NAIC survey: 88% of insurers are using AI or machine learning

A recent survey of auto insurers found that 88% of insurers currently use, plan to use or plan to explore using artificial intelligence or machine learning as part of their everyday operations.

The National Association of Insurance Commissioners published the report by the Big Data and Artificial Intelligence Working Group. It is part of a wide-ranging effort on the part of several NAIC groups to get a better grasp on artificial intelligence and big data usage in insurance.

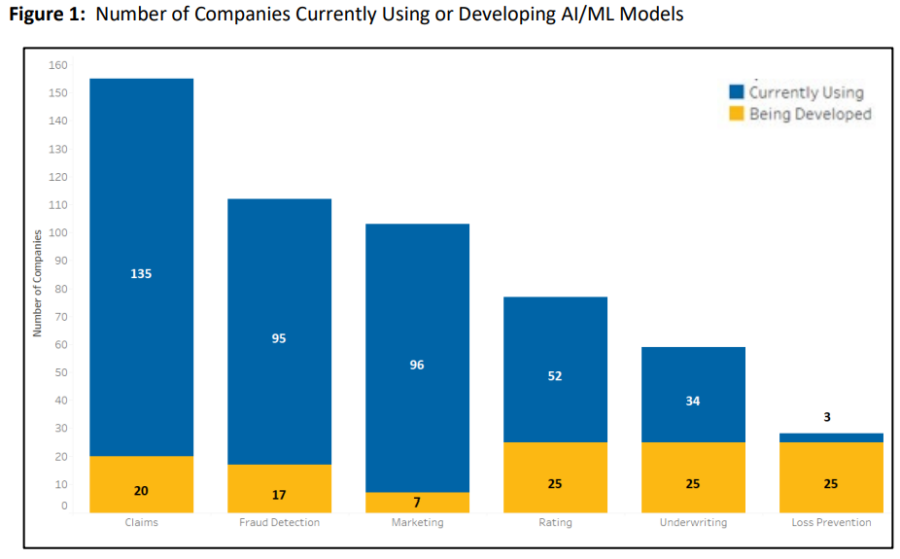

The 193 respondents to the Private Passenger Auto Artificial Intelligence/Machine Learning Survey say they are staying away from the controversial uses of AI and data tracking. Most respondents said they are using AI/ML in claims, followed by marketing and fraud detection, and only a minority using it for underwriting, rating and loss prevention.

The PPA survey was conducted under market conduct examination authority of nine states: Connecticut, Illinois, Iowa, Louisiana, Nevada, North Dakota, Pennsylvania, Rhode Island, and Wisconsin. The survey was limited to only larger companies, defined as those PPA writers with more than $75 million in 2020 direct premium written.

Settling on a definition

NAIC regulators have placed a greater emphasis on AI, big data and related technology in recent years. Several states have adopted laws as well. The concern is that technology will create automated processes that discriminate, even inadvertently, against consumers based on race, religion, sex or other factors.

Legislators in several states, Colorado and California, for example, have acted to rein in use of AI and big data through new laws. Insurers prefer uniform laws so they don't have to comply with different requirements in different states. But it might already be too late for the NAIC to create a uniform model of standards.

According to research firm IDC, the use of AI solutions in the insurance market will grow 32 percent by 2026. Global spending on AI will more than double by then to over $300 billion, the firm predicted.

According to the survey, claims is the most popular application of AI and ML. Out of 193 reporting companies, 135 reported using AI/ML for claims operations, and 20 reported having

models under construction.

"Companies reported currently using AI/ML claims models mostly as an informational resource for adjusters (96 companies)," the survey reads. "Few companies are using AI/ML claims models for claims approvals (9) and none are using them for claims denials. Other AI/ML claims models are currently used to determine claim settlement amounts (50), to make claim assignment decisions (58), to evaluate images of loss (55), and for other claim-related functions (66)."

Here is a full breakdown of AL/ML uses as reported by respondents:

Five objectives

Regulators laid out five key objectives for the survey. They are:

1. To learn directly from the industry about what is happening in this space.

2. To get a sense of the current level of risk and exposure and whether or how the industry is managing or mitigating that risk.

3. To develop information for trending, such as how the risk is evolving over time, and the industry’s responsive actions.

4. To inform a meaningful and useful regulatory approach, framework, and/or strategy for overseeing and monitor in this activity,

5. To learn from prior surveys to inform and improve future surveys.

The Big Data and Artificial Intelligence Working Group meets March 22 at the NAIC Spring Meeting in Louisville. Discussion of AL/ML surveys is on the agenda.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Is the Silicon Valley Bank failure 2008 all over again?

Louisiana Insurance Commissioner Jim Donelon ends re-election campaign

Advisor News

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

More Advisor NewsAnnuity News

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News