Serving members royally for 130 years — With Royal Neighbors’ Zarifa Brown Reynolds

Royal Neighbors of America was founded by women at a time when women couldn’t get life insurance. “In 1895, nine women got together, and they met socially just to talk about their life and their community,” said president and CEO Zarifa Brown Reynolds. “Out of that meeting grew the idea that women needed to also be able to have access to life insurance, and they started Royal Neighbors of America. Now that women can obtain life insurance, we support everybody.”

At Royal Neighbors, Reynolds said, “we lean into what we think we’re good at. I’ve worked at other insurance companies where everybody’s going after the affluent portion of the population. We serve lower-middle-income and middle-income families, primarily through our annuity products and through our life products.”

Prior to joining Royal Neighbors in 2023, Reynolds was an executive at Guardian Life, where she led national sales, account management and underwriting teams. Before joining Guardian, she was head of corporate development at TIAA, where she was responsible for corporate mergers and acquisitions, corporate finance, strategic venture capital investing, and corporate strategic projects.

In this interview with InsuranceNewsNet Publisher Paul Feldman, Reynolds talks about Royal Neighbors’ mission and about building the business.

Paul Feldman: You have an amazing resume, from Brown University undergrad, and a law degree from Harvard University through a stellar career to president and CEO of Royal Neighbors of America. How did you end up in this industry?

Zarifa Reynolds: People could look at my resume and think it’s amazing. I just think of it as my life journey. I’ve always wanted to help people, from the time I was young. And so every choice that I’ve made — from what I studied in college to going to law school to ultimately pivoting to the insurance industry, and now as CEO and president of Royal Neighbors — is just about helping people. And that’s what Royal Neighbors was founded to do, and that’s the value that we live every day.

Feldman: Royal Neighbors is a fraternal organization. Tell us a little bit about the company and what makes it different.

Reynolds: The company is owned by members, not by stockholders. There’s a common bond, which means that the people who buy insurance products and services from a company such as Royal Neighbors believe in our mission. We exist to insure lives, support women and serve communities. A lot of our insurance proceeds are directed toward programming around this mission of empowering communities and women through our many philanthropic efforts.

We do this in several ways, but most notably, we have a scholarship program that we’ve administered for many years. If you’re a member of Royal Neighbors, we will give you scholarships for all four years of college. You just need to apply through the process. We also have what’s called Nation of Neighbors. We give 10 grants of $10,000 to nonprofits that are serving communities and focusing on women throughout their service in the communities. Last but not least — and this is where the bulk of our social good comes in — we’re a national life insurance company. When you’re a member of Royal Neighbors, you can either have an insurance product or you can also be a member through service, and you are a part of what’s called a chapter system. We have more than 200 chapters throughout the U.S., and we fund each of these chapters as they do good works in the community.

