Protecting clients amid the ‘triple threat’ in LTC services

America is facing a “triple threat” in long-term care services. The convergence of three major trends — the mounting retirement crisis, a dearth of long-term care planning and an aging population burdened by long-standing illnesses — is a potentially devastating dilemma that can compromise your clients’ dreams of aging in place and enjoying a happy, healthy retirement.

Although America’s retirement crisis looms large, it’s only one aspect of this troubling trifecta. Overall, 80% of households with older adults — 47 million households — are financially struggling or at risk of economic insecurity as they age, the National Council on Aging reported. And despite preferences to age in place, NCOA said 60% of older adults would be unable to afford two years of in-home services.

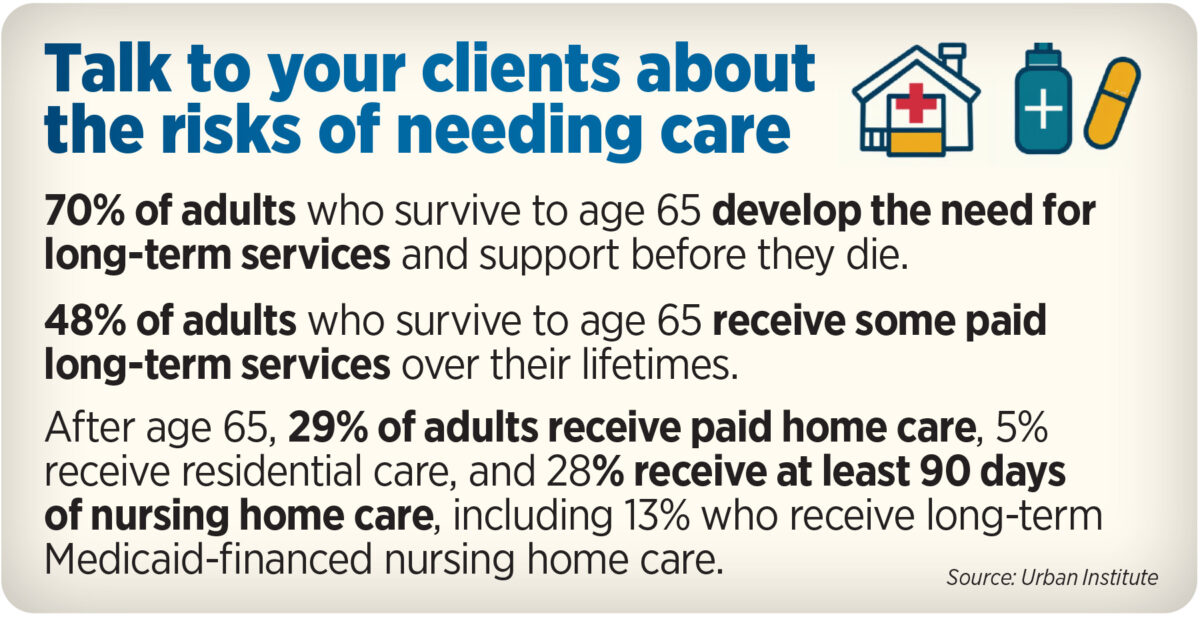

Recent research also reveals a short-sighted attitude regarding long-term care services. The Urban Institute reports 70% of retirement-age Americans will need ongoing care at some point. However, the Transamerica Institute found a mere 14% of retirees are very confident they’ll be able to afford it, and an alarming 31% have no long-term care plans whatsoever.

Perhaps most distressing, though, is our country’s overall health. The U.S. has the lowest life expectancy among high-income countries, according to the Commonwealth Fund, while the Centers for Disease Control and Prevention says 6 in 10 American adults have a chronic disease. Plus, the CDC says nearly 42% of adults suffer from obesity, which is directly linked to preventable deaths from heart disease, stroke, Type 2 diabetes and certain cancers.

With the population aging — NCOA says the number of adults aged 65 and older is expected to reach more than 80 million by 2040 — this ominous reality promises to intensify in the future. However, this challenge brings an opportunity to help heighten clients’ long-term care preparedness.

Become a proactive partner in health

The growth of the senior-adult cohort must prompt a paradigm shift within the insurance industry. This unique demographic requires fundamental change in the attitudes of insurance professionals and how they perceive and serve their clients.

The agent-client relationship’s inherent nature has been somewhat adversarial amid business directives to increase rates and decrease payouts or claims. This long-standing approach must evolve into one centered on a “best alignment of interests” model that creates a mutually beneficial partnership between agents and policyholders. This approach gives agents a vested interest in supporting clients in their pursuit of an enhanced quality of life. The goal of creating an environment in which agents work with clients to keep them healthier, longer, will impact loss and claim ratios to benefit insurers and clients in the long run.

When it comes to building relationships with older adults, it is critical to discuss a long-term care plan to ensure they are prepared for a potentially financially devastating event. Even though older Americans are the single largest group facing financial hardship, the topic is often ignored due to a lack of awareness. One of the most common, and perilous, misconceptions among the public is that Medicare covers long-term care. The fact is that Medicare only covers basic medical needs, and not long-term care services.

