Variable Annuities: Winning By Not Surrendering

After all the analysis is done on rates, fees and performance, there is really one key metric that means more than the others – patience.

Great returns don’t mean much if investors motivated by emotion or misplaced confidence in their market timing skills jump in and out of funds. When investors jump, those small gaps widen to large gulfs between what they accumulate and what they could have amassed for retirement.

Advisors have been telling clients that for decades, but now new research can show how that is particularly true when investors use variable annuities. That data comes from an annual survey conducted by the marketing research firm, Dalbar, which has conducted the study for 27 years.

The average variable annuity fixed income subaccount investor outperformed the average fixed income mutual fund Investor by 291 bps in 2020, according to DALBAR’s Quantitative Analysis of Investor Behavior report. Fixed income subaccount investors earned an average of 6% in 2020, nearly doubling the average return of 3.09% for mutual fund investors.

A major factor in that difference was the large number of jumpers during the equity market crash in March 2020, said Cory Clark, Dalbar chief marketing officer, during a webinar discussing the report. (The latest survey was conducted with 1,000 investors in August 2020.)

“We start with a huge investor gap for the year, where the Bloomberg Barclays aggregate bond index earns a little over 7½%, but the average fixed income investor earned only a little over 3%,” Clark said, attributing the difference to jumpy investors. “But if we look at the average fixed income sub account investor, we didn't see the same panic. And consequently, we saw a 291 basis point difference between the average fixed income sub account investor and the average fixed income investor."

Investors who jumped during the plummet missed the big bounce back up to record territory, fulfilling the maxim that investors who time the market miss the best times in the market.

“For us in the industry, we know the effects of investor behavior are profound,” Clark said. “If we were to look at the four main factors of performance, I think in broad strokes, we would have in fees, the behavior, investment selection, and asset allocation. Behavior is by far the most important element.”

So, are the investments particularly good in VA subaccounts? It turns out that the differences in performance matter less than the investors’ patience in staying in their investments, which is what variable annuities are designed to do.

“When we measured their retention rates, subaccount owners stayed invested in their investments for 21% longer than the average investor did,” Clark said. “And that's looking at the past 21 years.”

Investors might complain about surrender fees, but if they don’t surrender, they win-win. Not only are investors not paying the penalty to drop the VA, but they are also benefitting from the constant compounding effect.

Another crucial element with variable annuities is the cushion on the downside when they come with guarantees. This removes the fear of loss, which research shows is more powerful than the allure of gains. It is that fear of loss that pushes investors to jump out of their investments at the worst times -- known as catching a falling knife.

Dalbar’s research showed that investors were willing to accept slightly lower returns in trade for relative safety from loss.

Here is some of what the surveys have found over the years:

➢ The gap between the retention rate of the average equity subaccount investor and average equity mutual fund investor widened from 0.95 years (5.45 years vs. 4.50 years) in 2019 to 1.04 years (4.55 years vs. 3.51 years) in 2020.

➢ The gap between the 20-year average retention rate of the average equity subaccount and mutual fund investor widened from 0.78 years in 2019 to 0.79 years in 2020.

➢ The average equity subaccount investor continued to be a net withdrawer of equity assets in 2020, liquidating slightly less equity assets throughout the year in 2020 than they did in 2019 (8.52% of assets in 2019 vs. 8.07% of assets in 2020).

