How FIAs Can Ease 3 Retirement Risks

Investors put more importance on income protection than financial professionals do, and that means advisors must address ways that annuities can protect retirement income.

That was the word from Tamiko Toland, director of retirement markets for CANNEX USA, who discussed fixed indexed annuities and their role in addressing key risks in retirement planning as part of a webinar by the National Association for Fixed Annuities.

Toland cited two recent studies conducted by the Alliance for Lifetime Income: one among investors ages 45-75 with $100,000 or more in investable assets, and the other among financial professionals. The main focus of the two studies was to identify how protected retirement solutions fit with retirement planning approaches, and how frequently investors and financial professionals consider or use annuities in addressing different income approaches and needs.

Income Protection Is Important To Investors

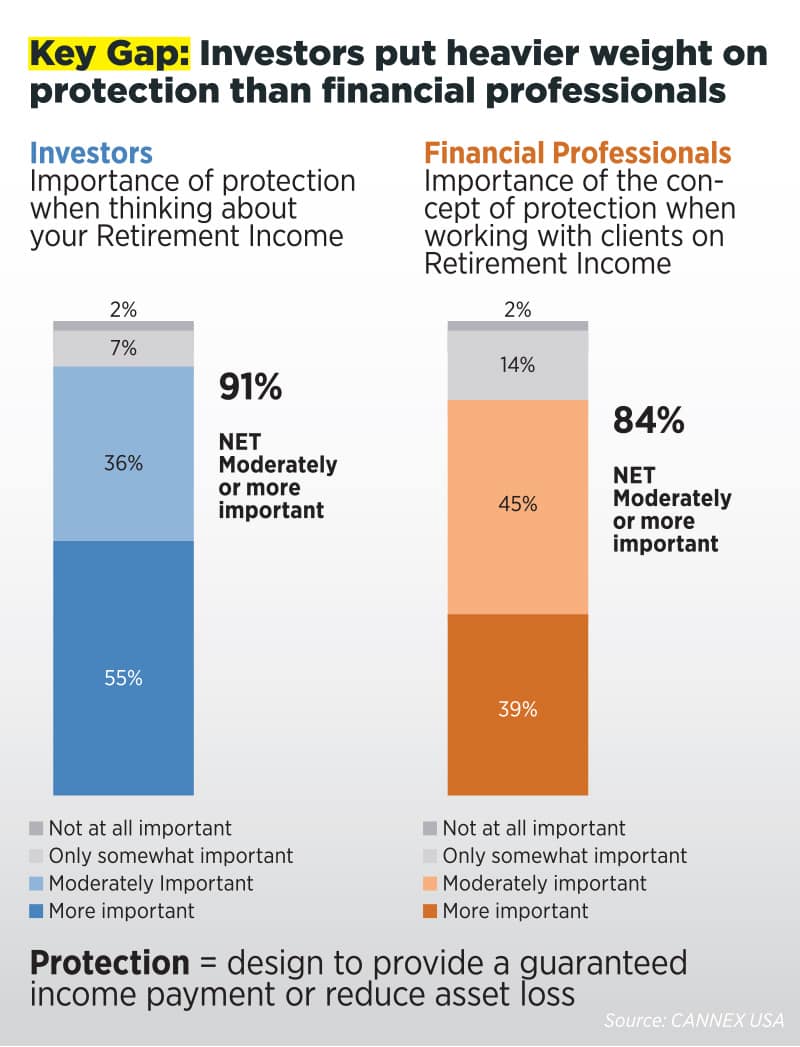

The key takeaway from the study, Toland said, was that more investors believe income protection is important than advisors believe. More than half (55%) of investors said they believed protection was “moderately important” when thinking about retirement income while only 39% of advisors said they believed it’s important to discuss the concept of retirement income protection with clients.

“The mismatch on this thing is a lot greater, and it’s important to bear in mind that if you’re a financial professional and you’re talking with clients, this resonates with them more than you realize,” Toland said. “And the way that people frame the retirement income planning process may work better when you’re leaning more into the protection question.”

The study showed that two-thirds of financial professionals said their approach to retirement planning changed somewhat in the past year. The top two reasons? Low interest rates (71%) and reduced returns on bonds (49%).

