Everyone needs financial literacy education

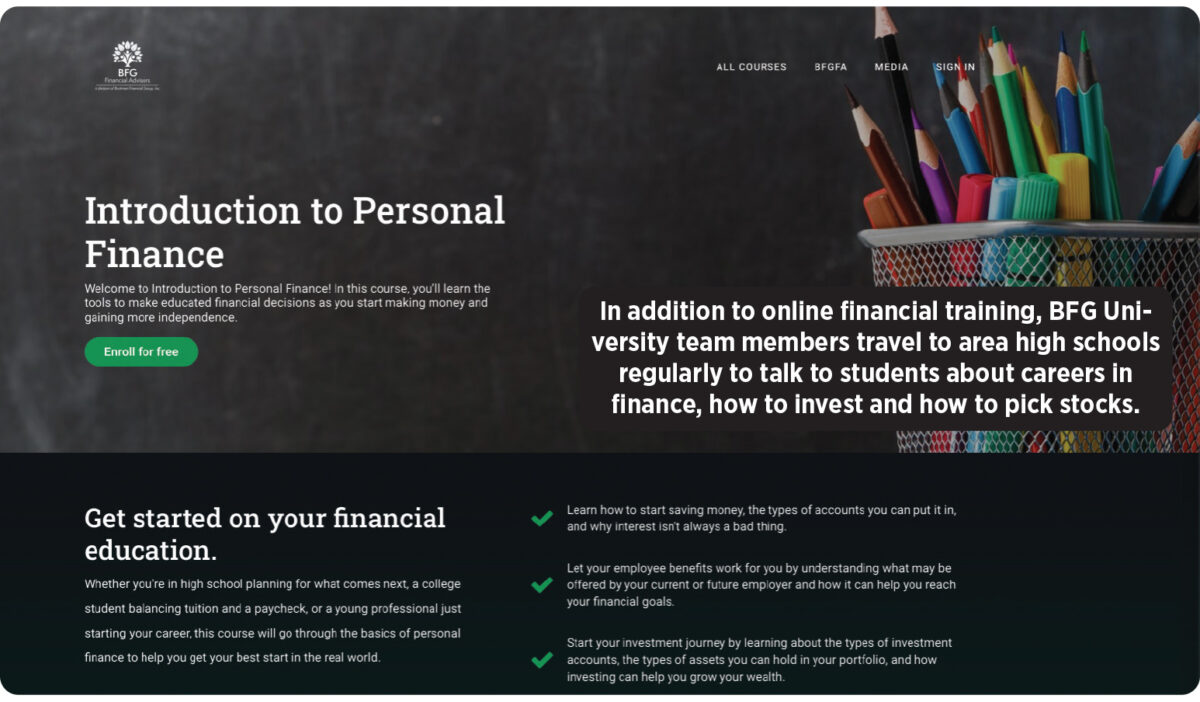

Lena Nebel and the rest of the team at BFG Financial Group saw a need to teach young people about financial literacy concepts. So they created a university to do just that.

Nebel is president and chief operating officer at BFG Financial Group, located in Timonium, Md. She said the company’s interest in providing financial literacy education stems from the company CEO Eric Brotman’s desire to teach others to free themselves from debt and have a secure retirement. Brotman is the author of three books, including Don’t Retire…Graduate!: Building a Path to Financial Freedom and Retirement at Any Age; Retire Wealthy: The Tools You Need to Help Build Lasting Wealth – On Your Own or With Your Financial Advisor; and Debt-Free for Life: The Tools You Need to Free Yourself from Debt.

“BFG University starts with students in their freshman year of high school and going into their senior year, starting with the basic financial topics and then getting into the more advanced topics,” Nebel said.

She added that BFG University was born from the firm’s marketing department. “They saw there is this need among individuals who are underserved in the financial community,” she said. “With our CEO writing this book about retirement being like graduation, we started brainstorming how to present this information in a university-like program.”

Nebel and the other members of the BFG team travel to area high schools regularly to talk to students about careers in finance, how to invest and how to pick stocks. Nebel often works with investment clubs in local high schools.

BFG University and related financial literacy programs are among the ways financial professionals give of their time and expertise to help members of their communities improve their financial knowledge.

