Estate planning during the great wealth transfer

The great wealth transfer is well underway, with trillions expected to pass from one generation to the next. Yet despite the magnitude of this shift, many Americans are unprepared.

A new survey from MDRT found that 45% of consumers have not taken any action to prepare an estate plan, leaving critical decisions unresolved and families vulnerable. This disconnect highlights a major opportunity — and responsibility — for financial advisors to help clients ensure wealth, values and intentions are passed down smoothly across generations.

Many people view estate planning as something to “get to eventually.” With wealth moving at an unprecedented scale, estate planning has become a critical component of financial well-being for all ages. Advisors must help clients understand their options, make informed decisions and plan proactively to create confidence that their legacy is truly protected.

A new financial reality

As a financial advisor for more than 30 years, I’ve watched the retirement landscape change dramatically. Decades ago, most people retired with a pension and Social Security. Qualified accounts, especially accounts holding significant balances, were far less common.

Today, it’s completely different. When I started my career, rolling over $100,000 was considered a big milestone. Now, clients regularly come to me with $500,000 to several millions in nest eggs. Life expectancy has increased, savings have grown and the decisions clients make about these assets matter more than ever.

This shift is reflected in today’s expectations around giving and receiving an inheritance. According to the MDRT survey, 60% of consumers ages 59 and below expect to inherit wealth, while 64% of consumers ages 60 and above plan to pass wealth to heirs. With so much wealth expected to change hands, it becomes even more critical to address the obstacles that continue to prevent clients from preparing effectively. Advisors play a crucial role by helping clients navigate these complexities through structured conversations, personalized strategies and tools that align with their legacy goals.

Removing barriers through accessible planning

Even with so much at risk, many people delay estate planning because of long-standing misconceptions. Simply not knowing where to start often prevents clients from taking the first step. My firm recently began using a digital estate planning platform that helps clients create wills, trusts, health care proxies and powers of attorney at a lower cost and without having to navigate the legal process alone. Once clients learn this option exists, the most common response I hear is, “I’ve always wanted to do this, I just didn’t know how.”

Making the process smoother and more accessible has removed a key barrier that used to hold many clients back. It also strengthened the trust they place in our firm, as we’re more integrated in every part of their financial life. Offering these services in-house can provide a clear entry point into estate planning conversations, ease client hesitation and help advisors maintain relationships across generations.

Turning knowledge into empowerment

Lack of education around estate planning also prevents people from creating a plan. Some believe that it can wait until later or don’t understand the implications of leaving things undecided. I’ve seen firsthand how unprepared families struggle when someone passes unexpectedly. My mother died suddenly at age 55, and because nothing was documented, it created significant stress. That experience alone showed me just how critical it is to have clear plans, and it prompted me to help my grandparents get their documents drawn up immediately after my mother’s death. When they eventually died, the transition was smoother and simpler because we had taken the time to prepare.

Stories such as these help clients understand the value lies not just in managing assets, but in the emotional and logistical burden it alleviates from loved ones. Clients are more likely to move forward when given context, real-life scenarios and the necessary clarity to see why these decisions matter now, not later. The more we lean into teaching, the more empowered our clients become to act.

Meeting each generation where it is

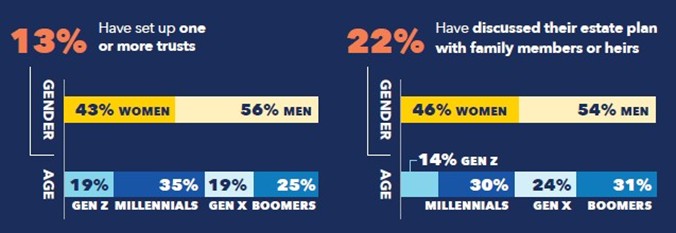

When beginning estate planning conversations, it's important to note that different generations face different challenges and levels of preparedness. MDRT’s survey found Generation X showed lower levels of estate planning preparedness than millennials across nearly all areas. In my experience, millennials see how difficult it is to buy homes, manage debt and build wealth in today’s environment. Many of them also didn’t grow up with parents who had financial advisors or talked openly about finances, so they’re turning to advisors for education.

Gen X, on the other hand, is in a uniquely demanding phase of life — juggling aging parents or trying to secure their own retirement. Estate planning becomes something they know they should address, but other responsibilities may push it to the bottom of the list. For this group, the most effective strategy is to focus on simplicity, protection and peace of mind. Meeting clients where they are and tailoring the approach to estate planning based on each generation’s mindset and priorities, whether its knowledge, structure or reassurance, can be the difference maker in their willingness to act.

As the great wealth transfer continues to unfold, it has become clear that financial advice cannot be limited to investments or retirement alone. Families need holistic guidance that weaves together financial planning, estate planning and long-term security. Advisors who embrace this broader role will not only help clients prepare for the future – they’ll strengthen their client relationships and help them last for generations.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Domenick D’Andrea, AIF, CRC, CPFA, is the cofounder of DanDarah Wealth Management, and has been a financial advisor for more than 30 years. He is also a 9-year member of MDRT.

Advocates warn of ‘significant time bomb’ with healthcare barriers

Insurance Compact warns NAIC some annuity designs ‘quite complicated’

Annuity News

- Life and annuity sales to continue ‘pretty remarkable growth’ in 2026

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

More Annuity NewsHealth/Employee Benefits News

- New Findings from Brown University School of Public Health in the Area of Managed Care Reported (Site-neutral payment for routine services could save commercial purchasers and patients billions): Managed Care

- Researchers from University of Pittsburgh Describe Findings in Electronic Medical Records [Partnerships With Health Plans to Link Data From Electronic Health Records to Claims for Research Using PCORnet®]: Information Technology – Electronic Medical Records

- Studies from University of North Carolina Chapel Hill Add New Findings in the Area of Managed Care (Integrating Policy Advocacy and Systems Change Into Dental Education: A Framework for Preparing Future Oral Health Leaders): Managed Care

- Medicare telehealth coverage is again under threat. Here’s how it affects elderly patients

- Illinois Medicaid program faces funding crisis

More Health/Employee Benefits NewsLife Insurance News

Property and Casualty News

- Oregon bill would require home insurers to consider wildfire prevention efforts

- Global power struggles over the ocean’s finite resources call for creative diplomacy

- Best’s Special Report: Infrastructure Projects Spur Growth and Help Fuel Profits for U.S. Surety Insurers

- Insurance carriers can now carve out wildfire coverage from Nevada homeowner policies

- The Seattle Times: Remain wary even as feds resume review of research grant applications

More Property and Casualty News