Retirement confidence at record low, but will it improve?

Worker confidence in having enough money for retirement is still at record lows, though perhaps trending slightly upward, according to latest survey from the Employment Benefit Research Institute, the longest running survey of its kind.

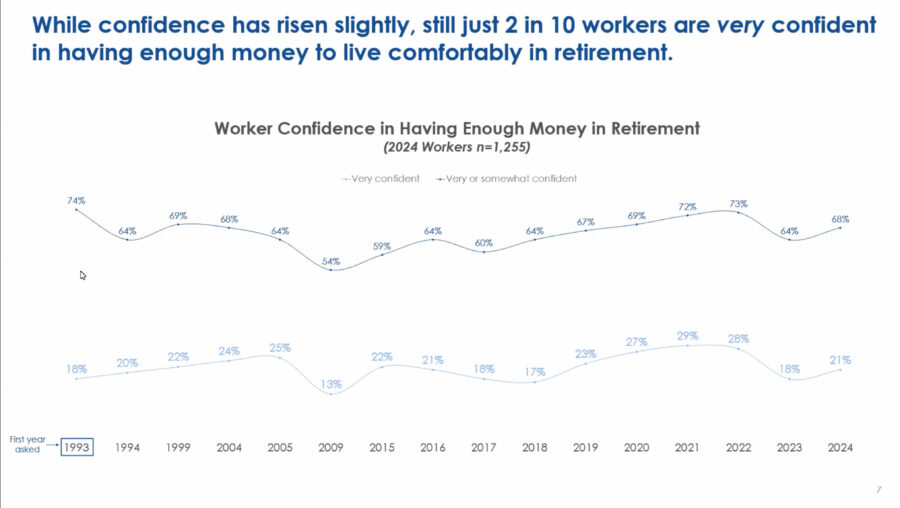

In January of 2023, the survey recorded the historically largest percentage point decline in confidence since 2008. That has only come back a little, EBRI officials said, an amount that isn’t statistically significant ; 68% said they were confident they would have enough money to live on in retirement, compared to 64% a year earlier. Just 21% said they were very confident, compared to 18% in 2023. (see chart).

Similar results were found among retirees, though overall confidence was fairly high at 74%, it did not match record levels of 2020 and 2021.

The reason: inflation.

'It’s all about costs'

“It’s all about costs,” said Craig Copeland, director of wealth benefits research at EBRI. “The increased cost of living is making it harder to save as much money as they want, or they fear inflation will stay high for the next 12 months. Those are two of the top three concerns among workers. The other one is they're concerned about the U.S. government making significant changes to the economy.”

The good news for retirement planners and investment managers is that a significant number of survey respondents said they would appreciate more financial guidance when it comes to saving for retirement. Workers primarily rely on family, friends, and online resources for financial advice, where retirees are more likely to use professional financial advisors, according to the survey. A full 44% of people wish their employer offered more one-on-one financial help.

“Approximately the same number said they're just not getting enough advice,” said Peter Kapinos, head of workplace and Investment marketing at Empower, a Colorado-based financial services company that also surveys retirement trends and confidence. “We found that employer matching is an important incentive whether for recruiting or for employees to stay longer. About 71%, nearly three out of four, said that retirement plan matching is one of the top benefits companies have.”

The EBRI survey is rich with data on everything from expected retirement ages of workers to what expenditures are most important for retirees. Among the most surprising results involved the higher-than-expected level of security, both financially and physically, workers and retirees expressed. But there were also some obvious misconceptions among the respondents.

“It may not be new but something I’ve taken a renewed interest in this year is the persistent positive and objective assessments of how retirees are doing,” said Lisa Greenwald, CEO of Greenwald Research, a Washington D.C.-based independent research and consulting firm. “In the past It was easy to say, ‘Oh, well, these are all retirees who have defined benefit plans, and when those plans go away, retirees are going to be miserable.’ But that really hasn't happened. And so, I think, for me, the persistency of retirees suggesting in more qualitative data, relatively, is that they're doing okay, is one of the more important findings.”

Pension misconceptions

At the same time, though the number of workers believing they’re eligible for an employer pension is much higher than statistics would indicate.

