Giving back: It’s a family affair

Sean Locke was everybody’s friend. A talented basketball player at the University of Delaware, Sean was as gifted at bringing people into his life as he was at racking up points on the court.

He lived in an off-campus house a few blocks from the university. The house soon became known as the party house, where everyone was welcome and the fun never ended.

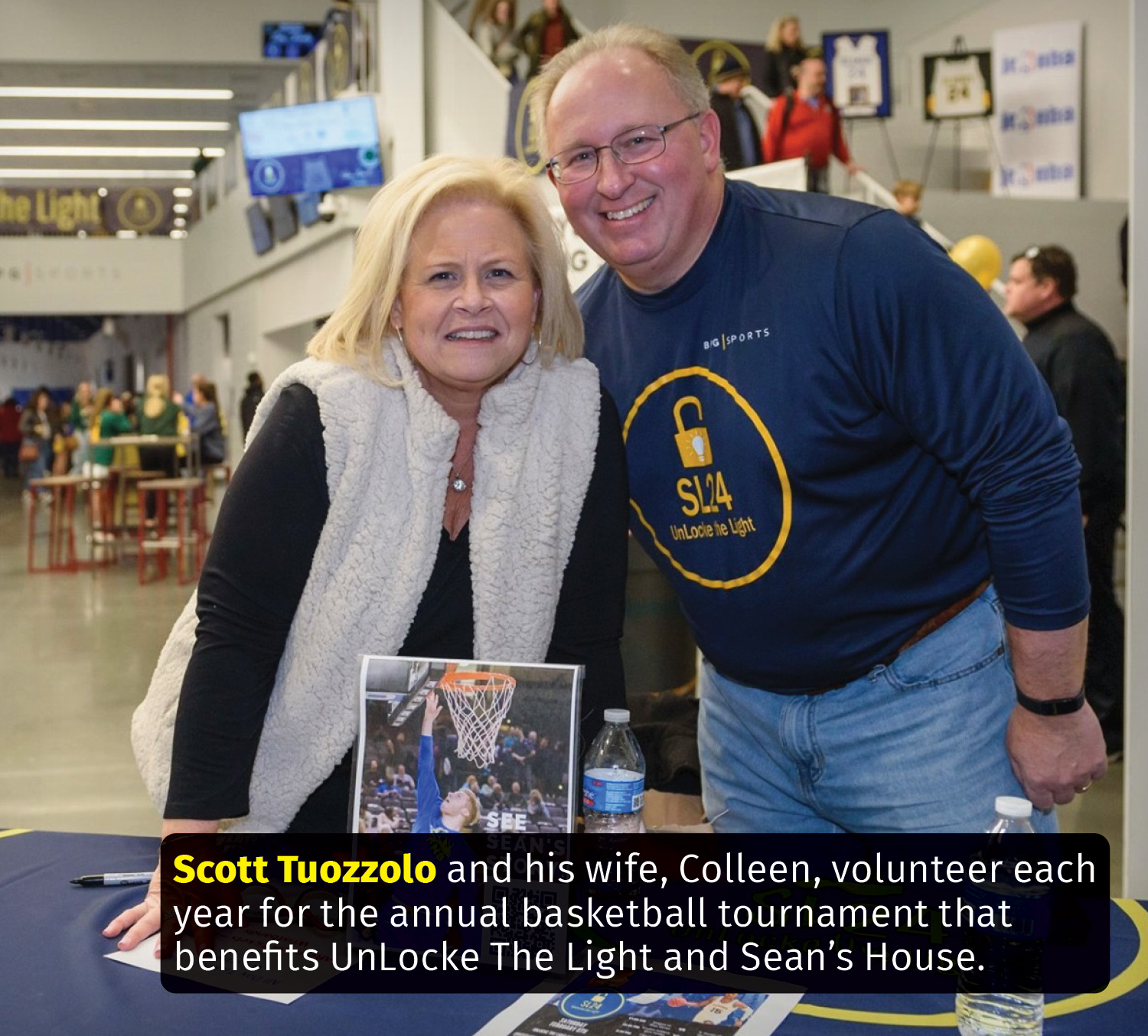

“Sean didn’t care who you were or where you were from. If you walked through the door, you were a friend,” said Scott Tuozzolo, a family friend.

Sean died by suicide in 2018, shocking his family and friends. “He was struggling, and obviously struggling in silence,” Tuozzolo said.

The party house where Sean spent much of his college life has a new purpose since Sean’s death. Sean’s family created a foundation, UnLocke The Light, in his honor. The foundation is dedicated to unlocking students’ light by providing resources for those struggling with depression, self-injury and suicide. The house on West Main Street in Newark, Del., is now Sean’s House, a safe haven for teens and young adults who need support to improve their mental health and well-being as well as connect with their peers in a confidential environment.

