LIMRA/SOA study: Fixed-rate deferred annuitants are not surrendering early

Insurance companies generally prefer that annuity contract holders do not surrender their contracts.

While a surrender charge penalty would apply, and some of those who surrender an annuity are doing so to buy another annuity, insurers prefer the stability of a long-term contract holder.

A new study by the Society of Actuaries and LIMRA found that most fixed-rate deferred annuity owners are at least waiting until their surrender charge period is up before surrendering. The two organizations jointly studied fixed-rate deferred annuity surrenders covering 2015 through 2022.

Dale Hall, managing director of research for the SOA, shared the data with insurance regulators Sunday during the National Association of Insurance Commissioners' summer meeting in Chicago. Hall presented to the Life Actuarial Task Force.

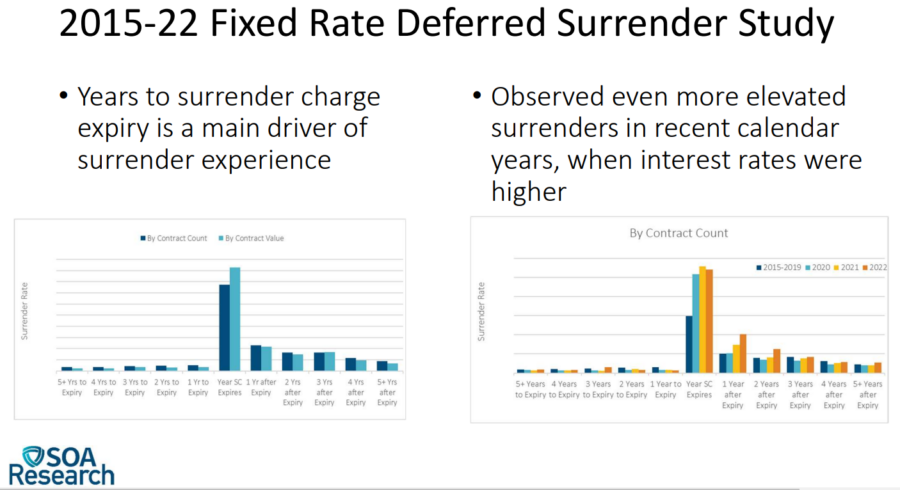

"In the previous studies, I think you'd see higher levels of contract surrenders even two years to expiry, one year to expiry of the surrender charge," Hall explained. "It seems like more and more of that focus is now in the year the surrender charge. ... Maybe it's more information or guidance, or policyholders just more apt to hold on to the contract to the full time when there's a much lower if no surrender charge."

Advisors often counsel patience to avoid a surrender situation.

Surrender rates by both contract count and contract value peaked in the year the surrender charge expired, at a rate of 38.6% by contract count and 46.3% by contract value, the study found. After that year, surrender rates remained elevated since there continued to be no surrender charge in the successive years.

Twenty-three companies contributed data to the current study, encompassing approximately 45% of fixed-rate deferred annuity market share during 2015-2022, SOA said. The study contains about 13.4 million contract count exposed, $1 trillion in contract value and more than 900,000 surrenders.

Higher surrender rates

Surrender rates in 2020, 2021 and 2022 were "significantly higher" in the year the surrender charge expired compared to surrender rates in 2015-2019, SOA reported. Surrender rates by contract count in the year the surrender charge expired were 51.7% for 2020, 55.7% for 2021, 54% for 2022 and 29.7% for 2015-2019; surrender rates by contract value in the year the surrender charge expired were 62.8% for 2020, 66.5% for 2021, 66% for 2022 and 33.7% for 2015-2019.