“That pension number to me is scary,” said Kapinos. “Nearly two-thirds of respondents think they’re eligible for a pension when we all know the number is actually much smaller [about 21%]. People maybe don't wrap their heads around reality sometime.”

The variations of confidence and savings levels among workers and retirees, younger and older, male and female, respondents are striking.

Retirement confidence for younger generations is a little higher than average, likely because they are looking through a much longer lens, Kapinos said.

Women better at saving

“Men outpace women in terms of retirement confidence,” he said. “But when we look at overall preparedness, it is higher for women. Women often save at higher rates than men, but it's a lifelong career earnings number. So sometimes as we go through these numbers, when you look at retirement confidence, people aren't just saving within a vacuum. They're looking at broader expectations around their savings.”

A significant number said they expect to retire at age 65 when, statistically more people retire around age 62.

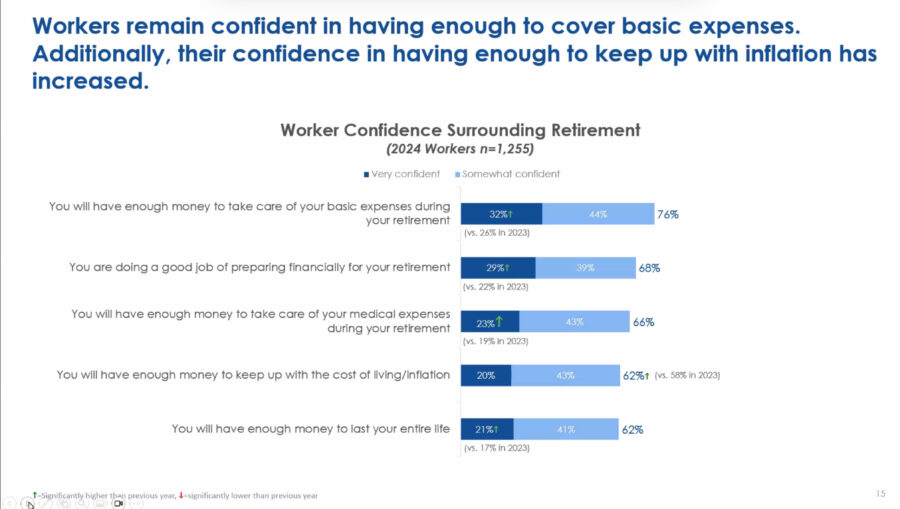

About 76% of workers felt they’ll have enough saved for medical expenses, and two-thirds said they were confident they’ll have enough to take care of basic expenses. 62% said they’ll have enough money to last their whole life, and the same amount said felt confident they would keep up with the cost of living and inflation, despite obvious worries about those issues.

“The percent who feel very confident is quite small, however, by comparison,” Copeland said. Most people are in that somewhat zone. And importantly we see that two-thirds of our workers feel at least somewhat confident that they have done a good job preparing financially for retirement, but that's only 3 in 10 who feel very confident they've done a good job, and that is up only slightly from where it was last year.”

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

FSI, SIFMA join federal lawsuit to overturn DOL fiduciary rule

With more people ‘living in harm’s way,’ auto, home rates soar

Annuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- ICYMI: BUCHANAN PRESSES HEALTH INSURANCE CEOS ON RISING HEALTH CARE COSTS, CALLS FOR PREVENTION AND AFFORDABILITY

- New Mexico sees record health care exchange sign-ups despite rising costs

- Fleming files transformational Kentucky Medicaid Reform Act

- Healey unveils health insurance reforms

- Guest Column: I lost my mom to cancer. Better advocacy is needed.

More Health/Employee Benefits NewsLife Insurance News

Property and Casualty News

- Governor talks about legacy, says she's not leaving office without medical malpractice fixes

- Winter Storm Fern comes with billion-dollar threat to property insurers

- CONGRESSMAN FLOOD HIGHLIGHTS ADVANCEMENT OF TERRORISM RISK INSURANCE ACT PROGRAM REAUTHORIZATION FROM COMMITTEE

- First American Title Launches Free Property Title Monitoring and Fraud Alert Service for Eligible Customers

- Lemonade Unveils Autonomous Car Insurance, Slashing Rates for Tesla FSD Miles by 50%

More Property and Casualty News