Annuity sales set more records in Q4, break $100B, Wink reports

Annuity sales smashed through the $100 billion barrier in the fourth quarter, Wink, Inc. reported today, setting more records along the way.

Total Q4 sales for all deferred annuities were $105.4 billion, up 33.1% compared to the previous quarter and up 32.9% compared to the same period last year. All deferred annuities include the variable annuity, structured annuity, indexed annuity, traditional fixed annuity, and multi-year guaranteed annuity (MYGA) product lines.

Experts predict that 2024 annuity sales could be even better.

Noteworthy highlights for all deferred annuity sales in the fourth quarter include Athene USA ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 12.9%. Massachusetts Mutual Life Companies held second place, while Lincoln National Life, Corebridge Financial, and Equitable Financial rounded out the top five carriers in the market, respectively.

Massachusetts Mutual Life Stable Voyage 3-Year, a MYGA, was the No. 1 selling deferred annuity, for all channels combined, in overall sales for the second consecutive quarter.

Total fourth-quarter, non-variable deferred annuity sales were $81.3 billion, up 48.4% when compared to the previous quarter and up 40.5% compared to the same period last year. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for non-variable deferred annuity sales in the fourth quarter include Athene USA ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 16.5%. Massachusetts Mutual Life Companies held onto second place while Corebridge Financial, Lincoln National Life, and Global Atlantic Financial Group completed the top five carriers in the market, respectively.

Massachusetts Mutual Life Stable Voyage 3-Year was the No. 1 selling non-variable deferred annuity for the quarter, for all channels combined, in overall sales for the second consecutive quarter.

Total fourth-quarter, variable deferred annuity sales were $24.1 billion, down 1.2% when compared to the previous quarter and up 12.3% when compared to the same period last year. Variable deferred annuities include structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the fourth quarter include Equitable Financial ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 20.1%. Jackson National Life continued in the second-place position, as Lincoln National Life, Brighthouse Financial, and Allianz Life concluded the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling variable deferred annuity, for all channels combined, in overall sales for the quarter.

Indexed annuity sales for the fourth quarter were $27.9 billion, up 19.8% when compared to the previous quarter, and up 29.1% when compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500.

It was a record-setting quarter for indexed annuity sales, topping the Q2 2023 record by 11.1%. This was also a record-setting year for indexed annuity sales, topping the prior 2022 record by 25.5%.

Noteworthy highlights for indexed annuities in the fourth quarter include Athene USA ranking as the No. 1 seller of indexed annuities, with a market share of 11.4%. Allianz Life moved into the second-ranked position, while Lincoln National Life, American Equity Companies, and Sammons Financial Companies rounded-out the top five carriers in the market, respectively. American Equity’s IncomeShield 10 was the No. 1 selling indexed annuity, for all channels combined, for the quarter.

“Indexed annuities have now sold over a trillion dollars, since their introduction in 1995," said Sheryl Moore, CEO of Wink, Inc.

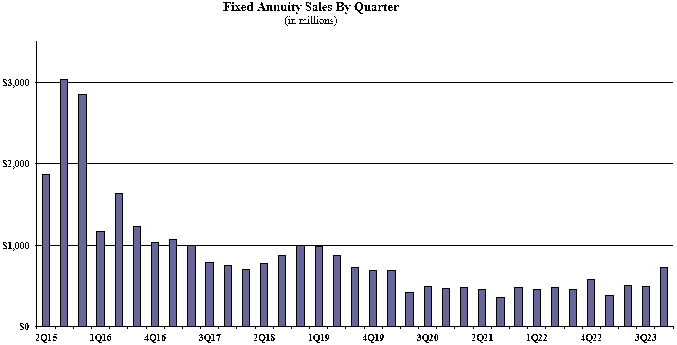

Traditional fixed annuity sales in the fourth quarter were $730.6 million, up 47.3% when compared to the previous quarter, and up 26.9% when compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the fourth quarter include Nationwide ranking as the No. 1 carrier in fixed annuities, with a market share of 28.4%. Global Atlantic Financial Group ranked second while Modern Woodman of America, EquiTrust, and CNO Companies completed the top five carriers in the market, respectively.

Forethought Life’s ForeCare Fixed Annuity was the No. 1 selling fixed annuity, for all channels combined, for the fourteenth consecutive quarter.