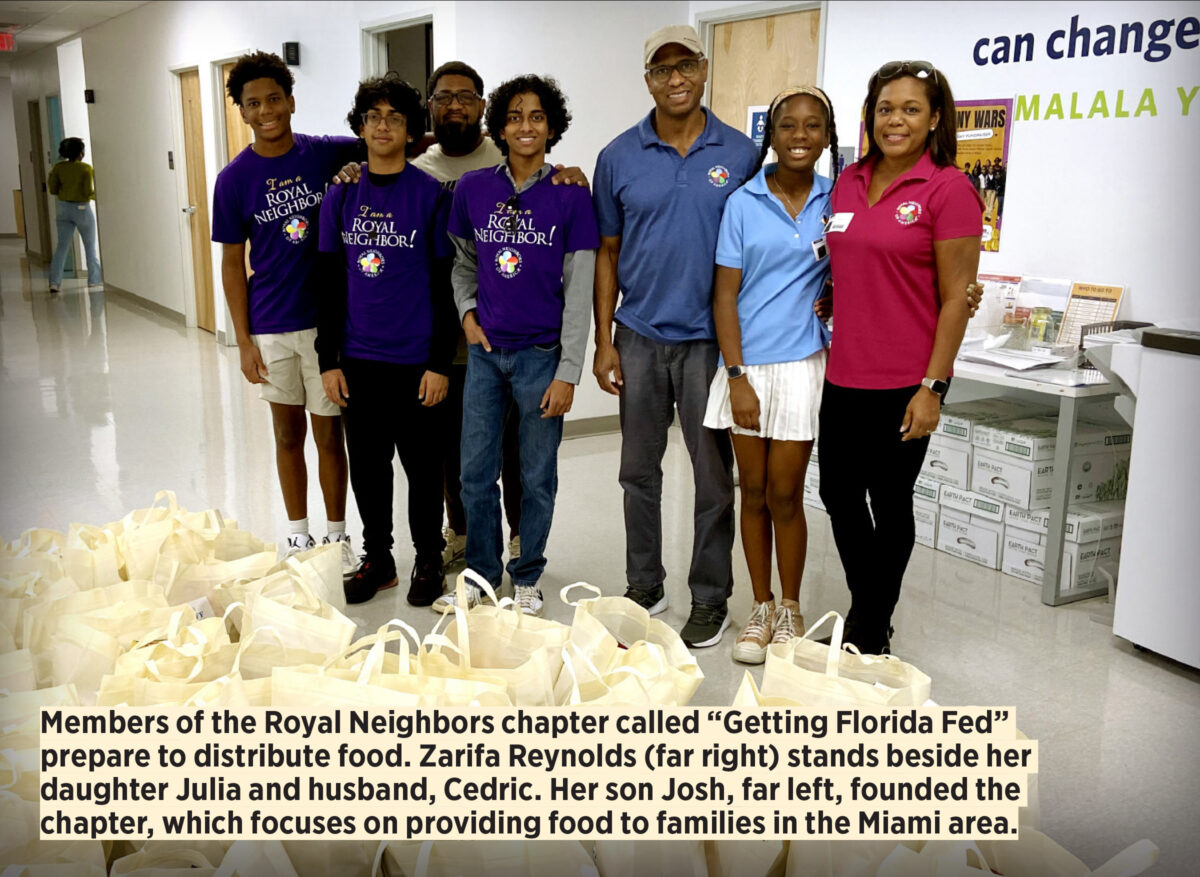

For example, my son wanted to help with food insecurity in our neighborhood because he’s somewhat fortunate and he sees how a lot of people are struggling. So he founded a Royal Neighbors chapter, and they distribute healthy food products supported by Royal Neighbors. Some of it is supported by his own fundraising and his own dollars, but a lot of it is supported by Royal Neighbors. When you do community good, Royal Neighbors will give you money every month, every quarter, for special projects to help you engage in that endeavor. That is our common bond. No matter who you are, you can serve somebody else. And if you lean into service, you feel good about yourself, you feel good about humanity and you’re really making things better for everybody.

Feldman: That’s a great mission. How did the company get started? And how are you building brand recognition?

Reynolds: Royal Neighbors was founded by women at a time when women couldn’t get life insurance. Now they can, so we support everybody. We have a diverse employee base. Many members of the executive team who make things happen on a daily basis are men in various senior roles in the organization, and that’s been the case for a long time. We lean into our history, we’re proud of it, but we recognize that we’re here to help everybody.

In 1895, nine women got together and they met socially just to talk about their life and their community. Out of that meeting grew the idea that women needed to also be able to have access to life insurance and they started Royal Neighbors of America. They were supported by men because we have still a close relationship with another insurance company, called Modern Woodmen, which literally I could see from my window at Royal Neighbors. The men of Modern Woodmen were husbands of the women of Royal Neighbors and supported them in that endeavor, and that’s how Royal Neighbors was started.

As far as getting our name out there, we do try to do it through our chapter system. As people are out in their community doing things and we support them through our net income by helping them in their community service, we feel as though we’re getting our name out there.

We sell our products through third-party distribution, so we’re in the briefcase of a lot of agents and we engage with them in a number of ways. We go to their conferences and talk about the great work that we’re doing at Royal Neighbors and our remit about serving lower-middle-income and middle-income families through our products and services. We host our own conference with agents as well.

I think having conversations like the one I’m having with you is another way to get our name out there and create brand recognition. We are on all the social media outlets — Twitter, Facebook, LinkedIn and others. Especially when we’re refreshing it or issuing a new product and service, we do a big marketing push to get our name out there as well. I’d be remiss if I didn’t say we’re celebrating our 130th year as an organization this year.

