Prudential boosts Q1 earnings, shutters disappointing Assurance IQ

Prudential Financial recorded stronger first-quarter earnings from both its asset manager and sales growth in its U.S. and international businesses.

The insurer continued an evolution that began several years ago to remake its product offerings and reduce risk. To that end, Prudential signed a significant reinsurance deal during the quarter to go along with a pair of pension risk transfer deals.

Prudential reported first-quarter net income of $1.1 billion, down from $1.46 billion in the year-ago period. After-tax adjusted operating income was $1.14 billion for the first quarter of 2024, compared to $1 billion for the first quarter of 2023.

"Our results for the quarter reflect accelerating momentum across all our businesses, including significant positive net flows in PGIM, our global asset manager, and strong sales in our U.S. and international insurance businesses," said CEO Charlie Lowrey. "We've made substantial progress in shifting our business mix and growing our market leading businesses to become a higher growth, more capital efficient and nimble company."

Prudential is coming off a strong 2023, when net income reached $2.48 billion, compared to a net loss of $1.64 billion in 2022.

The insurer cut bait with Assurance IQ – an insurance-distribution platform Prudential acquired in a $2.35 billion deal in 2019 – after several years of draining losses. Assurance IQ launched in 2016 as an online marketplace for multiple insurance products, including life, auto, health and Medicare supplement policies.

Assurance IQ struggled to meet growth targets set by the company, but finally turned a profit in the fourth quarter 2022 ($29 million). However, Prudential was forced to include "a goodwill impairment charge of $713 million" in the same quarter to reflect the loss of value. Similar charges followed in 2023.

Lowrey defended the Assurance IQ acquisition.

"Certainly, we anticipated a different outcome when we purchased Assurance and we've incorporated these lessons into our [merger-and-acquisition] approach," he said. "As we look forward will we will focus on acquisitions of more established businesses that present present opportunities to expand our capabilities and scale in our existing market-leading businesses."

Geekwire reported that Assurance IQ has about 1,000 employees, most of whom will be laid off. The wind down will not be material to Prudential earnings, the insurer said.

Big Q1 deals

Prudential had an active first quarter on the dealmaking front. For starters, the insurer officially completed a major reinsurance transaction with Somerset Re involving a portion of its guaranteed universal life insurance block.

Announced in July 2023, the deal includes $12.5 billion of reserves backing Prudential’s guaranteed universal life policies issued by Pruco Life Insurance Co. and Pruco Life Insurance Co. of New Jersey.

The deal further advances Prudentials' strategy "to reduce market sensitivity and increase capital efficiency," Lowrey said.

On the flip side, Prudential struck a pair of lucrative pension risk transfer deals during the quarter. A PRT transaction with Shell USA for $4.9 billion in pension obligations covers a block of about 21,500 of the company’s U.S. retirees.

A Prudential subsidiary, The Prudential Insurance Co. of America, will be responsible for the pension benefit payments to these retirees beginning May 15, 2024.

In a second deal, Verizon Communications transferred $5.9 billion in employee pension obligations via the purchase of single-premium group annuity contracts from Prudential Insurance Co. of America and RGA Reinsurance Co.

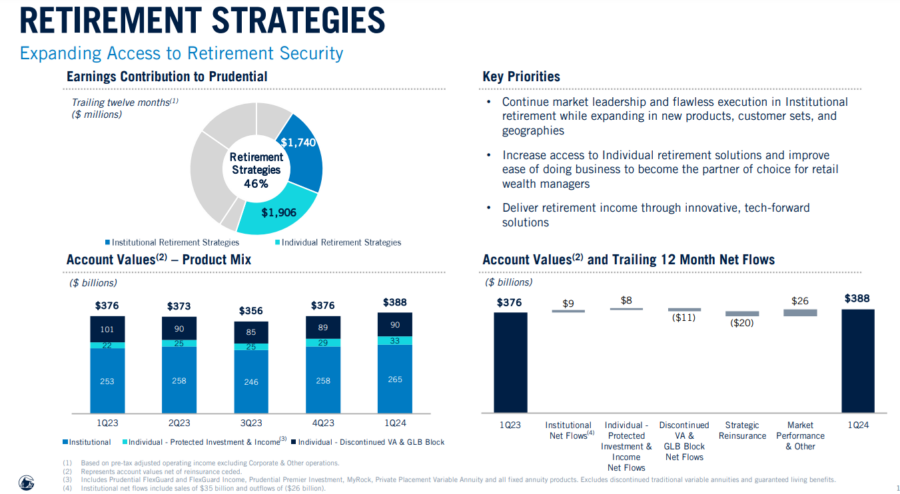

The PRT deals drove a monster quarter for the institutional retirement segment, said Rob Falzon, vice chairman of Prudential.

