LIMRA: Record number of Americans plan to purchase life insurance

The life insurance story in the United States is some good news offset by a little bit of bad news.

First, the bad news: Just 52% of U.S. adults report having life insurance, down from 63% in 2011, LIMRA reported. On the plus side, a record-high number of Americans (39%) say they plan to purchase life insurance this year.

There was more good news than bad, according to new LIMRA data.

“The industry experienced broad growth with 6 in 10 carriers reporting increases in premium. Of the top 10 carriers, eight reported, on average, 15% growth,” said Karen Terry, assistant vice president, head of LIMRA Product Research. “This quarter whole life, term and variable universal life experienced the highest premium growth rates, driving the overall positive results in premium. We believe sales will continue to improve in the second half of the year spurred by the stronger economic conditions.”

An opinion survey earlier this year revealed that Americans place a high value on life insurance.

Life insurance premium up

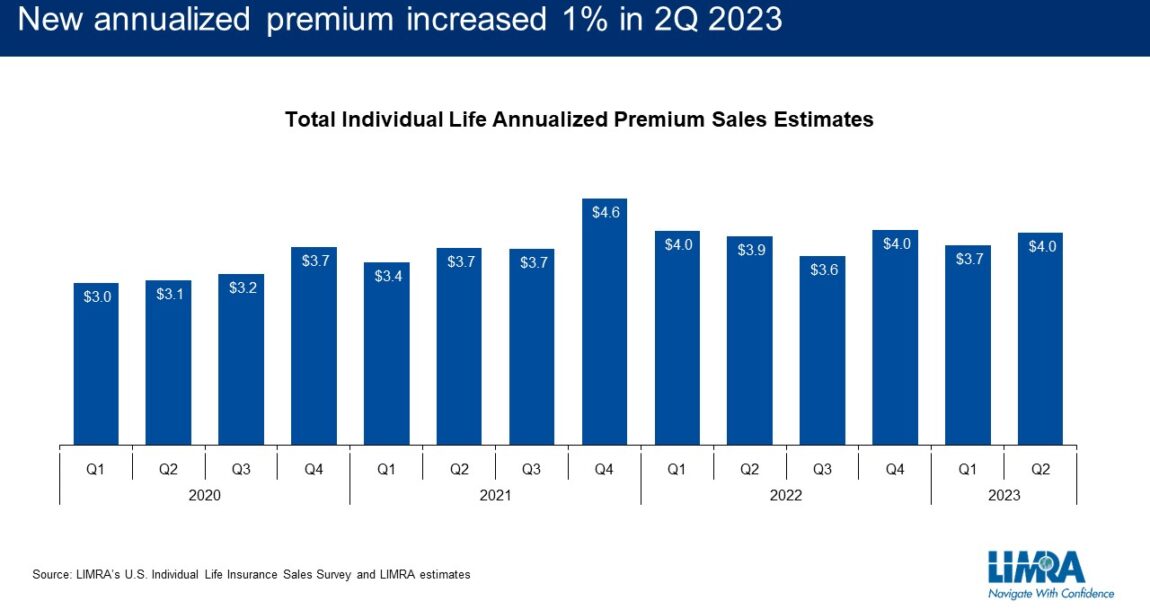

Total U.S. life insurance new annualized premium was $4 billion in the second quarter 2023, a 1% increase, according to final results from LIMRA’s Second Quarter U.S. Retail Individual Life Insurance Sales survey.

For the first half of the year, new annualized premium was $7.7 billion, 3% below the same period in 2022.

For the second consecutive quarter, policy sales increased. In the second quarter total policy sales rose 3%, due largely to indexed universal life products. Year-to-date, policy sales increased 4% over the same period in 2022.

