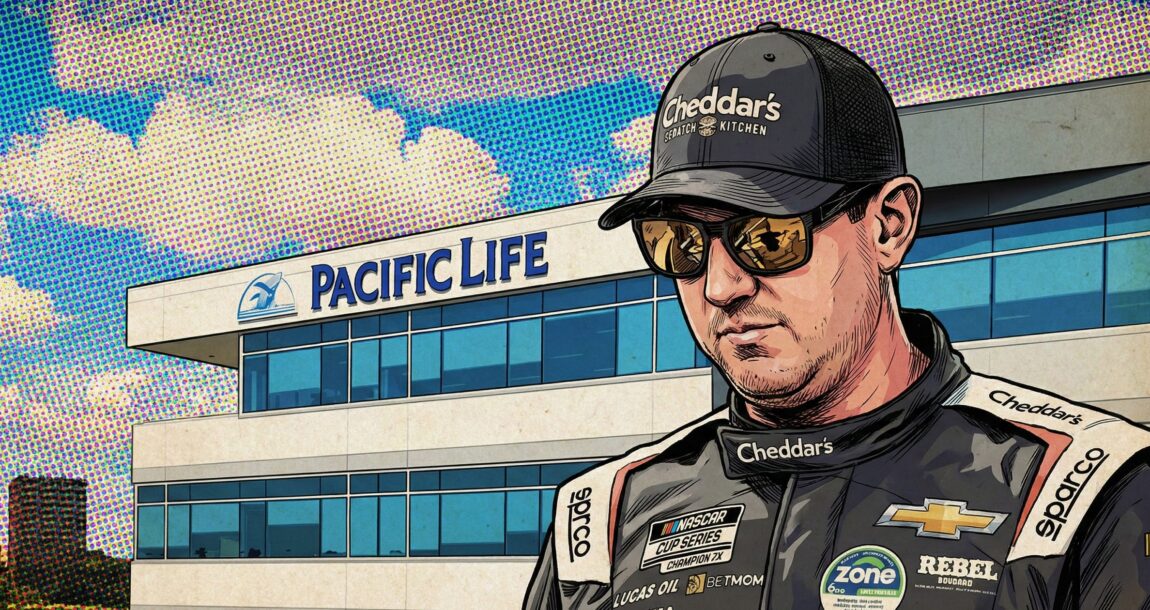

‘Baseless claims’: PacLife hits back at Kyle Busch in motion to dismiss suit

Pacific Life Insurance Co. responded Thursday to racing superstar Kyle Busch’s indexed universal life lawsuit, filing more than 1,000 pages worth of exhibits in a motion to dismiss.

PacLife cited failure to state a claim, a common defense from insurers who maintain no wrongdoing. Busch, who initially filed the lawsuit in North Carolina state court in October, was well-represented and should have known what he agreed to, PacLife attorneys wrote.

Kyle Busch and his wife, Samantha, signed policy illustrations indicating they intended to pay planned premiums and hold the policies over 30 years, the insurer said. Instead, the couple bailed out on the plan and surrendered the policies before their growth potential could be realized, a memorandum accompanying the motion reads.

“Rather than accept responsibility for their own decisions, Plaintiffs now attempt to blame their negative outcome on the IUL product – a product approved by insurance regulators in every state – and purported oral promises that are directly contradicted by express written disclosures they acknowledged and signed,” the memo states.

The Busches' lawsuit was quickly moved to federal court in the Western District of North Carolina. Plaintiffs filed an amended complaint two weeks ago.

According to the filing, the defendants used misleading illustrations, undisclosed costs, and false promises of guaranteed multipliers and controllable charges to induce Kyle and Samantha to pay more than $10.4 million in premiums, resulting in net out-of-pocket losses exceeding $8.58 million.

PacLife's motion relies on a "familiar defense playbook" for these cases, said Robert G. Rikard of RP Legal, attorney for the Busches, and does not address the substance of the allegations. He accused the insurer of relying on the "fine print defense," a reference to boilerplate disclaimer language found in life insurance contracts.