"We have now completed six of the 10 largest transactions on record," he noted.

Segment report

Prudential's U.S. businesses reported adjusted operating income of $839 million for the first quarter of 2024, compared to $760 million in the year-ago quarter. This increase "primarily reflects higher net investment spread results and more favorable underwriting results, partially offset by higher expenses and lower net fee income," the insurer said in a news release.

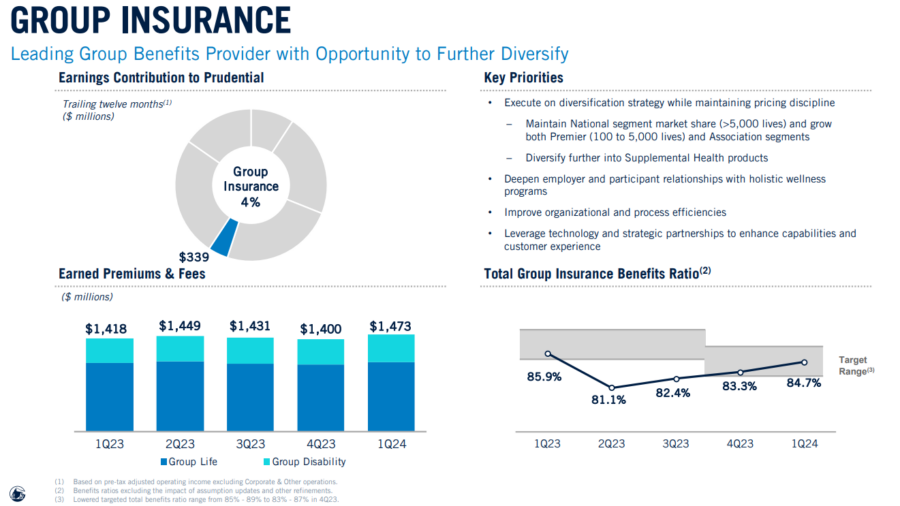

Group Insurance reported adjusted operating income of $45 million in the current quarter, compared to $25 million in the year-ago quarter. This increase "primarily reflects more favorable underwriting results in group life and higher net investment spread results, partially offset by higher expenses," the release said.

Reported earned premiums, policy charges, and fees of $1.5 billion increased 4% from the year-ago quarter, reflecting growth in both disability and life.

On the life insurance side, FlexGuard Life recorded its highest sales quarter, Lowrey said. Sales of $167 million in the quarter increased 12% from the year-ago quarter, driven by variable life and term sales, "reflecting our pivot to more capital efficient products," the release said.

Still, the Life segment lost $121 million in the quarter, compared to a loss of $102 million in the year-ago quarter. "This higher loss reflects one-time costs and lower net investment spread from closing the guaranteed universal life reinsurance transaction, partially offset by more favorable underwriting results," the release said.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Equitable execs tout Q1 retirement growth, Wall Street wants more income

AIG boosts income off life and retirement, low catostrophic losses in Q1

Advisor News

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

More Advisor NewsAnnuity News

- Trademark Application for “EMPOWER MY WEALTH” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Conning says insurers’ success in 2026 will depend on ‘strategic adaptation’

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

More Annuity NewsHealth/Employee Benefits News

- Researchers to study universal health care, as Coloradans face $1 billion in medical debt

- Study Findings on Chronic Pain Are Outlined in Reports from Brody School of Medicine at East Carolina University (Associations of Source and Continuity of Private Health Insurance with Prevalence of Chronic Pain among US Adults): Musculoskeletal Diseases and Conditions – Chronic Pain

- As health insurance costs rise, locals confront impacts

- Plainfield, Vermont Man Sentenced to 2 Years of Probation for Social Security Disability Fraud

- LTC: A critical component of retirement planning

More Health/Employee Benefits NewsLife Insurance News