Riding above the competition — with JD Moya

When JD Moya and his then-business partner decided to create a managing general agency aimed at the Hispanic market, they met for lunch at a rotating restaurant atop a high-rise building in Dallas.

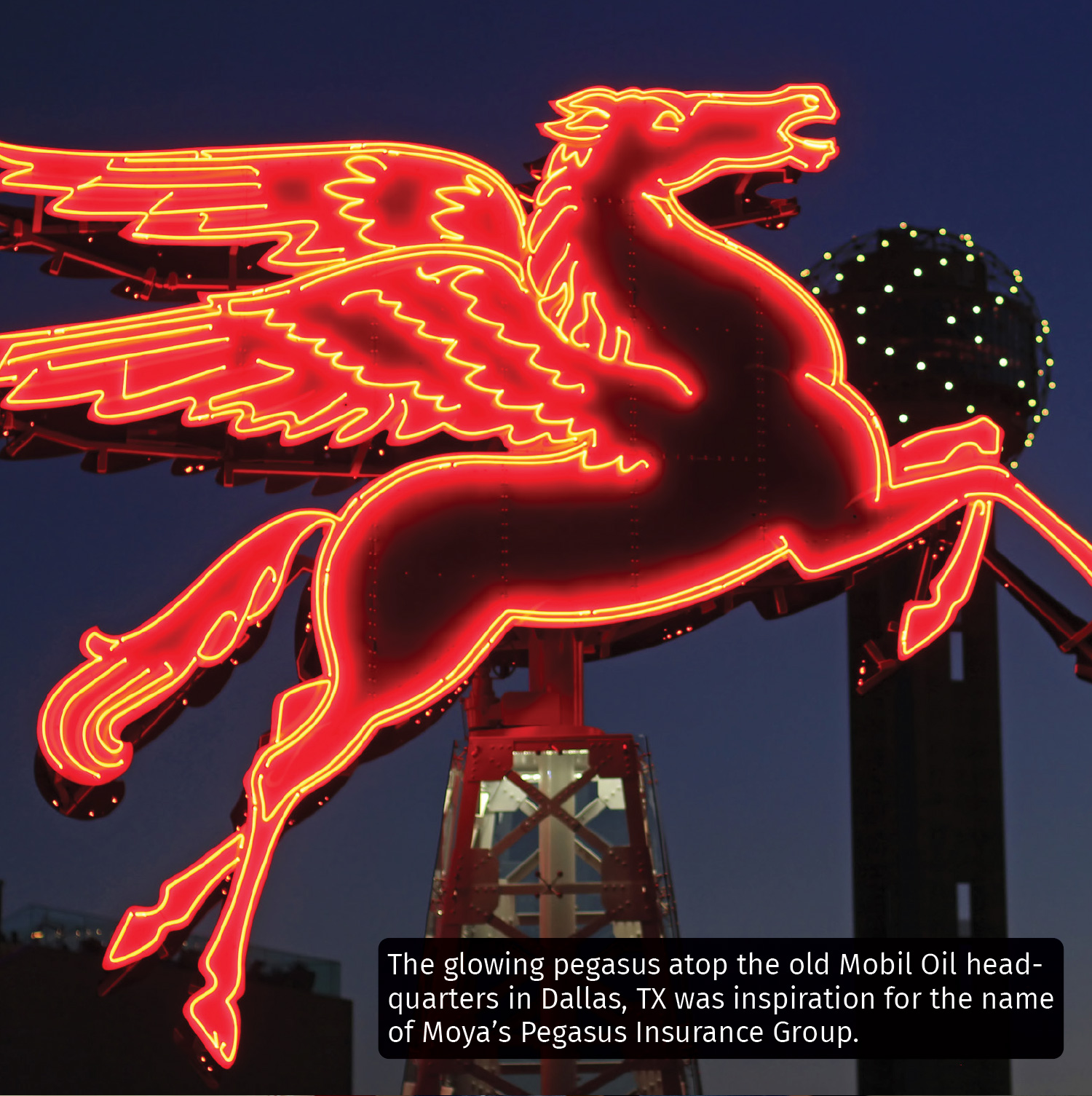

While drinking Scotch, the two of them kicked around some possible names from history, religion and mythology. Genesis was one possibility; Excalibur had some appeal. But then they looked out of the restaurant window and saw an iconic piece of Dallas architecture — the red figure of Pegasus, the winged horse of Greek mythology, atop the Mobil Oil headquarters (now the Magnolia Hotel). Pegasus was Mobil Oil’s mascot, and the figure of the legendary horse has lit up the Dallas skyline for decades.

Moya recalled the story of Pegasus from Greek mythology — how the warrior Bellerophon captured and tamed the flying beast only to be thrown from the horse as he tried to ride it to Mount Olympus.

The Pegasus Insurance Group of Companies was born.

“I started telling people, if you ride with us, you will be above your competition,” Moya said.

Today, Pegasus is a $14 million company with headquarters in San Antonio, Texas, and Albuquerque, New Mexico. Moya, his wife, Gale, and their three children run a company focused on serving Hispanic consumers.

“I was Hispanic before Hispanic was cool,” Moya said, adding that he grew up speaking only Spanish until the age of 14.

Moya was born and raised in Grants, New Mexico, a small town that was a center for uranium mining between the 1950s and the 1990s. “Our town was mostly Hispanic, although we didn’t notice that in those days. I came from no money, but I came from a lot of love. My parents were the two greatest people in the world,” he said.