Tuozzolo is principal and head of agency development at Income & Estate Planning Partners in Newark. Sean and Tuozzolo’s son were longtime friends. Now Tuozzolo and his wife volunteer with UnLocke The Light, helping with various fundraising events and helping raise awareness of the foundation’s work.

Tuozzolo is one example of how people in the financial services industry are giving back to their communities and involving their families in their charitable work.

Not long after Sean’s death, Tuozzolo said, his family held a high school basketball tournament to raise funds for the Mental Health Alliance of Delaware. That first tournament, held in February 2019, raised $168,000.

“It kind of morphed from there, where his family created the foundation and then created Sean’s House, at the house where Sean lived for three of the four years he was at the University of Delaware,” he said. Tuozzolo said he and his wife volunteered at that initial fundraising basketball tournament and every tournament held after that. And when it was time to turn the former party house into Sean’s House, the Tuozzolos were among the volunteers who showed up to paint.

Sean’s House was dedicated in 2020 and provides peer support, crisis help and support groups to young people experiencing mental health crises. Support groups for the parents of these young people also are available. Tuozzolo calls himself “an unofficial ambassador” to Sean’s House, where he often brings people to meet Sean’s father, Chris, and learn more about the work that is done there.

UnLocke The Light has grown since 2020, opening “Sean’s Rooms” in several schools in the Newark area. The rooms are places where students can access mental health resources and talk with someone who understands. Future plans include opening Sean’s Rooms on military bases and in police departments to provide mental health resources to people who work there.

Tuozzolo said he is working with a payment processing company to create an affinity program that would benefit UnLocke The Light. He also solicits sponsors and volunteers for the annual basketball tournament, which keeps growing every year.

He and his wife keep their calendars open for the first weekend of February each year, where they will spend two days at Chase Fieldhouse in Wilmington, Del., volunteering at the basketball tournament that raises funds for the house named in memory of their son’s friend.

“It’s a fun event,” he said. “It’s kind of like a reunion for so many of us, because you see people there who you may not have seen in some time.

“I tell everyone, if you like high school basketball, come out and catch a couple of games because there’s some good basketball to watch and you’re supporting a tremendous cause.”

Giving back is a GIFT

Some companies have a giving plan that is part of their organization and guides them on their quest to make their communities better places to live.

Financial Independence Group in Cornelius, N.C., established the GIFT Fund, a program that blends employee engagement with volunteer work. Employees are encouraged to have their family members join them in volunteering.

GIFT stands for Giving time, Investing in our community, Feeding the children and Teaching financial literacy, Leslie Lipscomb, FIG’s senior vice president, told InsuranceNewsNet. FIG works with a number of core nonprofit partners that rotate each year. This ensures the fund supports a broad range of causes and addresses various community needs. It also allows FIG to keep its volunteer efforts fresh and diverse, while continuing to build deep, lasting relationships with the nonprofit partners.

FIG encourages its employees to suggest new volunteer activities and share causes that are close to their hearts. The company holds quarterly volunteer days, and employees can pitch local causes to the GIFT Fund board. The board votes on two causes they will fund for the year.

