With more people ‘living in harm’s way,’ auto, home rates soar

Auto and home insurance rates are rising like the flood waters in the Midwest.

In fact, flooding, tornadoes and hurricanes are playing a pivotal role in premium increases, but it’s not only because more extreme weather events are hitting the United States, according to Mark Friedlander, director of corporate communications for the non-profit Insurance Information Institute.

“More people are living in harm’s way than ever before,” he said.

In 2023, the U.S. experienced 28 weather and climate disasters costing at least $1 billion, according to the NOAA National Centers for Environmental Information.

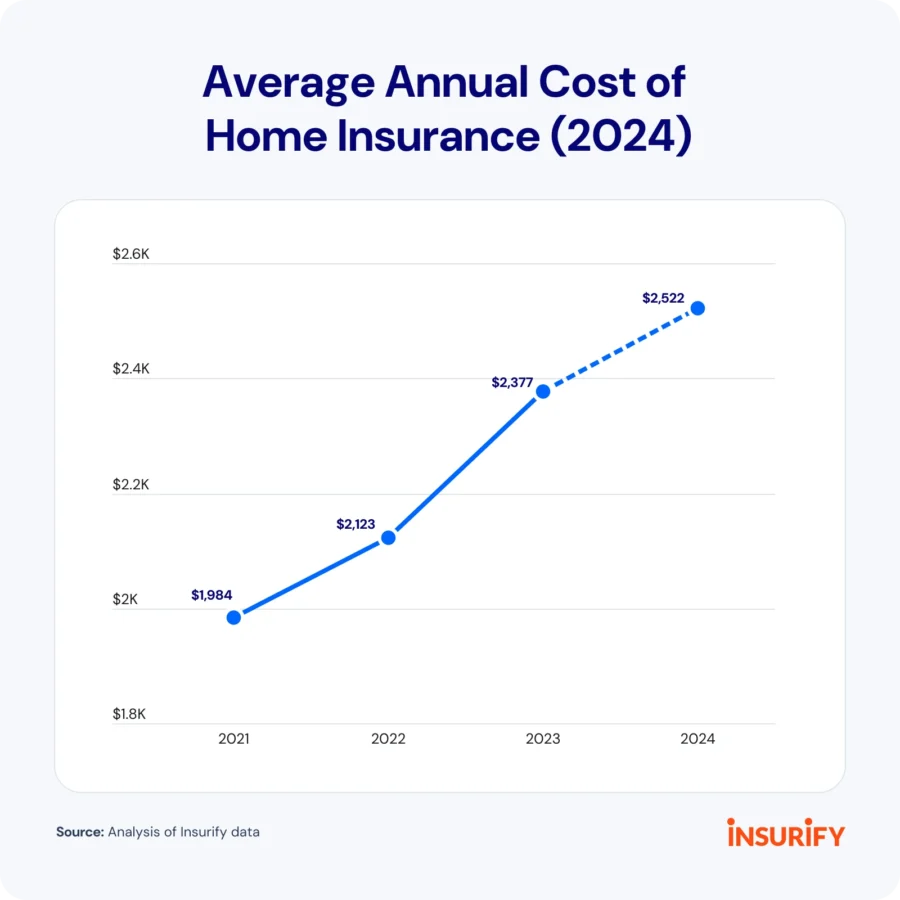

Homes and cars swept up in flood waters and hurricanes are becoming more common, and insurance premium increases are following suit. According to Bankrate, average premiums for auto insurance have reached $2,543 this year, a 26% increase from 2023. In homeowners’ policies, there’s been a 20 percent increase in premiums over the last two years and another 6 percent expected by the end of the year, according to Insurify.

Some states are seeing even higher numbers. The booming populations in coastal communities mean more damage to the homes they’ve built and the vehicles they’re using.

In 2023, U.S. home insurers had their worst underwriting performance since 2011, spending $1.11 for every $1 collected, Friedlander said. State Farm suffered a net loss of $6.3 billion in 2023 due, in part, to a “significant” increase in the severity of homeowners’ damage claims, the company reported.

But more factors, including inflation, are having an impact on the rise in prices.

Why are homeowners’ rates increasing?

The population shift to sunnier climates creates bigger impact in states like Florida and Texas when hurricanes hit. Hurricane Ian is expected to be a $60 billion loss event, according to Friedlander, second only to Hurricane Katrina.

