Is continuing illiquidity in the life/annuity portfolio a cause for concern?

With results from 2023 investments for both life/annuity and property/casualty insurers in, we see life/annuity insurers continue to reach for yield through illiquid assets, such as mortgages and private placements.

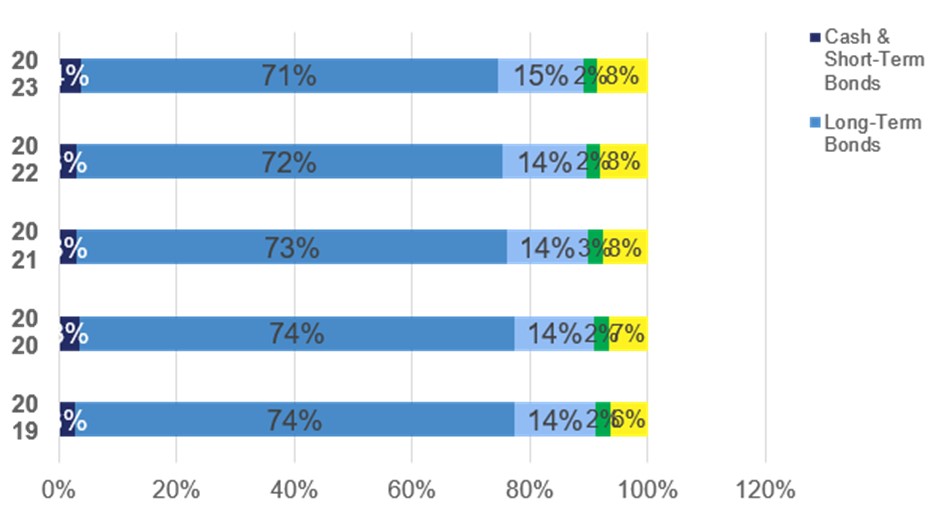

Life & Annuity Industry Asset Allocation

As a % of Net Invested Assets

Prepared by Conning, Inc. Source: Copyright 2024 S&P Global Market Intelligence LLC

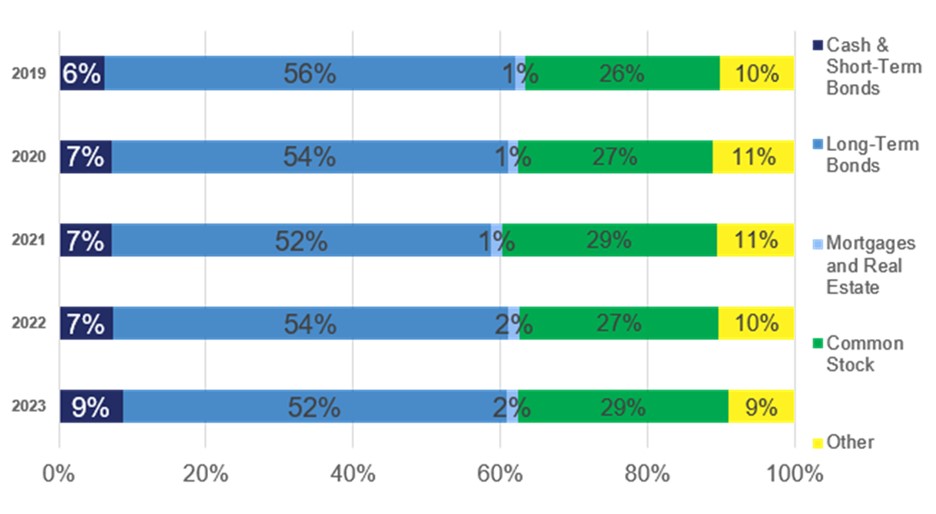

Property/casualty insurers, in contrast, have increased their cash and short-term bond holdings, maintaining their relatively high liquidity position.

Property/Casualty Industry Asset Allocation

As a % of Net Invested Assets

Prepared by Conning, Inc. Source: Copyright 2024 S&P Global Market Intelligence LLC

In general, given the longer duration of life liabilities, life insurers have been taking on more illiquid profiles in their asset portfolios. However, as interest rates rise, this may put the squeeze on insurers as the market value of fixed rate assets decreases in response and as policyholder behavior responds to the changing environment.

