RILAs take off as consumers look for balance, protection

As more Americans retire without the backstop of a pension, the individual annuity market is stepping up to provide the ability to layer on protection and security to an investor’s portfolio.

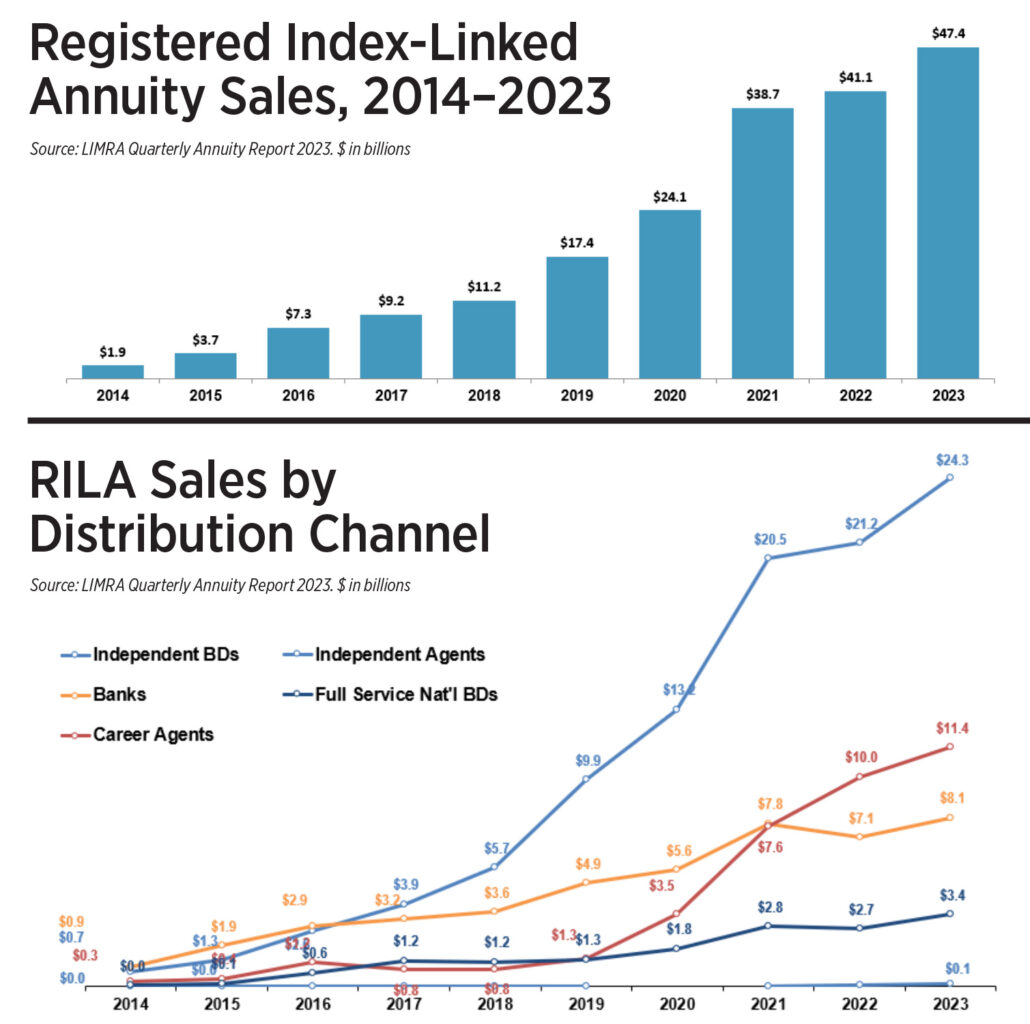

Registered index-linked annuities were first introduced in 2010 following the financial crisis of 2008-2009. However, RILA sales didn’t really take off until more than a decade later. Around the time of the pandemic, fears about an equity downturn motivated investors to take advantage of the product’s unique function of downside protection while simultaneously taking advantage of upside potential.

As a result of the value proposition offered by RILAs, these products have experienced growth for the ninth consecutive year, with sales reaching $47 billion in 2023. The growth in 2023 represents a 15% increase over 2022 and an increase of more than 2,000% from 2014 volumes, with new premium representing roughly 98% of sales and, as of 2022, an average premium of around $160,000.

Product innovation and new market entrants suggest the RILA market still has significant growth potential. For 2024 and 2025, LIMRA is forecasting RILA products to expand on the five consecutive years of record sales. RILA sales are likely to be as high as $52 billion in 2024 and $57 billion in 2025.

When looking at sales by the various channels they are provided in, RILAs continue to be sold typically through the independent broker-dealer, with IBDs accounting for more than 50% of sales in 2023, followed by the career channel, representing roughly 25% of sales.

Currently, most sales (a ratio of roughly 9-to-1) are coming from products without a guaranteed living benefit. However, as more and more carriers enter this space and emphasize sales of products with a guaranteed living benefit, we expect this segment to grow.

When looking at the split between sales of traditional variable annuities and sales of RILAs, an interesting pattern emerges. In the past, traditional VAs accounted for the majority of sales. However, as of fourth-quarter 2023 we have seen a shift where RILAs are now the dominant registered product. This trend continued through the first quarter of 2024, with no changes expected throughout the year. We might even see 2024 as the first year when RILAs outperform traditional VAs at an annualized level.

Moving forward, the RILA market is expected to continue growing, posting record sales year after year. Currently, there are roughly 20 carriers in this space, with the top five companies representing more than 70% of sales (as of first-quarter 2024). With additional carriers entering the market and providing innovation and unique features that appeal to investors, the market will grow for years to come.

Teddy Panaitisor is assistant research director, annuity research, LIMRA and LOMA. Contact him at [email protected].

Protecting clients amid the ‘triple threat’ in LTC services

Should you recommend a CLAT or a reversionary CLAT in wealth planning?

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- Sick of fighting insurers, hospitals offer their own Medicare Advantage plans

- After loss of tax credits, WA sees a drop in insurance coverage

- My Spin: The healthcare election

- COLUMN: Working to lower the cost of care for Kentucky families

- Is cost of health care top election issue?

More Health/Employee Benefits NewsLife Insurance News