As insurtech investment slows, future remains cloudy

Insurtech startups arrived in a big way in recent years, propagated by millions of dollars in startup investment. The promise of insurtech has been to provide insurance faster and easier — and cheaper — relying on big data, more accurate risk assessment, technology such as telematics, and convenient apps. Investment in insurtech has slowed recently, though, and the industry may not be delivering on its initial promise.

Insurtech experienced an investment high in 2021 of $14.4 billion across 644 deals, according to Boston Consulting Group. Insurtech in Q2 of 2022 has been on course to be about 50% of the investment seen in the previous year. According to GlobalData, the value of global investments in insurtech fell by a staggering 79.6% in 2021.

“These trends are likely due to a combination of factors,” said Ben Carey-Evans, senior analyst at GlobalData, adding, “The investment into the sector has dried up somewhat.”

Insurtech has made inroads into the insurance industry, however, despite the declining valuations and reduced investments.

According to the recently released J.D. Power 2022 U.S. Home Insurance Study, “Overall, nearly one-fourth (23%) of home insurance customers are aware of insurtech offerings from companies like Lemonade, Hippo, Kin, Openly, Jetty and Trove. Among homeowners not currently insured by Lemonade but aware of the brand, 34% say they ‘definitely will’ or ‘probably will’ purchase from Lemonade if it is available in their state.”

“I think the future of insurtech investing will be with those that are designed for insurance distributors — agents, brokers, etc. — rather than those that are too focused on the direct-to-consumer market,” said Mike Brown, director of communications at Breeze, an insurtech that specializes in disability and critical illness insurance. Breeze received $10 million in series A funding in 2021.

“It’s become clear that the insurance market is a tough one to crack for new companies,” said Brown, adding, “There are just too many legacy companies and insurance professionals with too many strong relationships. It’s difficult to reach buyers … you need the agents and the brokers; they are the veins of the industry. The insurtechs that will win going forward are those that have designed streamlined online platforms that make it easier for agents and brokers to sell a product.”

‘Opportunity for new entrants’

“There is definitely opportunity for new entrants in the market, especially ones who excel at improving the customer journey and streamlining the entire digital experience,” said Eileen Potter, solution marketing leader for the insurance industry, ABBYY. “Chief among them is making onboarding easier so customers complete the entire process via their smartphone,” said Potter, adding, “This includes automatic document processing with mobile capture, identity proofing, and affirming of IDs and supporting documents — and using process intelligence to ensure the digital experience is smooth.”

“I also think there will be continued innovation in insurtechs that are created in incubators run by established insurers,” said Potter. “This enables them to market-test new products and innovate with new distribution channels. This will also give them the opportunity to use new technologies on a smaller scale before trying them out in other parts of their organizations. It’s definitely a faster and less risky way to road-test ways to use artifical intelligence, low-code/no-code and other emerging technologies in their operations.”

Potter cited Lemonade and Hippo as examples of insurtechs that are likely to succeed.

“They’ve both made similar moves with respect to making executive hires from within more established corners of the industry,” Potter said, adding, “Ultimately, I feel like the combination of innovative ideas from industry newcomers who feel unencumbered by ‘the way we’ve always done things’ combined with the business acumen of insurance veterans will be what separates insurtechs who are a flash in the pan from those who will succeed over time.”

