Prudential CEO Lowrey: We’ll manage life business ‘very, very carefully’

Prudential Financial has no plans to exit the life insurance business anytime soon, but will move forward with caution, president and CEO Charles Lowrey said today.

Lowrey lauded the potential in the life insurance business during a second-quarter earnings call with industry analysts. With the final question of the session, Lowrey was asked if Prudential might consider shedding its life segment.

Prudential pivoted away from annuities in recent years as part of a de-risking strategy. During the second quarter, the insurer sold a $31 billion block of traditional variable annuities to Fortitude Re.

The life business faced some "difficulties" of its own, said Mike Ward, a Citi analyst in asking his question.

"We still think there's a significant potential for growth in the life industry," Lowrey said. "You have a $12 trillion life insurance gap. You have increasing sales as shown by last year's industry, with sales being the best they have been in about two decades.

From a business mix perspective, Lowrey added, the life business continues to be a "really helpful component" in balancing longevity with mortality. "It's a business that we would like to remain in, but we'll do so very, very carefully as we go forward."

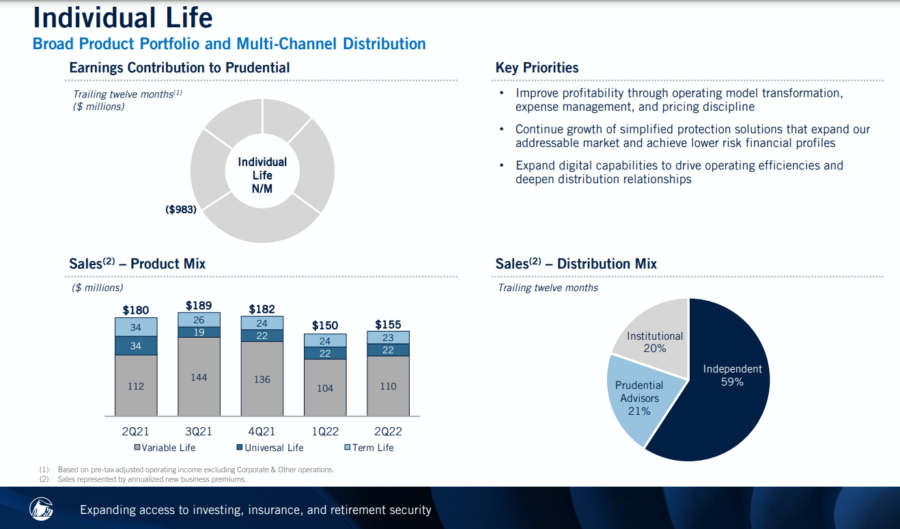

Life segment loss

Prudential reported a loss, on an adjusted operating income basis, of $1.325 billion in the current quarter, compared to adjusted operating income of $146 million in the year-ago quarter. This decrease includes "an unfavorable comparative impact from our annual assumption update and other refinements of $1.408 billion, primarily driven by updated policyholder behavior and mortality assumptions in the current quarter," Prudential said in a news release.

Current quarter results primarily reflect lower net investment spread results and higher expenses, partially offset by more favorable underwriting results, the release said. Sales of $155 million in the current quarter decreased 14% from the year-ago quarter, driven by lower universal life and term sales.

Assurance IQ continues to struggle, reporting a loss, on an adjusted operating income basis, of $61 million in the second quarter, compared to a loss of $38 million in the year-ago quarter. This higher loss includes "an unfavorable impact from our annual assumption update and other refinements of $17 million in the current quarter," the release said.

Assurance IQ was launched in 2016 as an online marketplace for multiple insurance products, including life, auto, health and Medicare supplement policies. It was acquired by Prudential in 2019.

In response to a question about Assurance IQ, Andy Sullivan, head of U.S. businesses, said a few factors kept Prudential from performing better with Medicare advantage sales. For one, the Biden administration did not open up a special enrollment period like they did last year.

"We're still very focused on scaling up revenue in each of the distinct product lines in the Assurance IQ platform, as that really is what's required to get the business to achieve profitability," Sullivan added.

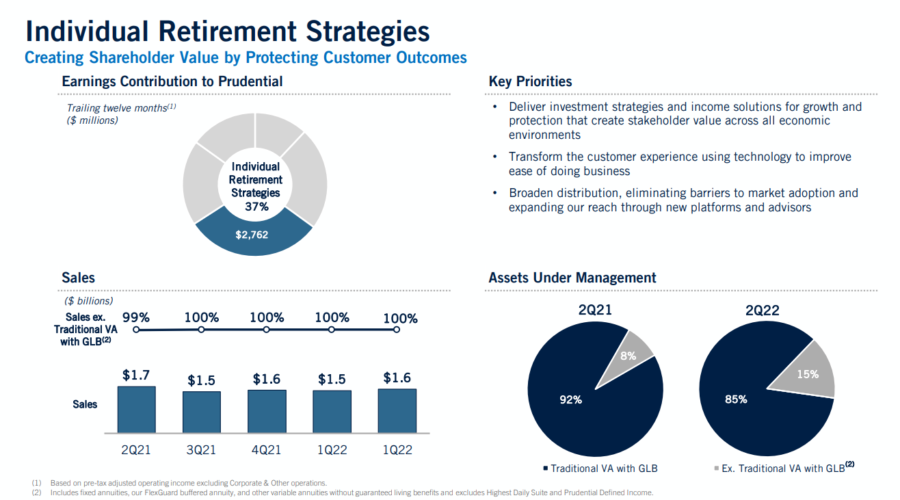

Individual retirement segment

The renamed Individual Retirement segment (formerly Individual Annuities) had a strong quarter, led by Prudential's strong-selling FlexGuard annuity line, said Rob Falzon, vice chairman.

"Our product pivots in individual retirement have resulted in strong sales of more simplified solutions with nearly $1.5 billion of FlexGuard and FlexGuard Income sales in the second quarter," Falzon said. "Our strong FlexGuard sales benefited from implementing a fully digital and automated new business experience. This tech-forward approach helps to maintain our record pace of sales."

The segment reported adjusted operating income of $1.305 billion in the second quarter, compared to $472 million in the year-ago quarter. This increase includes "a favorable comparative impact from our annual assumption update and other refinements of $40 million," the release said. The Fortitude Re sale also netted $852 million.

"Excluding these items, current quarter results primarily reflect lower fee income, net of distribution expenses and other associated costs, partially offset by a gain on a strategic investment and higher net investment spread results," the release said.

Overall, Prudential posted revenues of $13.77 billion for the quarter that ended June 30, 2022, compared to year-ago revenues of $13.1 billion.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Harvard study: how poor people stay poor – and how to fix it

5 strategies to streamline the recovery and restoration process

Advisor News

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

More Advisor NewsAnnuity News

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

More Annuity NewsHealth/Employee Benefits News

- agilon health Reports Fourth Quarter and Full Year Fiscal 2025 Results

- Heart disease: The real cost to employers and workers

- DUCKWORTH SOTU GUEST DELIVERS POWERFUL, EMOTIONAL TESTIMONY DETAILING HOW HIS HEALTH INSURANCE BILL QUADRUPLED AFTER TRUMP LET ACA TAX CREDITS EXPIRE

- Kontoor updates executive severance package

- AZ ACA enrollment drops 65,000 as tax credits expire

More Health/Employee Benefits NewsLife Insurance News