Big, Beautiful Tax Changes

The federal tax outlook changed dramatically when Donald Trump defeated Joe Biden in November 2024 — both for the short term and the long.

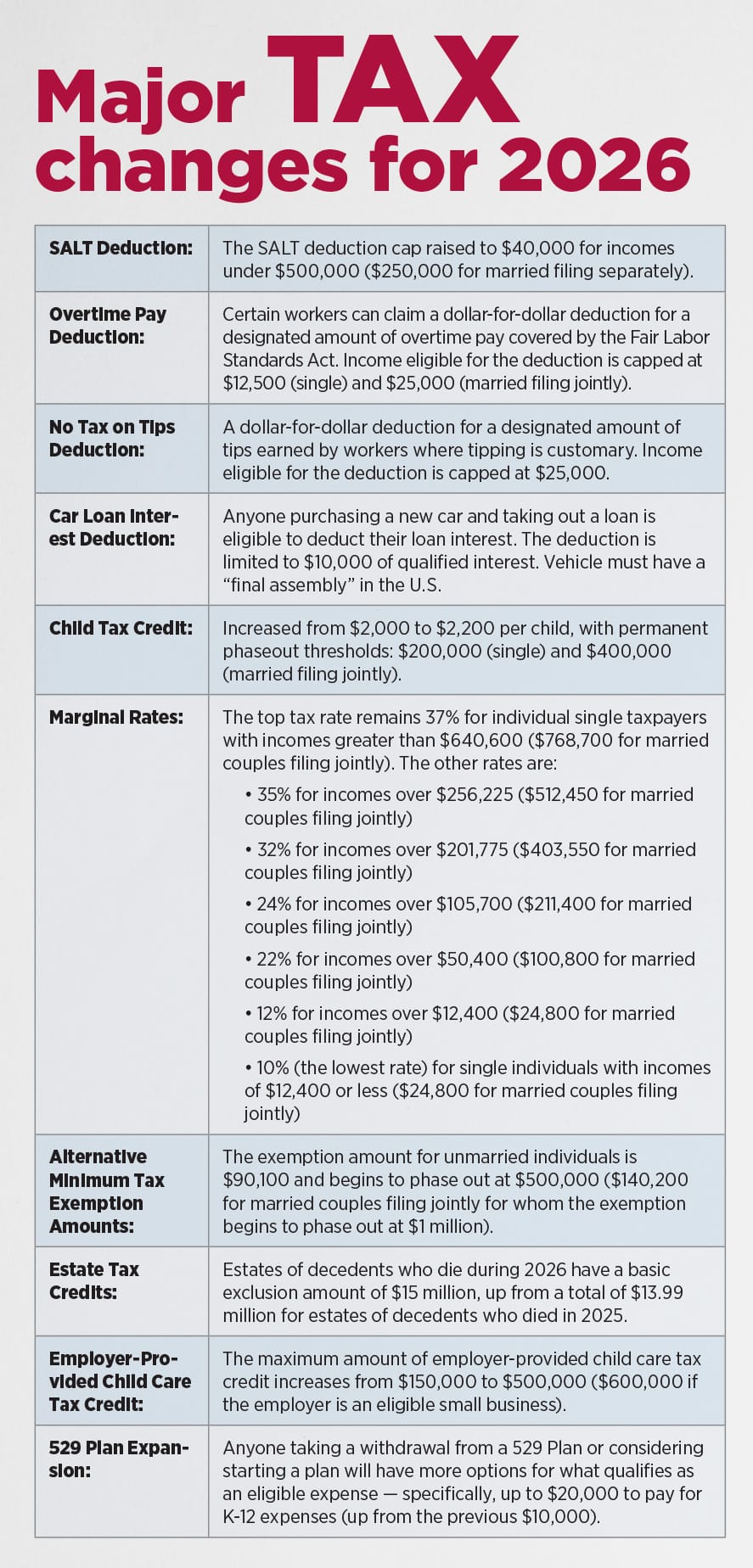

For starters, it meant that the Tax Cuts and Jobs Act of 2017 — Trump’s signature accomplishment from his first term — could be extended. Congress did so in July.