Increased surrenders in face of rising interest rates and challenging economics

Policyholder behavior can have a large effect on life/annuity results, especially when it comes to surrenders. Although some product features reduce the impacts of policyholder options, such as surrender charges or market value adjustments, many of the most popular products in the life/annuity industry, especially in individual annuities, have policyholder options that can create disintermediation risk as policyholders exercise them.

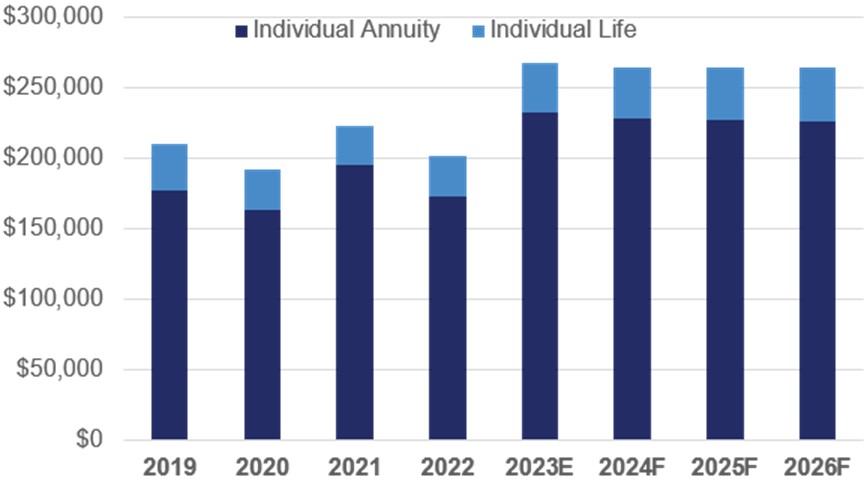

Life-Annuity Industry Surrender Benefits, Historical and Forecast

$ in millions

Prepared by Conning, Inc. Source: Copyright 2024 S&P Global Market Intelligence LLC

Surrenders increase not only as policyholders cash out of products to use the cash for present needs, but also when exercising guaranteed minimum withdrawal benefits on annuities or surrendering old life insurance policies or annuities to roll over into new products with better features. As interest rates have risen, some traditional products have become more attractive with better crediting rates. New product designs such as registered index-linked annuities or registered indexed universal life have also provided higher upside potential accumulation for customers, attracting certain market segments that may already own life-annuity products.

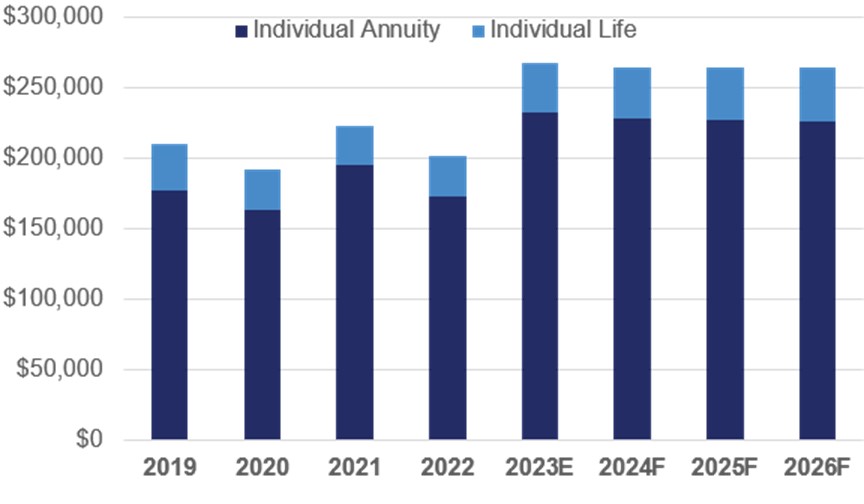

Life-Annuity Industry Surrender Benefits, Historical and Forecast

$ in millions

Prepared by Conning, Inc. Source: Copyright 2024 S&P Global Market Intelligence LLC

These increased surrenders create cash flow demands on insurers. If incoming cash flows do not cover surrender cash flow demands, assets must be tapped. More than 90% of the life/annuity general account portfolio is fixed income in nature, leaving a potential loss in value from interest rate risk. However, there is additional liquidity risk as life/annuity insurers have been increasing the illiquidity of their portfolios.