“Both of these reasons point directly to fixed annuities,” Toland said. “We’re talking about a set of solutions appropriate for individuals who are looking to replace products. This shows the value of the fixed annuity product set in providing guaranteed income for life.”

Nearly one-quarter (22%) of financial professionals said their approach to retirement planning changed moderately or a great deal in the past year, the study showed. Advisors who are using annuities are using them more for income purposes (45%), asset growth and protection (41%), and tax deferral (19%).

Investors who have annuities are more satisfied with their financial advisors than are investors who do not have annuities, the study showed. More than eight in 10 investors who have annuities (84%) said they were extremely satisfied with their advisor, as opposed to 74% of those without an annuity.

“Advisors may be underestimating how satisfied clients are with having protected income,” Toland said.

Advisors Need To Have The Talk

The study showed the importance of having advisors discuss retirement income strategies with clients.

Financial professionals reported they know the importance of retirement income planning and have had conversations about it with eight out of 10 clients who are age 55 or older. In addition, most investors who haven’t had a conversation about retirement income with an advisor want to do so.

More than half (52%) of financial professionals said one of the benefits to retirement income planning is to create an income stream that lasts a client’s entire life. Investors concur — 54% appreciate this benefit. While 47% of investors say a benefit of income planning is protecting assets, only 26% of financial professionals say the same, creating a potential gap between the benefits clients want and the planning services they’re provided.

Financial professionals admit low knowledge of annuities, suggesting a need for more education. Forty percent of financial professionals said they are only somewhat knowledgeable or not at all knowledgeable about annuities. However, this rises to 50% among registered investment advisors.

Three Risks And Solutions

Conversion of retirement savings to retirement income may be difficult for advisors, Toland said. For some consumers, it also may be a different way of thinking.

“Low interest rates make other tried-and-true methods less sustainable,” she said. “COVID-19 underscored those low interest rates, but we have been in a low interest rate environment for some time. Having to deal with low interest rates makes certain income strategies — bond laddering or CDs — unsustainable. Fixed annuities can give a better yield, and that’s more important as interest rates for other products hit the floor.”

Fixed annuities can replace income before retirement if a client needs additional income, or they can replace income during retirement as part of a fixed income allocation, she said.

Clients have three risks that fixed annuities can address, Toland said. They are:

1. Longevity risk. Clients risk outliving their savings. Fixed annuities address the risk of living a long time. The income from an annuity lasts as long as the client lives.

2. Inflation risk. Clients risk reduced purchasing power in the future. If a client has a strong base of guaranteed income, they can invest the rest of their portfolio in ways that have more risk but bring higher gains. This is a great protection against future inflation, since clients may need to rely on withdrawals from their portfolios to keep up with costs.

“Once you establish a strong base, you can invest the rest of the portfolio more aggressively because you can assume higher risk because you have that guarantee with the income floor,” Toland said. “Not having to take significant withdrawals from the base portfolio really does impact that risk profile and it enables you to invest in such a way as to keep up with inflation.”

3. Sequence of returns risk. Client portfolios may not recover from market losses experienced early in retirement. With income from annuities, clients will not need to rely on their savings to pay the bills. If the stock market value goes down, clients can give their investments time to recover before they need them in the future. This protects future income and helps grow the money clients will leave to their heirs.

“I don’t think it’s difficult for people to understand that exposing yourself to greater risk at a time when you have to make withdrawals from that pool of money is something you want to avoid,” Toland said. “And any product that allows you to avoid it is going to be helpful, and that’s where the annuity fits in.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Legislation Would Encourage Retirement Product Innovation

The Impact Of Genetic Testing On Life Insurance Coverage

Advisor News

- Affordability on Florida lawmakers’ minds as they return to the state Capitol

- Gen X confident in investment decisions, despite having no plan

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

More Advisor NewsAnnuity News

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

More Annuity NewsHealth/Employee Benefits News

- In Snohomish County, new year brings changes to health insurance

- Visitor Guard® Unveils 2026 Visitor Insurance Guide for Families, Seniors, and Students Traveling to the US

- UCare CEO salary topped $1M as the health insurer foundered

- Va. Republicans split over extending

Va. Republicans split over extending health care subsidies

- Governor's proposed budget includes fully funding Medicaid and lowering cost of kynect coverage

More Health/Employee Benefits NewsLife Insurance News