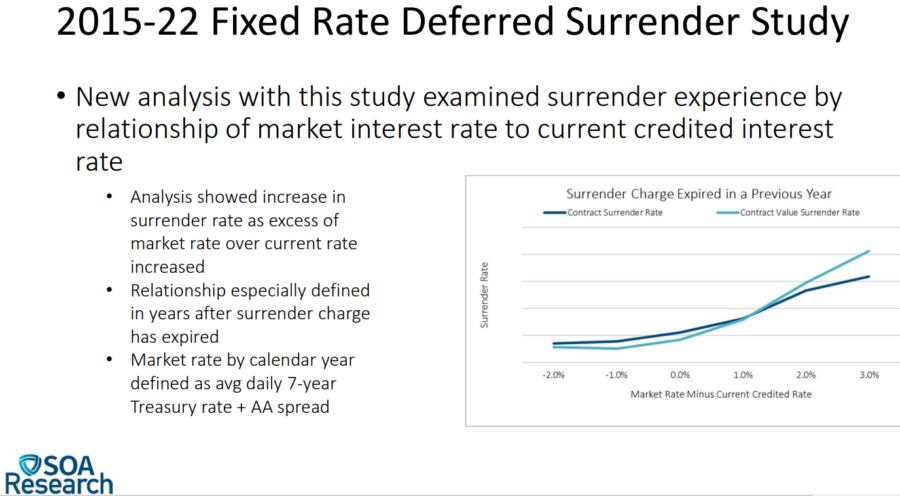

"Surrenders became much a little bit more prominent, relatively, in the more recent environment, obviously driven a lot by strong movements in interest rates and strong opportunities, perhaps for higher accredited rates coming out of that in those particular environments," Hall said.

Some additional highlights from the LIMRA/SOA study of surrenders:

• There was more nonqualified experience in the study, with 57.6% of contracts, compared to

traditional and Roth IRA experience.

• Females represented a larger percentage of the study in force than males in all market types

(traditional IRA, nonqualified, and Roth IRA), with females making up between 54-57% of

contracts depending on market type.

• The career agent distribution channel dominated the FRDA market for traditional IRA and Roth IRA market types, with 38.8% and 72.3% of contracts, respectively. The bank/savings and loan distribution channel had the largest percentage of contracts in the nonqualified market type, with 23.7% of contracts.

• The surrender rates by both contract count and contract value were relatively stable across

attained age groups 60-64 and older. The surrender rates for attained ages under 60 were the

lowest of all attained age groups.

• Surrender rates by individual contract year show "shocks" in the surrender rates in contract years 4, 6, 8 and 11, which correspond with common surrender charge periods of 3, 5, 7 and 10 years.

• When examined by grouped calendar years of study experience, calendar year group 2015-2017 experienced much lower surrender rates overall compared to the experience for calendar year group 2018-2022. The highest "shock" surrender rate occurred in contract year 6 for calendar year group 2018-2022, with surrender rate by contract count of 33.4% and surrender rate by contract value of 40.3%. In comparison, the surrender rate for calendar year group 2015-2017 in contract year 6 was 10.2% by contract count and 10.6% by contract value.

• When examined by individual contract year and surrender charge expiry timing, contract year 6 had the highest surrender rate by far for contracts in the year the surrender charge expired, at 59.1% by contract count and 68.7% by contract value.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

California to fast track rate review process in bid to improve insurance crisis

STLDI plans banned in Illinois: What advisors must know

Advisor News

- Study asks if annuities help financial advisors build client relationships

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

- Making the most of Financial Literacy Month

More Advisor NewsAnnuity News

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

More Annuity NewsHealth/Employee Benefits News

- More cancer coverage for firefighters clears hurdle

- AG files suit against Syracuse claiming misappropriated funds

- Legislation for more cancer coverage for firefighters clears the Iowa Senate

- Gentry Mountain Mining Under Fire Due to Recent Allegations

- Rural Hospitals Question Whether They Can Afford Medicare Advantage Contracts

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- Jackson Announces New President and Chief Risk Officer

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

- AM Best Revises Issuer Credit Rating Outlook to Stable for Life Insurance Company of Alabama

More Life Insurance News