Apollo touts new products, distribution with No. 1 Athene this year

Apollo Global Management had a booming fourth quarter thanks to Athene, putting the company solidly at the top of the fixed annuity business and the CEO put the industry on notice that Athene intends to stay there.

Apollo has been solidifying its position as a private credit behemoth partly with the help of capital generated by Athene, with the recent acquisition of Credit Suisse’s Securitized Products Group to create Atlas SP, a new credit unit. Apollo expects Atlas to be “the finance company of finance companies.”

The alternative asset company’s fourth quarter net income of $584 million doubled the fourth quarter of 2022, breaking with losses over the three previous quarters largely due to rising interest rates depreciating reinsurance assets on the books.

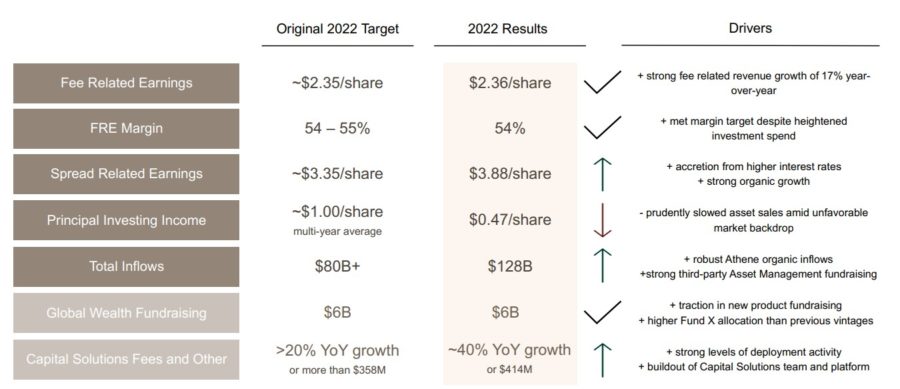

The company’s plus side benefited from record earnings related to fees, $394 million for the quarter and $1.4 billion for the year, as the company “restarted the growth engine” in 2022, said Apollo CEO Marc Rowan during an earnings call on Thursday. Although the quarter was strong, the company had a $3.2 billion loss on the year because of the reinsurance assets.

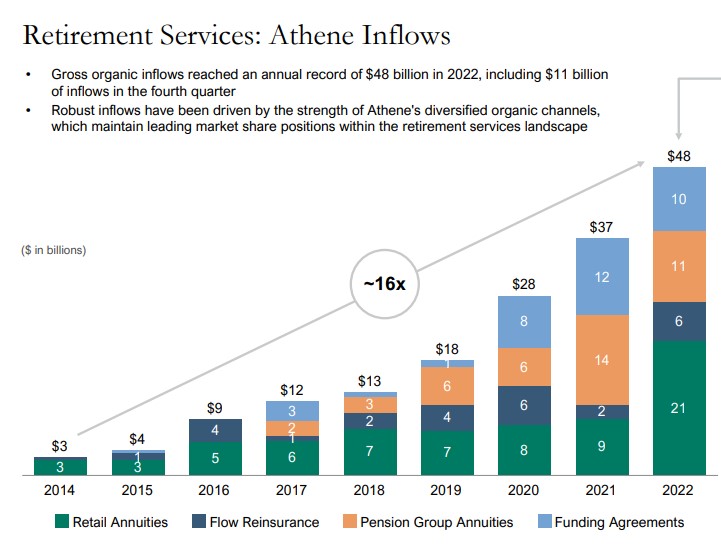

The rising interest rates may have depreciated some assets, but the rates, along with strong performance in its alternative asset portfolio, helped propel the Athene retirement services segment with three consecutive quarters of record annuity sales growth.

Apollo acquired Athene in 2021 and spooled up growth with the company, climbing from the fourth largest seller of fixed annuities in the first quarter of 2022 to the top position by the third, narrowly eclipsing New York Life, according to LIMRA data. Athene remained the top seller in fixed index annuities throughout the year, with a rapid rise in sales from $2.2 billion in the first quarter up to $7.1 billion by the third, outpacing No. 2 Allianz by $1 billion.

Rowan said that not only was the fourth quarter even stronger in annuity sales, but the quality also improved with the spread at 145 basis points versus 120 for the full year. He added that although Athene’s performance might not be as strong as the fourth quarter throughout 2023, he expected the company will solidify its position as the top fixed annuity seller.

“As we step back, and we think about our positioning in this marketplace, one of the questions we asked the team is who is the fortress balance sheet in our industry? And the answer is we are the fortress balance sheet in our industry,” Rowan said during the call. “We are A-plus across all three agencies. We ended the year [with] $2 billion of excess capital and more than a billion ahead of S&P AA.”

The company is freeing up more capital to “further spur the flywheel of our capital solutions and other businesses,” Rowan said. The company now has access to about $7 billion with its latest sidecar, Dedicated Investment Program II.

He added that Athene’s success in retirement solutions has not gone unnoticed with more than 100 asset managers or insurance entities that have become asset managers following the Athene model.

Looking to grow

Rowan cited four characteristics to be successful in the alternative capital business.

“First is capital, massive amounts of capital in an industry that has not been able to raise capital,” Rowan said. “The second is an ability every day to create investment grade spread. This is something and a skill set that is not traditionally resonant within the alternatives industry, or quite frankly, within traditional asset management. It is a skill that we have built up.”

The other two are a “really attractive” cost structure and cost of funds. He referred to cost structure as having the scale for an efficient cost base, which contributes to a low cost of funds.

The company also benefits from “well-designed” products so that it does not have to take investment risks for good returns and allows for wiser investments, he said, adding that everything goes in reverse if the cost of funds is very high.

“What we are watching in our industry is the haves, like Athene, where we have some $48 billion of organic origination,” Rowan said, “versus the have-nots, the market entrants, who in fact are paying up for inorganic blocks at very high cost of funds, which also are very expensive to administer on a hope that they will get to scale.”

He added a dire prediction: “I believe that the vast majority of new entrants, although not all, will not be successful, and will learn a very expensive lesson along the way.”

Besides the cost of funds issue, Rowan cited the increased scrutiny of regulators as a risk to the newer market entrants. Athene, he said, has spent 13 years creating the kind of regulatory dialogue and transparency necessary to thrive.

“We are to my knowledge not just a fortress balance sheet, but the most transparent of the companies,” he said. “We regularly publish stress tests although we are not required. We regularly publish details of assets that we are not required. We regularly go back and forth with respect to our reinsurance so that people understand there is no quote ‘arbitrage’ between the U.S. regulatory standard and the Bermuda regulatory standard.”

Rowan said Athene will help lead regulatory dialogue to ensure that regulation gets to “the right place” with appropriate oversight.

The company is also at a point where it can offer Athene’s investment toolkit to other companies. The company expects to raise $10 billion in capital over this year by sharing these assets with other retirement services companies.

Apollo expects to expand into new distribution and offer new suites of products over the year, Rowan said: “We are still early in our build-out phase.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Lincoln ‘selling on our terms’ as it rebounds from lost quarter

Brighthouse sees record annuity year, while life insurance lags

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- Why health care costs hit harder in Alaska

- Dozens laid off at Blue Cross of Idaho amid organizational changes

- Rising health care costs will hurt Main St.

- House committee advances bill aimed at curbing Medicaid costs, expanding access for elderly Hoosiers

- OHIO CAPITAL JOURNAL: 'HUSTED TOOK THOUSANDS FROM COMPANY THAT PAID OHIO $88 MILLION TO SETTLE MEDICAID FRAUD ALLEGATIONS'

More Health/Employee Benefits NewsLife Insurance News