Consumer Confidence In Agents And Insurers At All-Time High

Two years into the pandemic, people are still uneasy about the economy, the effects of inflation, and the health and well-being of their family members. According to LIMRA research, only three in 10 Americans said their lives are, for the most part, “back to normal.”

In light of COVID-19, nearly half of those surveyed said financial issues became more of a priority. A third of workers said their employment is more important today than it was before the pandemic.

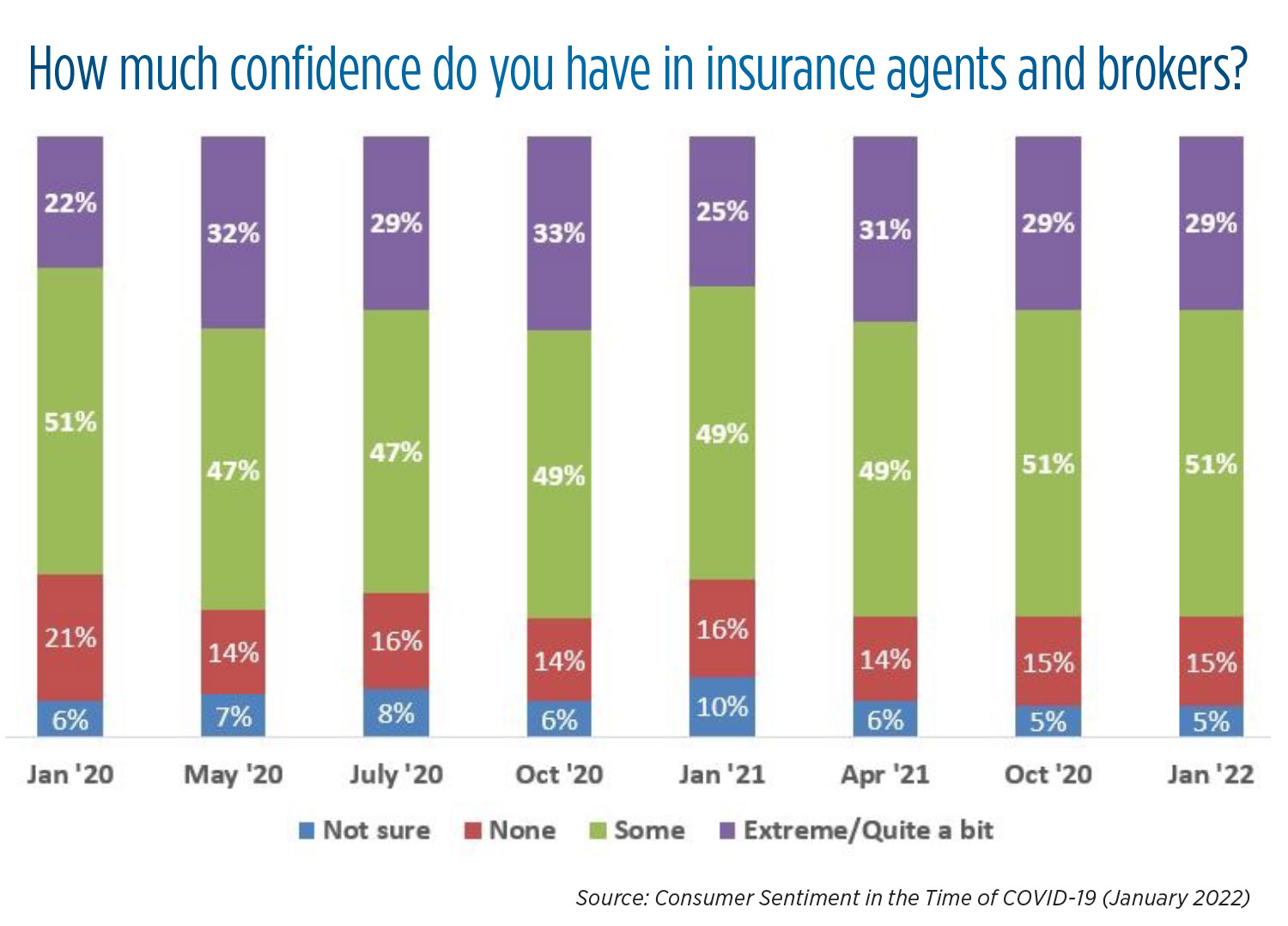

Although consumers may be unsure about their financial situations, consumer confidence in the financial services industry is at or above pre-pandemic levels. When it comes to life insurance companies, 38% of consumers said they were “extremely” or “quite a bit” confident. Our research also shows consumer confidence in insurance agents and brokers accelerated during the pandemic, with 33% of consumers saying they were “extremely” or “quite a bit” confident. This is the highest level of confidence recorded since LIMRA began this survey in 2008 to gauge consumer opinion of the economy and the financial services industry.

The pandemic also had more Americans saying they planned to purchase life insurance. LIMRA research shows COVID-19 has increased awareness about the importance of life insurance. In general, 31% of Americans say they are more likely to purchase coverage due to the pandemic.

According to our research, approximately 73 million Americans own life insurance but know they need more. This perception of the need for (or the need for more) life insurance was particularly pronounced among women, Blacks and Hispanics.

Even before the pandemic, the proportion of women with life insurance coverage was falling. Today, only 47% of women have coverage, compared with 58% of men. For Black Americans, the pandemic had a significantly higher impact on their perceptions of life insurance. Four in 10 Black Americans said they were more likely to purchase life insurance due to the pandemic, compared with only 31% of the general population. Similarly, almost four in 10 Hispanic Americans (37%) said they are more likely to purchase life insurance due to the pandemic.

Our hope is that this increased interest in life insurance, along with increased confidence in the companies and agents that provide it, will translate to more people getting the life insurance they need in order to protect their loved ones.

