Inflation Losing Steam By The Day, Conference Board Economists Say

Inflation in the U.S. has already peaked and is decelerating, according to The Conference Board, the global independent business research association.

That may come as a surprise to employers who are raising wages and benefits to attract needed workers, and to consumers who are tracking the rising price of gas, groceries and many other goods.

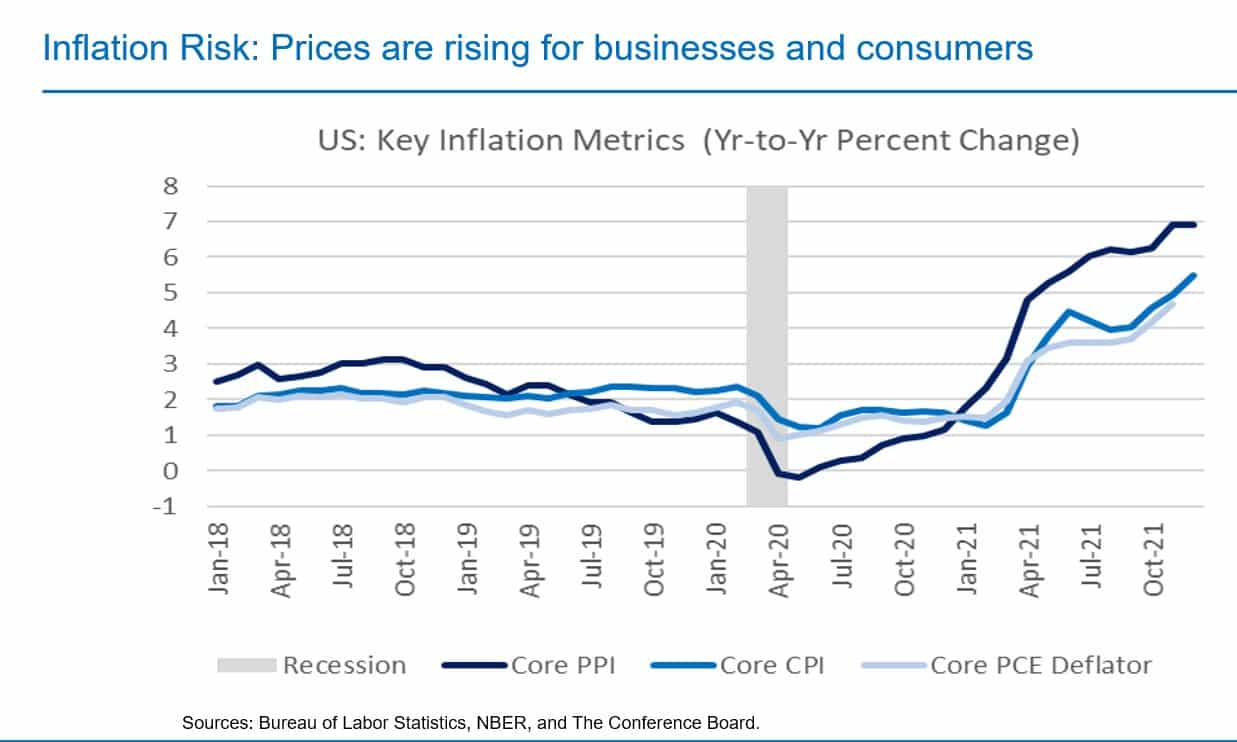

But in a briefing to the press this the week, Conference Board economists presented data showing how inflation rates actually topped out around 5.5% in December of 2021 and are headed to below 3% by the end of this year.

There were many caveats to the board’s somewhat rosy-sounding prediction, however, and no one predicts inflation will return to its pre-pandemic levels below 2%.

“Some inflation is temporary, pandemic related, other pressures will remain and they're more structural in nature, or they're policy related,” said Dana Peterson, chief economist for The Conference Board. “We expect it will stay above the 2% target for longer, meaning into 2023.”

Peterson said the board predicts the Federal Reserve might raise interest rates as many as five times this year and start reducing its balance sheet, which should drive down prices. However, she cited a host of other ongoing factors that she said would put pressure on prices and send them slowly spiraling.

Among them:

- Monetary policy tightening.

- Consumer demand for discounting or purchasing cheaper goods.

- More automation as employers turn to technology to fill the demand for workers.

- Online shopping at retailers that keep prices low.

- More remote work, allowing employers to hire people from lower-wage jurisdictions.

- Greater outsourcing to improve supply chain gaps.

- Improved infrastructure to lower the costs of moving goods.

- Greening of the economy, which, after its transition phase, should lower utility and other costs.

'A Big Ramp-Up'

The board’s economist also cautioned against misreading or misinterpreting inflation numbers.

“On the one hand, you have year-over-year gains and the difference between December 2020 and December 2021, in which a lot happened,” said Eric Lundh, the board’s principal economist. “But if you look at month-to-month changes, we certainly had a big ramp-up in the third quarter and beginning of the fourth quarter.”

In late 2021, though, monthly price increases began to decelerate a bit, leading to the conclusion that some of the inflation drivers are cooling a bit.

“We may see those reverse in January with omicron because there have been a lot of people calling in sick and who are quarantined and can't go to work,” he said. “So some of these disruptions to the economy have been exacerbated by that and we saw month-to-month price increases really take off.”

Lundh said The Conference Board bases its year-to-year calculations on a period of time before inflation suddenly increased.

“So once we hit second quarter, I think we'll start to see those year-over-year numbers plateau and probably start to go down a little bit,” he said.

Asked what companies can do to prepare for continuing labor shortages and price increases, Gad Levanon, vice president, labor markets, said “a lot.”

“Some companies, such as Target, were well prepared and planned in advance for the labor shortage,” he said. “Their retention rates didn’t decline during the pandemic and current labor shortage.”

Companies can raise wages and benefits, he said, which can be inflationary. Companies also can increase the number internships and apprenticeship programs they offer, improve recruiting policies and expand to other geographic areas, allowing more flexible work policies.

“One thing that they're not doing so much, is increasing or trying to retain older workers,” he said. “That was a surprise, despite the labor shortages this was not a really big solution for most companies.”

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

Americans Renewing Focus On Financial Security, AIG Survey Says

Husband And Wife Business Owners Arrested In $4.5M Workers’ Comp Fraud

Advisor News

- Does your investor client know how much they pay in fees?

- Get friends to do business: 2 distinct approaches

- Unlocking hidden AUM: Prospecting from within your client base

- Protests in D.C. Take Aim at Health Insurance, Financial Institutions, Oil & Gas Interests

- Charitable giving tools available for taxpayers; due to expire

More Advisor NewsAnnuity News

Health/Employee Benefits News

- DOCCS commish: Striking NY correction officers will lose health insurance Monday

- Leadership: The Virginia Power 50 List

- Research Conducted at Cleveland Clinic Has Provided New Information about Insurance (High-intensity Home-based Rehabilitation In a Medicare Accountable Care Organization): Insurance

- Researchers from Marshall B. Ketchum University Describe Findings in Insurance (Office Procedures for Older Adults By Physician Associates and Nurse Practitioners): Insurance

- GOP lawmakers commit to big spending cuts, putting Medicaid under a spotlight – but trimming the low-income health insurance program would be hard

More Health/Employee Benefits NewsLife Insurance News