Older Americans represent a highly underserved market to which agents can lend their vital support as a partner in promoting extended quality of life. Be proactive in formulating a plan to help clients live the best possible versions of their lives.

Embrace innovation for an aging society

The explosive growth of the aging baby boomer population means advisors will face a surge of clients who are, unfortunately, woefully ill-prepared, and whose particular needs must be addressed. Despite the fact that the Administration for Community Living says someone turning 65 today has a nearly 70% chance of needing future long-term care services, KFF reports only 10% of those in this age group have a plan to address that need.

Although the need for long-term care insurance is urgent, purchases of LTCi are declining. LTCi policy purchases have steadily ticked downward, with 2022 marking the lowest sales volume in more than two decades, the American Association for Long-Term Care Insurance reported. This trend is understandable due to heritage issues such as inaccurate assumptions that led to significant rate increases, in addition to lack of product innovation, agents and carriers dropping out of the market and overall consumer perception of the segment.

To safeguard elderly individuals from financial insecurity during their retirement phase, the insurance sector must foster innovation that will ignite behavioral and buying changes in this category.

Let’s begin with Step 1. Innovation can streamline the LTCi application process, which has traditionally involved in-person exams and lengthy procedures that frustrate consumers and result in high rejection rates. The ability to streamline this inconvenience is already here. Improved risk selection and application processing techniques enable current insurance products to provide decisions within an hour. This tidier and expedited approach has led to better risk selection and significantly improved consumer experiences.

Innovation is also transforming the way insurance companies handle claims, making the process more efficient and precise. Automated initial claims routing streamlines the process, swiftly directing claims to the appropriate department or personnel for evaluation and next steps. We must replace legacy systems with automation that saves time and resources, leading to faster response times and reducing the risk of claims getting lost or mishandled.

Venture capital recognizes the need and size of the opportunity, driving investments in insurtech companies upward of $11 billion, McKinsey reports. Much of this money will focus on resolving issues and friction points, leveraging machine learning to improve risk selection during the application process, and generating better insights into what is driving morbidity and mortality.

Other opportunities exist in identifying potential policyholders who might require assistance and make future claims for health challenges. Those opportunities require insurers to analyze massive data sets mapped against population health metrics.

Promoting prevention for mutual benefit

Preventive services play an integral role in protecting and promoting health, yet the Office of Disease Prevention and Health Promotion reports only 5% of adults aged 65 and older received these recommended services in 2020. By using data analytics and predictive modeling, insurance carriers can reach out to these individuals, offering assistance, guidance and resources to address their needs before a crisis occurs. This preemptive approach can prevent or mitigate potential problems, helping policyholders maintain better health and quality of life.

Some insurance carriers are now incorporating innovative wellness programs into their preclaim processes. These programs offer policyholders access to targeted, personalized health and wellness services such as fitness programs, nutrition counseling, mental health support and preventive screenings. By encouraging healthier lifestyles and early intervention, these insurers reduce the chances of claims arising from preventable health issues while improving the overall customer experience, and building stronger and deeper connections.

The big value of small interventions is real. Falls are the leading cause of fatal and nonfatal injuries for older Americans, with NCOA reporting 1 out of 4 Americans aged 65 and older falling each year. Simply installing a grab bar in a bathtub can decrease that fall hazard by 76%, according to the National Institutes of Health. And, treating hearing loss may lower the risk of dementia, with hearing aids reducing the rate of cognitive decline in older adults at high risk of dementia by almost 50% over a three-year period, NIH reports.

Doubling down on the triple threat

The inevitable reality facing insurers must be addressed to offset the significant cost of long-term care. We should be encouraged by what we are seeing, as insurtech companies are introducing innovative solutions that can revolutionize the insurance industry and fill this gap. These efforts are powered by our social obligation to serve the needs of the growing elderly population, and by the business opportunities they present. The combined force of dynamic solutions and adaptive client service methods can drive the industry successfully into the future.

Financial freedom is worth protecting

RILAs take off as consumers look for balance, protection

Advisor News

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

More Advisor NewsAnnuity News

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

- Crypto meets annuities: what to know about bitcoin-linked FIAs

- Trademark Application for “EMPOWER MY WEALTH” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Conning says insurers’ success in 2026 will depend on ‘strategic adaptation’

- The structural rise of structured products

More Annuity NewsHealth/Employee Benefits News

- Report: 16 Nevada insurance carriers illegally give mental health care claims short shrift

- NABIP looks to reset after CEO’s departure

- RISING EMPLOYER-SPONSORED HEALTH INSURANCE RATES

- New Managed Care Study Findings Have Been Reported by G. Martin Reinhart and Co-Researchers (Psychiatric Medication Prescribing by Nurse Practitioners and Physician Associates for Medicare Beneficiaries): Managed Care

- Data on Managed Care Reported by Researchers at American Dental Association (Early association of expanded Medicare dental benefits to dentist billing in Medicare): Managed Care

More Health/Employee Benefits NewsLife Insurance News