“It’s not that we haven’t had more severe hurricanes, but it’s where it hits,” he said.

Replacement costs have also pushed up prices because of labor shortages in the home construction sector, disruptions in the supply chain and supply costs. Between 2019 and 2022, replacement costs increased 55 percent, Friedlander said.

Also having an impact on premiums is what Friedlander calls “legal system abuse,” as “billboard attorneys” publicly encourage civil suits for property and auto damage, he said.

“It’s a sue-first mentality,” he said. “If you’re going to have more attorney-driven cases, the losses will be higher.”

Weather, thefts, distracted driving hurt auto premiums

Weather, thefts, distracted driving hurt auto premiums

Car accidents are more frequent and more severe, according to Friedlander, and distracted driving is the leading reason why they’re happening. In 2022, 3,308 people died and about 290,000 more were injured in crashes involving distracted drivers, according to the National Highway Transportation Safety Administration.

Severe and more frequent accidents are one culprit in rising premiums, but the other is, once again, the weather. While hurricanes typically hit coastal areas and tornadoes roll through the central region of the United States, floods can happen anywhere, and they’re more frequent now, carrying away cars, buses, motorcycles and motorhomes.

Car thefts are also on the rise – more than 1 million vehicles were stolen in both 2022 and 2023, numbers that hadn’t been reached since 2008, according to Friedlander.

There has also been a spike in uninsured motorists. According to Friedlander, 14 percent of U.S. drivers were uninsured in 2022. “That hurts all drivers.”

High-tech vehicles that beep when a car crosses a solid line or signals that a car is passing have created more safety for drivers, but replacing parts after an accident is much more expensive with those vehicles, even in a simple fender bender, Friedlander said.

In Florida, there’s a “very high level” of staged accidents, creating false insurance claims for no damage. The state has taken notice and started to crack down on fraud, Friedlander said.

Here are some of the other factors:

- Supply chain disruptions

- Labor shortages

- Increasing medical costs

What are insurers doing to improve the numbers?

“Instead of just being a financial payout post-event, how can you move upstream to try to prevent or at least mitigate the severity that an event will cause?” said Ian Sterling, principal, advisory, actuarial for KPMG US.

That’s how the insurance industry should be moving forward: mitigating harm before it happens, he said.

Some insurers are using credit data to evaluate the customer’s risk level; 46 states and the District of Columbia allow credit evaluations. According to the Fair Isaac Corporation (FICO), 95 percent of personal insurers use credit-based insurance scores, in states where it’s permitted, to evaluate applicant risk. Actuarial data shows higher credit scores have been associated with lower risk, Friedlander said.

Insurers have also employed app technology to track the driving habits of willing participants, which can provide feedback to the insured about key risk factors, such as the amount of time the driver is distracted as well as braking and acceleration habits. The feedback has led to safer driving, according to Friedlander.

In high-risk areas, like tornado alley or coastal areas prone to hurricanes, insurers have started using drones to assess property before coverage is provided, primarily the condition of the roof, Friedlander said.

Kim Strong, a freelance writer, retired from journalism as an award-winning news editor and reporter of four decades.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Kim Strong, a freelance writer, retired from journalism as an award-winning news editor and reporter of four decades. Contact her at [email protected].

Weather, thefts, distracted driving hurt auto premiums

Weather, thefts, distracted driving hurt auto premiums

Retirement confidence at record low, but will it improve?

Are team-based advisory practices better positioned for growth?

Advisor News

- Unlocking hidden AUM: Prospecting from within your client base

- Protests in D.C. Take Aim at Health Insurance, Financial Institutions, Oil & Gas Interests

- Charitable giving tools available for taxpayers; due to expire

- Study: How should lawmakers fix the Social Security gap?

- Could Trump seek revenue via a sharp cut in 401(k) contribution limits?

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Business People: Andrew Rosendorf to head Six Points Theater’s Wellsprings program

- Virginia: SCC faults Cigna's coverage of transgender, autism treatment

- Concern should be your health and our nation's

- 6 Republicans join Democrats, pass Medicaid funding bill in Oregon House

- Medicaid funding bill easily passes Oregon House

More Health/Employee Benefits NewsLife Insurance News