular, into retirement plans — while the regulation clarity is perhaps the most important development in years. The costly and chilling effect on annuity marketing, distribution and sales is slowly being eliminated as a harmonious best-interest standard wins consensus.

“There could be a path of regulation that might cause challenges in different jurisdictions, but it’s not something we’ve seen yet,” said Bryan Pinsky, senior vice president of individual retirement pricing and product development for AIG.

A SECURE Future

The door cracked open wider for annuities to be sold into retirement plans with the surprise passage of the SECURE Act in December 2019. After passing the House early in the year, the bill collected dust for months. When senators started looking for a bipartisan issue to get a legislative win, the pickings were slim, which elevated the SECURE Act.

The legislation made several significant changes, many of which are still being put in place. Officially known as the Setting Every Community Up for Retirement Enhancement Act, it allows:

→ More time in individual retirement accounts and 401(k)s. The bill raises the age for taking required minimum distributions from age 70 1/2 to age 72.

→ Granting older workers benefits. As long as you’re working, you can still contribute to your IRA after age 70 1/2. Previously, you couldn’t.

→ Boosting small-business 401(k)s. Small businesses can now band together in group plans.

→ 529 plans. They can be used to repay up to $10,000 in student loans, as well as for siblings.

Industry lobbyists are calling SECURE a great first step, but one that needs companion legislation known as Securing a Strong Retirement Act of 2020. It was introduced by Reps. Richard Neal, D-Mass., and Kevin Brady, R-Texas, in late October, but did not go far. Hopes are high for a “SECURE 2.0” bill this summer.

The latest bill included the following:

• Allow people who have saved too little to set more aside for their retirement.

• Offer low- and moderate-income workers a tax credit for contributions to a 401(k) or similar plan.

• Help people with student loans save by letting employers make retirement plan contributions equal to what an employee pays on their loans.

• Further support the use of annuities that provide guaranteed lifetime income in retirement.

• Create a new incentive for small businesses to offer a retirement plan.

A Best-Interest World

If we had peeked ahead five years in 2016 and saw state insurance commissioners, federal Department of Labor civil servants and Securities and Exchange Commission regulators all agreeing on general annuity sales standards — few would have believed it.

But that is where we are in 2021.

To recap, the Biden administration closed the loop on harmonization of a best-interest standard when it allowed the Trump DOL-authored investment advice rule to take effect.

The DOL rule has two main parts: a new prohibited transaction exemption allowing advisors to provide conflicted advice for commissions, and a reinstatement of the “five-part test” from 1975 to determine what constitutes investment advice.

Most importantly, it is similar in spirit to rules put forth by the SEC and its Regulation Best Interest and the model annuity sales rule finalized by the National Association of Insurance Commissioners. As of press deadline, about a dozen states have adopted or are in the process of adopting the latter rule.

Standards are becoming clear: Agents and their financial institutions need to carefully document all annuity transactions. Commissions are fine, and higher-priced products can be sold, but only with a careful paper trail explaining why that recommendation was made. It is all music to the ears of annuity executives who feel the burden of uncertain regulations being lifted.

“It’s been an interesting road, but we’re happy with where we’re at, and I think it’s been a situation that has generally provided more opportunities to meet clients’ needs,” Pinsky said.

3. A Stronger Leg To Stand On

The traditional ‘three-legged stool’ is wobbly. Read why one veteran retirement planning expert says the pensions leg should be sawed off and replaced with annuities.

Jason Fichtner recalls a typical conversation with a 62-year-old newly minted retiree applying for benefits when he worked at the Social Security Administration.

“I’d ask them, ‘How long do you think you’re going to live?’” he said. “And they’d say, ‘Twenty years.’ I’d say, ‘So you have money saved up until you’re 82.’ And they would look at me like, ‘What?’”

The entire exchange reveals the poor planning and incomplete assumptions that have plagued the retirement industry for decades. With pensions nearly nonexistent today and a final surge of baby boomer retirements lurking, it is time for change, Fichtner said.

Former acting deputy commissioner of the Social Security Administration and a senior economist with the Joint Economic Committee of the U.S. Congress, Fichtner is bringing his impressive background to the Alliance for Lifetime Income.

A nonprofit consumer education organization, the alliance was formed by a coalition of financial services companies. The data is shocking, its leaders note: The entire baby boomer generation, more than 70 million strong, will be 65 or older in 2030.

