Prudential rides strong FlexGuard sales to second-quarter earnings win

Main takeaway: Prudential turned a big corner in the second quarter with robust sales of its FlexGuard flagship annuity boosting revenues.

The insurer continued an evolution that began several years ago to remake its product offerings and shift away from market sensitive products. During the first quarter, Prudential cut ties with its money-losing Assurance IQ direct-to-consumer business.

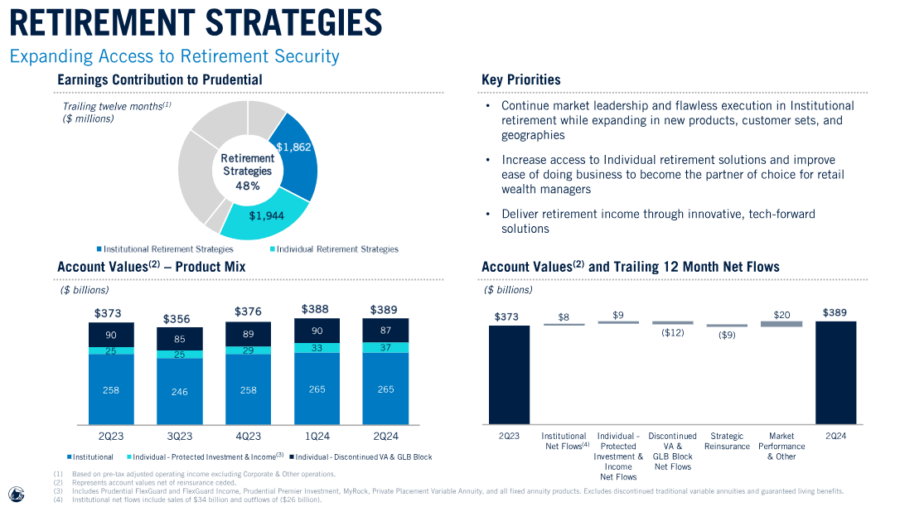

Prudential reported sales of $3.5 billion in its individual retirement segment, up 83% from the year-ago quarter, “reflecting continued momentum of our FlexGuard products and increased sales of fixed annuity products.”

“Our product pivots have resulted in continued strong sales of FlexGuard and FlexGuard Income and fixed annuity sales have doubled from the prior year,” said Rob Falzon, vice chairman. “Additionally, we continue to reduce market sensitivity by running off our legacy variable annuities.”

The opportunity to serve the retirement market is only going to grow, CEO Charles Lowrey told Wall Street analysts on a call today.

“This year, historic levels of Americans will turn 65,” Lowrey said. “At the same time, 55-year-olds will enter a crucial decade before retirement in preparation for life after work. These aging demographics will result in an estimated $137 trillion retirement opportunity in the U.S., and $26 trillion in Japan, by 2050.”

The strong possibility of an interest rate hike when the Federal Reserve meets in September is not a major concern, said Caroline A. Feeney, executive vice president and head or U.S. Business, in response to an analyst's question.

“It's certainly possible that in a decreasing interest-rate environment, we could see some pullback from the record sales levels, particularly in fixed annuities,” Feeney said. “From a Prudential perspective, while we've been very pleased with the growth in our fixed annuity sales, it's really just a piece of the overall portfolio. We have the broadest product portfolio we've ever had, with no over-concentration in any single product.”

Management Commentary

“We are experiencing very turbulent times right now, obviously, and this is exactly when clients need us the most. And we've seen that in the past, when clients turn to us during these kind of volatile times, such as the great financial crisis and others that we've all been through, and what we've observed is that we've been a net beneficiary in these turbulent times as there is a real flight to quality, which we define as having the financial strength, the strength of brand and the strength of distribution, so that clients can meet us when, where and how they want.”

