Now really is the time to invest in online ecosystems

It’s no secret that the COVID-19 pandemic brought immense changes to all Americans’ lives. For many, one of those changes was a heightened awareness of the need to protect their families against unforeseen circumstances. This significantly increased their intent to purchase life insurance.

This heightened awareness of life insurance — and how it can provide financial security for families — did translate into increased sales in 2022. According to the 2023 Insurance Barometer study, conducted by LIMRA and Life Happens, slightly more than half (52%) of American adults say they own some form of life insurance coverage (individual, employer sponsored, etc.). This is up from 50% in the 2022 Insurance Barometer study.

As we move into what I’m tentatively calling the “post-pandemic” world, what now? What are some of the lasting effects the pandemic will have on our industry and how advisors work?

I am not in the business of predictive sales models, but I am in the business of measuring consumer attitudes and behaviors — specifically concerning all things life insurance.

There are two seismic shifts occurring that will have a profound effect on the way we do business:

» Millennial and Generation Z consumers who grew up with access to the internet are at or approaching the ideal age to seriously think about individual life insurance policies.

» The pandemic forced almost all of us into online consumerism and transactions.

Every company has a website, and many have a social media presence. But is it enough?

Historically, the majority of Americans have preferred to purchase life insurance in person with an agent or advisor. As the use of technology has become nearly ubiquitous and people have grown accustomed to conducting meetings and transactions online, this trend has shifted. In 2011, 64% of consumers said they preferred to buy in person; by 2020, only 41% felt this way.

In 2022, that number dropped to 33%.