“So many people now are entering retirement with Social Security as their only protected source of income,” explained Fichtner, most recently senior lecturer in International Economics at Johns Hopkins University Nitze School of Advanced International Studies.

With all these factors in play, the time is right for annuities to take on a bigger role in across-the-board retirement planning, Fichtner concluded in the alliance white paper, “The Peak 65 Generation: Creating A New Retirement Security Framework.”

It suggests that annuities should replace pensions as the third leg in the traditional “three-legged stool” of retirement income, which includes Social Security and accumulated savings.

“We’re doing a refresh on annuity products because we see a role for annuities in filling that gap that Social Security can’t provide for and helping to mitigate risk and have that safe security that [retirees] want,” Fichtner said.

Hitting The Peak

The alliance is touting “Peak 65” to publicize the value of annuities. Peak 65 is a term used to describe the point in time when more Americans will turn age 65 than at any point in history, which will occur in 2024.

While the focus is on replacing pension income, the other legs are not exactly on the firmest footing. Social Security will require a legislative fix to keep from running short of funds by the mid-2030s. Even with that fix, the demographics suggest that future retirees will need to become even more active in securing lifetime income.

In 2018, 16% of the population was age 65 and over. By 2060, it is estimated that percentage will rise to 23%. At the same time, the working-age population will be getting smaller, from about 62% today to 57% in 2060.

In addition, surveys indicate that most Americans are undersaved for retirement. A quarter of Americans have no retirement savings, a Forbes study found.

A new framework is needed to address the current realities that put “as many as 50% of households at risk” of not having enough money to maintain their standard of living in retirement, Fichtner’s white paper concluded. And the fix must include a focus on how protected income can help to provide the security necessary to maintain a given standard of living in retirement.

“Social Security is one source of protected income, and for many people, it’s their sole source of protected income in retirement,” Fichtner said. “The problem is that it’s not enough.”

Employers Have A Role

Meeting the challenges presented by Peak 65 will require collective action on the part of employers, advisors and policymakers, Fichtner said.

Policy is changing, as evidenced by the SECURE Act, passed in 2019, and the potential for Congress to consider SECURE 2.0 later this year. Both pieces of legislation are aimed, at least partly, at providing greater access to annuities.

Likewise, advisors are warming up to annuities as time goes on. A recent survey by DPL Financial Partners found that 68% of advisors said they would consider recommending annuities to clients.

That leaves employers as the final piece. The alliance recommends employers take three steps to promote access and education for annuities.

→ Ensure that American workers have better access through their workplace retirement plans to solutions that generate protected income easily and efficiently.

→ Consider the use of “trial annuities” as part of workplace retirement plans to mitigate behavioral hurdles to annuitization and encourage adoption of proven protected income strategies.

→ Make professional financial advice, education and retirement income planning a key workplace benefit.

“Employers really do want to help their employees,” Fichtner said. “One of the things that the SECURE Act now allows us to do is have that discussion about how you can re-create that guaranteed income someone got from a pension, but actually now more secure.”

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Always End With The Beginning In Mind

Four Career Growth Resources For NexGen Advisors

Advisor News

- Is there a mismatch between advisor marketing and consumer preferences?

- State health plan users may see premium increases under SC House budget proposal

- Advisor: SEC trying to ambush my defense on bad annuity sales charges

- Partner split: Grant Cardone and Gary Brecka swap charges in dueling lawsuits

- 4 things every federal worker should do to safeguard their benefits

More Advisor NewsAnnuity News

Health/Employee Benefits News

- President of Insurance Brokerage Firm and CEO of Marketing Company Charged in $161M Affordable Care Act Enrollment Fraud Scheme

- STATEHOUSE: Senate Republicans approve limiting health insurance program for Hoosiers

- State health plan users may see premium increases under SC House budget proposal

- Senate Republicans approve limits on health insurance program

- Health agents ‘optimistic’ as a new administration takes charge

More Health/Employee Benefits NewsLife Insurance News

- Whole life vs. term life: The great debate

- Prudential launches OneLeave

- Annual financial and audit reports – JPMORGAN CHASE & CO.

- Conning research: Insurers must be flexible in the 2025

- AM Best Places Credit Ratings of Banner Life Insurance Company and William Penn Life Insurance Company of New York Under Review With Developing Implications

More Life Insurance News