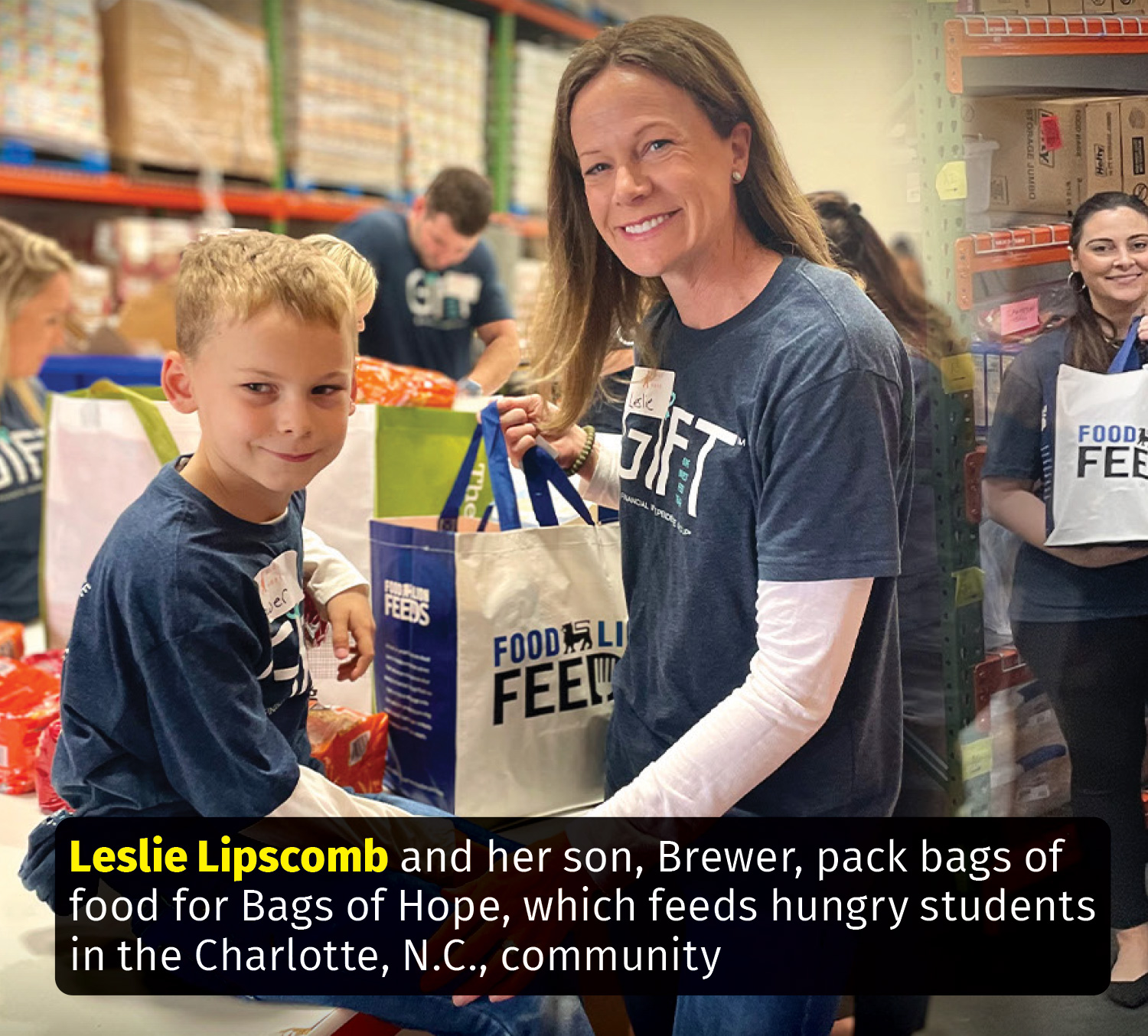

Lipscomb said the Feed aspect of GIFT is of particular interest to her.

“We are hyperfocused on making sure children in our community are not hungry,” she said. The GIFT fund has partnered with community initiatives such as FeedNC, which provides food and other resources to people in need. FeedNC operates a community dining room, Donaghue’s Open Door, where anyone can eat one meal a day between 7 a.m. and 2 p.m. The dining room also provides training to those developing culinary arts skills. “It doesn’t matter if you walk up carrying your sleeping bag or you drive up in your Lexus, you are entitled to one free meal a day,” Lipscomb said.

FeedNC also operates Grassroots Grocery, where eligible individuals can select food in a retail-like setting. “It’s set up just like your Publix or your Harris Teeter,” Lipscomb said. “And a lot of donations come from those retail grocery stores, so we’re talking good food — not expired food.”

Lipscomb said she and her seven-year-old son, Brewer, often help at Grassroots Grocery, helping clients pack the food they have chosen and loading groceries into their cars.

The GIFT Fund also has worked with Bags of Hope, which provides food for children in need in the Mecklenburg County Schools. Students are given a bag full of breakfast items, milk, juice, vegetables and ready-to-eat meals every Friday so they have food at home to tide them over for the two days when they won’t receive lunch at school.

“We packed more than 800 meals for the children to take home to provide 16 meals during spring break,” Lipscomb said.

The Teach aspect of GIFT goes hand in hand with FIG’s role in the financial services industry.

“We have a big emphasis on helping people understand the concept of financial literacy,” she said. The GIFT Fund has partnered with Common Wealth Charlotte, an organization dedicated to providing what it calls “uncommon financial solutions for low-income families.” Common Wealth provides economically vulnerable people in the community with trauma-informed education, certified financial counseling, asset-building and wealth-building skills, and access to banking services and 0% interest loans.

“Regardless of your credit, you can go to Common Wealth and get a $750 loan,” Lipscomb said. “Part of the terms is that you repay the loan, which helps you build your credit. People take advantage of the opportunity to build their credit. We’ve partnered with Common Wealth to help people focus on building their credit and working with people to increase their financial literacy.”

One of Lipscomb’s most enjoyable “giving back” projects through the GIFT Fund was helping rebuild a playground at the elementary school she and her sister attended as children.

“It was at the Marie G. Davis School in Charlotte, and my sister came along with me to support that initiative to do the playground build,” she said. “It was really special given that the two of us went to school there. I went to fourth grade there and she went to fourth and fifth grades there. So there were definitely some roots there for us, and it meant a lot for us to work on this.”

