State insurance regulator on pace of AI rules: ‘We must go faster’

Artificial intelligence is developing fast, maybe too fast for state insurance regulators.

The difficulty in trying to write rules for the quick-moving AI, amid the slow pace preferred by regulators, was the main topic for discussion Tuesday during a meeting of the Big Data and Artificial Intelligence Working Group.

The group met during the spring meeting of the National Association of Insurance Commissioners.

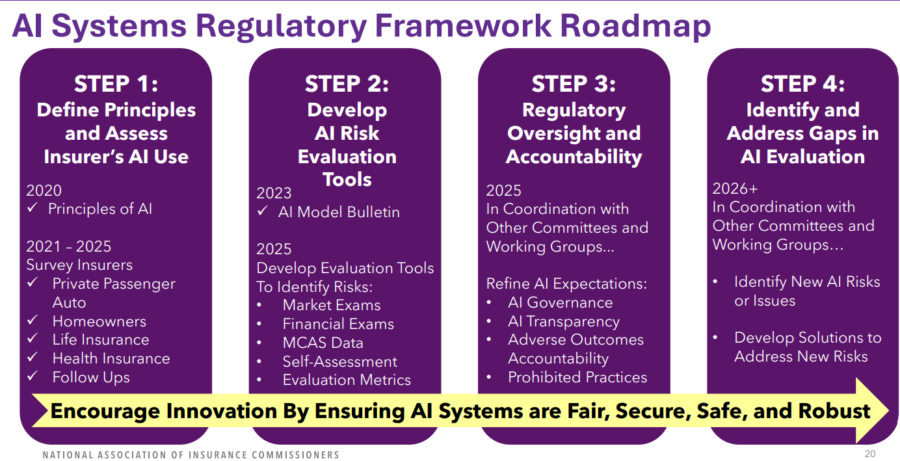

In 2020, The NAIC adopted the Principles on Artificial Intelligence, establishing foundational guidelines for the ethical and responsible use of AI in the insurance industry. Three years later, the NAIC approved the Model Bulletin on the Use of Artificial Intelligence Systems by Insurers.

But not enough is happening for some who follow the AI issue.

“Are insurance consumers better informed and better protected, specifically in this area now, than they were [in 2020]?” asked Peter Kochenburger, a visiting professor of law at Southern University Law Center. “I would much prefer it's not a rhetorical question, but I think it is because there has yet to be a single, specific right or guideline that consumers have.”

Working group co-chairs Doug Ommen, Iowa insurance commissioners, and Michael Humphreys, Pennsylvania insurance commissioner, outlined a four-step process they are halfway through.

Humphreys pointed out that there is active dialogue to remind consumers that they have rights under existing insurance coverage. Likewise, 23 states and the District of Columbia have adopted the model bulletin on AI.

But Humphreys also agreed that action must come sooner rather than later.

“Where I do agree with you is we must go faster,” he said. “We're starting to see AI legislation in our states, and it can be very different across different states. So. I mean when we're going to continue to make the argument that there shouldn't be a federal floor, that there shouldn't be a federal ceiling, we had better start doing something.”

A handful of states are not waiting for NAIC model laws on AI and related areas such as consumer protection, data privacy, and accountability.

In particular, Colorado became the first state to pass comprehensive legislation to regulate AI. The Colorado AI Act, which takes effect on Feb. 1, 2026, requires developers and deployers of AI high-risk systems to use care to protect consumers from any known or reasonably foreseeable risks of algorithmic discrimination or bias.

Health insurers love AI

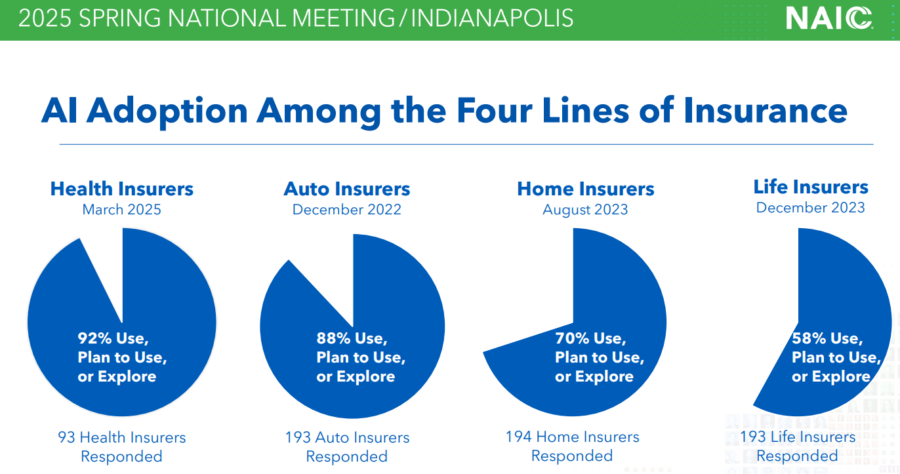

The working group shared the latest survey data from the health insurance industry. The survey was conducted in 16 states and completed by active insurers that either: Wrote business in one or more of the participating states and had at least $250 million in earned premiums in 2023; or held a significant market share in one or more of the participating states.

Ninety-three health insurers met the criteria and responded to the survey, Humphreys said. It marks the fourth insurance segment surveyed by the working group, with each survey returning a greater enthusiasm for AI. Ninety-two percent of health insurers said they "use, plan to use or explore" the use of AI.

Humphreys acknowledged the length of time between the initial survey to the most recent results is surely skewing the numbers.

"As we all know, I think the development of AI, the implementation of AI, has been moving pretty quickly," he said.

The group is not quite finished with its full report on health insurers and AI, Humphreys said, but the more-than-200-page report should be available in April.

Of the companies that participated, 83% said they are "actively" using AI. Health insurers are facing a number of lawsuits over the use of AI to handle claims. One such lawsuit followed an in-depth investigation by STAT, which covers health and science news. STAT detailed how UnitedHealth allegedly used a computer algorithm to cut off care to older patients.

The STAT report claimed that internal documents show UnitedHealth managers set a goal for clinical employees to keep patients' rehab stays within 1% of the days projected by the algorithm.

Some obstacles remain to AI

Just 9% of respondents said they are "planning or exploring" the use of AI in their operations, Humphreys said.

"While it's surprising that there are companies that are still not using AI, some of those companies that we have talked to are still facing some obstacles implementing AI," he explained.

Brian Bayerle, chief actuary for the American Council of Life Insurers, urged the working group to "focus on its charge to monitor and promote the model bulletin implementation. This focus should include assessment of the effectiveness of the bulletin by collecting lessons learned from both industry and regulators.

"This analysis is really necessary before contemplating what tools may be necessary, and in particular, any additional requirements."

Humphreys disagreed with the last part and said that regulators will pursue action as it is deemed to be needed.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

As number of wildfires explode, expert says mitigation is possible

Medicare Advantage marketing driving up costs; fiduciary role recommended

Advisor News

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

More Advisor NewsAnnuity News

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Best’s Market Segment Report: Hong Kong’s Non-Life Insurance Segment Shows Growth and Resilience Amid Market Challenges

- Product understanding will drive the future of insurance

- Nearly Half of Americans More Stressed Heading into 2026, Allianz Life Study Finds

- New York Life Investments Expands Active ETF Lineup With Launch of NYLI MacKay Muni Allocation ETF (MMMA)

- LTC riders: More education is needed, NAIFA president says

More Life Insurance News