Corebridge Financial reports strong Q1 results

Corebridge Financial completed a big week with a strong first-quarter earnings report as it prepares for life as a standalone company.

Corebridge reported first-quarter net income of $878 million, compared to a loss of $459 million in the year-ago quarter. Peter Zaffino, CEO of parent company American International Group, said Wednesday that full separation of Corebridge could be completed by the end of the second quarter.

"We grew our earnings by pursuing profitable organic growth with focused execution, and leveraging our broad product suite and distribution platform to help meet the needs of an aging U.S. population," said CEO Kevin Hogan. "We see a growing generation of advisors who are becoming more aware of the value of annuities in helping their clients prepare for retirement."

The financial services company posted revenue of $5.85 billion in the period, beating Wall Street forecasts. Four analysts surveyed by Zacks expected $5.5 billion.

Strong annuity sales

As AIG's longtime life and retirement unit, Corebridge started life from a strong position. It finished 2023 with $23.6 billion in annuity sales, ranking third in LIMRA's sales rankings. The hot sales continued into the new year, said Elias Habayeb, chief financial officer.

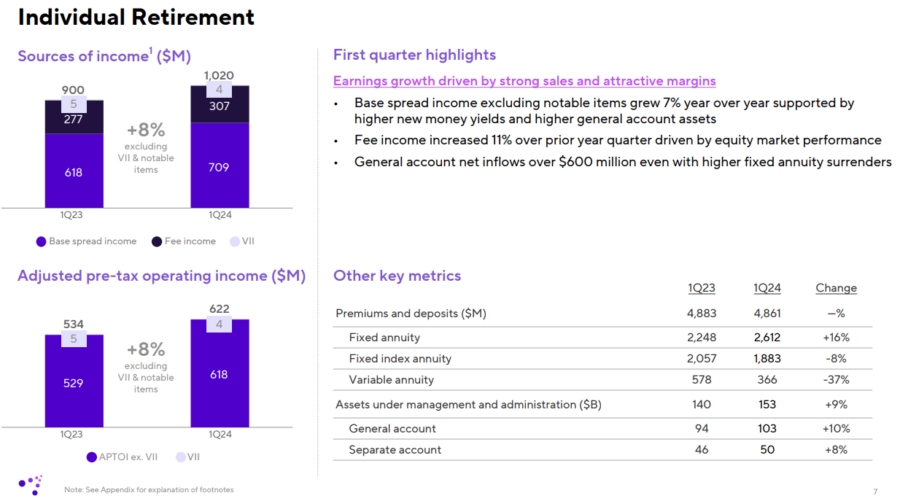

The Individual Retirement segment "delivered positive general account net flows of over $600 million in the quarter, even with an elevated fixed annuity surrender rate arising from a large block exiting its surrender charge period," he said. "Our surrenders peaked at the beginning of the quarter, but trended lower continuing into April. At the same time, we saw monthly sales of fixed annuities steadily increase from January and that trend continued into April."

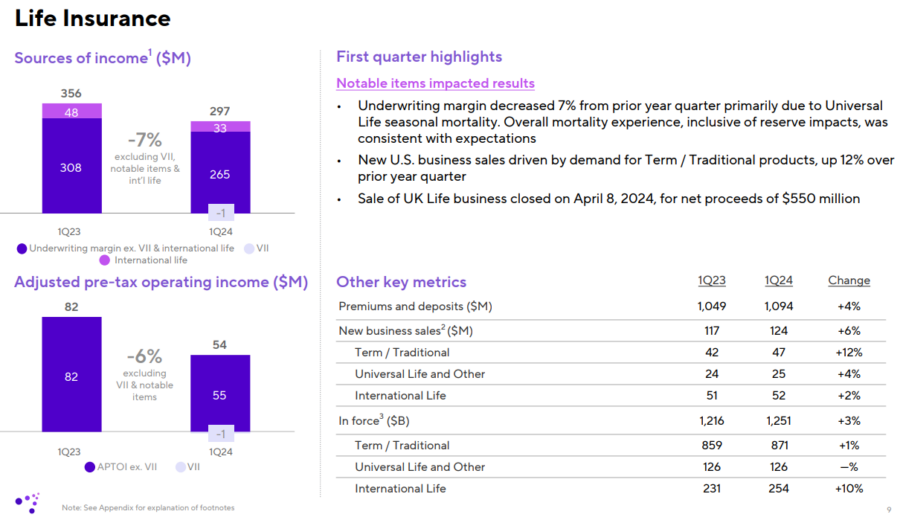

On the life insurance side, demand increased during Q1. Corebridge closed a deal last month to sell its UK life insurance business (operating as AIG Life Limited), to Aviva plc for $550 million.

"With this transaction now closed, we are fully focused on life and retirement products and solutions in the world's largest life insurance market, the U.S.," Hogan said.