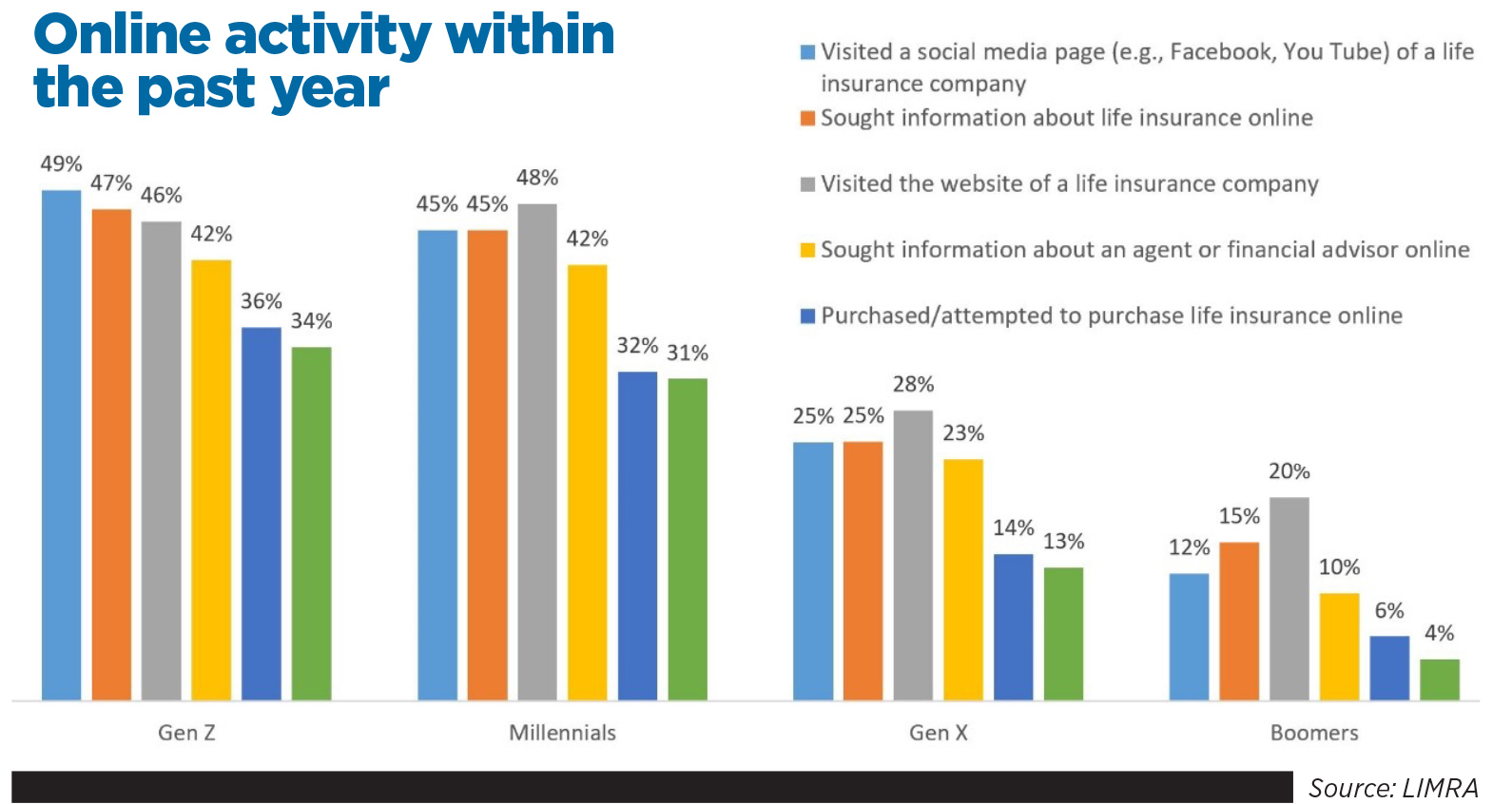

Conversely, the idea of shopping and purchasing entirely online has gained in popularity every year — exacerbated by the pandemic. When we look at the generational differences, this shift becomes more pronounced. When the 8,185 Barometer study respondents were asked how the internet would factor into their buying process, only 5% of those under 40 said it would not have an impact at all.

It’s important to note that of those who indicated they had sought information about, purchased or attempted to purchase life insurance online, more than 60% said that they used a comparison tool such as SelectQuote or AccuQuote to better understand what they were shopping for.

As you can see, younger generations rely on the internet for information gathering and shopping.

Participating in online meetings via video software and apps has become part of their daily lives.

Just as with other industries, financial services companies and financial professionals must make a concerted effort to become more accessible online.

Consumers most often mentioned the need for life insurers to be “more personable” online.

Although “easier navigation” and “better comparison charts” are necessary, features such as live chat with knowledgeable staff and “policy quotes with clear explanations” speak to the expectation that online shopping and sales will replace face-to-face meetings in the future.

None of this should come as a shock to the life insurance industry or financial professionals. But it should spur discussion and potential investment for many. This shift is happening faster than many of us could have anticipated. It is safe to say that not keeping up with online technology may result in missed opportunities and sales.

Consumers routinely purchase houses, cars and fresh vegetables online. Many doctor’s visits now occur online. Why should buying life insurance be any different?

As part of LIMRA’s Markets Research team, Steve Wood is responsible for providing analyses and insights for some of the industry’s most compelling reporting. You can contact him at [email protected].

Disability income insurance in a gig economy

Life insurance companies ready for analysts to pick apart Q1 earnings

Advisor News

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

- Most Americans surveyed cut or stopped retirement savings due to the current economy

More Advisor NewsAnnuity News

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

- Suitability standards for life and annuities: Not as uniform as they appear

- What will 2026 bring to the life/annuity markets?

More Annuity NewsHealth/Employee Benefits News

- Ga. Dems criticize Senate challengers for end of insurance subsidies

- Open Forum: Is that the way the ball bounces?

- Democrats criticize Georgia US Senate challengers for end of health insurance subsidies

- ICE is using Medicaid data to determine where immigrants live

- Column: Universal Health Insurance Could Cure Most Of What Ails This Nation’s System Today

More Health/Employee Benefits NewsLife Insurance News