Feldman: How did you get into the insurance industry?

Reynolds: Some of it was a little bit of luck. I went to law school in Cambridge, Mass., and I happened to go to an alumni event and heard a former president and CEO of TIAA-CREF, Roger Ferguson, speak. And I hadn’t really thought a lot about insurance up until this point, and I was probably 10 years into my legal career — a very junior partner — and I was just amazed by his presentation. Then, as luck would have it, one of the deals that I worked on subsequently was for TIAA. So, I was a lawyer working at a large international law firm, and my client was TIAA. I thought, “That guy was so fascinating during his presentation at an alumni event and now he’s a client; maybe there’s something there.” Sometimes it’s just that spark and luck where things start to come together.

I knew that I loved helping people in a more real way. As a corporate finance and mergers and acquisitions lawyer, I was working on important stuff, but I didn’t get to follow the deal once it closed. I still had this inkling that I wanted to go to a place where I could see things through for a longer period of time. That was the reason why I wanted to transition from being a deal lawyer to going into the business, and that’s what I did at TIAA — and then subsequently at other insurance companies.

Feldman: I think the industry is missing an opportunity in the way it serves women. What happens in a lot of cases, if the husband dies first, is that the advisor or agent loses that client. What can an agent or an advisor do to work with women undergoing that kind of transition?

Reynolds: Men tend to die before their female spouse or partner does. Also, families often use a lot of their assets in caring for that loved one and so, at the end of the day, the women are left without as much financial security. I think we must be very deliberate about how we think about insurance. A lot of times, at least early in life, we’ll insure the breadwinner, and a lot of times that will be the man in the house. We need to have a broader conversation around how we can protect the entire family.

I think as an industry we could do a better job of educating people and communicating with them when a death benefit is paid, especially concerning how to use proceeds from a death benefit to provide for care for the surviving spouse. One of my favorite riders, and I have one in my own personal life, is long-term care. I think that’s especially important for women. I think we all know what happened in the long-term care industry back in the day with stand-alone policies. And those are very expensive now, if you can get one at all.

Feldman: What do you see happening in the marketplace right now? Where are the opportunities and growth areas that you see?

Reynolds: There are many, but for Royal Neighbors, we lean into what we think we’re good at. I’ve worked at other insurance companies where everybody’s going after the affluent portion of the population. We serve lower-middle-

income and middle-income families primarily through our annuity products and through our life products. Our flagship product is a final expense product. We are an industry leader in this area. The policy sizes are $10,000, $20,000, $30,000 — not huge policies. The average age of the customer getting these policies is probably in their 50s. We believe that this portion of society needs the financial protection.

We have a very simple product. We try to do point-of-sale delivery, which means when you’re talking to an agent, we should be able to make a decision almost on the spot about what risk class you’re going to fall into from an insurance perspective. So, given that we’re looking at an underserved portion of the population, that’s really where we see our greatest strength, to be able to help people in general.

Feldman: You’ve been at Royal Neighbors for more than two years now. What do you believe you have accomplished, and where do you see the company going?

Reynolds: I view myself as a servant leader and as someone who’s there to empower everybody else to be able to do the best that they can for our customers. We’ve grown like gangbusters by Royal Neighbors standards. We’re not the biggest life insurance company, but on the life side, we’ve grown year over year in top-line sales more than 50% in our life products each year that I’ve been there.

And on the annuity side, it’s been between 50% and 100% growth. One year we grew more than 100%, and during the other years, we’ve grown roughly 50%. There are a lot of people who are underserved. We’re looking around and we’re thinking, “All these other people need protection too. What can we do to serve them?” We think there’s a lot of potential out there to continue to grow and we’ll continue to lean into that.

Feldman: Where is Royal Neighbors going in terms of product development?

Reynolds: As I said, our flagship product is final expense. We revamped that product last year and rolled out a new product that was well received in the marketplace and that fueled our growth. We’re in the process right now of revamping our single-premium whole life product, and that was rolled out in Q2 of this year. Our financial plans are projected to have outsized growth in that product as well. We’re leaning into ease of doing business, using an e-app, trying to make more point-of-sale decisions and working with our distribution partners to have a really good go-to-market strategy.

