How life’s milestones can play a role in selling financial services

Agents and advisors have long used life’s milestones to approach their clients about the need for more financial protection. After all, events like getting married, having a baby, or going to college, often signal a need by their clients for additional protection. Three financial professionals, Robert Arzt, David Appel and Brian Haney, recently offered some helpful hints on how financial professionals can make the most of these milestones and help their clients work toward securing a sound financial future.

Discussing the need for life insurance with an agent is not at the top of most people's list of favorite things to do, said Arzt, founder and president of Polaris One and Insurance.CoachU.com, as he shared some of the most “successful” milestones that agents and advisors can use to initiate and hopefully sell more financial services to their clients.

However, Arzt said, the times when people are the most open to these discussions are when they involve family and personal life changes. This is “because the consequences of not owning life insurance have a personal impact on the ones they love and want to provide for,” he said.

Arzt shared some family and personal life changes:

- Marriage or partnership: A desire to financially protect a spouse or significant other.

- Birth or adoption of children: A desire to ensure their future financial security. “This is especially true if the child has special needs,” Arzt pointed out.

The next category in which the topic of life insurance becomes easier to discuss with clients is homeownership and asset protection, added Arzt.

The two life events in this category are:

- Buying a home: Protecting mortgage debt is not only a self-serving thing to do, but it often is also mandated by the mortgage lending institution, Arzt pointed out.

- Owning high-value assets: “Life insurance is one way where you can protect financial assets from diminishing through taxes, thereby leaving more to one’s family and heirs. This also applies to protecting a business from a forced sale or an undervaluation,” he said.

Other categories in which there is a need for life insurance, but they may not create a sense of urgency to purchase them, include: health and aging issues, financial wake-up calls, career milestones, and retirement planning, he said.

When asked for some of the steps that agents can take to use these milestones successfully and hopefully make more sales, Arzt had this to say: “Becoming a trusted advisor is the best way to serve your clients. Their needs come first. One of the best ways to be that trusted advisor is through client education. In addition to conducting a thorough factfinder, preparing your client for potential future events is key. Regular communication and excellent customer service will help retain clients and ensure future sales.”

Additional milestone strategies

Appel, with Appel Insurance Advisors, LLC, consistently approaches the following groups:

- New Emerging Wealth Parents: They are building a family, and life insurance should be a core component of any financial plan.

- College Age Children: The college expenses are close to being complete and they can start thinking about the second phase of their planning, which, most of the time, will involve some kind of long-term care planning.

- Wealth Transfer Planning for HNW Clients: In retirement, high-net-worth clients start thinking about wealth transfer, creating a legacy, and creating wealth for future generations.

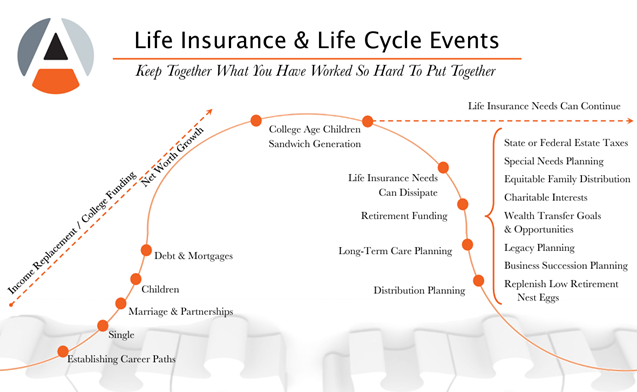

Appel also uses the following graph and segments with most of his clients:

Segment I

The beginning section of the bell curve, where milestones may begin for a client:

- Career, Marriage or Partnerships, Children, Debt and Mortgages, Promotion, Retirement Savings.

- Starting a career, understanding workplace benefits and what may need to be supplemented with personal planning.

- Getting promotions, which hopefully come with a higher income, buying a first home, taking on debt, school loans and how to plan around these new financial obligations.

- Starting to focus and plan around retirement savings, whether in employer-sponsored plans or individually.

- Two biggest concerns at this time in a client’s life are securing income for themselves as an individual, or if they have a spouse and if children are in the picture, making sure that they can attend private school if applicable, or college, whether the parent is here or not.

- Is there disability insurance in place? And if there is, the client should analyze a group disability insurance work plan to see if it is sufficient, and if not, look at piggybacking a group plan with an individually sourced policy.

Segment II

The top of the bell curve:

- The client is at the peak of his career but still has a lot of room for growth. Expenses are at their peak, with college-age children. Clients’ parents/in-laws or relatives’ health may be failing, and the client might have to help them out emotionally, financially, etc.