Lipscomb’s son is becoming more involved in the GIFT Fund’s projects. He worked alongside her at a recent Christmas Angel Workshop, helping pack gifts for families devastated by Hurricane Helene in western North Carolina. He also helped her and other FIG employees at a back-to-school event where volunteers filled backpacks with school supplies for students in need.

“Having our children watch us not just work but also serve the community and give back, doing things that mean a lot to people, is so important,” she said.

Youthful interests fuel giving back

The activities that interested us as teens and young adults can form the basis for giving back throughout adulthood. Laura and Tim Schultz, owners of Preservation Retirement Services in North Olmstead, Ohio, are inspired to give back by building on the things they loved in their younger years.

For Laura, giving back stems from her years as a Girl Scout. She earned Girl Scouting’s highest honor, the Gold Award, and is a lifelong Scout. Today, she volunteers with the organization in several capacities.

“I’ve had 35 years of membership at least, and I served on the board of Girl Scouts of Northeast Ohio, which is our local council, serving 18 counties in Northeast Ohio,” she said.

Laura said she joined Girl Scouts when she was in kindergarten “because I saw it as something fun to do. My mother and grandmother had been Girl Scouts. My grandmother was my mom’s Girl Scout leader, and then my mom became my Girl Scout leader.”

She persisted in Girl Scouting “because I saw the value in it.” When Laura was in high school, she took advantage of a Girl Scouting program called Wider Opportunities, which gave her the opportunity to spend a month at Sangam, a Girl Scout Girl Guide World Center in Pune, India.

“I came from a very small town in West Central Illinois, which was a wonderful place to grow up but didn’t offer much diversity,” she said. “So to travel to India as a 16-year-old girl was a big game changer for me.”

In India, Laura and the other Girl Scouts worked with women to help teach them life skills as well as skills that would help them earn money for their families. “This experience gave me the confidence that I could do anything,” she said.

Laura’s interest in Girl Scouts faded after she went to college and graduate school but was rekindled during an event in her community. “There was a fundraiser for the YWCA in which they had an auction where, instead of bidding on items, you could bid on lunch with a community leader,” she said. “I saw that one of the leaders was the CEO for the local Girl Scout council, and I thought about how I had lost touch with the organization and why not meet her and talk to her?” Laura had lunch with the leader and was soon asked to join the board.

She said her involvement with Girl Scouts dovetails with Preservation Retirement’s interest in serving women’s financial needs. “We have a concentration on women and investing,” she said. She added that she has invited some of Preservation Retirement’s clients to join her in helping the Scouts with some STEM projects.

Girl Scouting is more than the “3 C’s” of crafts, camping and cookies, Laura said. “Girl Scouting is investing a lot of resources in STEM programming. Our council is building a multimillion-dollar STEM Center of Excellence at one of our camps. Girl Scouting has leaned in and said, ‘Let’s give girls a space to do all the fun things we’ve always done. We’re still camping, we’re still selling cookies, we’re still making crafts, we’re still traveling. But let’s also give girls the opportunity to engage in STEM, with the hope of increasing the number of women in STEM and helping girls have a career if they are interested in it.”

Tim and Laura met at a University of Iowa alumni football watch party in Cleveland. They got married on the university campus, and a Hawkeye football game and tailgate were part of their wedding weekend.

At the same time, the University of Iowa was building the Stead Family Children’s Hospital that overlooks Kinnick Stadium, where the Iowa Hawkeyes football team plays. Before the 2017 college football season began, news broke that the Press Box, a lounge on the 12th floor of the children’s hospital where the patients and their families can gather for breathtaking views of the stadium and the game, would open for the first home game. On social media, one Iowa fan suggested that the team and fans should think up something to do during the game to connect with and cheer up the children in the hospital, and “the wave” was born. At the end of the first quarter, all 70,000 fans at Kinnick Stadium look up and wave to the children who are patients in the hospital.

Tim and Laura continue to support Stead Family Children’s Hospital. They not only provide financial contributions to the hospital but also hold events for their clients and friends, such as a March Madness tournament, to raise money for it.

Laura said she conducts presentations on how to incorporate charitable giving into a financial plan “because that is an important piece for folks who have the resources to do that.”

The Schultzes said they believe giving back involves more than simply writing a check.

“You can always give back no matter what you have,” Laura said. “We try to do that with our checkbook as well as with our time, because I think it’s important to do both. And we try to engage other people around us to do that as well.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Facing the long-term care explosion — With Genworth’s Tom McInerney

Riding above the competition — with JD Moya

Advisor News

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

- How OBBBA is a once-in-a-career window

More Advisor NewsAnnuity News

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

- How the life insurance industry can reach the social media generations

More Life Insurance News