At a young age, Moya felt called to the Catholic priesthood, so he left Grants at the age of 14 to attend St. Francis Seminary in Cincinnati. Moving to Ohio resulted in some culture shock.

“In the East, people talk differently. They have supper and they drink pop; they eat crazy things like sausages and Brussels sprouts, which was totally different from where I grew up.”

A change of plan

Moya graduated at the age of 23 and took some time off to discern whether the priesthood was his life’s work. He returned home to Grants and needed a job.

“I found work going door to door and collecting life insurance premiums for $100 a week,” he said. “That was back in 1974, so I have been in the business for 50 years now.”

Moya soon realized he couldn’t live on $100 a week, so he began selling life insurance. He sold 526 policies in his first year in the business, and thoughts of entering religious life were pushed aside.

He found his early success by upselling what customers were buying.

“Back then, it was mostly housewives who paid the premiums I collected, and I found that the agents who were there before me had sold them small policies — $500, $1,000 — and I would go in and say, ‘Well, funerals cost a lot more than that. Don’t you think you should add another $1,000 or $2,000 to that?’ And I started setting sales records.

“After my first year in the business, I thought, ‘Maybe this isn’t too bad of a way to make a living.’ And I liked getting dressed up and wearing suits every day!”

As Moya learned more about life insurance, he discovered products such as universal life, which he believed would make a difference for his clients.

“I thought it really felt right, for the consumers that I was dealing with,” he said. “My people couldn’t afford a lot, but they wanted a lot of life insurance, and I wanted to be able to provide that.”

Wanting to do more

Moya left the company he started with and eventually became a manager for a major carrier. But he wanted to do more and decided to go independent.

“Sales were going very well, and soon I was attracting attention from some of the companies,” he said. He eventually became an MGA.

“I didn’t even know what an MGA was, but they said they would help me recruit agents,” he said. “So they recruit agents and I tell the agents, ‘Let me tell you what I do. If you do it, you’re going to do well. If you don’t do it, well, you can keep on going the way that you’re going.’ And my story was basically: You must be focused. You must be persistent. Don’t leave the house until they throw you out.”

Business continued to grow, especially among Hispanic consumers. Moya paid attention.

“I noticed that my Hispanic agents stayed with me while my other agents would come and go. So I decided we would focus solely on the Hispanic market.”

But he found it was difficult to get carriers interested in focusing on this growing demographic.

“I would go to the carriers and say I needed material written in Spanish. And the companies would say the Hispanic population doesn’t have a lot of money, and they would question their mortality rate.”

An untapped potential

Moya persisted and his knowledge of the Hispanic community backed up his pleas for the industry to take this ethnic group seriously. Eventually, the carriers he worked with began to realize the potential of the Hispanic market.

“Hispanics are very family oriented,” he said. “But I don’t think the insurance industry — which is still mostly white men — understand what that means. For example, when there’s a funeral, you have to go. That’s part of our culture.”

Risk aversion also is something common to Hispanics, he said.

“We don’t want to take a big risk; we don’t want to lose money. We’re afraid of the stock market because we don’t want to risk losing money.”

It’s a myth that most Hispanics are poor, Moya said. “We are growing faster than any other group in the U.S., we are becoming wealthier and we are starting businesses.”

Moya said that to be successful in serving the Hispanic market, an advisor must know that many Hispanic men have an aversion to life insurance.

“We’ve heard every excuse. ‘Well, a cousin of mine bought life insurance and he died two weeks later. No, we don’t want to do that.’ Or, ‘When she gets all that money, the boyfriend is going to take it.’ Or, ‘I don’t want another bill.’”

Storytelling is key to overcoming objections, Moya said. He uses his own family as an example.

“I went to my father 10 years before he died and said, ‘We need to get you life insurance. You’re 10 years older than Mom. If something happens to you, who will take care of Mom?’ And he said, ‘You’re going to take care of Mom.’ And I said we would get him life insurance and I would pay the premiums, but eventually he took over paying them. Some years after Dad died, Mom needed to go to assisted living and she stayed there for 15 years. Where did she get the money to pay for that? From his life insurance. I invested the death benefit and kept it safe so she would be taken care of.

“You have stories. You need to use them, and people need to hear them.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Giving back: It’s a family affair

Advisor News

- Is a Roth IRA conversion key to strategic tax planning?

- Regulator group aims for reinsurance asset testing guideline by June

- Bessent confirmed as Treasury secretary

Former hedge fund guru to oversee Trump's tax cuts, deregulation and trade changes

- Jackson National study: vast underestimate of health care, LTC costs for retirement

- EDITORIAL: Home insurance, tax increases harm county’s housing options

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Many died in sober living homes due to fumbled fraud response

- Let's talk about Long Term Care insurance

- Many died in sober living homes as Arizona officials fumbled Medicaid fraud response

- Peter Daniel: Government mandates are driving up healthcare costs in NC

- NC bill would limit insurers' prior authorizations

More Health/Employee Benefits NewsLife Insurance News

- Legals for January, 31 2025

- Automatic Shelf Registration Statement (Form S-3ASR)

- Best’s Special Report: Impairments in US Life/Health Insurance Industry Jump to 10 in 2023

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of Solidarity Bahrain B.S.C.

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of First Insurance Company

More Life Insurance News