Prospecting: Beyond the steak dinner

When a prospect wants to contact Panos Leledakis, they usually encounter his avatar first.

The avatar, also known as “Panos,” is Leledakis’ artificial intelligence clone and chatbot, and appears on his website. The avatar begins a conversation with the prospect to find out what the prospect is seeking. From there, Panos can answer the prospect’s questions and serve up information on what product or service he is trained to sell. That electronic conversation eventually leads to a meeting with Leledakis.

Leledakis is founder of IFAAcademy, based in Miami, and a pioneer in incorporating AI, virtual reality and the metaverse into selling life insurance.

“Imagine being able to serve clients 24/7 with AI-powered chatbots like me that handle inquiries and provide personalized experiences without breaking a sweat,” he told InsuranceNewsNet.

Forget cold calling. Sending out invitations to free dinners? That’s so yesterday. Today, advisors are using technology as well as specialized ways of tapping into their target markets to reach prospects.

Leledakis’ latest move is to put a link to his website inside an near-field communication card and give that card to prospects and clients. “When I give that to people, I say, ‘Whenever you want, call me. If you don’t feel like talking or I’m traveling and you cannot reach me or whatever, take this card and tap it to your phone. My chatbot will come up, and you can speak with it like it’s me.”

“Panos” seems to appear everywhere in Leledakis’ universe. Leledakis is an avid blogger on insurance and technology topics, and he uses his social media channels and website to direct prospects to his blog, where they encounter “Panos” and can ask “him” questions.

“He’s like a sales representative for me,” Leledakis said. “He can start the sales pitch and have a discussion with someone. He’ll ask, ‘Are you interested in something?’ and then when a prospect replies, he can say, ‘We can do a needs analysis’ or whatever the proper response is. He gives me leads so I can follow up with the prospects. He works 24/7, in any language in the world.”

Leledakis invented two software systems for insurance need analysis by implementing the science of risk management, artificial intelligence and extensive neuroscience research on risk perception and decision-making. But although he is known in the insurtech world, he still has strong roots in insurance, with long-time membership in the Million Dollar Round Table and the National Association of Insurance and Financial Advisors.

His target market for insurance is venture capitalists and startup owners, who have a need for key person insurance and related products. A high-tech way of reaching prospects is a natural fit for those who are working to get new businesses off the ground.

Webinars add value

Leleldakis also is developing a content marketing strategy to educate prospects on his services. But one of the biggest ways he has of reaching prospects is through webinars. He began conducting webinars in 2015, but it took the COVID-19 pandemic for webinar prospecting to take off.

“At the beginning of the pandemic, we started to do webinars that had nothing to do with insurance,” he said. “We did a webinar on what to do with your children when they couldn’t go out and do anything because of COVID-19 restrictions. We sent the link to the webinar to our clients and invited them to ask their friends to participate as well. Because the webinar wasn’t about insurance, it was something extra we could bring to add value.”

He promoted the webinar on 100 social media groups and advertised it on Facebook. The result? More than 1,700 participated in the webinar, 1,300 of whom were not current clients. Of those participants, 500 booked an appointment with him, and 95 became clients.

He is active on many social media channels and uses those channels to discuss issues of interest to parents. “I post things that hit their pain points and get them to think about me when they think about insurance.”

Leledakis also uses virtual reality to reach prospects, particularly young adults who he says believe Zoom is outdated.

“You go inside as an avatar, and you can meet people like you’re going to a conference,” he said. “There are avatars all over the place, so you can go and introduce yourself. So I’m finding clients through these horizon worlds and VR worlds.”

Emotional intelligence speaks to prospects

Leledakis may have found the key to prospecting by using a high-tech approach, but Katie Kimball Dyer is reaching prospects through more low-key methods.

Dyer is a financial advisor and financial coach based in Boston. She relies on conversations to make prospects feel comfortable about discussing their financial concerns with her.

“If I put myself out there as a financial advisor or planner, people hear those words and they think, ‘That’s not for me. That’s for someone wealthier than I am or in a different world than mine,’” she said. “People don’t realize that I can help everybody. And those are the people I want to work with — everyday people and business owners.

“So one of the things I do is approach people with the message ‘I’m here for you. The reason I’m an independent advisor is because I represent you to this larger financial world.’ But part of that conversation is understanding people’s feelings and acknowledging how this could all feel. I have started getting younger clients by having that conversation.”