The One Big Beautiful Bill Act extended a foundational change to the entire structure of federal taxation and will result in billions of dollars remaining in the hands of taxpayers over the coming decade. Much of that money will end up in investments, annuities, life insurance and individual retirement accounts.

Winners in the “Big Beautiful Bill” tax policy include high-income earners, families with dependents, small business owners and estate planners.

One of the biggest tax changes is to the estate tax exemption. The OBBB permanently increases the federal lifetime gift, estate and generation-skipping transfer tax exemptions to $15 million per person ($30 million for married couples) starting Jan. 1, 2026, with future increases indexed for annual inflation.

The new law repealed the TCJA’s sunset provision, which would have reduced the exemption to about $7 million per person in 2026. That is a major tax change for high-net-worth clients.

But Joseph Spada, private wealth advisor at Summit Financial, cautions clients not to attach too much weight to the word “permanent.”

“Some clients feel like, ‘Well, since it’s permanent, I don’t really need to do anything, because it won’t get cut in half,’” Spada said. “Well, if they have the money, they still should. Because it may not be permanent six years from now, and whatever you get out of your estate now is gone.”

Charitable giving rules overhauled

One of the biggest tax changes the OBBB makes involves charitable giving. In fact, Steven Cashiola, a California-licensed certified public accountant, said taxpayers who itemize would be wise to accelerate any charitable giving into 2025.

Starting next year, there is an above-the-line deduction of up to $2,000 (married filing jointly) for taxpayers who do not itemize, Cashiola explained. This is a new benefit available for the majority of taxpayers in 2026.

Taxpayers who itemize will see several limitations take effect. For starters, deductions (cash and noncash) will be subject to a floor of 0.5% of adjusted gross income. Similar to medical deductions, charitable contributions below 0.5% of adjusted gross income will not be allowed.

“Taxpayers in the 37% marginal bracket lose the effectiveness of the deduction,” Cashiola noted. “Beginning next year, allowed charitable deductions will be limited to a 35% benefit. This loss is permanent and not available to carry over to the following year.”

The state and local tax deduction also changed significantly in the OBBB. Taxpayers who itemize their deductions to reduce their federally taxable income can deduct up to $10,000 for 2024 or $40,000 for 2025 — of property, sales or income taxes already paid to state and local governments.

This SALT cap was originally set at $10,000 by the TCJA. However, the OBBB increased the cap to $40,000 for 2025, subject to a phasedown. The SALT deduction can be especially attractive for taxpayers in high-tax states and for high-income filers as it avoids double taxation.

The new schedule calls for a phase-down of the $40,000 SALT cap for individual taxpayers or couples making above $500,000, at a 30% rate. The phase-down threshold increases by 1% each year through 2029. As income rises, the $40,000 SALT cap phases down to $10,000, meaning that the highest-income taxpayers can deduct up to $10,000 in SALT.

SALT reverts to the $10,000 limit (previously set by the TCJA) in 2030, with no income limits.

When analyzing the highest average deduction claimed in each state, the Bipartisan Policy Center found coastal states (California, Connecticut, Maryland and New York) and other selected states (Illinois, Minnesota and Utah, for example) generally see the largest deductions.

“It is likely that with the increased deduction cap, these states will see an even greater benefit compared to states with relatively small average deductions, such as Wyoming, South Dakota, and North Dakota,” the BCP wrote in its analysis.

HNW tax strategies

There are a number of HNW tax strategies, many of them traditional options, that became clearer once the OBBB passed. Employing these strategies can save wealthy clients a substantial amount of money in taxes, Spada said.

The biggest change for wealthy taxpayers is the estate tax exemption, bar none, he said.

“If you’re a high-net-worth person, the biggest benefit is to maintain the $30 million lifetime exemption, because if that got cut in half, it would have been $15 [million],” Spada said. “That extra $15 million is saving your family 40% in estate tax, plus that’s growing an index for inflation. So that by far outweighs anything else in these changes.”

Many wealthy clients will set up an LLC or create a partnership to remove money from their taxable estate, he explained.