The need for financial literacy education continues to grow. Consider these statistics from zippia.com:

• 73% of teens want a more personal finance education.

• Americans lose an average of $1,819 annually due to financial illiteracy.

• 77% of Americans are financially anxious.

• Only 25% of American teens have confidence in their personal finance knowledge.

“We do go into schools and talk about financial topics as much as we can, because unfortunately a lot of young people, even when they get into college, aren’t aware of some of these things,” Nebel said.

BFG also created a program called Financial Planning for All.

“It allows any individual, regardless of their assets, to work with a Certified Financial Planner,” Nebel said. “Many of our peers in this industry require clients to have a minimum amount of assets before they will work with them. We partner with a lot of firms and form strategic alliances. We call it ‘collaboration over competition,’ where we can meet with clients and help them because there are a lot of people who need planning advice, but they may not have any money.”

Nebel said she started an investment club at York College of Pennsylvania when she was a student there. She loves to work with Junior Achievement and high school students to teach young people about the stock market.

“There are high schools in our area that have an investment club, where they begin picking stocks on Sept. 1 and the students’ portfolio runs until the end of the school year. And I work with Junior Achievement on their stock market challenge. I’m a trader for the day, so I run back and forth to the tables where the kids are placing orders. It’s a lot of fun.”

Nebel said she believes financial literacy education should begin as early as possible. “I think the more we can talk about these issues and emphasize the importance of starting early, the better.”

Not just for kids

Financial literacy education isn’t just for students. Adults need help in understanding an array of financial topics. Protection Point Advisors in Roseville, Calif., uses everything from webinars to a network of professionals to provide financial education for clients and nonclients alike.

“We have something called 3-D Asset Care, which is a series of monthly webinars on topics that are important for our clients,” he said. The topics are not confined to financial planning matters. For example, 3-D Asset Care conducted a webinar on “Reverse Mortgages: The Good, the Bad and the Ugly.”

“To my knowledge, there’s no one in my firm who even holds a mortgage broker license, so it wasn’t about generating business,” he said. “It’s more because clients are asking about reverse mortgages as property values go up and there’s a lot of equity stored in people’s houses.”

Heck said his firm also offers financial literacy education to its clients as well as clients’ children and grandchildren.

“We have a financial education system that’s accessible through our website,” he said. “It has hundreds of modules in 17 or 18 different categories — everything from budgeting and spending to buying a car or a house, debt management, taxes, workplace transition. We make all that available to our clients when they come on board with us, but we also encourage them to give their children and grandchildren access to that information.”

Heck described his firm’s financial education system as “real-world topics, things that will benefit people, especially people who are just starting out, because these are things that aren’t taught in school anymore.”

The founders of Protection Point Advisors created the National Referral Network, in which they teach professionals such as accountants, insurance agents, mortgage brokers and real estate professionals how to educate and deliver value to their clients. Heck said that his company produces a weekly podcast with different professionals within the network to discuss various financial education issues. He also writes articles regularly for LinkedIn and industry publications.

When it comes to educating people about financial issues, Heck said most of those he works with want guidance more than anything else.

“They want guidance as to what they can do to empower themselves, to know more about the direction in which they want to go, because a lot of people know where they want to go but they usually don’t know how to get there. So what they are largely looking for is, ‘OK, John, this is where we’re at and how do we get from Point A to Point B?’”

Heck said his company was inspired to take on financial literacy education after its founders acknowledged that people often are uncomfortable discussing financial topics.

“We asked ourselves, ‘How can we do this differently? How can we do it better?’ That’s where all this came from — from a place of asking ourselves how we can add more value to the client relationships we have.”

Repairing the disconnect

When Nadia Vanderhall first started working in marketing for financial services companies, she noticed a disconnect between the information consumers needed to make financial decisions and the information that was out there. So she set out to fix it.

“I create content and educate people on different topics that are within the personal finance space,” she said.

Vanderhall’s content appears on several platforms, including YouTube, Facebook, Instagram, LinkedIn and X.

“People like to digest content in different ways,” she said. “And I find that I can talk about the same thing on all those platforms. But people can get a different perspective, depending on the channel.”