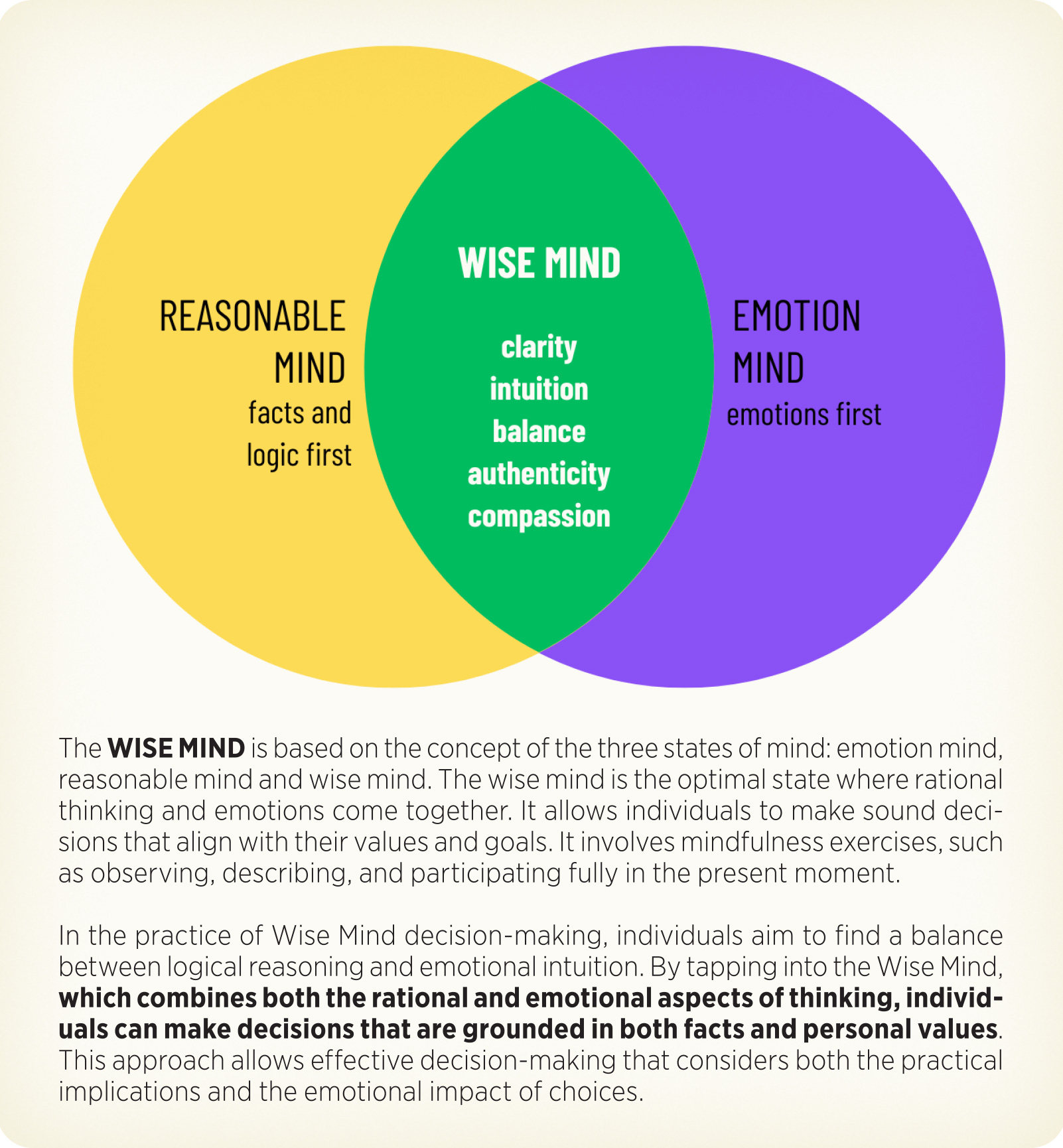

Dyer said she bases many of her prospect conversations on the concept of “the wise mind.”

“It’s a psychological term,” she explained. “It’s when you take the most perfectly logical option and the most perfectly emotional option, and you combine them for a middle ground solution. And that’s how I treat people’s financial planning, because I don’t think feelings should be a secondary conversation when dealing with money. I think people’s feelings govern a lot. I don’t think they should govern the whole decision, but I do think that they play such a bigger role in how people act with their money and make decisions with their money that it should just be part of the initial conversation.”