We’re already seeing an uptick in individual life insurance sales as people have become more aware of the financial impact of losing the primary breadwinner. Life insurance premium increased 20% and policy sales grew 5% in 2021, representing the highest annual growth since 1983.

With the COVID-19 pandemic highlighting Americans’ financial vulnerability, it is becoming even more critical for our industry to engage and educate consumers about the important role life insurance plays in a family’s financial security.

This is one of the reasons LIMRA is continuing its Help Protect Our Families campaign. We are working with seven other trade associations and 76 insurance companies and distributors to raise industry awareness of the role life insurance plays in providing peace of mind and financial security.

As an industry, there is so much we can do to have a positive impact on consumers’ financial concerns and reduce the number of Americans who are financially at risk because they do not have the life insurance coverage they need.

John Carroll is senior vice president, LIMRA and LOMA. He may be contacted at [email protected].

How To Successfully Frame Client Expectations

Ripples On A Pond? Or Spaghetti Thrown Against The Wall?

Advisor News

- The ‘guardrails approach’ to retirement income

- Is there a mismatch between advisor marketing and consumer preferences?

- State health plan users may see premium increases under SC House budget proposal

- Advisor: SEC trying to ambush my defense on bad annuity sales charges

- Partner split: Grant Cardone and Gary Brecka swap charges in dueling lawsuits

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Idaho bill to require coverage of supplemental breast cancer screening to at-risk patients advances

- Bills aim to address pharmacy closures

- Business marketplace

- Congress considers cuts that could impact Medicaid

- President of Insurance Brokerage Firm and CEO of Marketing Company Charged in $161M Affordable Care Act Enrollment Fraud Scheme

More Health/Employee Benefits NewsLife Insurance News

- Atlantic Coast Life Insurance Company and Southern Atlantic Re Vindicated in South Carolina Administrative Law Court Order

- Northwestern Mutual sees record dividend, surplus

- IUL vs. annuities: Settling the debate

- While U.S. mortality spike is normalizing, 5 troubling trends continue

- Whole life vs. term life: The great debate

More Life Insurance News