– CEO Charles Lowrey

Financial Overview

Net Income: $1.2 billion ($511 million in Q2 2023)

Earnings Per Share (EPS):

Operating Income: $1.2 billion ($1.1 billion in Q2 2023)

Share repurchases: $250 million

Dividend declared: $475 million ($1.30 per share)

Stock price movement: Shares dropped about 9.5% at midday Friday to $110.90

Segment Performance

Individual Retirement Strategies:

- Operating Income: $486 million ($448 million in Q2 2023)

- Sales: $3.5 billion (up 83% over Q2 2023)

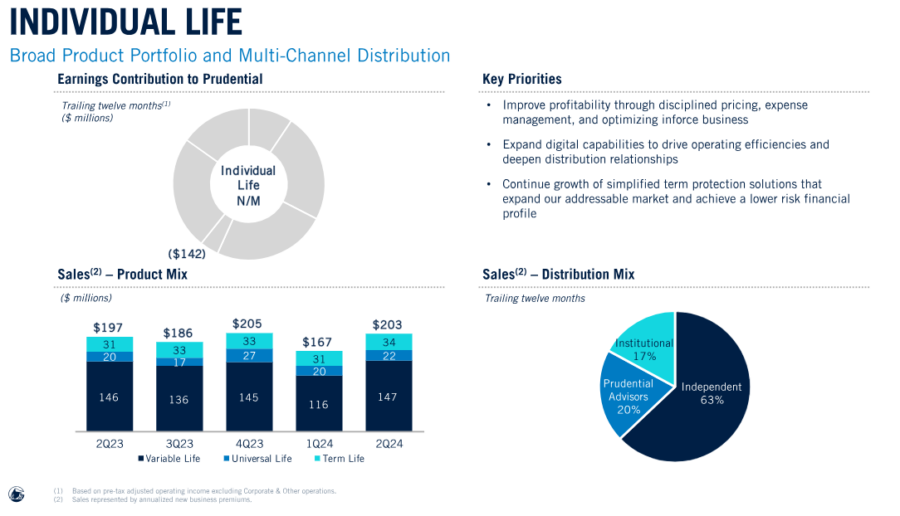

Individual Life:

- Operating Income: Loss of $87 million (loss of $59 million in Q2 2023)

- Sales: $203 million (up 3% over Q2 2023)

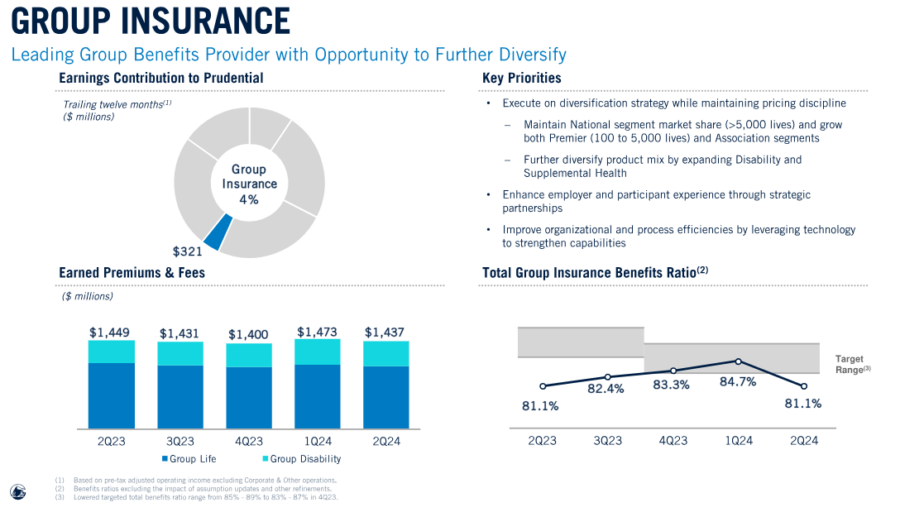

Group Insurance:

- Operating Income: $121 million ($139 million in Q2 2023)

- Sales: $424 million (up 13% over Q2 2023)

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

AIG takes Q2 hit from loss of life, retirement revenues

Is continuing illiquidity in the life/annuity portfolio a cause for concern?

Advisor News

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Legal Notices

- Higher premiums, Medicare updates: Healthcare changes to expect in 2026

- Wellmark still worries over lowered projections of Iowa tax hike

- Trump’s Medicaid work mandate could kick thousands of homeless Californians off coverage

- CONSUMER ALERT: TDCI, AG'S OFFICE WARN CONSUMERS ABOUT PURCHASING INSURANCE POLICIES FROM LIFEX RESEARCH CORPORATION

More Health/Employee Benefits NewsLife Insurance News

- Marv Feldman, life insurance icon and 2011 JNR Award winner, passes away at 80

- Continental General Partners with Reframe Financial to Bring the Next Evolution of Reframe LifeStage to Market

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

- NAIFA and Brokers Ireland launch global partnership

More Life Insurance News