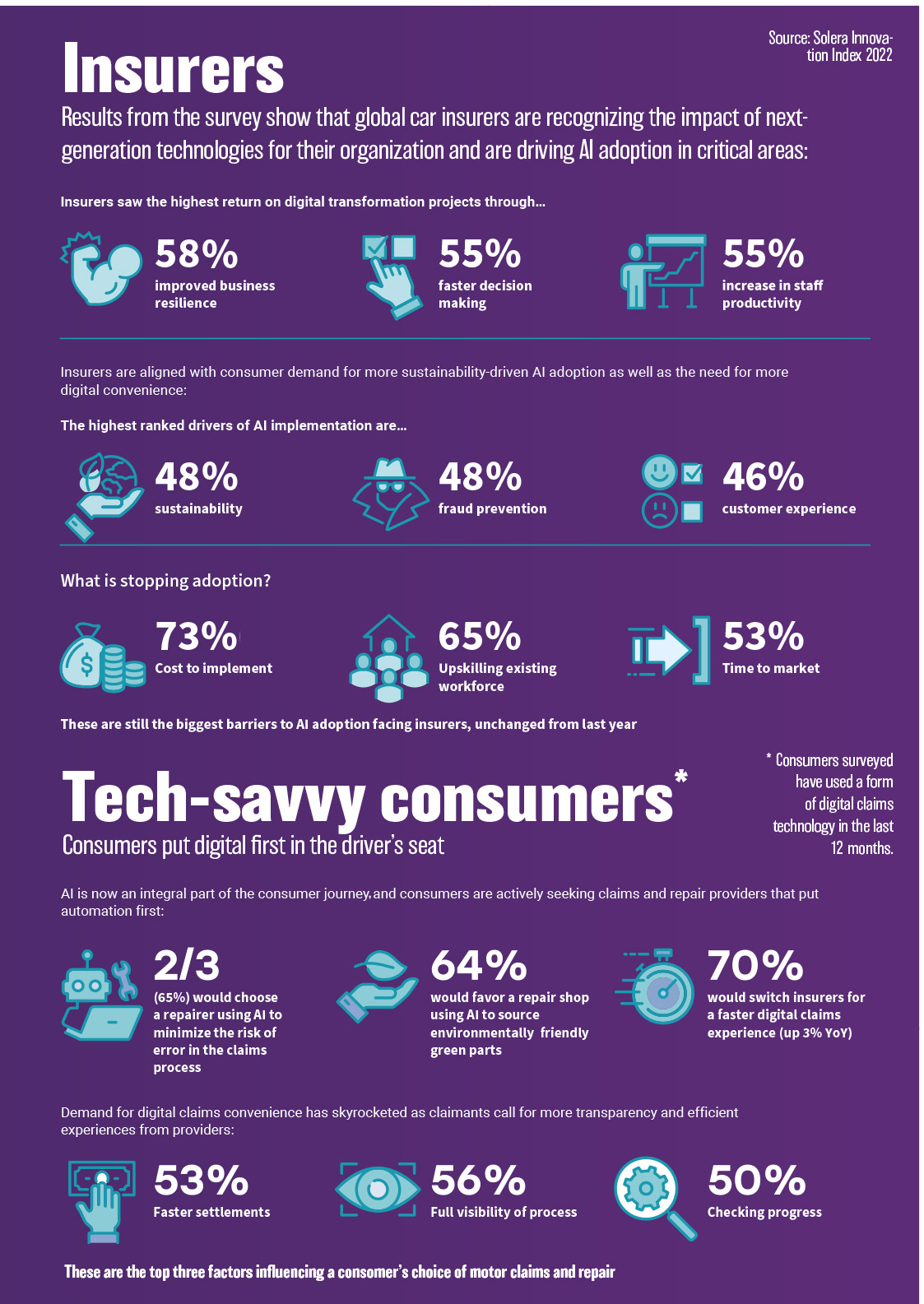

Bill Brower, vice president industry relations and vehicle claims at Solera, has a long history with traditional carriers, having worked at Liberty Mutual and Nationwide. He believes that consumers, especially after the pandemic, want to see more ease of use and convenience. “This idea of automating claims is growing in popularity with customers,” he said.

In their Innovation Index 2022 report, Solera found that 49% of tech-savvy consumers surveyed would prefer self-service when it comes to vehicle claims. “Also, 79% said they would trust automotive claims powered entirely by AI,” he said.

Consumers seek digital convenience

Since COVID-19, Brower said, consumers have become accustomed to using digital services. “They’re saying “If I’m using Amazon, if I’m using Uber, if I’m using some of these restaurant apps, they’re very easy, they’re very intuitive, and I love this. Why can’t I do more with insurance?”

He added that with carriers facing financial pressures due to inflation, workforce turnover (“the great resignation”) and supply chain issues, a move to more self-service and automation in the insurance industry is likely.

Dennis Winkler, insurance industry director with global technology research and advisory firm ISG, says that investment in insurtech has decreased for a couple of reasons.

“Leading into the pandemic, the availability of cheap capital led venture capital and private equity firms to look for new opportunities for investment returns,” Winkler explained. “In recent years, the insurance industry has been viewed as a soft target ripe for disruption. That led to a huge ramp-up in investment in insurtechs. As a result, we’re coming off a near-term high-water mark.

“The market is seeing lower valuations in the tech sector overall, and insurtech valuations are also being impacted by rising interest rates — and the fact that most insurtechs are not delivering ROI or even making money,” Winkler said. “In addition, opportunities for realizing gains on investments through initial public offerings and merger, acquisition and divestiture have diminished. An example of this lack of profitability is Lemonade, one of the higher-profile insurtechs, which lost $56 million in Q1 and $68 million in Q2.”

Winkler said insurtechs that offer complementary — rather than competitive — products to current carriers have a great opportunity to continue to fill gaps with carriers. Carriers, said Winkler, “know it is better, cheaper and faster to buy these services and software than try to build on their own. There is always risk with a tech startup, but insurtechs should see a better-than-typical share of winners versus losers.”

Winkler said insurtechs competing for insurance business need to make “bold growth and diversification moves” like Lemonade did with its July acquisition of Metromile, which brought with it licenses to sell auto insurance in 49 states. “And with Lemonade instantly adding Metromile’s data and algorithms, it gave them a competitive advantage that other auto insurance carriers will take years to build,” he said.

“We must look beyond insurtechs attempting to compete as full carriers to those that are solving specific industrywide problems or challenges, which legacy carriers don’t have the time, priority or ROI to solve themselves,” Winkler said. “The more niche and simultaneously universal the problem, the increased likelihood of success,” he said, adding, “Those insurtechs that can fill these voids, while achieving near-term profitability to enable future growth, will be the long-term winners.”

John Forcucci is InsuranceNewsNet editor-in-chief. He has had a long career in daily and weekly journalism. Contact him at johnf@innemail.

‘Financial planning is for everyone’ — With Osmar Garcia

Can ‘regtech’ help producers stay compliant with new rules?

Advisor News

- Does a $1M make you rich? Many millionaires today don’t think so

- Implications of in-service rollovers on in-plan income adoption

- 2025 Top 5 Advisor Stories: From the ‘Age Wave’ to Gen Z angst

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News