Vanderhall’s content covers topics around budgeting, investing and saving. “I want to give people information that will be relevant to what they are trying to do to reach their financial goals,” she said.

What consumers most need in terms of financial education, she said, is cutting through the clutter of advice that’s out there.

“They need someone to give them guidance and confirmation on how to reach their goals from where they are right now,” she said. “Do they need to make any changes to what they’re currently doing? What is that change? Will it be easy to do? People need someone to give them a concise plan and be their ally and help them make that goal a reality.”

Vanderhall’s YouTube channel is called “NV Knows” (@NVKnows). She discusses financial topics that are in the news or that she knows people are talking about.

For example, a recent video focuses on money trends, including “girl math,” “loud budgeting,” “YOLO spending” and “doom spending.”

“If I see a financial topic that people are talking about — for example, inflation — I give a spin to it. This connects back to what I notice people are talking about, and I use it as market research.”

One of Vanderhall’s motives in using social media channels to teach financial literacy is a desire to show consumers that they don’t have to be wealthy to access financial advice.

“When people hear the words ‘financial planning,’ they automatically feel that it’s for the affluent,” she said. “But I believe planning and education are not necessarily for the affluent but for people who need to be able to afford their lives.”

Connecting all the dots

Students need financial literacy education. The financial services industry needs new blood. Kimberley Brown is connecting the dots to fulfill both sets of needs.

As part of her work with the coalition, she works with institutions of higher learning that target Black, Hispanic and Native American students to educate those students about careers in the industry. But she also sees a need for young people to learn more about their own finances.

“I talk to them about understanding budgeting. I discuss how you can’t save and plan for retirement when you’re carrying so much student debt.”

Brown said she believes financial literacy education changes students’ lives and then has wider implications.

“I want to change that student’s life because they’re going to be educated on financial topics that perhaps they’ve never heard before,” she said. “I’m going to help students or early-career entrants understand how to save and plan for retirement. I’m going to help them understand that retirement is not about a pension — it’s about your 401(k) or any other type of retirement plan you participate in.”

Brown said that after she helps a young person understand financial concepts such as retirement planning, “I expect they will take that same information and have a conversation in their household, in their church community and then begin the transformation of their community.”

The coalition is expected to work with 20,000 students this year. Brown said the coalition operates what she calls “virtual handshake career fairs” online in which coalition members discuss careers in the wholesaling sector. But there’s a financial literacy component as well.

“We talk about LinkedIn and resume writing,” she said. “We have an internship experience where I also do presentations about saving and retirement and the financial implications of staying in college an extra year versus graduating in four years.”

There are many opportunities for students to learn about careers. And there are programs to teach students about financial literacy. But Brown said there is a need to incorporate both into a single program.

“Nobody is connecting all the dots. Nobody is explaining why you need to budget in the swipe-debit card era we live in. We need to get back to the basics and explain why these things are important. We need to explain to students that the decisions they make today will impact them 30 years later. But you have to make those conversations meaningful in order for them to be transformative.”

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

The need for speed — With Sammons CEO Esfand Dinshaw

The ‘triple whammy’ keeping women from saving for retirement

Advisor News

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual reports strong 2025 results

- The silent retirement savings killer: Bridging the Medicare gap

More Advisor NewsAnnuity News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

More Annuity NewsHealth/Employee Benefits News

- Wellpoint taps Rachel Chinetti as president

- Proposed changes to MA and Part D would harm seniors’ coverage in 2027

- Pan-American Life Insurance Group Reports Record 2025 Results; Premiums Reached $1.86 Billion and Net Income Totaled $110 Million as Company Enters Its 115th Year

- LightSpun and Smile America Partners Announce Partnership to Accelerate Dental Provider Enrollment to Expand Treatment for 500K Underserved Kids

- Lawmakers try again to change ‘reflection in the mirror’ for cancer patients

More Health/Employee Benefits NewsLife Insurance News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- LIMRA: Individual life insurance new premium sets 2025 sales record

- How AI can drive and bridge the insurance skills gap

- Symetra Partners With Empathy to Offer Bereavement Support to Group Life Insurance Beneficiaries

- National Life Group Ranked Second by The Wall Street Journal in Best Whole Life Insurance Companies of 2026

More Life Insurance News