- Clients may be juggling nuclear and extended families.

- “We find clients at this point also have a higher chance of dealing with a divorce situation,” Appel said.” This is the time for them to buckle down and really assess their overall financial situation.”

- Do clients have the right estate plan? Is it outdated? Do they need to contact an existing or a new attorney to bring documents up to date?

- Have clients outgrown their P&C agent and need to re-evaluate them?

- Is long-term care planning now more important than disability planning?

Segment III

The upper half of the far side of the bell curve.

- Approaching Retirement: Are clients saving enough? What are they saving in, and do they need to balance their fully taxable retirement accounts with plans that are tax-free?

- Some insurance needs diminish or change: Should life insurance stop or continue? Should clients continue to need disability insurance, and is long-term care a concern now?

- Advisors should focus on Retirement savings & Distribution Planning, either fast funding it if the client realizes that they are short of their goals, assessing if and when they can retire, and what type of income they can draw from their principal, without jeopardizing spending through their capital.

- Long-Term Care Planning: Clients should look at family history, parents/relatives, longevity within the family, assess what’s in place to combat the financial threat, or what can be done to alleviate some, but not all, of the issues, since it’s an impossible thing to fully plan or insure for. “But we can help to take some of the burden off the family with proper planning by co-insuring the risk with an insurance carrier,” Appel said.

Segment IV

Clients face many challenges after hitting the top of the bell curve and heading down the other side. “The issues may be isolated to the type of client and their background, but these are many of the issues we have seen in our combined 70+ years of experience,” Appel said. “Many of these challenges can be alleviated by maintaining permanent life insurance policies that are either individually owned or trust owned.”

Examples of these include:

- State or Federal Estate Taxes: Creating capital to help offset taxes due upon death.

- Special Needs Planning: Again creating capital to maintain the lifestyle of a child or relative who has special needs and needs proper planning that doesn’t jeopardize public assistance.

- Equitable Family Distribution: Alleviating the issues in families based on different lifestyles, success, and involvement in family businesses. “We may need to help make things fair for the family, not necessarily equal,” Appel said.

- Wealth Transfer Goals: This is helping clients maintain as much of their wealth for future generations if this is something that is important to them.

- Legacy Planning: For example, Appel said that a recent grandfather held his grandchild for the first time and decided that he wanted to plan now around that once-removed generation.

- Business Succession Planning

- Helping spouses if retirement savings goals have not quite been met at or near retirement.The need for client engagement between milestone events

Like Appel, Haney, who is CEO of The Haney Company, has used traditional milestones over the years to initiate the need to discuss more financial protection with his clients. But he has found out that the key is to not wait until the milestone. Instead, it is to build the habit with clients about when they may want to be engaged with their finances as their lives unfold.

“It is really important that from the start of a relationship, I work with clients to let them know that navigating their finances effectively is not static, but fluid, and requires vigilance from both them and me as their advisor,” Haney said. “I work to build that habit with them, so that they already know things will need to be addressed when, say, a baby comes, or they buy a house. It’s not always perfect, but like any healthy habit, being more active with your finances can provide lifelong benefits.”

According to Haney, the “most successful” milestones in creating a sale are job changes, marriage, kids being born, moving, and certainly eventually retiring. “These stimulate the most conversations and often grow the relationship,” he said.

Tertiary events can be worth noting, he said. “I also try and pay attention to the life events of the people close to my clients as well,” he explained. “With social media, if you happen to be connected with your clients, you may see them sharing information about things that have happened to other people they care for, and sometimes, I use those as a chance to reach out and see if they would like to talk about things themselves.”

Haney added that he approaches these events very delicately and with care, holding space for them in compassion, rather than using them as a means to sell more. But he has found that these kinds of moments, though not happening to them directly, can be healthy ways to stimulate good money conversations and moments when personal pressure may not be so significant.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Ayo Mseka has more than 30 years of experience reporting on the financial services industry. She formerly served as editor-in-chief of NAIFA’s Advisor Today magazine. Contact her at [email protected].

How ‘data augmentation’ might speed up AI adoption in P&C insurance

How to overcome the fear of calling prospects

Advisor News

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- OBBBA and New Year’s resolutions

- Do strong financial habits lead to better health?

- Winona County approves 11% tax levy increase

- Top firms’ 2026 market forecasts every financial advisor should know

More Advisor NewsAnnuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

- ‘Egregious’: Idaho insurer says planned hospital’s practices could drive up costs

- D.C. DIGEST

- Medicaid agencies stepping up outreach

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- State employees got insurance without premiums

More Health/Employee Benefits NewsLife Insurance News