On the annuity side, I think everybody knows about the growth in the annuity industry over the past several years, so there’s a lot of opportunity in the marketplace to continue to grow from an annuity perspective.

With all of this growth, though, I have to talk about capital management as president of a life insurance company. We have engaged in a couple of capital management strategies in order to enable us to maintain and sustain our capital, because we’re an A-rated insurance company. We’re really proud of that, and we want to retain an A rating. So before we execute our growth plans, we put capital management strategies in place to be able to preserve our capital and our A rating and ensure we’re going to be around for people. We did a structured reinsurance transaction my first year with the company, and then, last year, we executed on a commission processing transaction. Both of those transactions helped us to make sure that we have the capital in order be able to sell this business in the market.

Feldman: The underwriting process is still time-consuming. How is Royal Neighbors looking to change or improve that?

Reynolds: It is still slow. It’s getting better. Artificial intelligence and other technology are really helping us. We’ve just embarked on a big e-delivery process so that we can deliver our insurance contracts for our final expense product using e-delivery. Rome wasn’t built in a day, so we can’t do everything all at once, but we’re taking steps methodically to try to modernize.

Feldman: This has been an amazing interview. Is there a question that I should have asked during this interview that I didn’t?

Reynolds: Oh, that’s interesting. I guess maybe why I’m most excited about the future of this industry. I like theoretical things as well as practical things, and one of the theoretical things that I’m starting to spend more time thinking about is longevity. I think we know intuitively that people are living longer and healthier lives, but I don’t think as a society we’ve figured out what that means. For example, my father-in-law, who is 80 years old, is still semi-working. There’s a lot of this going on.

I’m excited about life insurance because people will be living longer and they will need to figure out how they live their life, how they accumulate assets. If they’re looking at an annuity product, how do they remain productive members of the society? And, heaven forbid, if they’re living longer and they’re unhealthy, how do they fund being taken care of during that time?

The whole notion of longevity, I think, is a reason to be excited about being in the life insurance industry. You can use a life insurance contract to do other things than paying a death claim, especially with long-term care and other things. It’s projected that we’re going to have a barbell society probably in about 20 or 30 years. There will be a lot of people over 65 and not that many people under 65. What does that mean, and how do we continue to exist as a society?

Feldman: A lot of carriers are working to get their policyholders to be healthier. What is Royal Neighbors doing to help their members be healthier?

Reynolds: We’re starting to do that with wearables and information about what it means to live a healthy lifestyle. Because if you live to be 80 or 90 or 100 — whether you’re healthy or unhealthy — it has huge consequences for your quality of life but also economically for society. And that’s very true for life insurers because we want people to live a long time. But it’s also the right thing to do in terms of helping people.

Paul Feldman started the website InsuranceNewsNet in 1999, followed by InsuranceNewsNet Magazine in 2008. Paul was a third-generation insurance agent before venturing into the media business. Paul won the 2012 Integrated Marketing Award (IMA) for Lead Gen Initiative for his Truth about Agent Recruiting video and was the runner-up for IMA's Marketer of the Year, a competition that includes consumer and B2B publishing companies. Find out more about Paul at www.paulfeldman.com.

A 1035 exchange to an FIA: A smart choice in today’s environment

From football to finance: ‘A noble career’ — with Padric Scott

Advisor News

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

More Advisor NewsAnnuity News

- Trademark Application for “EMPOWER MY WEALTH” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Conning says insurers’ success in 2026 will depend on ‘strategic adaptation’

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

More Annuity NewsHealth/Employee Benefits News

- Veteran speaks out on veterans mail-order drug bill

- National Life Group Selects FINEOS AdminSuite to Transform Living Benefit and Life Insurance Claims Operations

- Delaware weighs cutting GLP-1 coverage on state plan

- Lawsuit accuses Cigna PBM of ‘demanding kickbacks’ from drug maker

- ACTING SUPERINTENDENT KAITLIN ASROW ANNOUNCES JERICHO SHARE TO CEASE OPERATIONS IN NEW YORK FOR SELLING UNLICENSED HEALTH INSURANCE PLANS

More Health/Employee Benefits NewsLife Insurance News