“They’ll put $50 million of real estate in a partnership and discount to get down to $30 million using lack of marketability, lack of control, discounts and give 99% of those limited partnership units to their kids,” Spada said. “There’s nothing new about that. People have been doing that for years, but still a lot of reason to get that money out as soon as you can.”

Tax-loss harvesting — selling investments at a loss and using those losses to offset gains in other investments — is something wealthier clients should be looking at every year. Clients can then take the money from the sale and use it to buy an investment that fills a similar role in their portfolio.

When clients tax-loss harvest, they’ll pay taxes on realized capital gains for the year, meaning they’ll only consider their net gains — the amount gained minus any investment losses they realized.

“The harvesting benefit is tax deferral,” Spada said. “If you don’t have to pay the tax now, those tax dollars stay with you in your portfolio. That’s the first benefit. But for wealthy people, they will always own stocks and they can hold their stocks and die with them. They get a step-up in basis, and they never have to pay tax.”

Other HNW tax strategies, some in concert with estate planning, include:

Lock in lifetime gifts. Even though the estate tax exemption increased permanently, clients should consider making substantial gifts to take advantage of high valuation levels. Future growth of a taxable estate can be slowed by gifting appreciating assets sooner.

Optimize trust structures. The increased estate tax exemption means the focus of trusts can shift from tax reduction to income tax efficiency. This can be accomplished through the use of irrevocable trusts, such as spousal lifetime access trusts or grantor retained annuity trusts, to transfer assets while leveraging valuation discounts.

Maximize tax-advantaged accounts. Maximize contributions to any tax-advantaged accounts, such as 401(k)s, IRAs and health savings accounts to reduce taxable income. For business owners, options like SEP IRAs or defined benefit plans can allow for even higher tax-deductible contributions.

Small business tax changes

The OBBB included plenty of good tax news for businesses as well. Small business owners can take advantage of these tax breaks immediately for expenses dating back to Jan. 20, 2025.

“Competitive, pro-growth tax policy is essential to strengthen the economy and raise wages for workers,” the U.S. Chamber of Commerce said in a statement following the OBBB passage.

Here are the significant business tax changes in the OBBB:

Permanent qualified business income deduction: Makes permanent the 20% deduction for QBI, with phaseout ranges expanded, thresholds indexed for inflation and a $400 minimum deduction introduced.

Expanded Section 179 expense deduction: The deduction limit is raised to $2.5 million with a $4 million phaseout threshold for property placed in service after Dec. 31, 2024. Covered examples include small businesses making new equipment or software purchases. Amounts are indexed for inflation after 2025.

Business interest limitation relief: Adjusted taxable income calculation reverts to earnings before interest, taxes, depreciation and amortization starting in 2025, easing restrictions compared to earnings before interest and taxes.

Permanent excess business loss limitation: The deduction limits for excess business losses — $313,000 for a single filer and $626,000 for joint filers in 2025 — remain in place permanently, converting excess to net operating loss carryforward.

There are still more potential tax changes to come. As this issue went to press, more than 150 organizations had called on Congress to permanently extend the enhanced premium tax credits that make health care more affordable for millions of Americans.

“Without a timely extension of the enhanced premium tax credits, more than 20 million people — including about 5 million small business owners and self-employed people, along with 6 million older adults — will see their health care costs skyrocket,” the group wrote in a letter to lawmakers.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Social Security at a Crossroads

Behavioral barriers to buying annuities (and how to overcome them)

Advisor News

- Affordability on Florida lawmakers’ minds as they return to the state Capitol

- Gen X confident in investment decisions, despite having no plan

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

More Advisor NewsAnnuity News

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

More Annuity NewsHealth/Employee Benefits News

- In Snohomish County, new year brings changes to health insurance

- Visitor Guard® Unveils 2026 Visitor Insurance Guide for Families, Seniors, and Students Traveling to the US

- UCare CEO salary topped $1M as the health insurer foundered

- Va. Republicans split over extending

Va. Republicans split over extending health care subsidies

- Governor's proposed budget includes fully funding Medicaid and lowering cost of kynect coverage

More Health/Employee Benefits NewsLife Insurance News