Overall, adjusted pre-tax operating income was $837 million, and grew 20% when variable investment income is removed. Corebridge credited higher base spread income, higher fee income and lower expenses, partially offset by lower underwriting margin driven by the sale of Laya Healthcare and one-time reinsurance-related items in the Life Insurance segment.

Corebridge sold Laya Healthcare to AXA for a 650 million pounds late in 2023. Laya, the second-largest health insurance provider in Ireland, is a full-service managing general agent headquartered in Cork, Ireland, and offers a diverse suite of innovative health insurance benefits and services in the Irish health insurance market, along with life insurance and travel insurance.

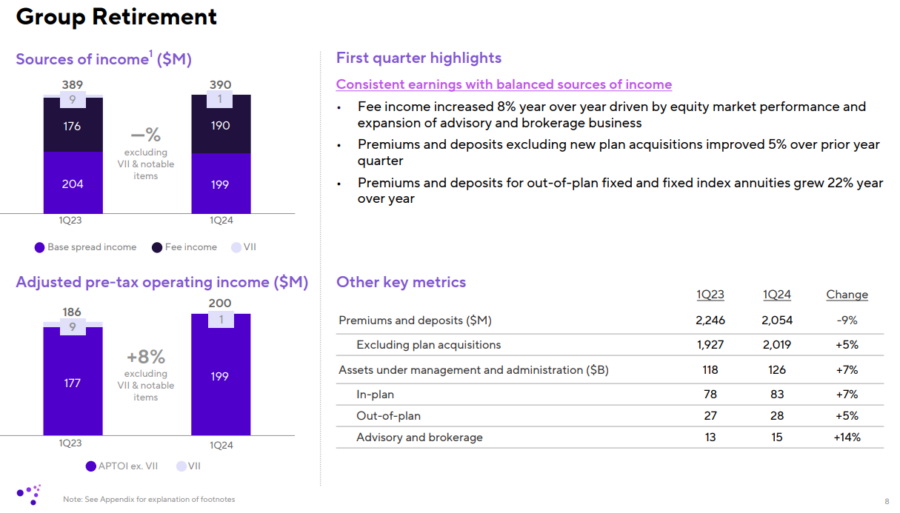

In the Group Retirement segment, premiums and deposits decreased $192 million, or 9%, from the prior year quarter due to lower plan acquisitions and out-of-plan variable annuity deposits, partially offset by higher in-plan deposits along with higher out-of-plan fixed annuity and fixed index annuity deposits, Corebridge said in a news release.

"Our in-plan business in group retirement exceeded an average age of 59 and a half about 10 years ago," Hogan said. "That kind of tracks with the aging of the in-plan business across the industry ... even in the 401(k) part of the market. We've seen an incremental increase in the average age, I think now it's in the low 60s for the in-plan business."

DOL rule thoughts

Hogan was asked for reaction to the Department of Labor's Retirement Security Rule, which seeks to make nearly all life insurance and annuity transactions subject to a fiduciary standard. The Federation of Americans for Consumer Choice filed a lawsuit in a Texas federal court Thursday to stop the Department of Labor fiduciary proposal from taking effect.

Still, the significant initial standards will be effective Sept. 23 unless the court intervenes. Hogan indicated little concern for what happens with the rule.

"We understand our obligations. We'll be prepared to implement what is necessary," he said. "The industry has essentially implemented something like this before, and we did it as well and we're prepared to do so again."

Most of Corebridge's business is already transacted under fiduciary or fiduciary like standards, Hogan noted.

"We have a small participation in the [independent marketing organization] channel," he added. "It is an important channel because it reaches a different demographic. It's something that strategically we're trying to develop. We're still studying the final rule, but we'll be prepared to implement it. We think it's important to have a common standard of care that everyone understands."

Clarification: A previous version of this story indicated that a 2022 AIG stock offering on Corebridge took place recently.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Inflation is still the top financial challenge for many Americans

Allstate earnings stages Q1 comeback; revenue up 10.7% to $15.3B

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- Researchers from Pennsylvania State University (Penn State) College of Medicine and Milton S. Hershey Medical Center Detail Findings in Aortic Dissection [Health Insurance Payor Type as a Predictor of Clinical Presentation and Mortality in …]: Cardiovascular Diseases and Conditions – Aortic Dissection

- Medicare Advantage Insurers Record Slowing Growth in Member Enrollment

- Jefferson Health Plans Urges CMS for Clarity on Medicare Advantage Changes

- Insurance groups say proposed flat Medicare Advantage rates fail to meet the moment

- As enhanced federal subsidies expire, Covered California ends open enrollment with state subsidies keeping renewals steady — for now — and new signups down

More Health/Employee Benefits NewsLife Insurance News