IUL Sales Jump As Agents Get Handle On Remote Selling

Indexed universal life insurance showed signs of life in the third quarter as sales jumped out of the tough first half of the year, according to LIMRA’s third-quarter sales reports.

The turnaround was surprising because of the difficulty in selling more complex products that require more intensive underwriting in a remote environment. Sales have been stronger for small face term products that are simpler for underwriting and for consumers to understand online.

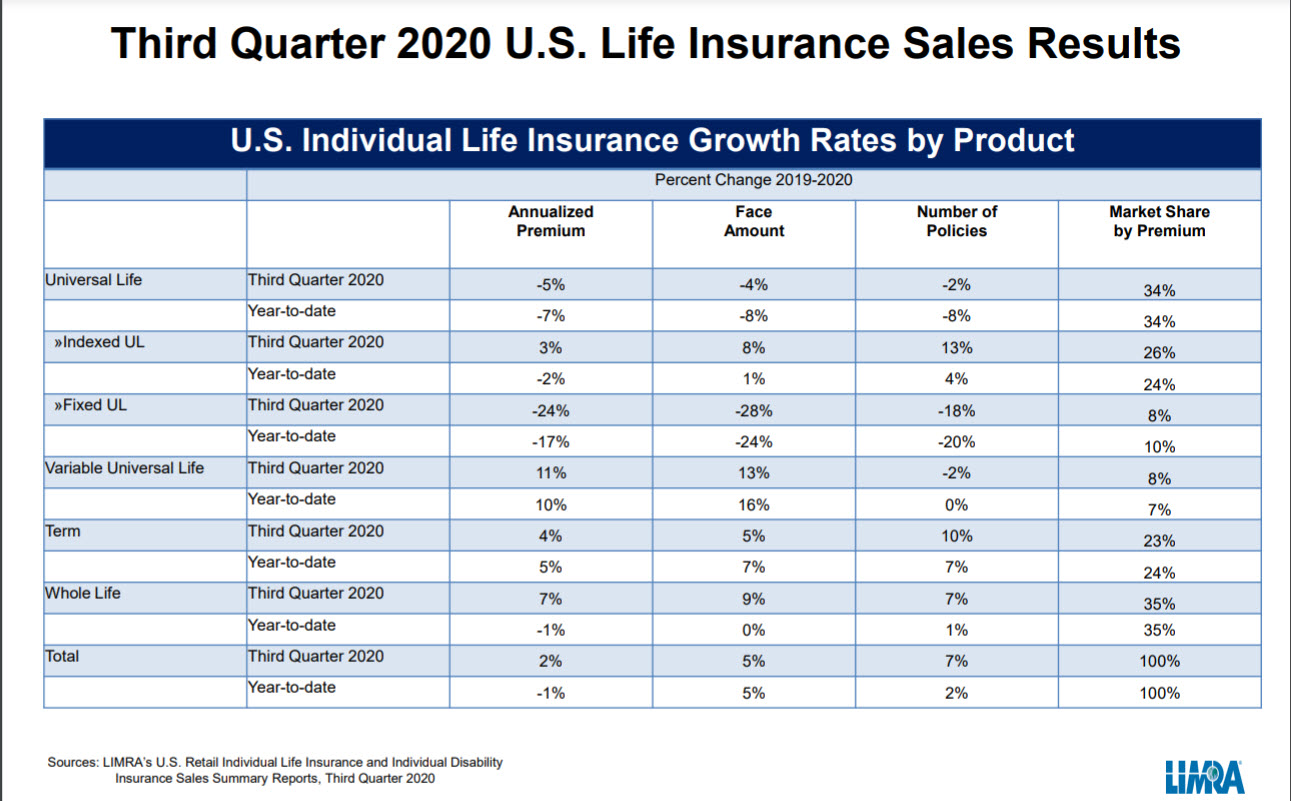

IUL sales were up 3% in the third quarter, the first positive quarter this year. And even though sales are expected to continue into the fourth quarter, the segment is not likely to come out of the year an overall winner on the sales charts, said Elaine Tumicki, corporate vice president, LIMRA Insurance Research.

“While third quarter IUL premium has recovered somewhat from the losses in the first half of the year,” Tumicki said, “it will be difficult to match the strong IUL sales of the fourth quarter 2019. LIMRA is forecasting IUL premium to contract 3%-7% in 2020, compared with 2019 results.”