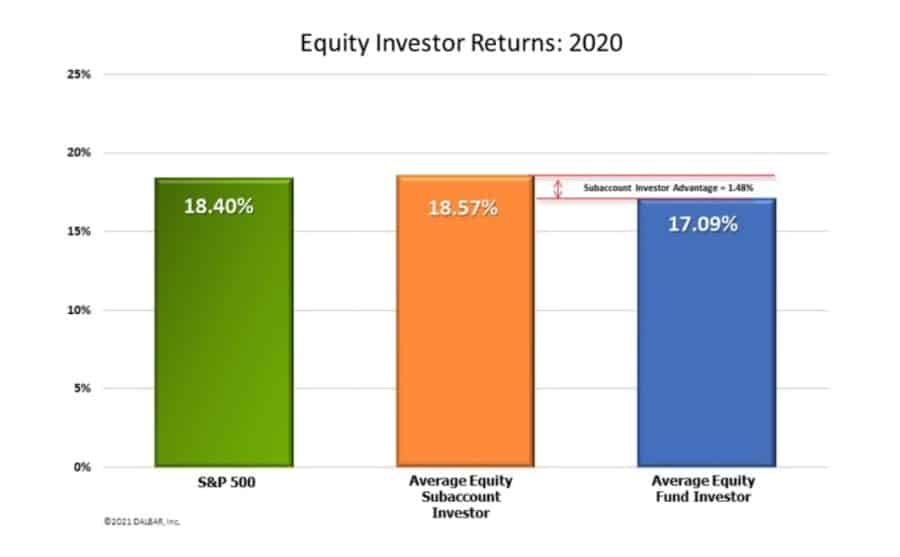

➢ The average equity subaccount investor outperformed the average equity mutual fund investor by 148 bps in 2020. The average equity subaccount investor earned 18.57% in 2020 versus an average return of 17.09% for the mutual fund investor.

➢ The average equity subaccount Investor continued to outperform the average equity mutual fund investor on an annualized basis for 1, 3, 5, 10 and 20-year timeframes.

➢ The gap between the retention rate of the average fixed income subaccount investor and average fixed income mutual fund investor narrowed from 1.48 years (5.08 years vs. 3.60 years) in 2019 to 0.87 years (3.99 years vs. 3.12 years) in 2020.

➢ The gap between the average retention rate of the average fixed income subaccount and mutual fund investor since 2000 is 0.83 years or 303 days.

Joe Jordan, the founder of the National Association of Variable Annuities, forerunner of the Insured Retirement Institute, attended the webinar and said the Dalbar research demonstrates what he said was the fallacy of comparing different products on fees alone.

“The design of the VA with a income account that grows regardless of market activity and the fact people were buying future income created a behavioral change to not panic,” Jordan said. “The result was better performance.”

Jordan said one of the important findings was that clients said they would tolerate a lower return if it helped to offset substantial declines, which is supported by behavioral economic research that shows people often do not make rational choices in the heat of the moment when it comes to money.

“It’s been a long road silencing the critics,” Jordan said. “This should silence Suze Orman, Dave Ramsey and Ken Fisher.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Digital Acceleration Will Drive The Customer Experience: LIMRA Panel

Greater Interest In Employee Benefits The ‘Silver Lining’ Of COVID-19

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsHealth/Employee Benefits News

- Providers fear illness uptick

- JAN. 30, 2026: NATIONAL ADVOCACY UPDATE

- Advocates for elderly target utility, insurance costs

- National Health Insurance Service Ilsan Hospital Describes Findings in Gastric Cancer (Incidence and risk factors for symptomatic gallstone disease after gastrectomy for gastric cancer: a nationwide population-based study): Oncology – Gastric Cancer

- Reports from Stanford University School of Medicine Highlight Recent Findings in Mental Health Diseases and Conditions (PERSPECTIVE: Self-Funded Group Health Plans: A Public Mental Health Threat to Employees?): Mental Health Diseases and Conditions

More Health/Employee Benefits NewsLife Insurance News

- AM Best Affirms Credit Ratings of Etiqa General Insurance Berhad

- Life insurance application activity hits record growth in 2025, MIB reports

- AM Best Revises Outlooks to Positive for Well Link Life Insurance Company Limited

- Investors holding $130M in PHL benefits slam liquidation, seek to intervene

- Elevance making difficult decisions amid healthcare minefield

More Life Insurance NewsProperty and Casualty News

- CCC Intelligent Solutions Appoints Chief Product Officer to Scale AI-Driven Innovation Across the Industry

- Winter Storm Fern signals a new reality for home insurance

- AM Best Affirms Credit Ratings of Virginia Surety Seguros de México, S.A. de C.V.

- Colorado lawmakers roll out bipartisan plan aimed at lowering home insurance risk

- The case for smarter risk management

More Property and Casualty News