Increasing illiquidity of the life/annuity bond portfolio

Life/annuity insurers have been shifting to an increasingly illiquid profile in their asset portfolio across many asset classes, but the most notable shift can be seen in the bond portfolio.

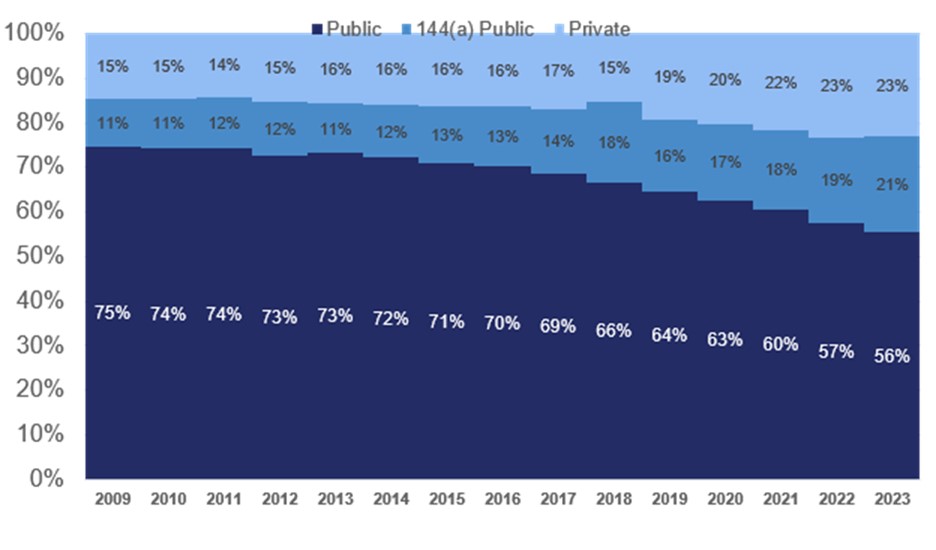

Private placements and 144(a) bonds have increased their share of the life/annuity bond portfolio to the extent that public bonds have decreased from 75% of the bond portfolio in 2009 down to 56% of the portfolio in 2023.

Life & Annuity Bond Type Distribution

As a % of Total Bonds

Prepared by Conning, Inc. Source: Copyright 2024 S&P Global Market Intelligence LLC

Both types of nonpublic bonds have increased their share in the portfolio as life/annuity insurers sought yield in bond types such as collateralized loan obligations and eschewed low-yielding government bonds. In some cases, insurers may have sought more credit protection in private placements. Private placements have been shown to have better credit loss experience in the Society of Actuaries’ experience studies covering 2003-2015, when compared to similarly rated public bonds.

However, one dimension on which private placements are less desirable than public bonds or even rule 144(a) bonds is liquidity. If insurers need to sell private placements before maturity, they may not get the full economic value of their asset or need to incur high transaction costs in time or money.

Increasing mortgage holdings another source of illiquidity

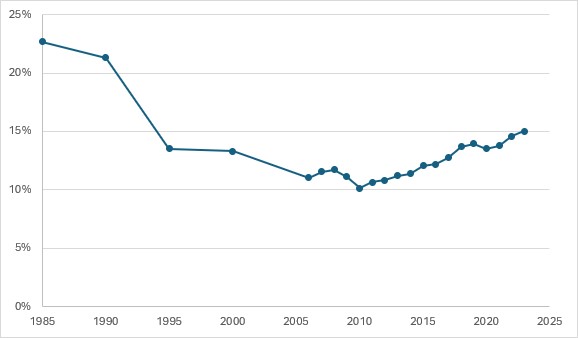

Life-Annuity Industry Mortgage Holdings

As a % of Investable Assets

Prepared by Conning, Inc. Source: Copyright 2024 S&P Global Market Intelligence LLC

The other allocation issue for life/annuity insurers is mortgage holdings. Most of the mortgages (whole loans, as opposed to mortgage-backed securities, held in the bond portfolio) are for commercial real estate, such as office buildings or hotels.