Of the top 10 IUL carriers, eight increased sales in the quarter.

In another sign that agents and prospects are adjusting to the remote environment, sales are growing in those channels, Tumicki said.

“Insurers and agents have begun to overcome the operational challenges presented in the second quarter by the pandemic,” she said. “While direct-to-consumer channels are propelling growth in both term and whole life policy sales we are seeing even stronger results from the independent and affiliated agent channels.”

Sales Stabilizing

Overall, individual life insurance new annualized premium increased 2% and the number of policies sold jumped 7% in the third quarter.

Life insurance new premium growth this year fell 1%, yet policy count increased 2%, compared with last year up to the third quarter. LIMRA is forecasting life insurance premium to fall 3%-7% in 2020, compared with 2019 results.

Whole life is accelerating its growth with a 7% jump in new premium and policy count in the third quarter. But even with that increase, whole life premium is still 1% lower than 2019 sales year-to-date.

Whole life sales are still expected to even out year-over-year because of consumer interest and online access.

“Due to increased consumer interest, growth in direct channels, and sales incentive programs, LIMRA expects continued WL growth in the fourth quarter, erasing the declines experienced in the first half of 2020,” Tumicki said. “As a result, whole life premium is forecasted to be level with 2019 results.”

Consumer demand is booming for other safety products that can be sold simply online. Term life had a historically good quarter.

Term premium improved 4% for the quarter and 5% year-to-date, compared with 2019 results. The number of term policies issued in the third quarter swelled 10% for the quarter.

This is the largest policy count growth in 18 years, according to LIMRA. Year-to-date, term policy count increased 7%, for the first nine months of 2020. Term premium held 23% market share in the third quarter.

“The pandemic highlighted the need for life insurance and led to increased demand in 2020. Term insurance, due to its design and price, is often the quickest sale and is the most readily available online end-to-end product,” Tumicki said. “LIMRA expects positive growth to continue in the fourth quarter, propelling term new premium to increase 3%-7% in 2020, compared with 2019 results.”'

Variable Sells With A Side Of Safety

Consumers like having a piece of the equities market in their life insurance, particularly with a protection focus, which boomed 27% in third quarter premium. Overall VUL new premium jumped 11%.

This is the 12th consecutive quarter of positive growth for VUL, according to LIMRA. But even with VUL’s double-digit growth overall, fewer than four in 10 writers were up this quarter.

In the first three quarters of 2020, VUL new premium is 10% higher, compared with prior year. Despite the growth in premium, the number of VUL policies sold fell 2% in the quarter and was flat year-to-date.

Overall, universal life new premium continues to struggle, down 5% in the third quarter and 7% year to date. The number of UL policies sold fell 2% in the third quarter and is 8% below 2019 year-to-date levels. UL market share was 34% in the third quarter.

Steven A. Morelli is editor-in-chief for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2020 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

DOL Sends Investment Advice Rule To OMB, But It Might Be Too Late

Life Insurance Sales To Match Pre-Pandemic Growth By 2022: LIMRA

Advisor News

- Is there a mismatch between advisor marketing and consumer preferences?

- State health plan users may see premium increases under SC House budget proposal

- Advisor: SEC trying to ambush my defense on bad annuity sales charges

- Partner split: Grant Cardone and Gary Brecka swap charges in dueling lawsuits

- 4 things every federal worker should do to safeguard their benefits

More Advisor NewsAnnuity News

Health/Employee Benefits News

- President of Insurance Brokerage Firm and CEO of Marketing Company Charged in $161M Affordable Care Act Enrollment Fraud Scheme

- STATEHOUSE: Senate Republicans approve limiting health insurance program for Hoosiers

- State health plan users may see premium increases under SC House budget proposal

- Senate Republicans approve limits on health insurance program

- Health agents ‘optimistic’ as a new administration takes charge

More Health/Employee Benefits NewsLife Insurance News

- Whole life vs. term life: The great debate

- Prudential launches OneLeave

- Annual financial and audit reports – JPMORGAN CHASE & CO.

- Conning research: Insurers must be flexible in the 2025

- AM Best Places Credit Ratings of Banner Life Insurance Company and William Penn Life Insurance Company of New York Under Review With Developing Implications

More Life Insurance News