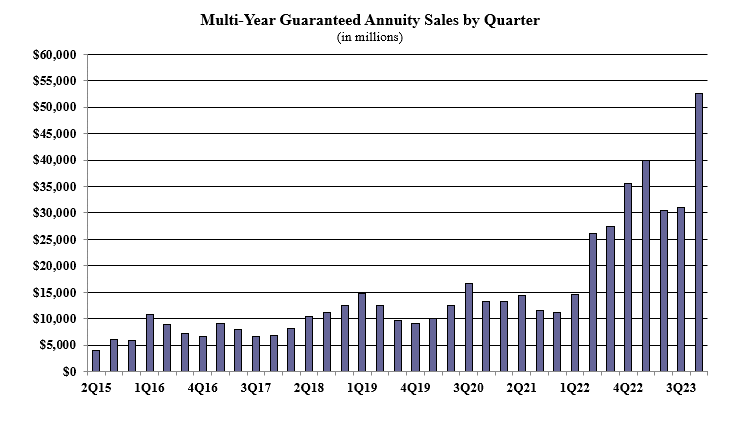

Multi-year guaranteed annuity (MYGA) sales in the fourth quarter were $52.6 billion, up 70% when compared to the previous quarter, and 47.7% when compared to the same period last year. MYGAs have a fixed rate that is guaranteed for more than one year. This was a record-setting quarter for MYGA sales, topping the Q4 2022 record by 47.7%. This was also a record-setting year for MYGAs, topping the 2022 record by 48.3%.

Noteworthy highlights for MYGAs in the fourth quarter include Athene USA ranking as the No. 1 carrier, with a market share of 19.4%. Massachusetts Mutual Life Companies moved into the second-ranked position, while Corebridge Financial, Global Atlantic Financial Group, and New York Life rounded out the top five carriers in the market, respectively.

Massachusetts Mutual Life’s Stable Voyage 3-Year product was the No. 1 selling multi-year guaranteed annuity, for all channels combined, for the second consecutive quarter.

“It’s no surprise to see MYGA sales hitting records," Moore said. "When five-year MYGAs are crediting upward of 6%, and CDs are crediting 1.72%, consumers are going to choose the MYGA every time."

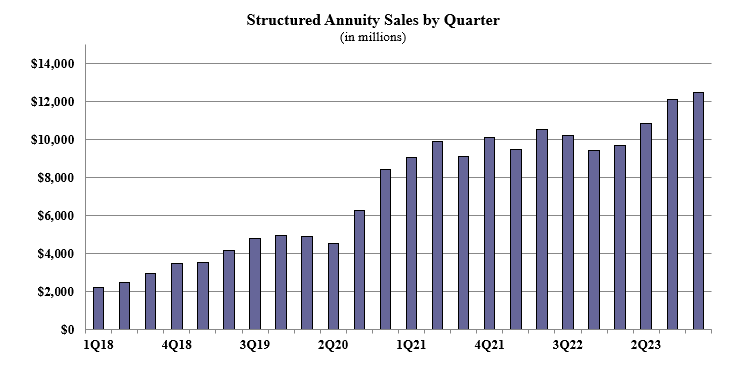

Structured annuity sales in the fourth quarter were $12.4 billion, up 3.2% compared to the previous quarter, and up 32.9% compared to the same period last year. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

It was a record-setting quarter for structured annuity sales, topping the Q3 2023 record by over 3.2%. This was also a record-setting year for structured annuity sales, topping the 2022 record by 13.8%.

Noteworthy highlights for structured annuities in the fourth quarter include Equitable Financial ranking as the No. 1 carrier in structured annuity sales, with a market share of 25.2%. Allianz Life ranked second, while Brighthouse Financial, Prudential and Jackson National Life completed the top five carriers in the market, respectively. Pruco Life’s Prudential FlexGuard Indexed Variable Annuity was the No. 1 selling structured annuity, for all channels combined, for the quarter.

"Structured annuity sales hit a record this quarter,” Moore said. “But what is more significant is the fact that structured annuity sales eclipsed variable annuity sales for the first time.”

Variable annuity sales in the fourth quarter were $11.6 billion, down 5.6% compared to the previous quarter, and down 3.7% compared to the same period last year. Variable annuities have no floor, and the potential for gains/losses is determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the fourth quarter include Jackson National Life ranking as the No. 1 carrier in variable annuities, with a market share of 18.4%. Equitable Financial ranked second, while New York Life, Lincoln National Life, and Nationwide finished out as the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the nineteenth consecutive quarter, for all channels combined.

Wink reports sales on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, variable annuity, and multiple life insurance product lines. Sales reporting on single-premium immediate annuity, deferred income annuity, and additional life insurance product lines will be available starting in the Q1 2024 report, Wink said.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Nearly 80% of near retirees fail or barely pass Social Security basics quiz

IncomePath: Helping clients reimagine retirement spending

Advisor News

- How OBBBA is a once-in-a-career window

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- ROUNDS LEADS LEGISLATION TO INCREASE TRANSPARENCY AND ACCOUNTABILITY FOR FINANCIAL REGULATORS

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

- Best’s Market Segment Report: Hong Kong’s Non-Life Insurance Segment Shows Growth and Resilience Amid Market Challenges

More Life Insurance News