Equitable execs tout Q1 retirement growth, Wall Street wants more income

Equitable Holdings reported plenty of good news from first-quarter financials, but still failed to make Wall Street happy on the income side.

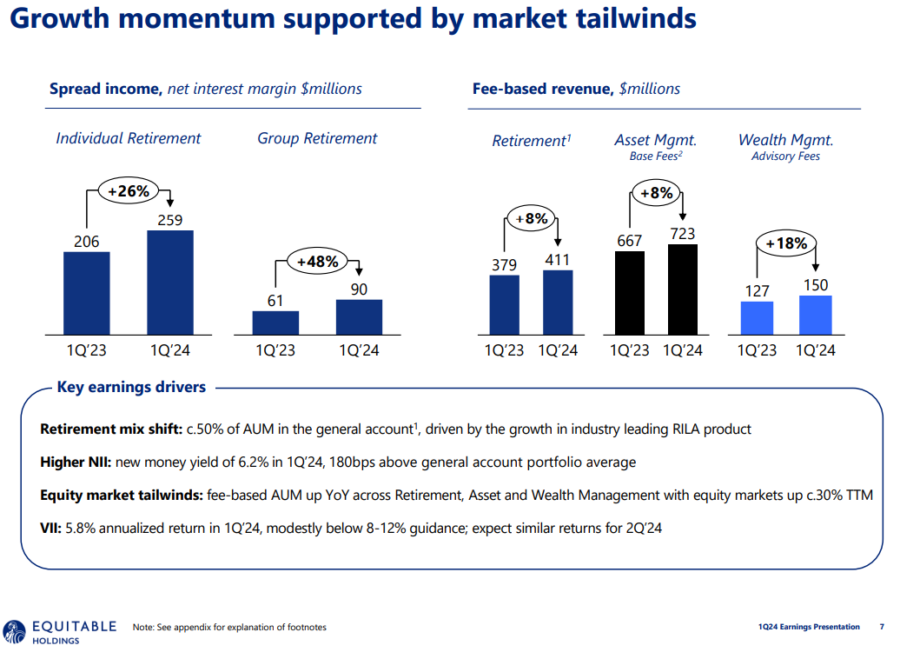

Operating earnings were up across business segments, market tailwinds drove growth and retirement premium and deposits grew 42% over the year-ago Q1. Yet, $114 million in net income declined from $177 million in the year-ago quarter and fell well short of Wall Street estimates.

Equitable is coming off net income declines for both the fourth quarter and full-year 2023. But the future is bright, executives said, due to market dynamics and Equitable's positioning to take advantage.

"The U.S. is by far the most attractive market I've seen," said Mark Pearson, president and CEO. "First, it's a huge market with over $35 trillion in assets, nearly 10 times the size of the next largest market. Secondly, there's a clear need for private market solutions. The U.S. has an aging population that is living longer, which necessitates a higher level of retirement savings. Social Security will not meet this need."

Pearson noted that Equitable is the leading seller of registered indexed-linked annuities. Equitable recorded $11.3 billion in RILA sales in 2023, according to LIMRA sales rankings, far outdistancing No. 2 Brighthouse Financial ($6.9 billion).

"We believe RILAs offer a compelling consumer value proposition by providing an opportunity to grow retirement income, while also having partial downside protection against a market decline," Pearson said.

No DOL impact

Equitable continues working with BlackRock on lifetime income options within retirement plans. Last week, BlackRock announced its LifePath Paycheck retirement income solution available in defined contribution plans. To date, 14 employers with plans totaling $27 billion in target date assets have committed to make LifePath available to 500,000 employees, a news release said.

The LifePath solution provides access to guaranteed income through a target date fund. Plan participants will have the option to use a portion of their plan account balance at retirement to purchase a fixed individual retirement annuity from Equitable.

The in-plan annuity market is an area of growth for Equitable, Pearson noted, with significant opportunity to help address the retirement savings crisis. There are approximately $7 trillion of assets in 401(k) plans,1 with more than $3 trillion invested in target date fund default investment options.

"We're very bullish on this part of our business," Pearson said. "The SECURE Act makes it easier for sponsors to add a decumulation option, and it's going to give us significant long-term growth potential."

Equitable is already seeing flows from the BlackRock partnership, but "it will take a little bit of time to see a meaningful impact on earnings," Pearson explained.

One area Equitable is mostly unaffected – while the industry as a whole has deep concerns – is the Department of Labor Retirement Security Rule, which would significantly expand the fiduciary standard to cover most insurance annuity sales.

Equitable advisors and broker-dealers already sell products under a fiduciary standard, noted Nick Lane, president of the company.

"We don't see a material impact," he added. "With that said the broader industry has concerns on the process and the impact to consumers. So, we expect there to be litigation going forward and we'll continue to monitor the situation."

Shares of Equitable Holdings are up about 46% over the past six months.

Retirement segment results

The Individual Retirement segment performed well with net inflows of $1.6 billion, and a 25% increase in account value driven by strong sales of RILAs. The Group Retirement segment, however, experienced net outflows of $132 million. The tax-exempt channel, which

includes Equitable’s K-12 educators offering, reported net inflows of $18 million.

In the Investment Management and Research segment, operated by AllianceBernstein, active net inflows of $3.7 billion were largely driven by the Retail and Private Wealth channels. Protection Solutions reported gross written premiums to $778 million, and Wealth Management operating earnings rose by 34% year-over-year.

Market tailwinds helped drive strong earnings in the quarter, executives stressed.

"I truly believe Equitable is in a privileged position," Pearson said. "The U.S. retirement market presents a huge growth opportunity and Equitable is unique and being able to participate across distribution, product manufacturing, and asset management."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

What’s new with SECURE 2.0 and workplace retirement plans?

Prudential boosts Q1 earnings, shutters disappointing Assurance IQ

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

- Insurer to cut dozens of jobs after making splashy CT relocation

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

- Crypto meets annuities: what to know about bitcoin-linked FIAs

More Annuity NewsHealth/Employee Benefits News

- Red and blue states alike want to limit AI in insurance. Trump wants to limit the states.

- CT hospital, health insurer battle over contract, with patients caught in middle. Where it stands.

- $2.67B settlement payout: Blue Cross Blue Shield customers to receive compensation

- Sen. Bernie Moreno has claimed the ACA didn’t save money. But is that true?

- State AG improves access to care for EmblemHealth members

More Health/Employee Benefits NewsLife Insurance News