Mortgage holdings as a percentage of investable assets has been increasing since 2010, when it had been at a low of 10.2% of the portfolio. There had been a fairly steady increase in allocations until the pandemic, leading to a small dip in 2020, but allocations began rising again in 2021 and stood at 15% at the end of 2023.

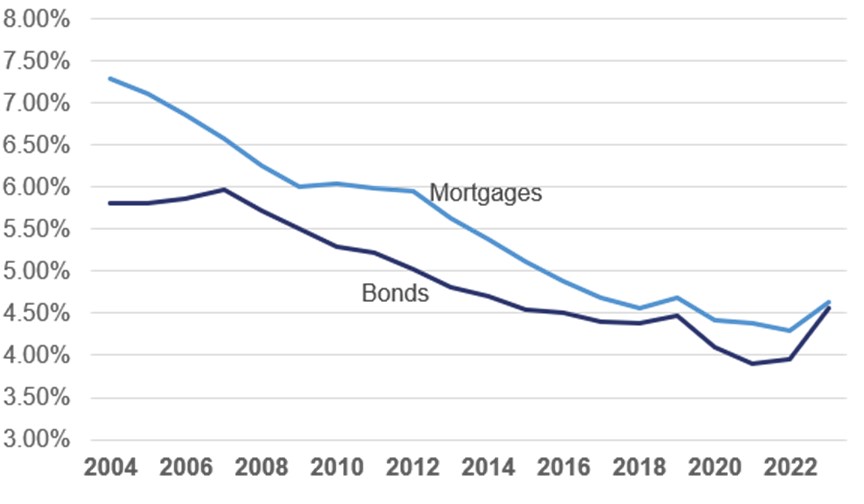

Mortgages have been seen as a way to achieve extra yield in a low-rate environment, but that advantage has eroded, at least in book yield terms. As interest rates have increased, the book yield on the bonds invested in by insurers have increased, more rapidly than the yields on mortgages. In addition, impairments on mortgages have increased.

Gross Book Yields for Bonds and Mortgages Held by Life-Annuity Industry

As a % of Average Underlying Investable Assets

Prepared by Conning, Inc. Source: Copyright 2024 S&P Global Market Intelligence LLC

Impairments further affect the liquidity of the assets, as well as the investment income to be realized in the portfolio. These impairments in 2022 and 2023 came before any official recessions and would likely increase in the case of a recession.

Allocation shifts differ by insurer size

While talking about liquidity of assets more generally, not all these concerns are shared equally over the life/annuity industry. Asset allocations differ greatly between insurers, and one of the dimensions where distinctions can be seen most clearly is by size. The largest insurers are most likely to have the highest allocations to mortgages.

The largest life/annuity insurers have invested more in illiquid assets, such as private bonds and commercial mortgages, than have smaller insurers. These assets may require special management in times of economic stress, but they may also offer higher returns and match more complex liabilities. However, these strategies may face challenges when interest rates rise.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Mary Pat Campbell, FSA, MAAA, is a vice president in Conning’s research and consulting group. Contact her at [email protected].

Prudential rides strong FlexGuard sales to second-quarter earnings win

A pair of North Carolina residents charged with insurance fraud

Advisor News

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

More Advisor NewsAnnuity News

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- U.S. REP. KATHY CASTOR JOINED BY TAMPA SMALL BUSINESS OWNER WHO FACES CRUSHING COST INCREASE FOR HEALTH COVERAGE FOR STATE OF THE UNION

- Rep. Howell, Sen. Watson propose health insurance protection legislation

- Braden Draggoo Named New York Life’s 2025 Council President

- Genworth Financial taking the offensive after years of LTCi rate struggles

- Ambler Brook Announces Strategic Growth Investment in Claimify

More Health/Employee Benefits NewsProperty and Casualty News

- Could AI claims settlement without a lawyer become the new norm?

- Nancy Guthrie abduction puts focus on 'kidnap and ransom' insurance

- U.S. insurers optimistic despite increased headwinds

- Bowhead Specialty Holdings Inc. Reports Fourth Quarter and Full Year 2025 Results

- Best’s Market Segment Report: AM Best Revises Outlook on Germany’s Non-Life Insurance Segment to Stable

More Property and Casualty News