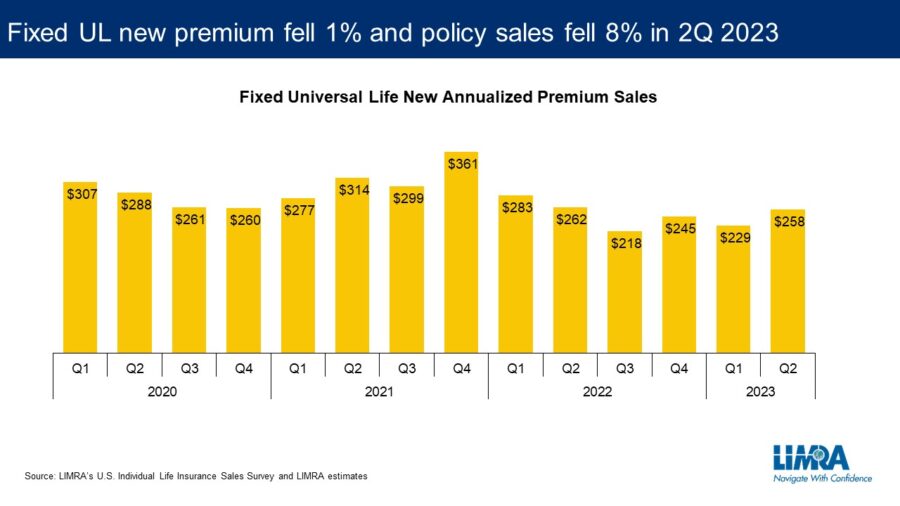

Indexed universal life was equally a mixed bag of sales results. New premium fell in the second quarter, but total policies sold skyrocketed. Fixed universal life sales on the other hand were down in both categories.

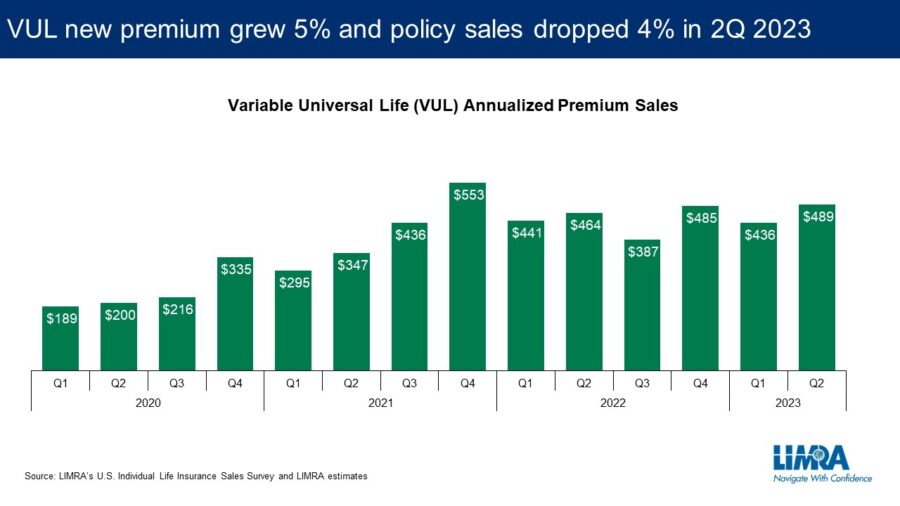

Variable universal life sales were also down to just a 12% share of the market in the second quarter. Year to date, VUL policy counts are down 9%.

Like many other lines, the number of Americans with term insurance policies has declined over the past two decades. But the face value is on the rise. In the second quarter, both term premium and policy sales rose.

It was the best quarter for term insurance in two years.

LIMRA reported a similarly positive story with whole life insurance sales. Whole life continues to hold the largest share of the market at 39%.

LIMRA’s Retail Individual Life Insurance Sales Survey represents 83% of the U.S. life insurance market.

Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Don’t let life insurance be the pumpkin spice of client financial planning!

John Hancock steps up redefining life insurance with ‘Longevity Symposium’

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- Researchers at Eli Lilly and Company Target Migraine [The Role of Income and Health Insurance on Migraine Care: Results of the OVERCOME (US) Study]: Primary Headache Diseases and Conditions – Migraine

- Access Health CT Adds Special Enrollment Period For New State Subsidy

- Trademark Application for “EVERY DAY, A DAY TO DO RIGHT” Filed by Hartford Fire Insurance Company: Hartford Fire Insurance Company

- Researchers at City University of New York (CUNY) Target Mental Health Diseases and Conditions (Impact of Medicaid Institution for Mental Diseases exclusion on serious mental illness outcomes): Mental Health Diseases and Conditions

- Reports Outline Health and Medicine Findings from Jameela Hyland and Colleagues (Embedding Racial Equity in a Health Access Campaign in New York City: The Importance of Tailored Engagement): Health and Medicine

More Health/Employee Benefits NewsLife Insurance News