Dyer said she has been successful prospecting in local groups and small groups, both virtually and in person.

“I’m part of a local women’s network of business owners for my community, and they have time at the end of the meeting where you can come up to the mic after the main presentation and talk about what you do,” she said. “I serve a lot of LGBTQ+ business owners, and I attend their events as well.”

She also has been successful prospecting among virtual communities where her core prospects gather.

But guiding people through their emotions to help them take action on their finances is at the heart of Dyer’s prospecting techniques.

“I believe emotions are a valid part of this conversation,” she said, “and when I build a recommendation for somebody, I ask them, ‘How do you feel about what I just presented to you?’ Because I could write the greatest numbers plan in the whole world, but if they feel uncomfortable for some reason, they’re not going to follow it.”

Anxious parents make good prospects

When Brock Jolly started his career in the early 2000s, he used cold calling to prospect for long-term care insurance clients. A few years later, after he moved out of the LTCi space, Jolly found a niche in the college planning market. And prospecting in that market needed a different technique than what he had used in the past.

Jolly is managing partner at Veritas Financial and founder of The College Funding Coach, based in Tysons, Va.

Like many advisors who want to share their expertise and find clients, Jolly took the free-steak-dinner route to reach anxious parents who wanted information on how to pay for their children’s college education.

“What I found was you had a lot of people who willingly came to get a great steak dinner and a glass of wine at some of Northern Virginia’s best steak houses, and then somehow disappeared when it was time to actually meet and talk about financial planning,” he said. “I spent an awful lot of money on those types of seminars and didn’t get the results.”