"The amended complaint alleges that Pacific Life went far beyond the role of a passive insurer and actively participated in the design, approval, marketing, and internal replacement of these policies," Rikard said. "Those allegations are supported by specific communications from Pacific Life employees, internal design approvals, and carrier-level decisions that directly affected policy structure, compensation, and performance."

Death benefit defended

The amended complaint adds extensive allegations regarding the policy design choices used in the replacement, particularly the use of 100% base coverage with no renewable term and an increasing death benefit.

The filing alleges that these design decisions materially increased target premium, early policy charges, and compensation, while offering no corresponding accumulation or survivability benefit to the policyholder.

In its memo, PacLife called this "a puzzling claim."

"High-face amount policies, however, with large up-front premiums in early years and a reduced death benefit in later years may be particularly appropriate for individuals (such as professional athletes) who may have a limited window of high income years and select a flexible product like an IUL policy to meet their needs," the memo says.

The complaint accuses PacLife and its appointed agent, Rodney Smith, of designing and promoting a series of complex IUL policies as "tax-free retirement plans" that were misrepresented as safe, self-funding investment vehicles.

Kyle Busch was assured that by contributing a million dollars annually for five years, he could withdraw $800,000 per year starting at age 52, he said in a news release. Instead, Busch discovered his funds were being directed to the insurance company's account rather than being invested in the market, preventing his investment from growing as markets rose.

Early in its memo, PacLife sought to distance itself from Smith.

“Plaintiffs agreed that they and their producer, not Pacific Life, were 'responsible for ensuring that the policy meets [their] insurance needs and financial objectives,'" the memo states.

'Their own team'

In their public media blitz accompanying the lawsuit, the Busches painted the IUL strategy as a "trap" during interviews and statements.

"We trusted the people who sold them and the name Pacific Life," Kyle Busch said in a new release. "But the reality is far different. What was pitched as retirement income turned out to be a financial trap."

PacLife specifically countered that claim in its memo, describing the couple as “[s]urrounded by their own team of financial and legal advisors.”

“The Complaint here is filled with inflammatory and disingenuous rhetoric, but none of it shows any wrongful conduct by Pacific Life," the memo says. "

PacLife notes that the complaint includes part of an illustration for the Busches’ $25.3 million policy taken out in 2022 and "admits it fully discloses charges against premium over 10 years and shows the resulting cash value each year.

"Yet Plaintiffs inexplicably contend they could not understand 'the true economic impact of the transaction,'" the memo states.

The complaint fails on negligence and breach of fiduciary duty claims, PacLife claims, and also fails to allege any misrepresentation by PacLife of a past or existing fact.

"While the Policies were in force, Plaintiffs had as much as $90 million of valuable insurance coverage on the life of Kyle Busch while he engaged in an ultrahazardous activity (plus insurance on Ms. Busch)," the memo states. "There is no legal basis to provide Plaintiffs with a massive windfall by refunding all of their premiums."

© Entire contents copyright 2026 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Winter Storm Fern comes with billion-dollar threat to property insurers

Bill giving insurance consumers restitution passes Washington state Senate

Advisor News

- Sketching out the golden years: new book tries to make retirement planning fun

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual reports strong 2025 results

- The silent retirement savings killer: Bridging the Medicare gap

- LTC: A critical component of retirement planning

More Advisor NewsAnnuity News

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

More Annuity NewsHealth/Employee Benefits News

- Minnesota teacher takes the fight to lower health insurance costs to the Legislature

- Predictable Benefits™ Launches White-Label ICHRA Platform For Benefit Providers To Offer ICHRA In A Matter Of Minutes, While Brokers Stay BOR

- XPOVIO® Receives Reimbursement Approval in South Korea for a Second Multiple Myeloma Indication

- Novocure Announces Optune Lua® Receives Reimbursement Approval in Japan for the Treatment of Non-Small Cell Lung Cancer

- Health insurance, inflation and federal funding cuts driving school budget increases

More Health/Employee Benefits NewsLife Insurance News

- Majority of Women Now Are the Chief Financial Officer of Their Household, Allianz Life Study Finds

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual Delivers Excellent 2025 Financial Results

- ACORE CAPITAL Named Alternative Lender of the Year ($15 Billion + AUM) by PERE Credit

- Baby on Board

More Life Insurance News