Brighthouse sees record annuity year, while life insurance lags

Brighthouse Financial had a record year for annuities but a down one for life insurance, as the company promises new products in both segments.

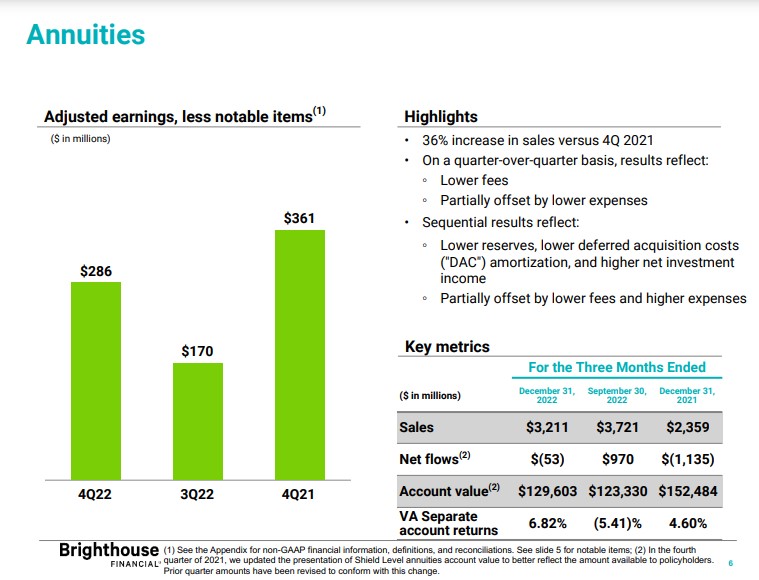

The company reported record annuity sales in 2022, with $11.5 billion for the year, up 26% compared with 2021. The fourth quarter’s sales of $3.2 billion were down 14% from the $3.7 billion in the previous quarter, but they were up 36% compared to the $2.4 billion in the year-ago quarter.

Brighthouse attributed the strong performance in part to fixed deferred annuities, which found high demand across the industry in the latter half of 2022 because of higher interest rates. The company does not expect the demand for fixed deferred annuities to remain as strong this year, CEO Eric Steigerwalt said during Friday's earnings conference call.

The company has been focusing on registered index-linked annuities, which Brighthouse helped popularize as it pivoted away from traditional variable annuities. In August, the carrier added Shield Level Pay Plus to its suite of Shield RILA products.

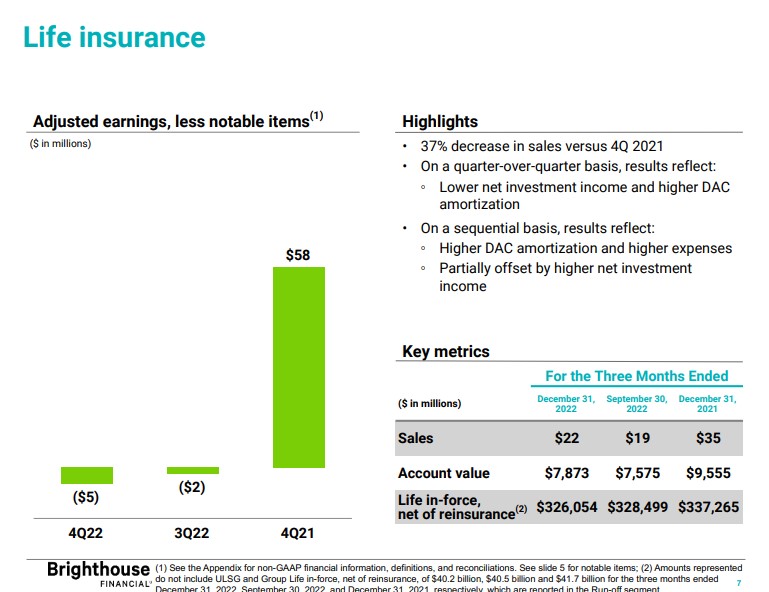

Life insurance sales totaled $22 million, which although up 15.8% over the previous quarter, was down dramatically from $35 million in the year-ago quarter. Total life sales were $80 million for the full year.

Although life sales were down year-over-year, sales were steady through the year, Steigerwalt said, adding that the company was still invested in the space.

“In 2023, we plan to introduce a new life insurance product, which we expect will further diversify and strengthen our life product suite,” Steigerwalt said. “We will continue to focus on maintaining and enhancing our suite of life insurance products, as well as expanding our distribution footprint into the future.”

had a $967 million loss in the quarter. “During the quarter, as a result of market performance, the value of our hedges decreased, as expected,” the company said in a statement. “Due to being accounted for as insurance liabilities as required under U.S. GAAP accounting, certain corresponding liabilities are less sensitive to market movements and, therefore, did not fully offset the decrease in the value of our hedges.”

Brighthouse ended the quarter with common stockholders' equity of $3.8 billion, or $55.11 per common share, and book value, excluding accumulated other comprehensive income of $9.7 billion, or $142.04 per common share. The company reported adjusted earnings of $242 million, or $3.46 per diluted share, in the quarter, compared with adjusted earnings of $323 million, or $4.02 per diluted share, in the fourth quarter of 2021.

Corporate expenses in the fourth quarter of 2022 were $243 million, up from $217 million in the third quarter of 2022, both on a pre-tax basis.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Apollo touts new products, distribution with No. 1 Athene this year

The 3 Ms of bringing flexibility and speed to the digital insurance experience

Advisor News

- We need Medicaid more than billionaires need tax cuts

- Empower CEO: stock market volatility ‘here to stay for a bit’

- Raven MacFarlane-Bradbrook: We need Medicaid more than billionaires need tax cuts

- Could in-plan annuities head up a new asset class?

- Social Security retroactive payments go out to more than 1M

More Advisor NewsAnnuity News

Health/Employee Benefits News

- ‘Devastating:’ LGBTQ activists sound alarm on KY bill banning Medicaid-funded trans care

- Clover Health Investments Corp. (NASDAQ: CLOV) is a Stock Spotlight on 3/13

- Luigi Mangione's attorney asks judge to drop Blair County charges in court filing

- Bill would expand coverage for breast cancer screening for Iowans

- We need Medicaid more than billionaires need tax cuts

More Health/Employee Benefits NewsLife Insurance News