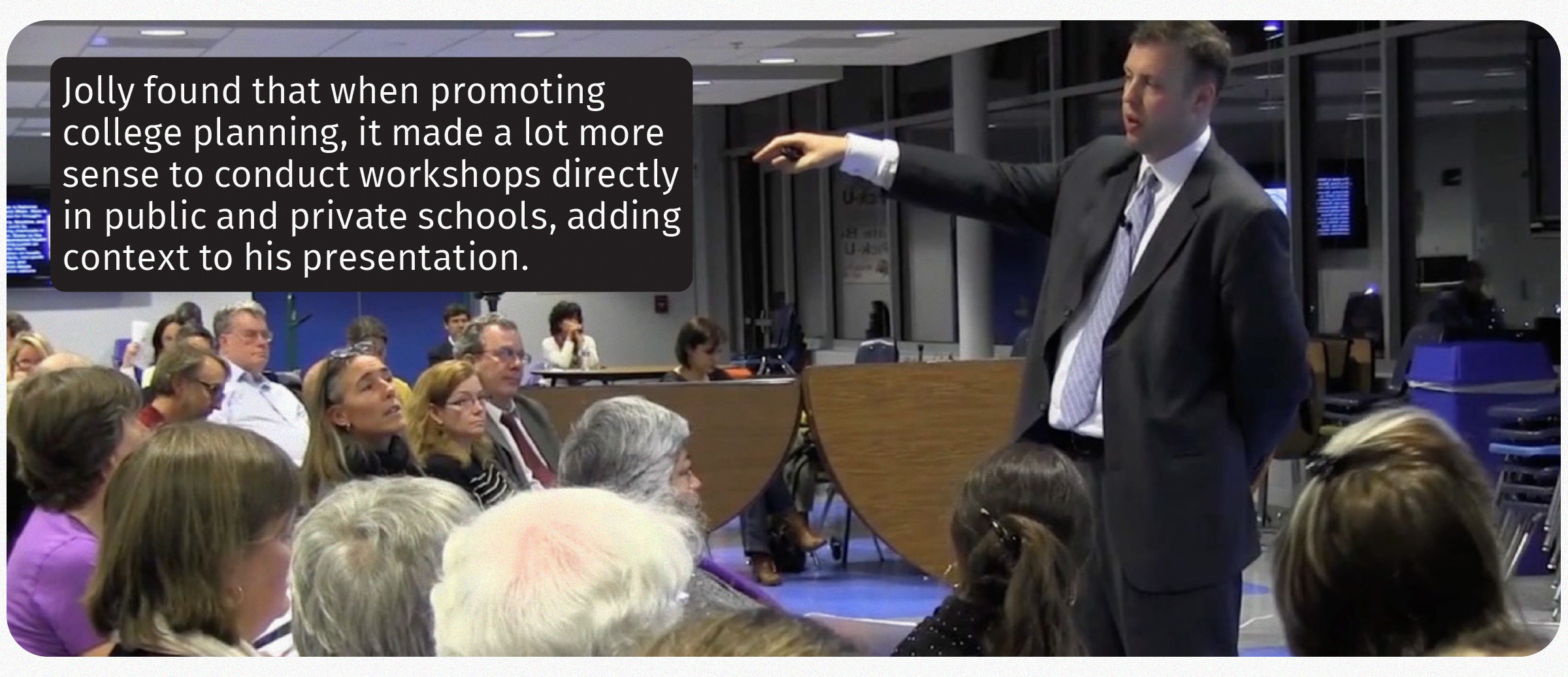

As he worked in the college funding market, Jolly discovered two things about prospecting.

“No. 1, there’s a sense of urgency. Parents are a little panicked about how they’re going to pay for their kids’ college education and still be able to retire,” he said. “No. 2, although we do a lot of seminars, we found that our bread and butter was being able to go directly to public and private schools — elementary schools, middle schools, high schools, even preschools — to conduct workshops about college funding, and we leverage these organizations to promote our workshops.”

Jolly said the schools where he conducts the workshop will promote the event, sending information home with students or doing email blasts to parents.

“The schools get the word out, and then we do our workshop,” he said. “We have a whole workflow built out before and after the workshops to be able to drip-market to these parents and give them valuable tools on how we can be a trusted resource for families when it comes to thinking about how they’ll save and plan and pay for college, and how that fits into the broader context of their overall financial plan.”

The attendance at Jolly’s workshops averages around 100. He compared that with the attendance at a steak-dinner seminar.

“I could get maybe 30 or 40 people to come, and I would pay for their steak dinner and their glass of wine and all of that, and it might cost me $10,000. Now I’m getting 100 households coming to a workshop, and I essentially haven’t paid a dime to get them there.”

The school-based workshops do more than bring parents out to gather in the local auditorium or gym. They convert these anxious parents into clients.

Jolly said that 68% of the households that attend his school workshop express interest in a follow-up appointment, and 38% end up doing some type of business with an advisor in his firm.

“They might engage with us to create a fee-based financial plan. Or it could be that they put money into a 529 plan each month, or it could be that they have a rollover that they want to invest.

“My point is that now you have a client. And whether they do six things with you on Day 1 or they do one thing with you, you have a reason to talk to them.”

Jolly’s college funding practice attracts prospects to the other aspects of his practice the old-fashioned way — through word of mouth.

“Over the years, some of my better clients became business owners, entrepreneurs and executives, so I homed in on how I can have repeat clients who look like this,” he said. “I’ve developed the ability to provide service and value to these types of clients. And interestingly, we do a lot of events with these types of clients where we invite them to bring someone who they think might benefit from the work we do, and then we follow up with them.”

Jolly’s advice to those who are looking for a new way of prospecting is “find a repeatable system for prospecting, where you almost don’t have to think about it.

“Find a system that allows you to focus on the more important thing, which is sitting in front of someone and discussing the strategies, techniques and tools that make sense and are appropriate,” he said.

Jolly cited Ron Carson, founder of Carson Group, who uses the term “passion prospecting.”

“It’s doing work, having fun and using that as a way to leverage relationships and meet people who are good prospects,” Jolly said.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Is the ‘Age Wave’ a retirement tsunami? — With Ken Dychtwald

Get friends to do business: 2 distinct approaches

Advisor News

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

More Advisor NewsAnnuity News

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Reliance Standard Life Insurance Company Trademark Application for “RELIANCEMATRIX” Filed: Reliance Standard Life Insurance Company

- Jackson Awards $730,000 in Grants to Nonprofits Across Lansing, Nashville and Chicago

- AM Best Affirms Credit Ratings of Lonpac Insurance Bhd

- Reinsurance Group of America Names Ryan Krueger Senior Vice President, Investor Relations

- iA Financial Group Partners with Empathy to Deliver Comprehensive Bereavement Support to Canadians

More Life Insurance News